Why it matters whether stocks gap up or down at the open

Why the open matters for intraday returns

It's long been known that U.S. stocks have performed better overnight than during regular trading hours. Theories abound, but in truth nobody really knows why.

Jay took an in-depth look at this phenomenon in the SPDR S&P 500 ETF Trust (SPY) since its inception. But helpfully, he broke it down by day, and whether each day's open was higher or lower than the previous day's close.

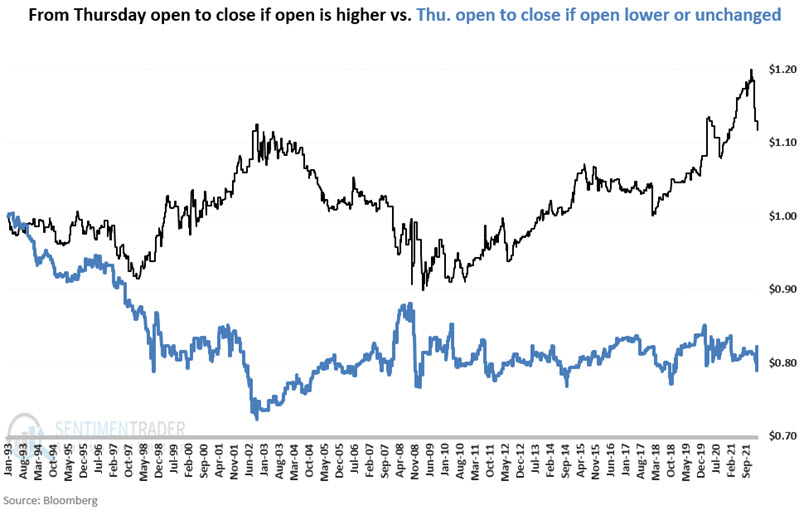

For example, the chart below shows the growth of $1 in SPY held intraday only on Thursdays if SPY opened higher versus the growth of $1 in SPY held intraday if SPY opened lower or unchanged.

We can clearly see that if stocks opened higher on Thursday, then they tended to do significantly better during regular trading hours as well. A hyper-active trader using this strategy (not including commissions or slippage) would have returned -17.8% if buying SPY after a down open on Thursday. Other days show even more stark differences in performance.

What do tech insiders know?

Jay also noted that insider buying in the technology sector keeps popping up on his radar - and seems completely counter-intuitive based on everything read and heard in the financial press.

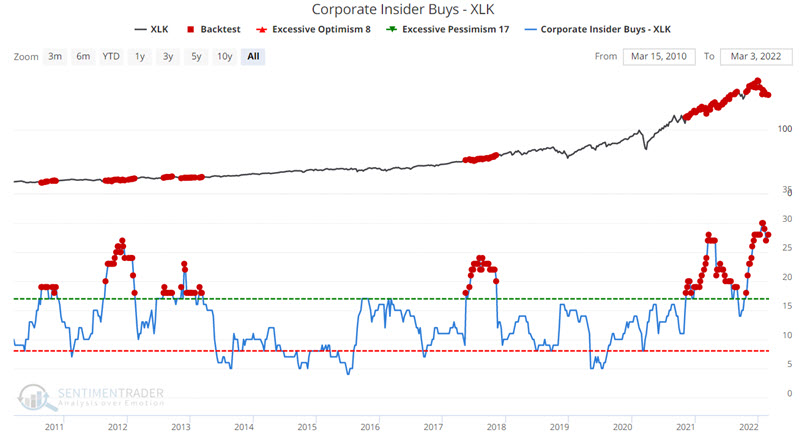

Ticker XLK (the upper line in the chart below) tracks an index of technology stocks. The lower line in the chart below represents open market purchases by corporate insiders for companies XLK. The red dots highlight each week when there were more than 17 open market purchases over a rolling 6-month period.

Based on the bearish conventional wisdom narrative and the low level of insider buying in general, the persistent and enthusiastic buying by tech insiders stands completely apart and seems to make no sense at all. So the question becomes, "Are tech insiders crazy, or do they know something we don't know?" What might cause these executives to ignore the doom-and-gloom pundits and buy heavily instead?