Why it has paid to buy on Thursday and sell on Tuesday

Stocks gapping up in the morning seems like it has become a seemingly daily occurrence. That's an exaggeration, of course, as "only" 60% of the days in 2021 have started with a gain.

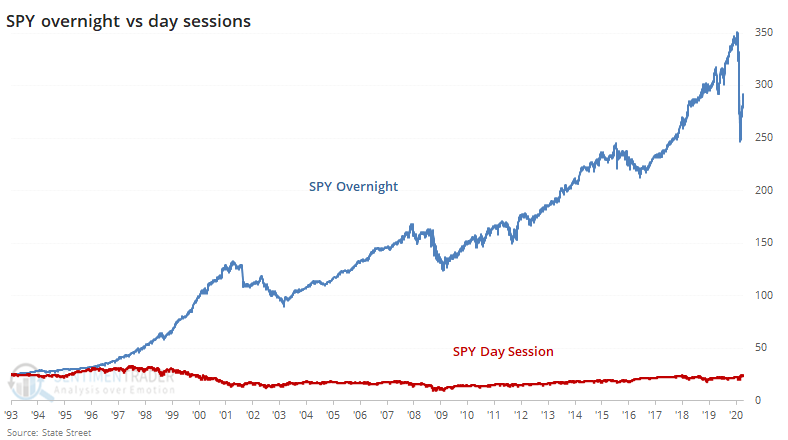

Last May, we saw how stark the difference was between activity outside of regular trading hours versus the daytime session. Excluding transaction costs, a trader would have enjoyed massive gains by buying at the close each day and selling at the open the next day. Someone exposed to stocks only during the day wouldn't have participated in any gains in almost 30 years. It was even starker for the IWM small-cap fund.

