When the Baa corporate bond yield does this, pay attention

Key points:

- The Baa corporate bond yield has closed at an 18-month high in 5 out of the last 12 months

- The increase in the cost of capital triggered a new alert for a component in the TCTM recession composite

- History suggests a potential recession looks more likely

- After similar signals, the S&P 500 shows negative returns on a medium and long-term basis

Baa corporate bond yields as a recession and stock market signal

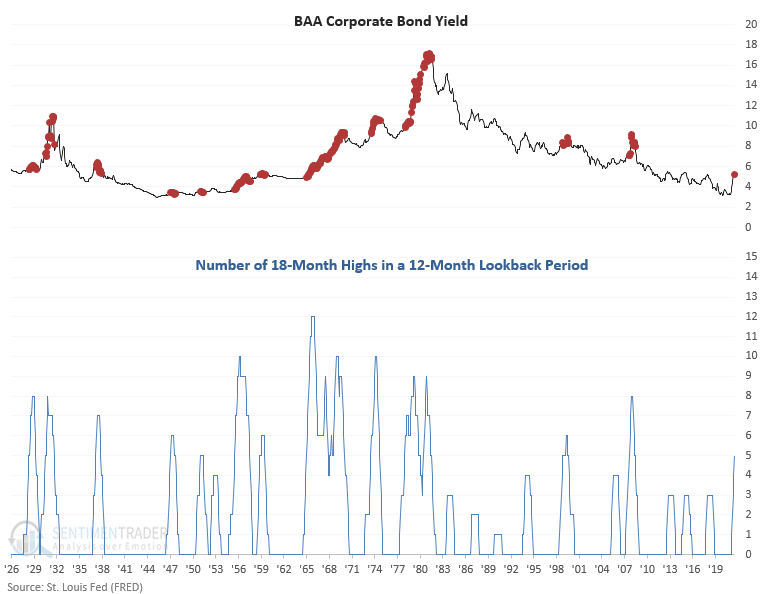

A new signal from a voting member in the TCTM Recession Composite Model registered an alert with the June update. The model identifies when the Baa corporate bond yield closes at an 18-month high in 5 out of the last 12 months.

With the new signal, the TCTM recession composite count as a percentage of components increased to 25%.

A consistent monthly increase in corporate bond yields above an 18-month high has been rare since the peak in rates in the early 1980s. The last two instances occurred before or during significant recessionary bear markets in 2000-02 and 2007-08.

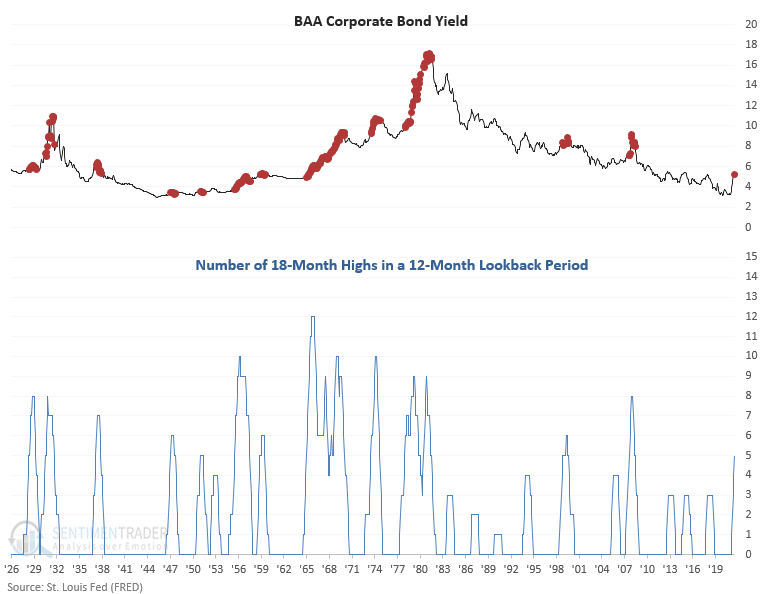

The Baa bond yield signal has triggered before or during a recession in 11 out of 15 instances since 1929. Most alerts occur before a recession.

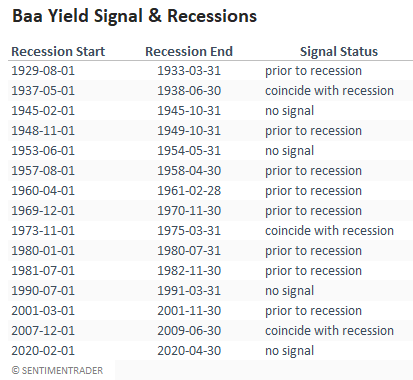

With the S&P 500 and other indexes in a bear market, monitoring the economy for signs of a recession is imperative. Bear markets accompanied by a recession typically experience more significant drawdowns.

Similar surges in corporate bond yields preceded negative returns for stocks

This model generated a signal 13 other times over the past 93 years. After the others, S&P 500 future returns, win rates, and risk/reward profiles were unfavorable across medium and long-term time frames. Returns were negative at some point in the first 6 months in 11 out of 13 instances. The 1999 signal was a bit early. However, we all know what happened after that one.

The TCTM recession composite increased to 25% with the Baa signal. While some components like economic sentiment are approaching levels that would trigger an alert, others, like my jobless claims model, are not in a position to fire a signal.

What the research tells us...

When the BAA corporate bond yield closes at an 18-month high in 5 out of the last 12 months, the increase in the cost of capital weighs on economic activity and stock prices. Similar setups to what we're seeing now have preceded most recessions and weak returns for the S&P 500 across medium and long-term time frames.