Who is actually buying?

The latest survey of individual investors from AAII showed a big drop in optimism. We saw a couple of weeks ago that apathy was prevalent in most of the surveys, and that has continued.

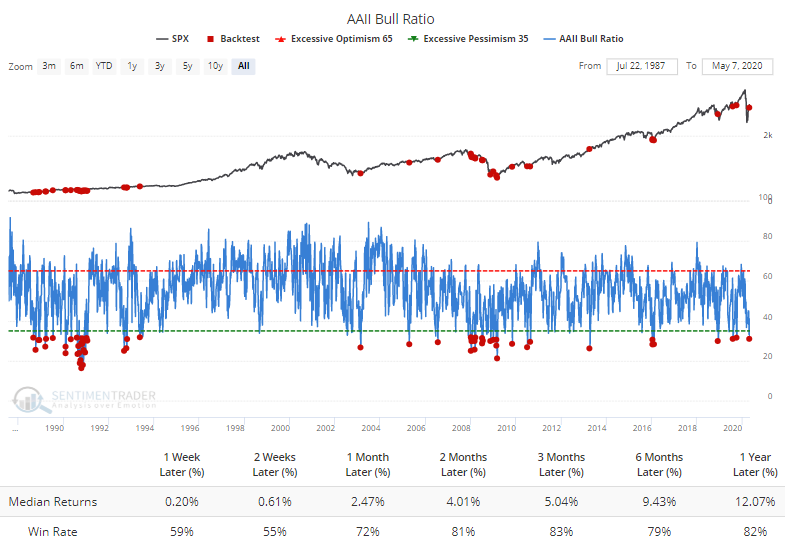

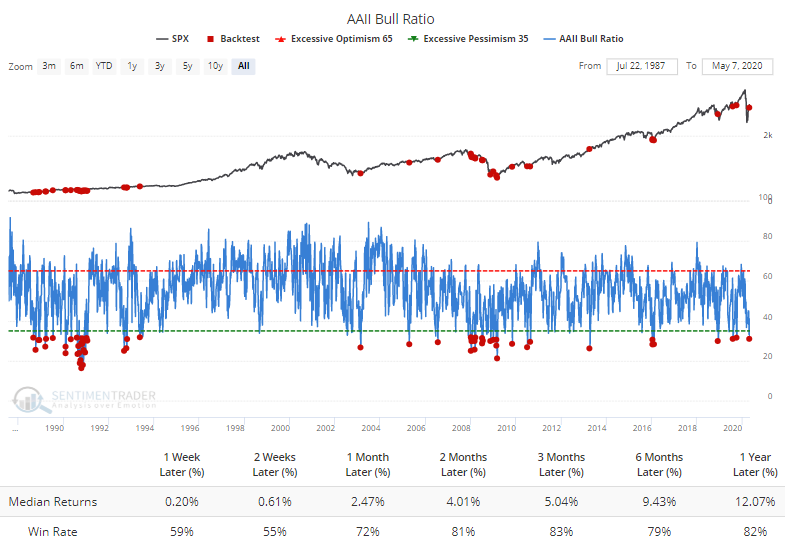

The Backtest Engine shows that following any week when the Bull Ratio (Bulls / (Bulls + Bears)) was below 32%, forward returns in the S&P 500 were consistently positive.

What's outstanding about the current week's reading is that it isn't coming after a big decline. Quite the opposite.

There has never been a period when optimism was so low after such a big rally. Out of the 54 times when the S&P 500 showed a gain of 10% or more over a 7-week period, not one of them (until this week) saw more than 50% of respondents consider themselves bearish.

