When not to own the euro (except briefly)

Key points:

- The euro has demonstrated a tendency to show significant weakness early in the year

- A brief two-day respite separates two distinctly unfavorable periods

The euro meets January and February

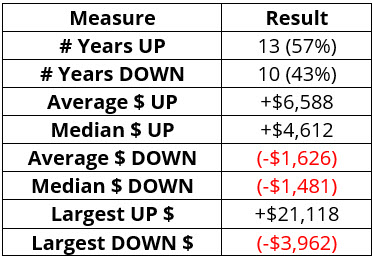

As always, when dealing with seasonality, it is essential to acknowledge that each year is its own "roll of the dice." And that there are no sure things. The chart below displays the annual seasonal trend for euro futures with that caveat in mind.

Our seasonal periods include:

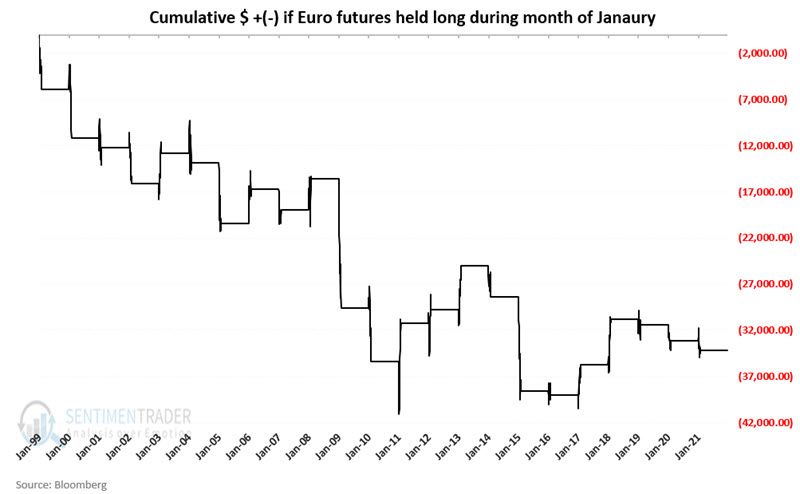

- Unfavorable: the entire month of January

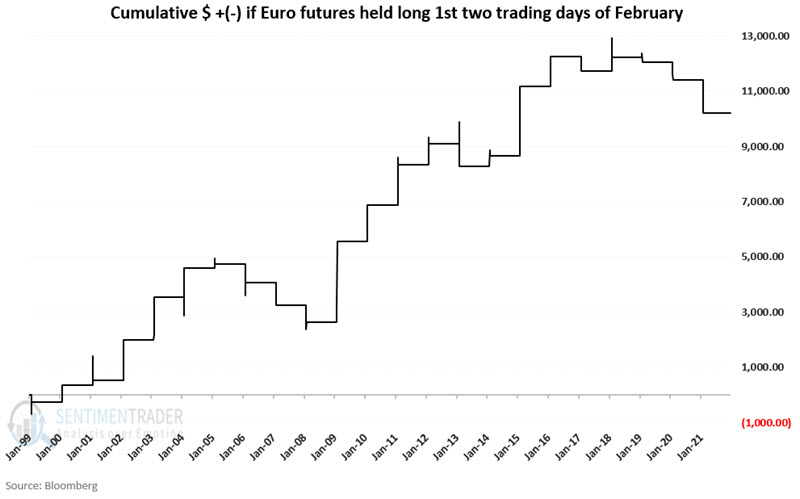

- Favorable: the first two trading days of February

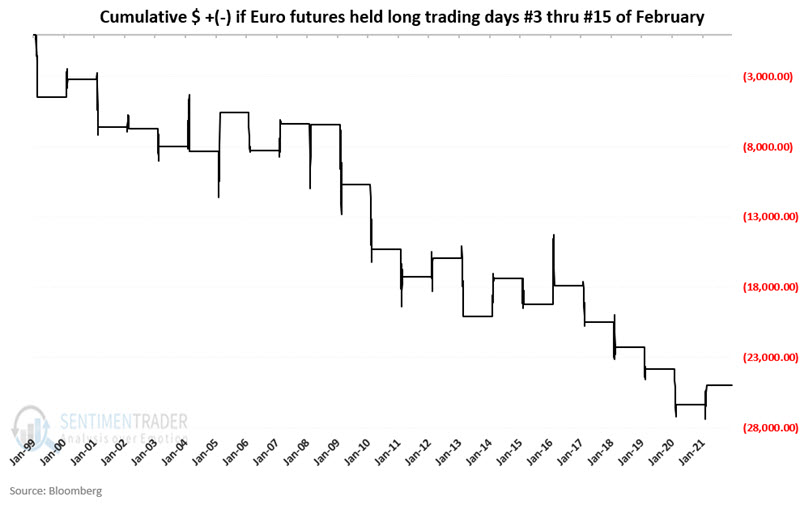

- Unfavorable: the next thirteen trading days in February (i.e., through February trading day #15

