When to Take a Week Off(?)

In this recent article, I wrote about a little-known seasonal anomaly that "hides in plain sight." In this piece, we focused solely on this anomaly during September.

Here we will look at historical results on a month-by-month basis.

THE DAYS

As a quick review:

- The last trading day of the month is designated as TDM -1

- The next to last trading day is TDM -2

- The day before that is TM -3

- Etc.

The test period:

- Includes TDM -10 through TDM -5

- On a month-by-month basis

- From January 1931

- Through December 2020

CUMULATIVE RESULTS MONTH-BY-MONTH

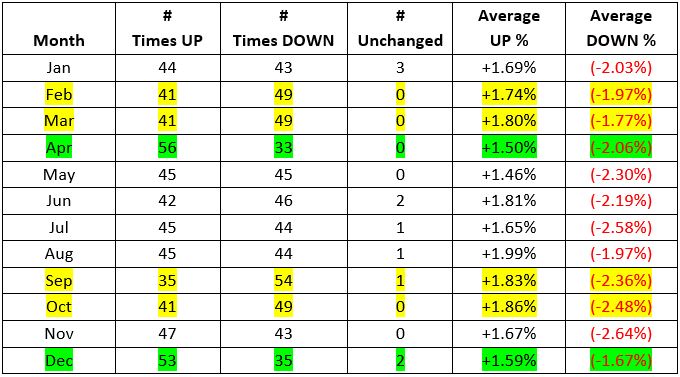

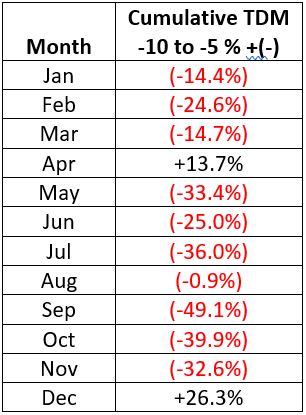

The table below displays the:

- Cumulative % price change for the S&P 500

- During this 6-trading day period

- For each month individually

- From 1931 through 2020

Things to Note (From 1931 through 2020):

- The only two months to show a gain are December and April

- The weakest months overall have been September, October, July, May, and November

MONTH-BY-MONTH

The table below displays the performance of the TDM -10 through TDM -5 period on a month-by-month basis.

When we look at the frequency of UP months versus DOWN months, what we find is that:

- The -10 to -5 edge is slight, even in the best and worst months

- The "best" -10 to -5 months have been December and April

- The "worst" -10 to -5 months were September, October, February, and March, and June

