Where S&P 500 seasonality stands now

Key Points

- The S&P 500 is entering one of its most reliably favorable periods of the year

- Unfortunately, this does not guarantee a positive outcome in 2025; Seasonality is only one of many factors that influence stocks (I follow valuation, price action, inflation, interest rates, economy, sentiment, breadth, seasonality, and corporate insiders) and arguably one of the least influential

- Still, seasonality primarily tells us "When to look where" - as a result, if the market is going to stabilize, then the period directly ahead is a logical time for that to happen

Late winter into spring

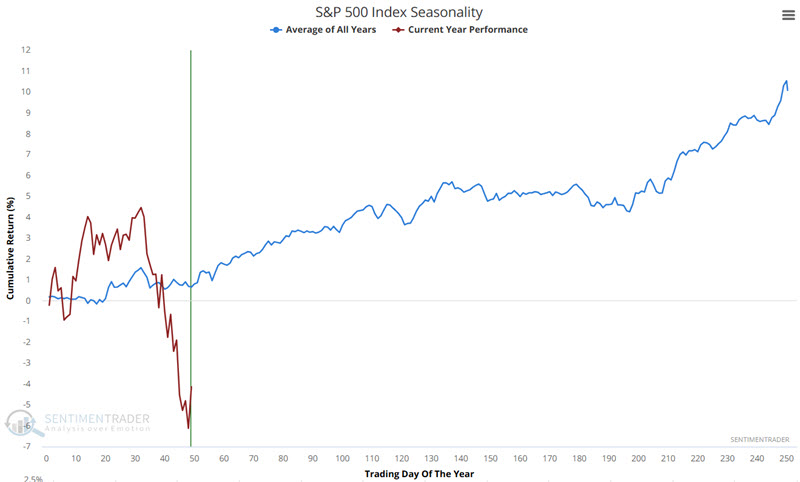

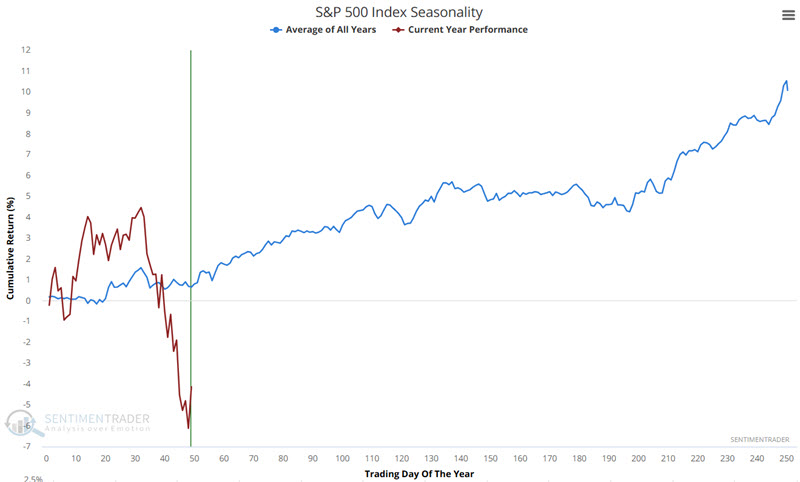

The chart below shows the annual seasonal trend, with price action for the S&P 500 so far this year overlaid. Remember that the seasonal chart is more about direction than price magnitude. In the broadest sense, stocks have followed their seasonal tendencies so far-i.e., strength through Trading Day of Year (TDY) #32 and weakness into TDY #49.