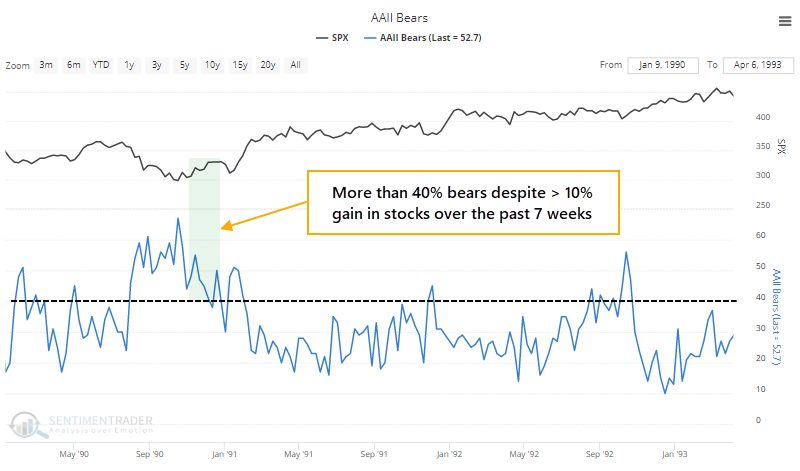

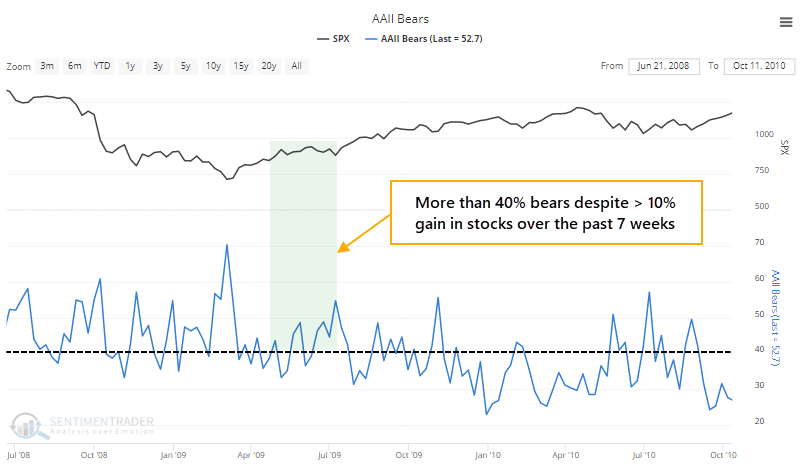

The only times more than 40% of respondents were bearish were December 1990 and a few weeks from April - August 2009.

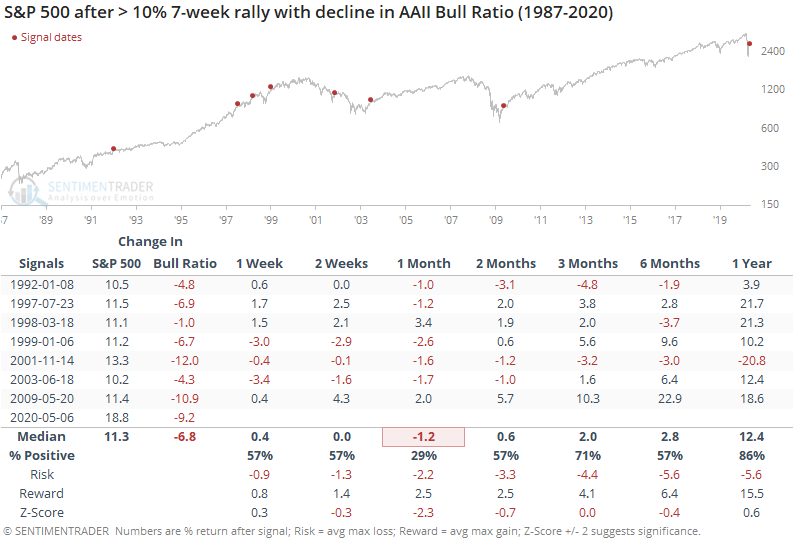

Like we've had to do with so many developments over the past two months, we'll need to relax the parameters in order to get any semblance of a precedent. The table below looks for times when the S&P rallied 10% or more over the past 7 weeks, and yet the AAII Bull Ratio declined during that stretch.

Bull markets need an increasing number of folks to turn optimistic, so stocks usually struggled a bit shorter-term after similar bouts of skepticism, then turned increasingly positive in the months ahead.