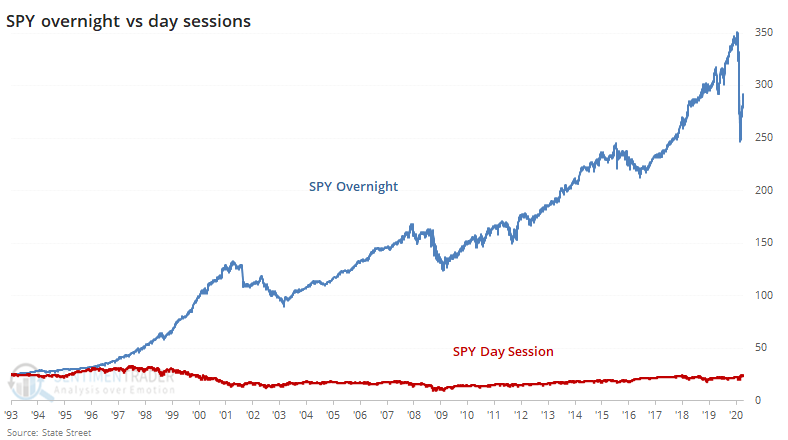

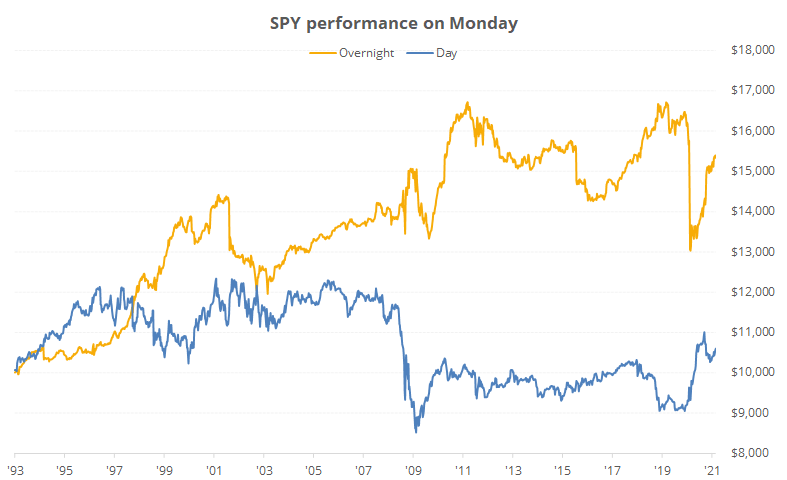

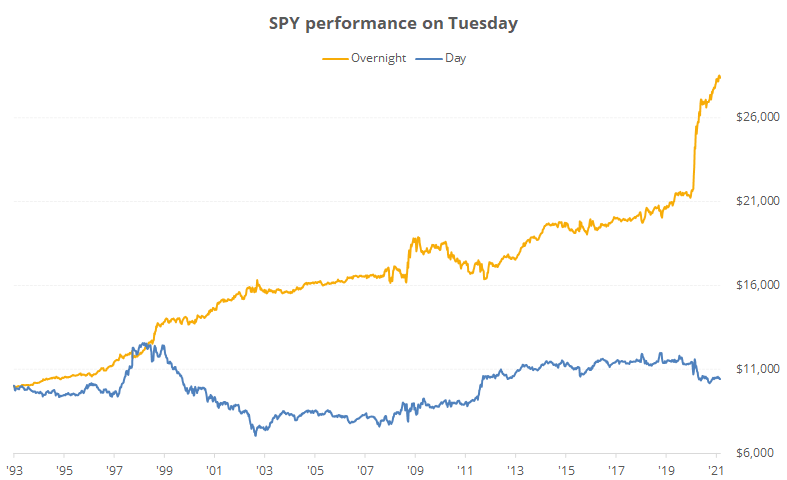

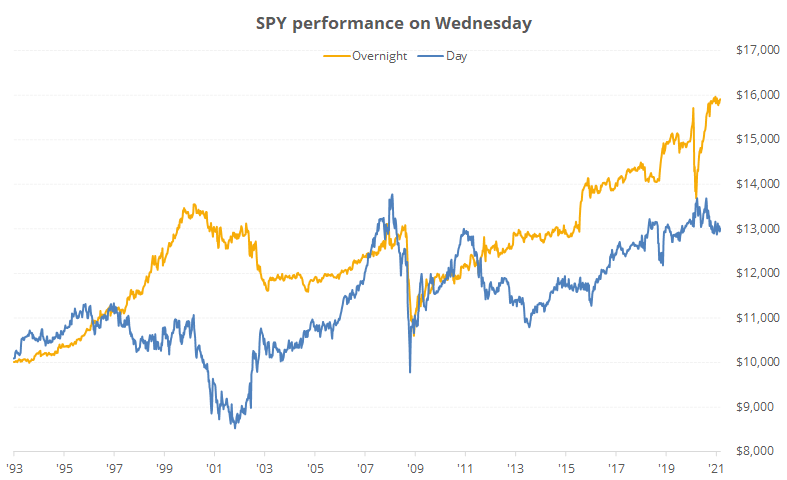

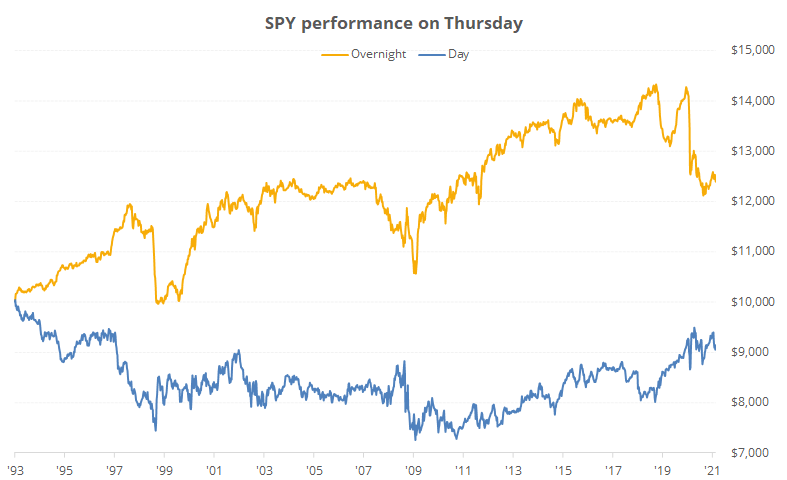

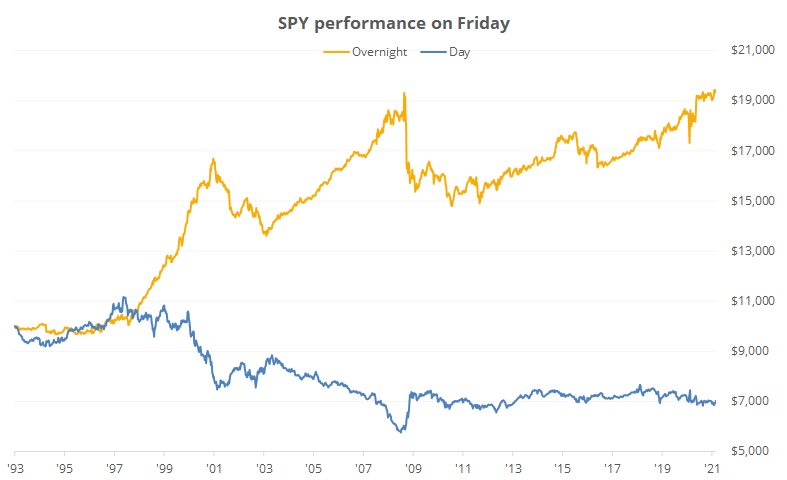

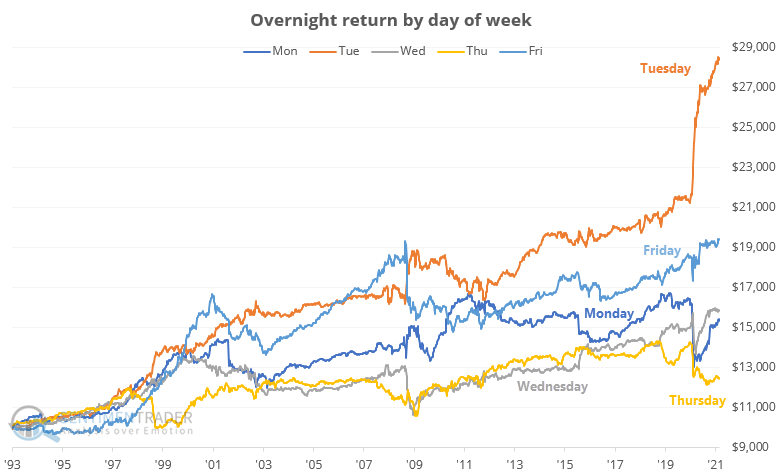

If we want to know which days provide most of the gains, then we can glean some insight from the charts below. For each day of the week, we can see the growth of $10,000 invested in SPY only overnight (gold line) or only during regular trading hours (blue line).

NOTE: This has been updated from its original publication, to better reflect each day's performance ONLY during the day, and not including the overnight session.

On Monday, the day session powered much of the gains from inception through the first couple of years, then greatly fell back during the financial crisis.

Tuesday has been the market's workhorse, particularly overnight. It wasn't that great of a weekday after the popping of the 2000 bubble, but since then it has been the best day to be invested, by far.

On Wednesdays, traders saw mostly decent returns, but during bear markets, it often bore the brunt of some of the selling pressure. Not sure why that might be.

Thursday has been, by far, the worst day of the week to hold the S&P. The gains from Wednesday's close through Thursday's open were meager, and they were even worse if holding through Thursday's day session.

If one bought Thursday's often ugly closes, though, and held until Friday's open, then it would have generated decent gains, the 2nd-best of the week. That seemed to use up a lot of the buying power heading into the weekends, though, because Friday's regular session has gone nowhere for 20 years.

