When NOT to own Bitcoin - Part II

Key Points

- In a recent article, we looked at how Bitcoin (BTC) and Grayscale Bitcoin Trust (GBTC) performed on certain days of the month

- In this piece, we will add results for cryptocurrencies Ethereum (ETH) and Litecoin (LTC)

- My original study was based on hypothetical results through the end of April 2021

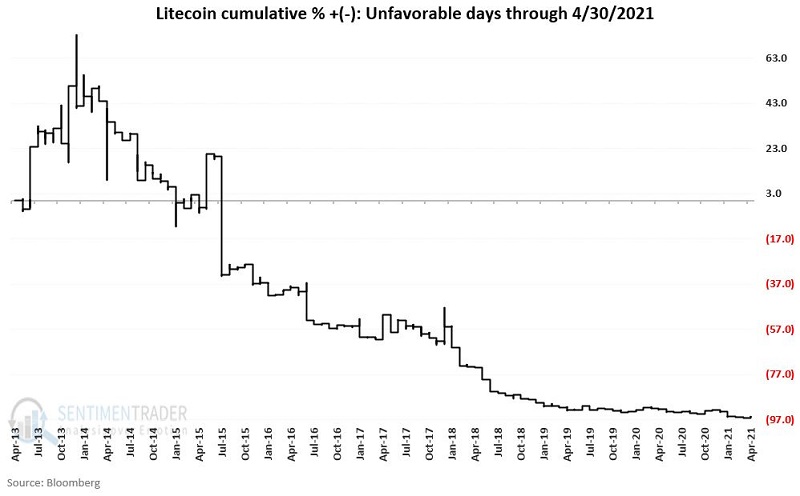

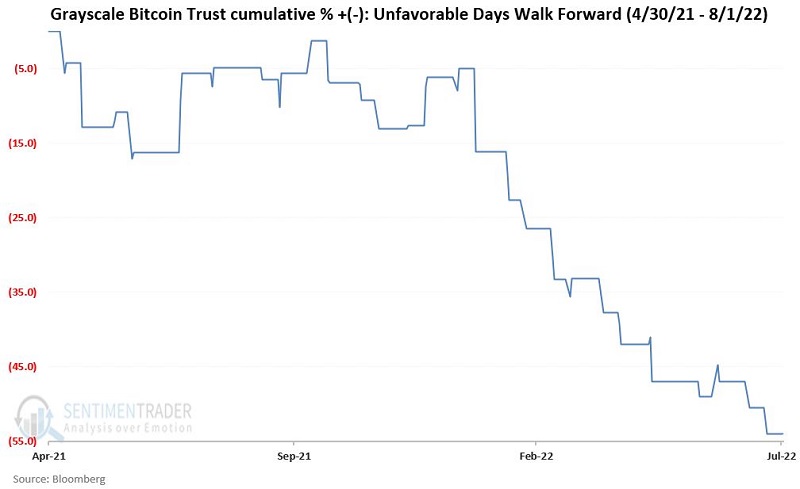

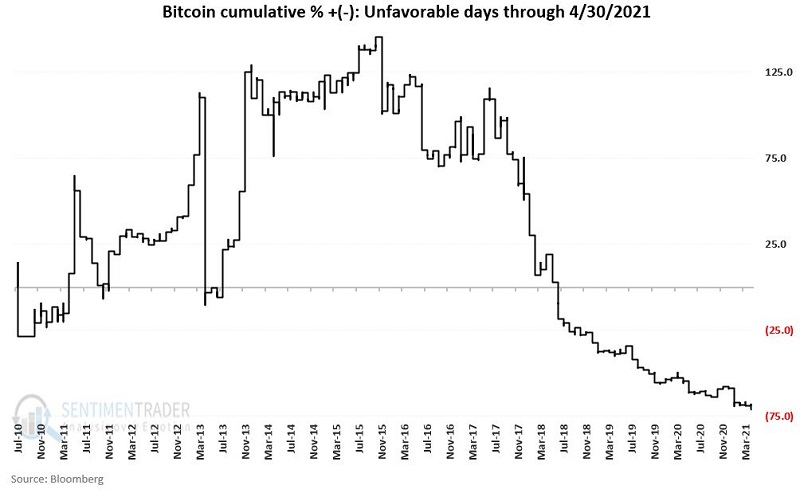

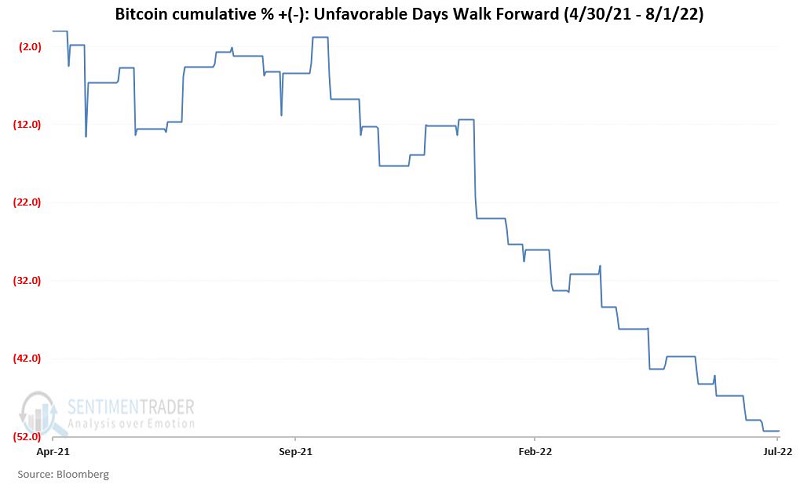

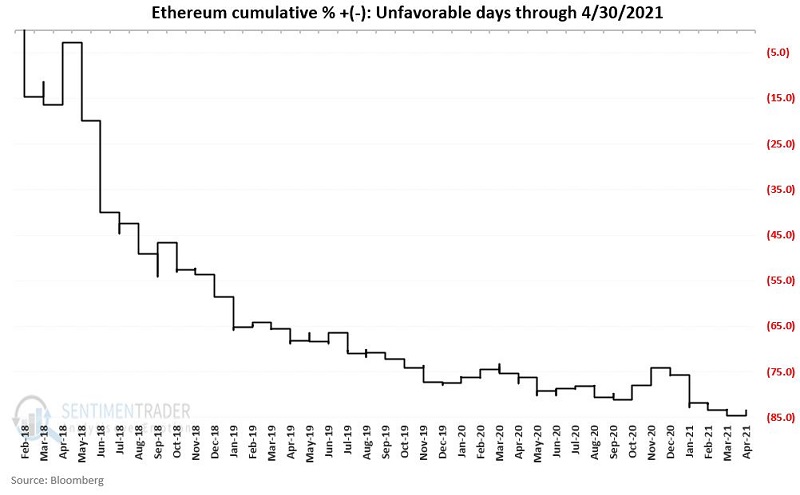

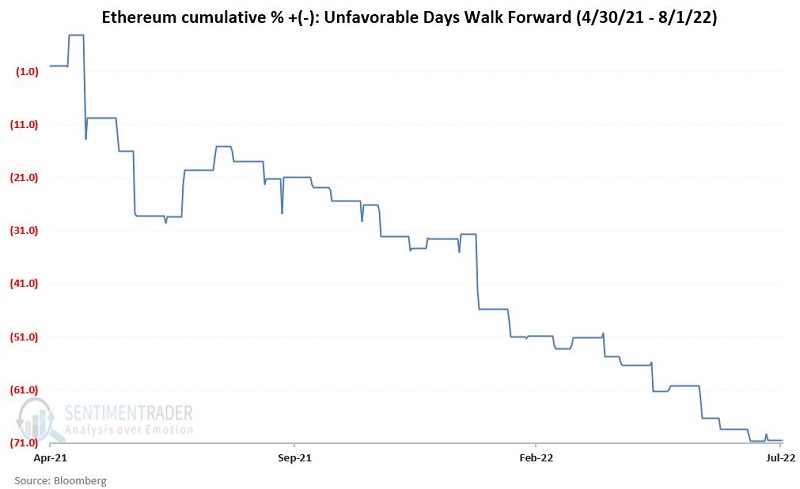

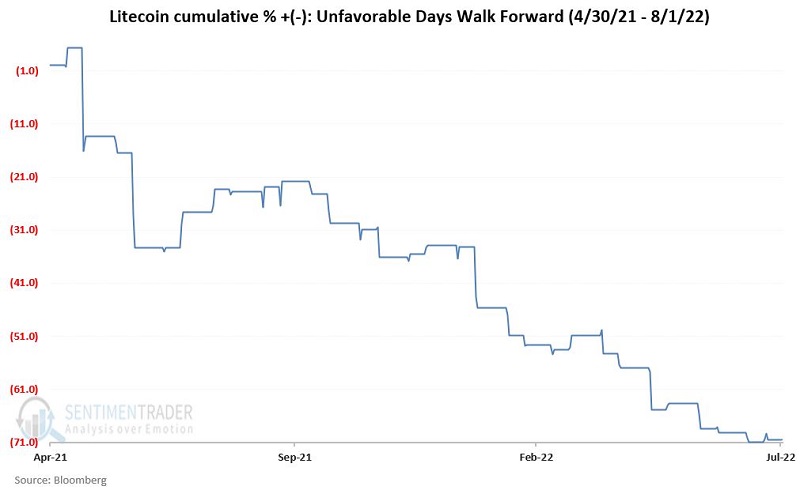

- In this piece, we will break performance results into two parts: Backtested through April 2021 and Walk forward from May 2021 through 8/1/2022

Starting at the end

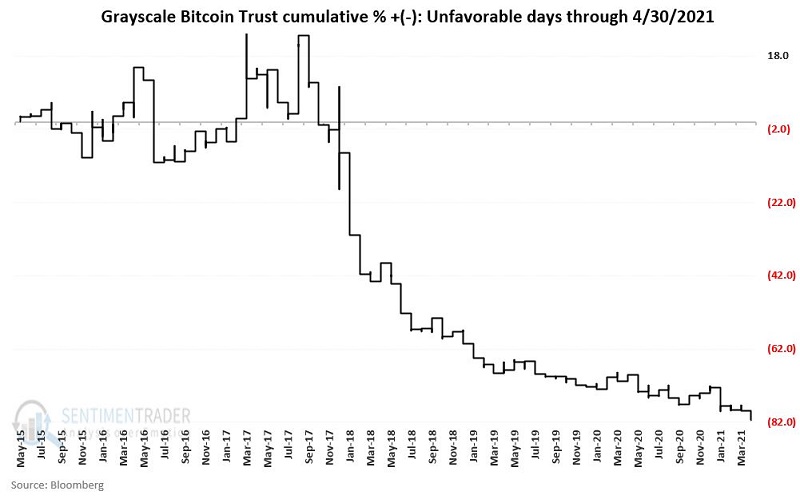

The calendar days of the month we will look at are once again the 10th, 11th, 21st, and 22nd. And again, the message is that (so far) it appears that on these dates, a long position in anything crypto-related