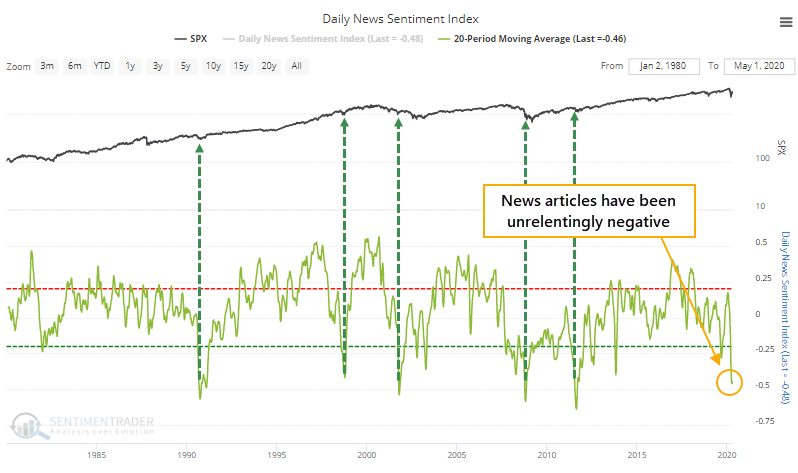

It's not hard to see why investors are so skittish. Watching any local or national news broadcast makes jumping off a bridge seem like an enjoyable afternoon activity. The unrelenting negativity is onerous, and by some measures, among the worst it's ever been.

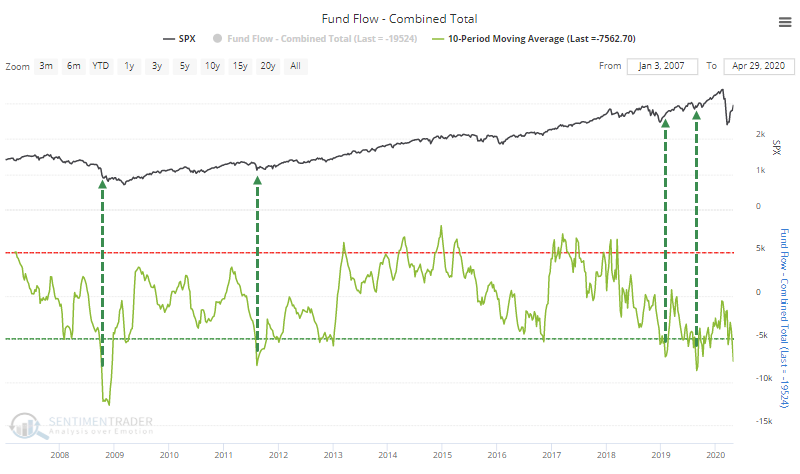

There is some evidence that investors are voting with their actions and not just their mouths. Combined equity fund flows in mutual funds and ETFs, with domestic and overseas exposure, continue to be among the lowest seen in over a decade.

It's even worse for overseas-specific funds.

If individuals aren't buying, then maybe hedge funds are. Some large investment banks have noted recently that their hedge fund clients have been buying, with relatively high net long positions.

Based on the rolling beta of various hedge fund indexes to the S&P 500 over the past month, though, it's hard to see which types of funds have been buyers. Trend-following CTAs remain net short, at least roughly judging by their movements against the S&P. The only group showing above-neutral exposure is long/short equity funds, and even that is only mediocre.

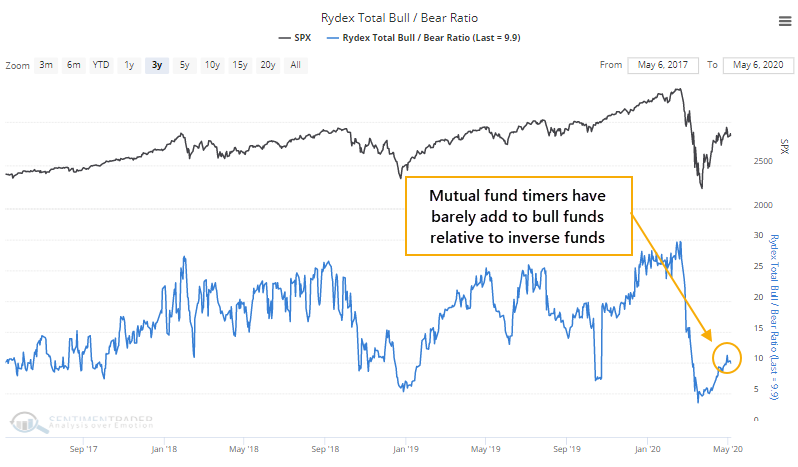

Rydex fund timers aren't buying, either. The ratio of assets in bull versus bear funds remains very low, including all index funds and only those that are leveraged.

