Why "financials over tech" may be just beginning

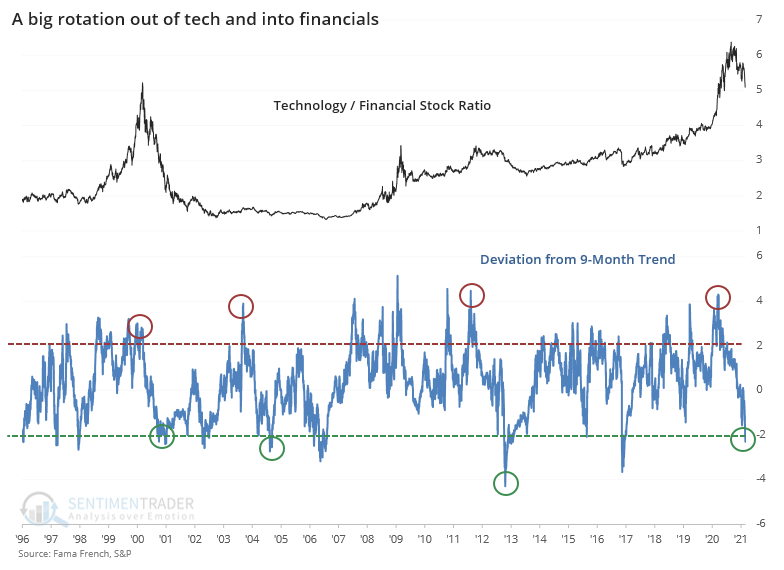

Thanks to investors resetting their view on interest rates, there has been a swift and meaningful rotation out of technology stocks and into financials. It has only increased in intensity in recent days.

When looking at the ratio between the two sectors, it has now cycled from being more than 2 standard deviations above its 9-month trend to 2 standard deviations below.

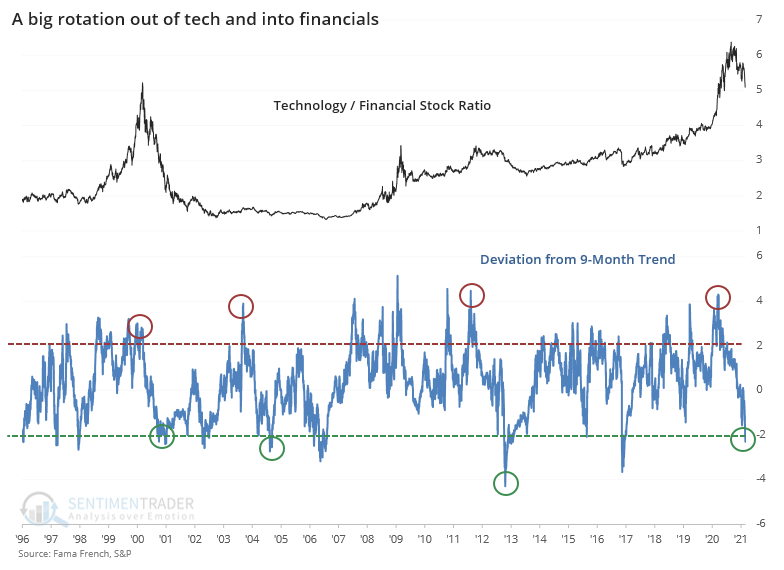

Whether this means anything for the broader market is debatable. The table below shows S&P 500 returns after the ratio cycled from +2 to -2 standard deviations. To avoid those times when there was a quick and volatile change (mostly prior to 1950), only those cycles that took longer than 100 days are included. The current cycle lasted 158 days.

Forward returns for the S&P were fine, even a bit above random over the medium-term. Nothing much to see here.

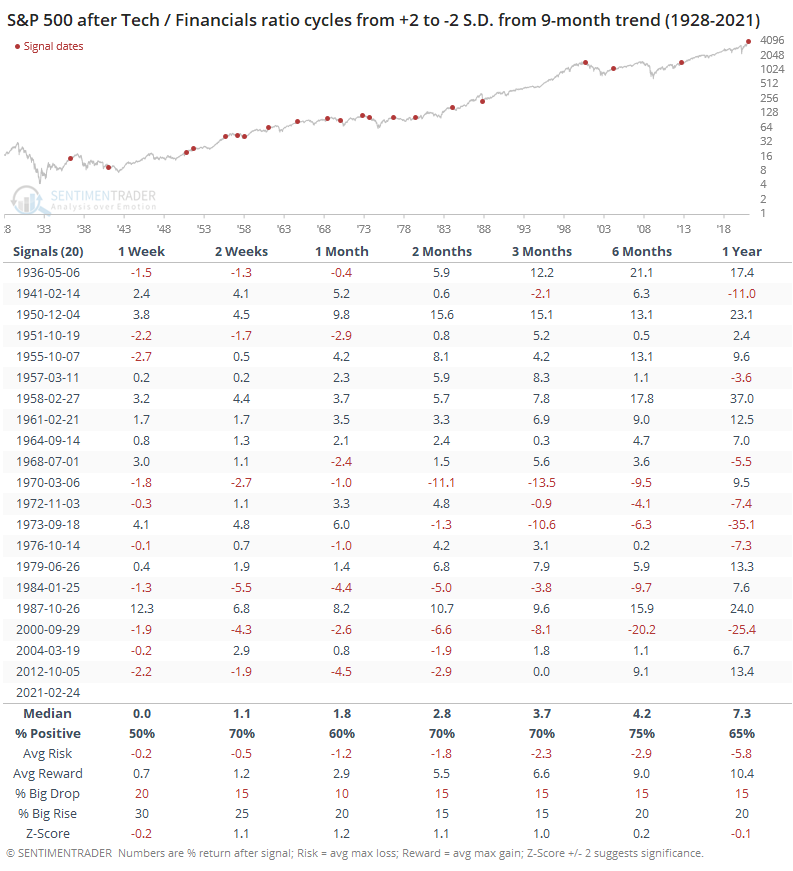

It was more consistent as an indicator for the ratio between the sectors, as tech stocks tended to keep underperforming relative to financials when there were similar resets.

Especially since 1970, the tech / financials ratio had a strong tendency to keep declining, with returns well below what was seen during more normal conditions.

This suggests that the underlying fundamental shift that has triggered this reset in expectations is much more likely to keep going, favoring financial stocks over technology-related stocks, than it is to revert to its prior trend.