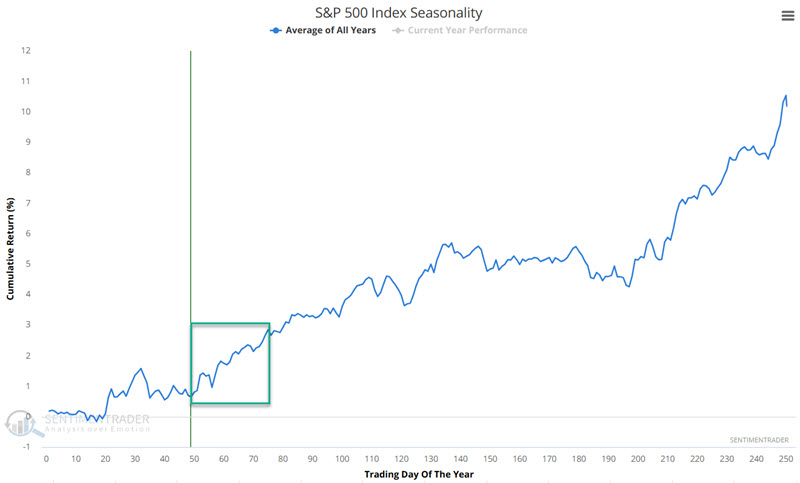

The chart below shows the annual seasonal trend for the S&P 500. It shows an upward bias from late March into the middle of the year. More specifically - and as highlighted in the green box - the period from Trading Day #49 through TDY #75 tends to show strength. For 2025, this period extends from the close on 2025-03-14 through 2025-04-22.

As always, it is essential to remember that seasonality is backward-looking - i.e., it is simply an average of the past - and should never be considered a roadmap for what will happen in the current year. Still, history is what it is for the S&P 500.

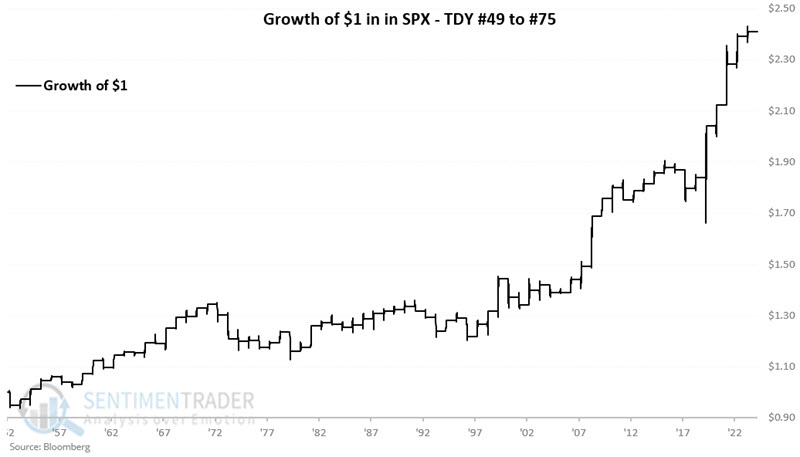

The chart below displays the hypothetical growth of $1 invested in SPX only from TDY #49 through TDY #75 every year since 1953.

The chart below displays the same information on a logarithmic scale.

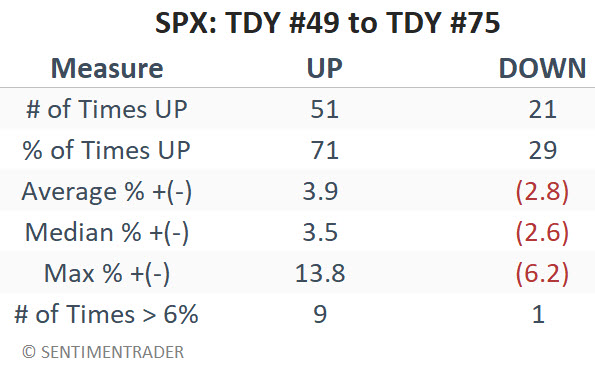

The table below summarizes S&P 500 performance during the TDY #49 to #75 period.

What the research tells us…

A 71% Win Rate is good but reminds us that a late spring stock market rally is no sure thing. With the majority of major stock market indexes below their respective 200-day moving average and with uncertainty (primarily around the ultimate effect of tariffs) still overhanging the market, the fact that "seasonality is favorable" should not be confused with a "buy signal." More than anything, the current round of favorable seasonality is a reminder not to let ourselves be overwhelmed by the cacophony of gloom and doom presently surrounding the market - and to be open to the possibility of bullish opportunities arising while the crowd looks the other way.