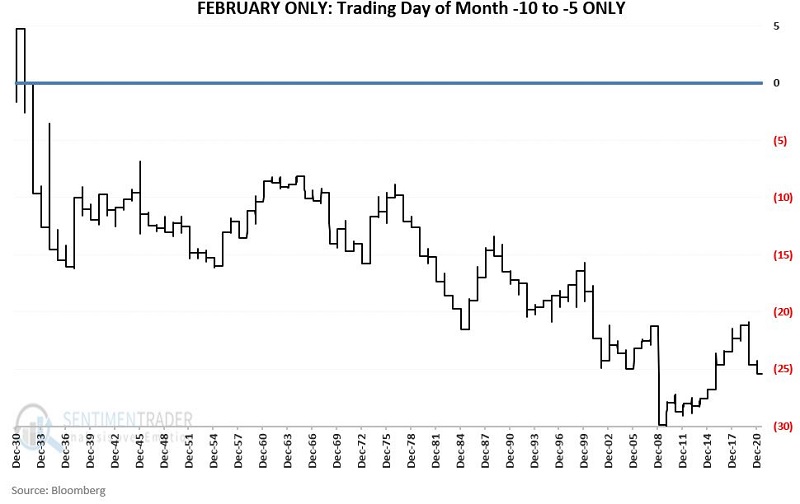

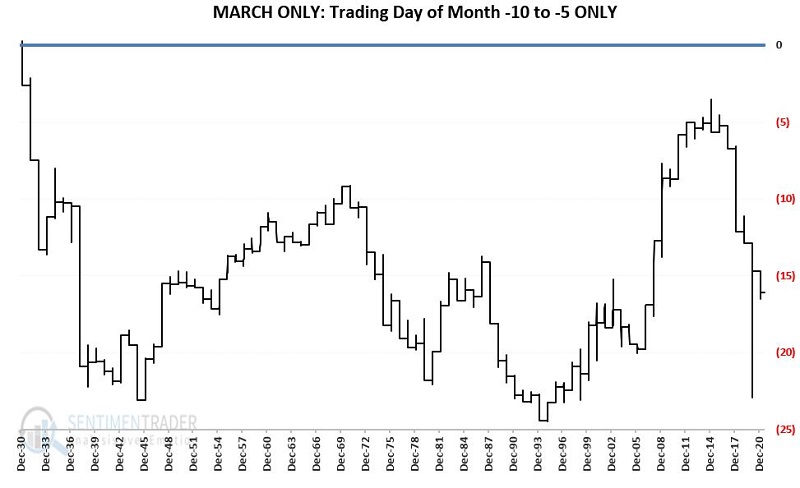

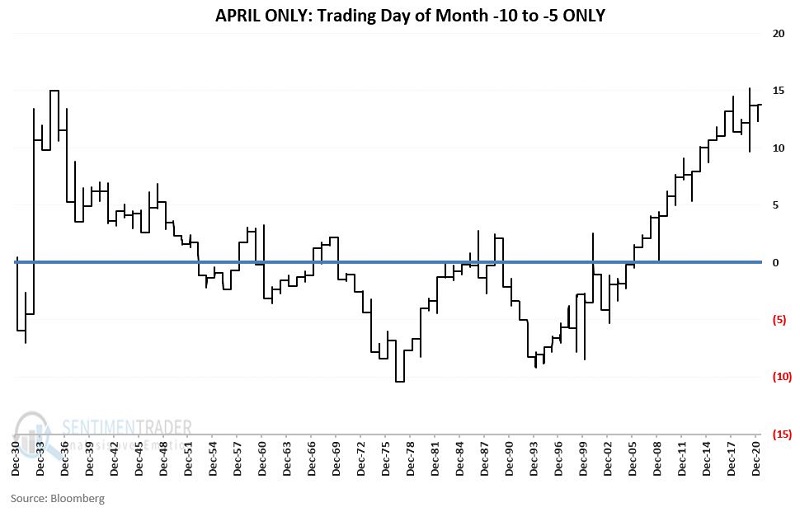

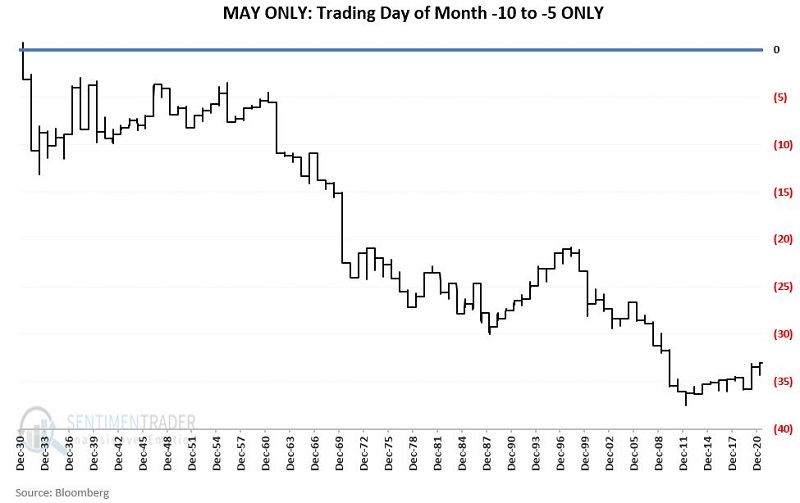

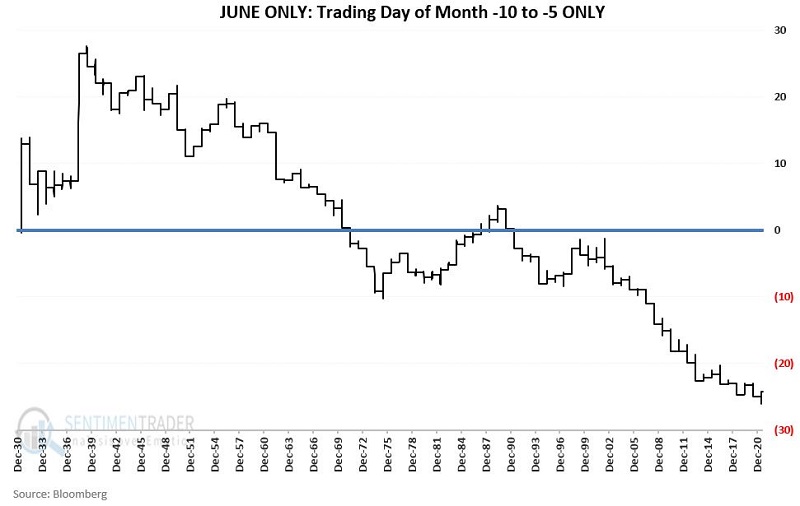

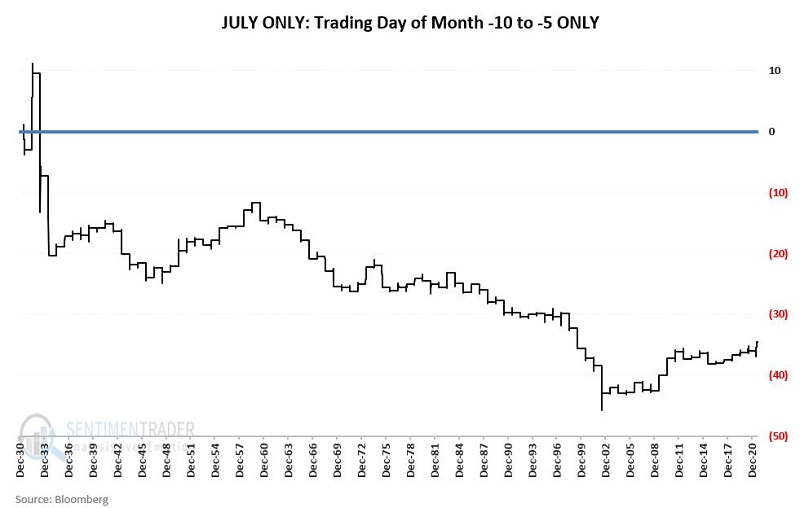

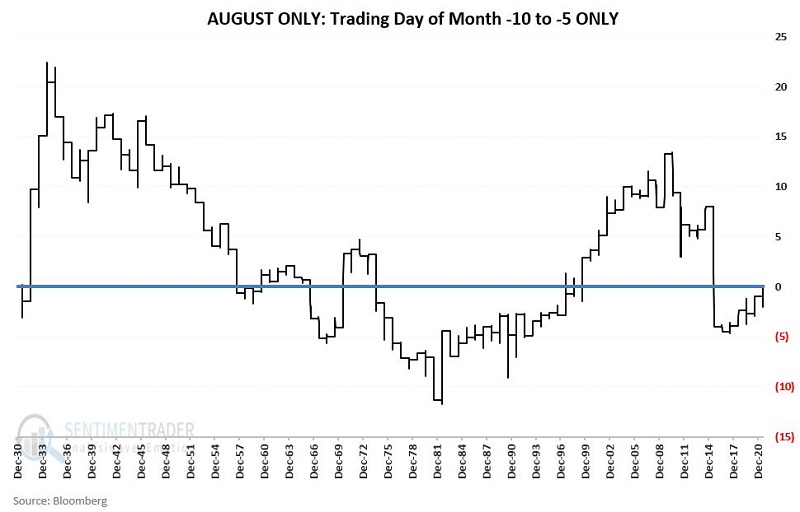

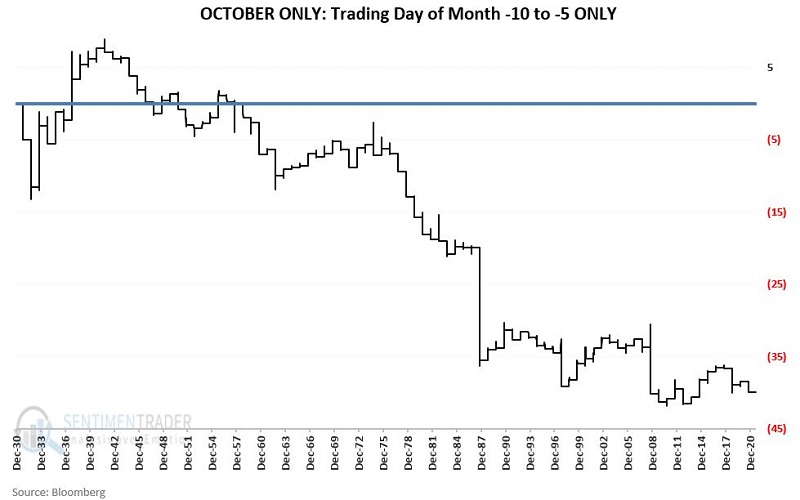

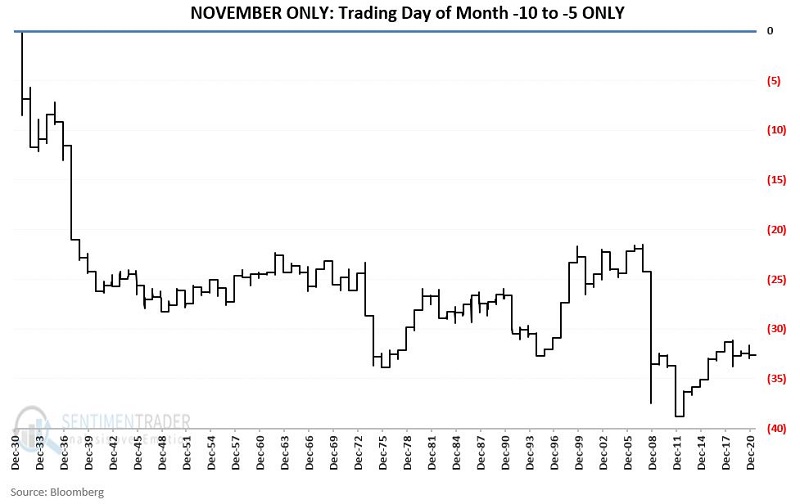

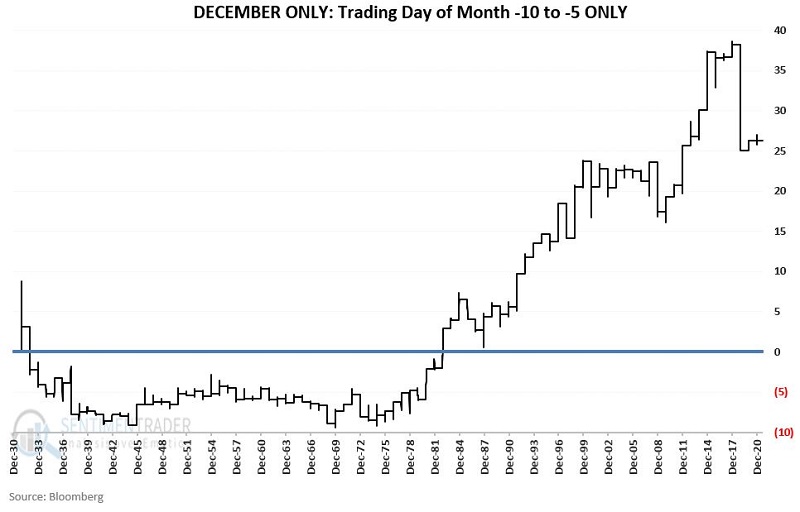

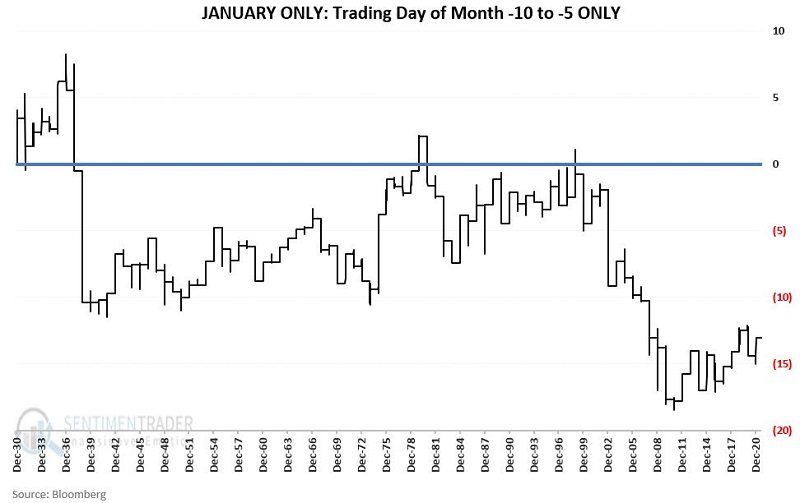

The following charts display the cumulative price return for our "seasonally weak" 6-trading day period on a month-by-month basis through the end of 2020.

REAL-WORLD TRADING APPLICATIONS

There does not appear to be any real rhyme or reason to the gyrations of the individual charts above. Nevertheless - except for April and December - there is an undeniable downside tendency for the stock market during the particular time of the month.

In terms of real-world trading:

- It probably does not make sense for long-term investors to unload their entire portfolio and then repurchase it six trading days later each month. Potential tax implications, slippage, commissions, and the sheer logistics of doing so can make this an unwieldy approach.

- That said, if an investor is looking to put money to work in the market, it can make a great deal of sense to wait until TDM -5 to do so.

- If an investor is looking to sell (whether a large or small part of their portfolio), selling before the close of TDM -10 would seem to be a good idea. The same goes for investors looking to hedge their portfolio or individual holdings within their portfolio.

- This anomaly can be a terrific "weight of the evidence" input for shorter-term traders. I.e., if the preponderance of the evidence is bearish heading into this period, a short position may look much more attractive and should be pursued aggressively.