should be avoided. It also bears mentioning that no inference is made that holding on every other day of the month will necessarily result in profitable returns.

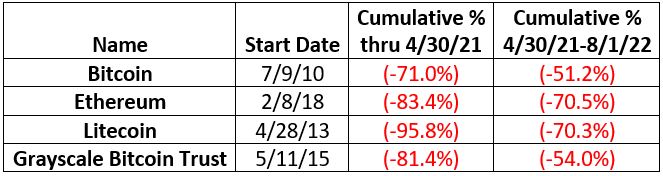

Let's start at the end by displaying the backtest and walk-forward results for each asset in the table below.

- The backtest period for each crypto asset begins with the Start Date listed and ends on 4/30/2021

- The walk-forward period for each crypto asset runs from 4/30/2021 through 8/1/2022

- The table below shows cumulative % returns if held only on calendar days of month 10, 11, 21, and 22

The reason I decided to write these pieces is pretty evident in the table above. For some unknown reason, crypto assets have displayed near-disastrous results on these calendar days of the month.

Let's look at the backtest and walk forward results for each asset separately.

Bitcoin

Ethereum

Litecoin

Grayscale Bitcoin Trust

The caveats regarding seasonality

Having analyzed a few seasonal trends in my day, the reality is that the results here are the type of results I find myself double and triple-checking under the assumption that I made a computational error somewhere. But having done so, I can state that the results displayed above are legit.

That's the good news.

The bad news is that seasonal trends are not magic, nor should they be considered a roadmap. It is rarely a good idea to rely on any seasonal as a standalone trading method. As compelling as the results displayed above appear, my frank expectation is that future results will likely not be as consistent and extreme as those shown above (Sorry, I don't make the rules).

What the research tells us…

Since each of the crypto assets considered above began trading, there has been a sizeable and consistent "edge" to avoiding them during the four days of the month listed above. Given that most cryptocurrencies trade 24 hours, the reality of timing trades to implement being in or out during certain days is a logistical question with which crypto traders must grapple. This is less of an issue for GBTC since it trades during market hours.