The chart below displays the cumulative $ return for euro futures held long only during the entire month of January each year.

The chart below displays the cumulative $ return for euro futures held long only during February's first two trading days each year.

Finally, the chart below displays the cumulative $ return for euro futures held long only during the trading day of month #3 through month #15 during February each year.

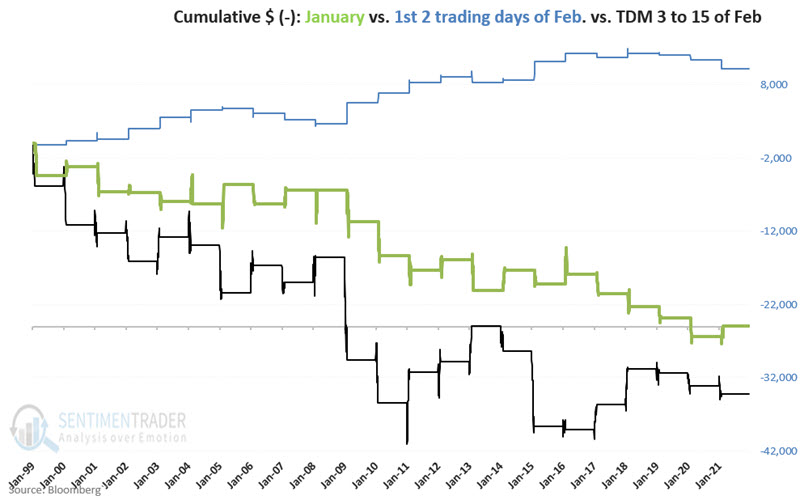

Putting the pieces together

The chart below combines the three graphs above. The long-term tendency to decline during the two unfavorable periods is pretty apparent, as is the "oasis" nature of February's first two trading days.

Lastly, let's consider the following hypothetical strategy:

- Short euro during January

- Long euro during first two trading days of February

- Short euro during February trading days of month #3 through #15

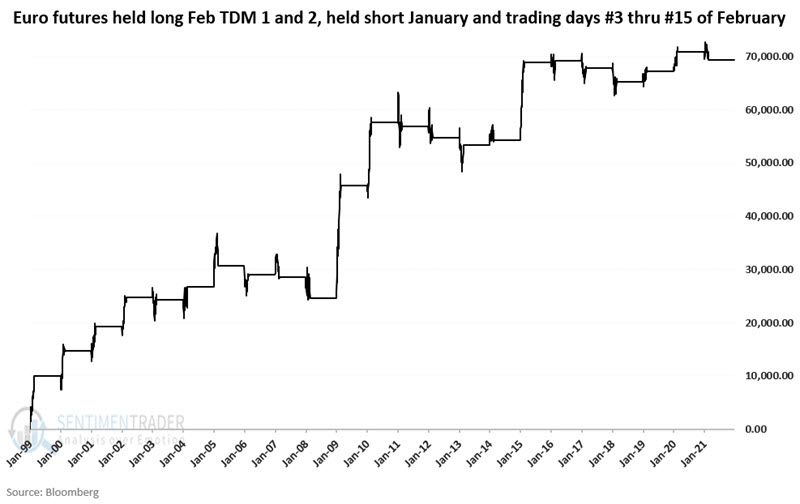

The chart below displays the hypothetical cumulative $ + (-) for this euro seasonal strategy.

The table below displays a summary of the results.

Three key things to note:

- The actual winning percentage is just 57%

- However, the average winner is four times greater than the average loser

- The median winner is three times greater than the median loser

What the research tells us…

The euro tends to show weakness early in the year; however, results can vary widely from year to year. Euro futures offer the potential for large gains but also significant loss for the unprepared and/or under-capitalized trader.