Where Are We in the Typical Sentiment Cycle?

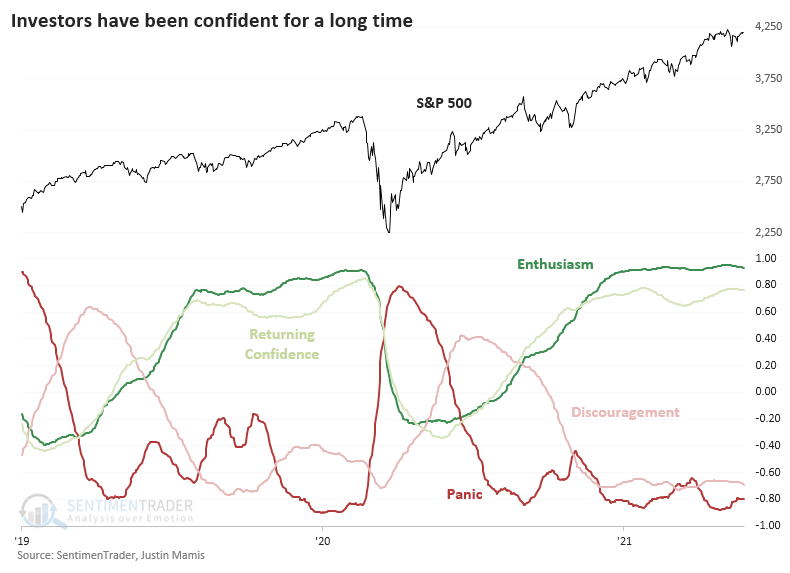

For more than six months, investors have had shown at least Returning Confidence and even Enthusiasm. That's according to the latest correlations to a Typical Sentiment Cycle.

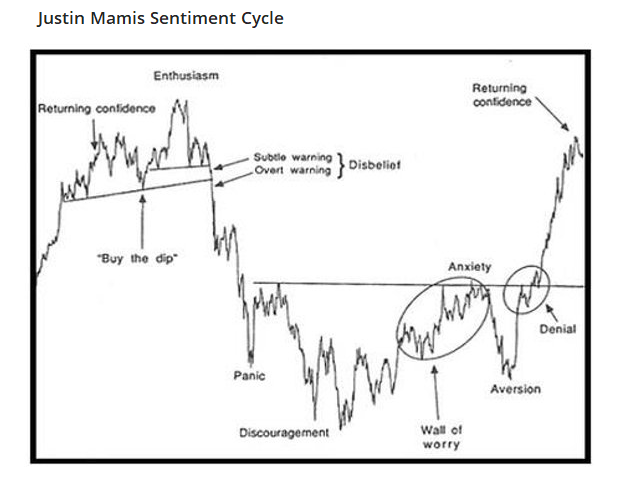

The idea of a repeatable pattern of investor behavior is questionable because the environment and inputs are always different. Human behavior is relatively constant, though, so many use some version of the Cycle popularized by Justin Mamis in his 1999 book, The Nature of Risk.

If we go back to 1928 and compare all periods that are similar to that 1990-1991 period, we can see the correlation we have to each part of the Cycle. When we do that, we get the following estimates for where we are in the Cycle:

- Enthusiasm: +0.93

- Returning Confidence: +0.77

- Discouragement: -0.69

- Panic: -0.80

The correlations range from -1.0 (perfect opposite) to +1.0 (perfect symmetry). Based on that, there is a strong probability that we're in the Enthusiasm phase. Last September, the correlations suggested we were moving into the Returning Confidence phase, a good sign. It stayed there for a while, then moved into Enthusiasm near the end of last year.

So, it has been more than six months, 140 days to be exact, that the price pattern of the S&P 500 has had at least a +0.60 correlation to both Returning Confidence and Enthusiasm, while also showing at least a -0.40 correlation to Discouragement and Panic.

That has moved us into the top 15 stretches of time with this kind of confidence among investors.

| Stat Box Nearly 93% of stocks in the S&P BSE Sensex Index of Indian stocks have climbed above their 50-day moving averages. When the index has seen similar internal thrusts, it rallied over the next 3 months after 19 out of 22 signals. |

What else we're looking at

- Full returns after investors showed at least Returning Confidence and not Discouragement for 140 days

- A worrisome - and little known - sign of inflation, and what it means for the Dow Industrials

- Indian stocks are showing a medium-term internal thrust