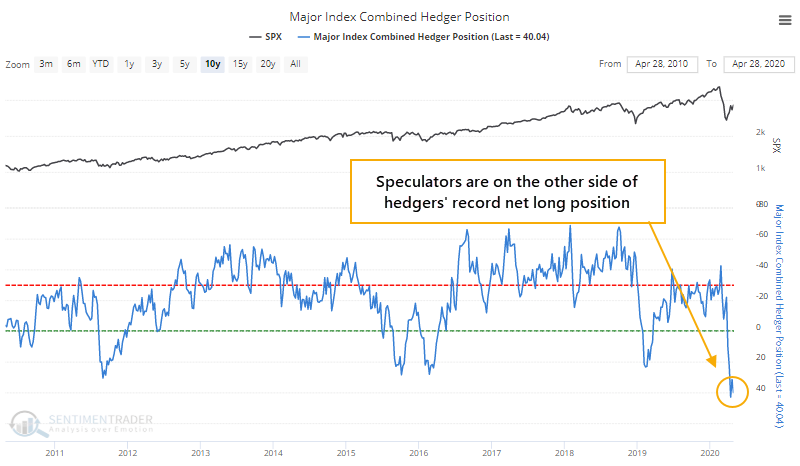

Large and small speculators in the major index futures are net short more than $40 billion worth of contracts, near a record. So, clearly, they're not eager to buy, either. By definition, speculators are on the other side of hedgers' positions.

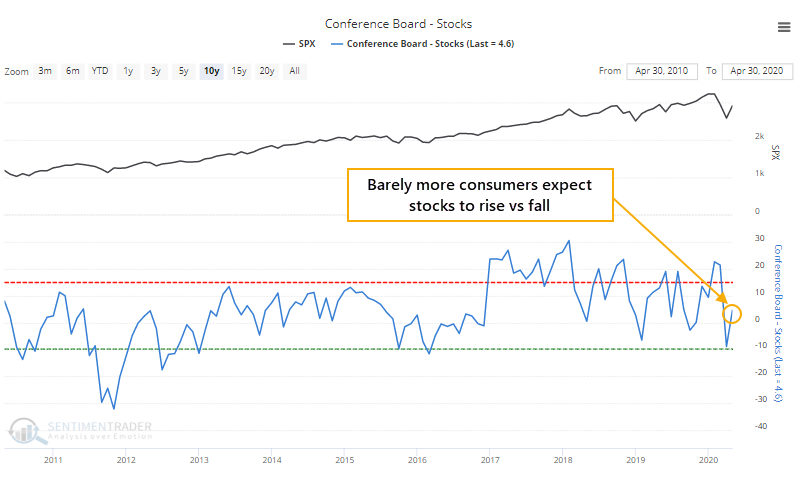

While they're not exactly showing pessimism, consumers in general still have a subdued outlook on stocks. Despite a massive rally in April, barely more expect stocks to rise than fall in the months ahead.

So...who's actually doing all the buying? I dunno. It seems to be a broad mix of groups, adding back modestly to whatever they sold during the plunge. There doesn't seem to be any single group that's helping to drive prices higher, at least not a group that's large enough to show an impact.

These are not necessarily positive developments. Bulls should want to see more and more people become optimistic, until the point when it hits an extreme. If we're truly in a prolonged bear market environment, then we won't likely see much more optimism than we have lately before stocks start to really struggle again. The jury is still out on that one. In a bull market, we have a ways to go before optimism would be considered troublesome, as most of them are still well below their thresholds.