When rising yields are driving volatility

What's been scaring investors over the past month? Rising yields.

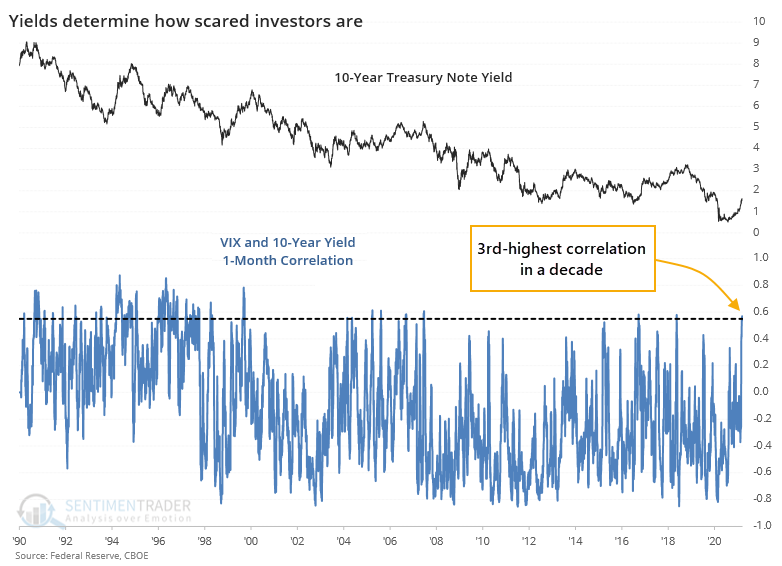

Maybe "scared" isn't the right word, since the VIX indicator, which measures options traders' estimate of future volatility, has mostly been dropping. So "influencing" is probably more appropriate. And over the past month, yields have been influencing the VIX at one of the highest levels in a decade.

The chart below shows a rolling 1-month correlation between daily changes in the VIX and 10-year Treasury yields. The higher the blue line, the more that yields seem to be influencing stock investors' volatility expectations.

Whether this matters is open to interpretation. So, let's put some numbers to it. We'll go back to the inception of the VIX and look for every time the 21-day correlation in daily changes between it and the yield on 10-year notes exceeds 0.55. This is on a scale of -1.0 (perfect inverse correlation) to +1.0 (perfect positive correlation).

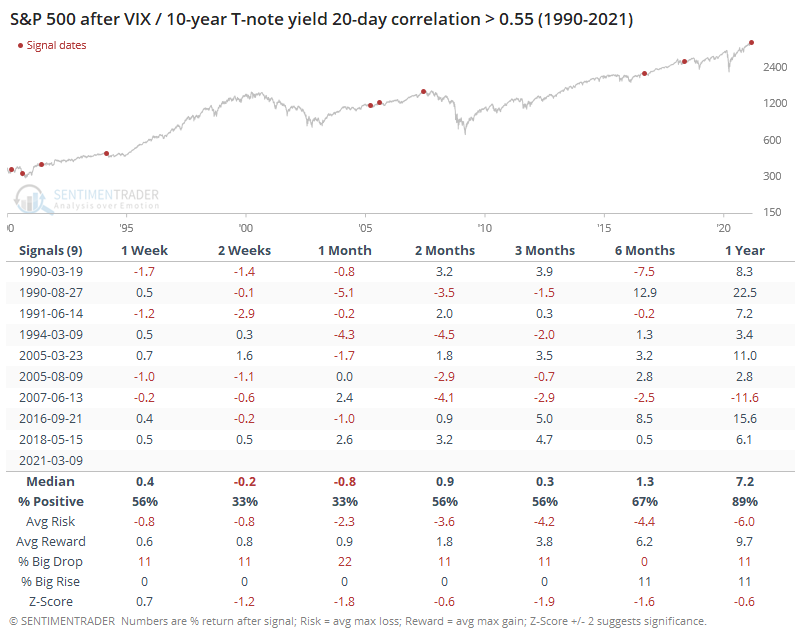

The table below shows only the instances when yields have risen the most over the past month.

When rising yields most influenced the VIX, the S&P 500 struggled a bit over the next 2-3 weeks. All but one instance, the latest one in 2018, showed a negative return either 1 or 2 months later. And even that 2018 signal ended up giving its gains back eventually. Over the next 3 months, the S&P averaged a return of only +0.3%.

