Why Coffee is Giving Me the Jitters

Coffee has long been a volatile commodity. And given that certain people HAVE TO HAVE IT OR ELSE!!!! (I'm not naming any names here) you can see why any shortage of supply at all can cause a massive spike in price.

In the monthly chart below (Courtesy of ProfitSource by HUBB), you can see the long history of massive price swings that routinely take place. You may also notice that of late, coffee appears to be "on the rise."

But there are several reasons why a trader might be wise to calm themselves about coffee (to the extent that that is possible) for a little while before piling in. Let's take a closer look.

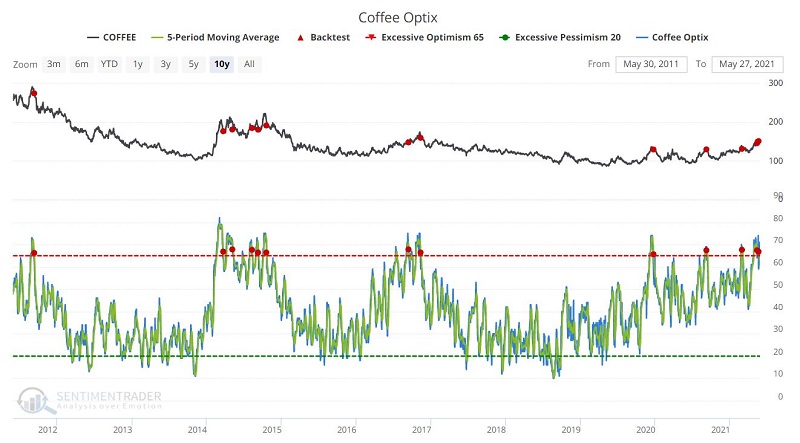

COFFEE OPTIX

The chart below displays those times in the last 10 years when:

- The 5-day average for Coffee Optix

- Dropped from above to below 68%

In the table below, you can see that the above has NOT been a favorable sign for Coffee during the last 10 years - particularly 3 and 12 months later. This DOES NOT mean that Coffee is doomed to decline. However, it does appear to argue for a more cautious approach.

Now let's turn our attention to seasonality

COFFEE SEASONALITY

The chart below displays the annual seasonal trend for Coffee futures.

Does anything jump out at you? Assuming you have had your coffee today, it should be fairly obvious that we are entering the seasonally weakest part of the year for Coffee. As always, it is critical to note the following: Just because the period just ahead has "typically" been weak - and just because June has historically been the weakest month of the year - DOES NOT guarantee a decline during June this year.

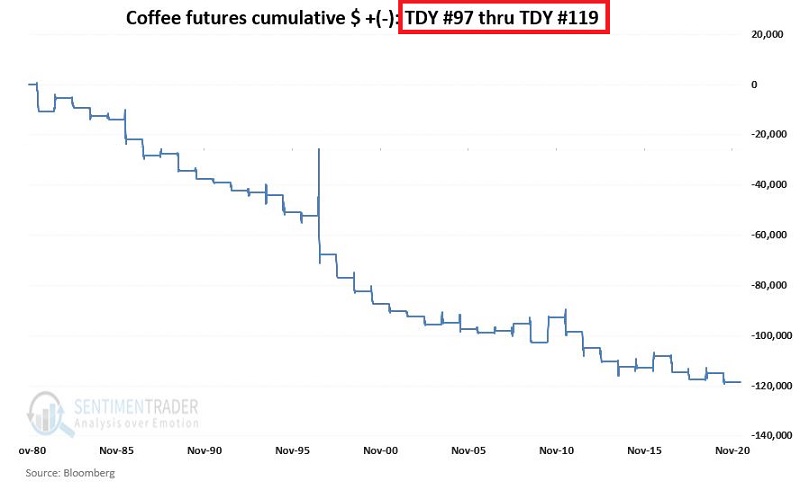

Still, trading is a game of odds. And the odds suggest that a trader must have a solid reason for buying Coffee within this time period. Not so sure? The chart below displays an equity curve that shows:

- The hypothetical gain or loss (with an emphasis on "loss) achieved by holding long a 1-lot of coffee futures

- ONLY from the close of Trading Day of the Year (TDY) 97 through the close on TDY 119

- Every year since 1980

Once again, I ask the question, "does anything jump out at you" in the chart above?

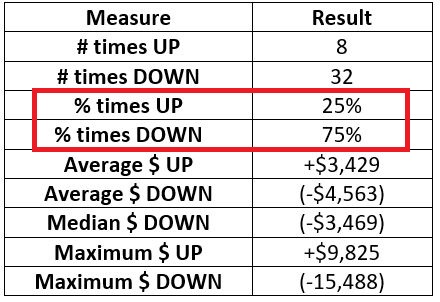

The table below displays a summary of the performance shown in the chart above. The numbers speak for themselves.

SUMMARY

Coffee is a volatile market. And when it decides it "wants to go," it "goes," and nothing seemingly can hold it back. If this happens to be "one of those times," then a massive continuation of the recent advance is absolutely possible.

Repeating now, trading is a game of odds. And it appears that the odds may be stacked against Coffee, at least for the near future.