It's interesting to note how traders aggressively bought overnight heading into Friday morning in the lead-up to the ends of the last two great bull markets.

When putting them all together for the overnight session, we can see just how stark of a difference there is between days of the week. A hyperactive trader would have earned nearly 3x their money holding overnight into Tuesday mornings than they would have by holding overnight into Thursday mornings.

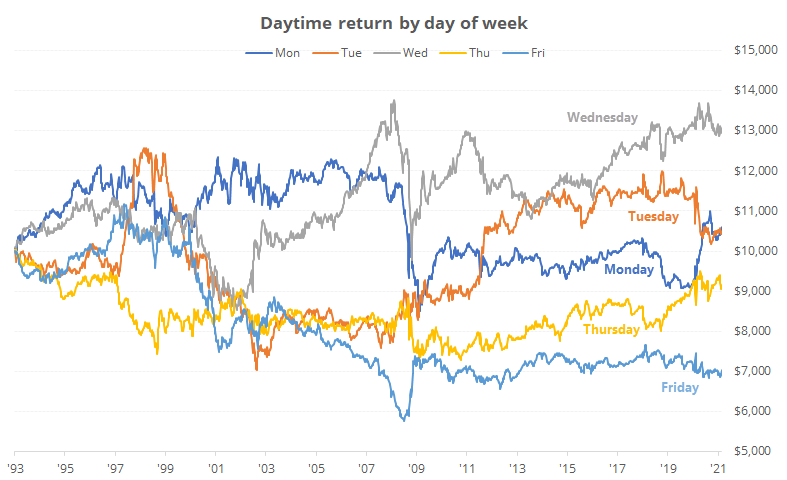

And for the daytime session, the differences weren't as stark. While Wednesday's day session led to twice as much in gains as Friday's, none of them were particularly good.

A long-term investor has pretty much no use for this information, even assuming that it stays somewhat static going forward. It seems like a consistent bias would be arbed away by hedge funds at some point. A major change in the market's trend can often serve as an impetus for a change like that, but with stocks soaring to new highs, a trend change doesn't look imminent.

For shorter-term traders, it's remarkable how consistent the bias has been, especially comparing Tuesday to Thursday overnight. So if planning an entry, perhaps waiting for Thursday's or Friday's close would give a better entry at a lower price, or waiting for Tuesday's close to exit would give sellers an edge. This can, of course, vary wildly from week to week, but over time it has been a consistent enough phenomenon to note.