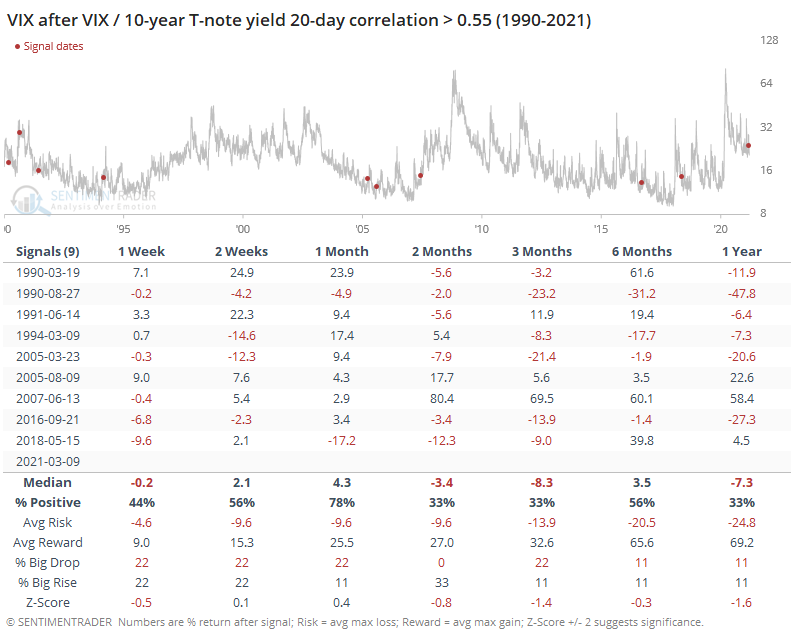

For the VIX itself, it was a mixed signal. It shows losses across most time frames, with the biggest chance for a spike being over the next month.

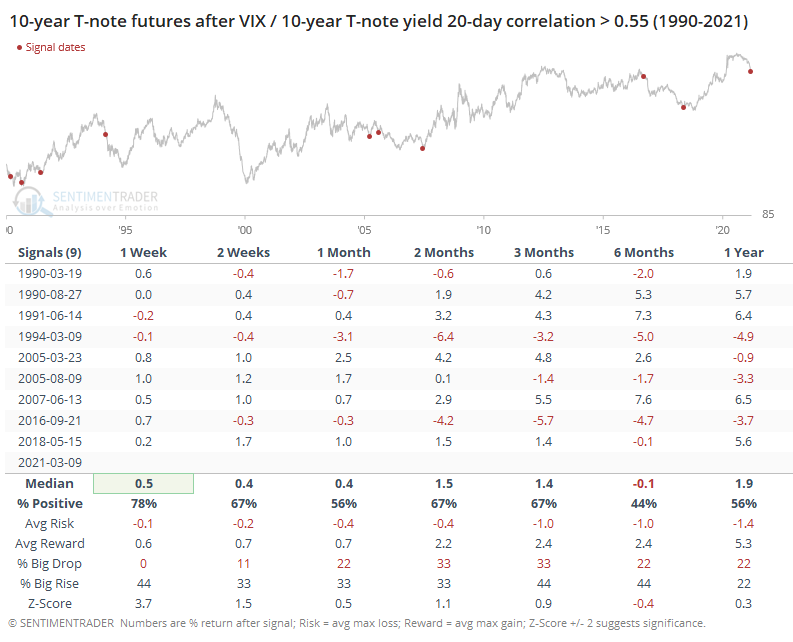

For Treasuries, it tended to be more of a shorter-term positive. Because yields were rising, that means note and bond prices were declining, and when the correlation with the VIX got to this high of a level, it mostly coincided with shorter-term oversold conditions in bonds.

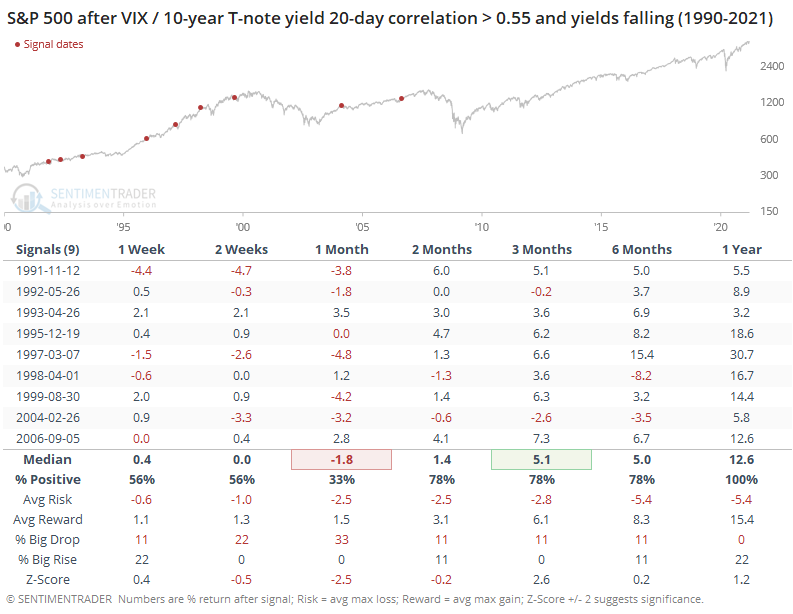

It's often helpful to look at opposing conditions, so the table below shows returns in the S&P when the VIX and yields were highly correlated, but it was due to declining yields, not rising ones.

Here, shorter-term returns were still sketchy, but over the next few months, the S&P averaged a return of +5.1% (versus only 0.3% when yields were rising more), and over the next year, showed a gain every time.

Opinions on what the rise in yields means for investors are all over the place. At least, we can suggest with a mild amount of confidence that when rising yields have been a primary force driving forward volatility expectations, then stocks have struggled more than when they were fearing the economic stagnation that lower yields would suggest.