When it's time to switch into Consumer Staples

From Jay...

One of the never-ending tug-of-war battles in the market is that between the consumer staples and consumer discretionary sectors. The theory is that in stable times consumers will splurge on "wants" which should pump up discretionary stocks. On the other hand, during more troubled times consumers will focus on "needs" which should be a boost for staples stocks.

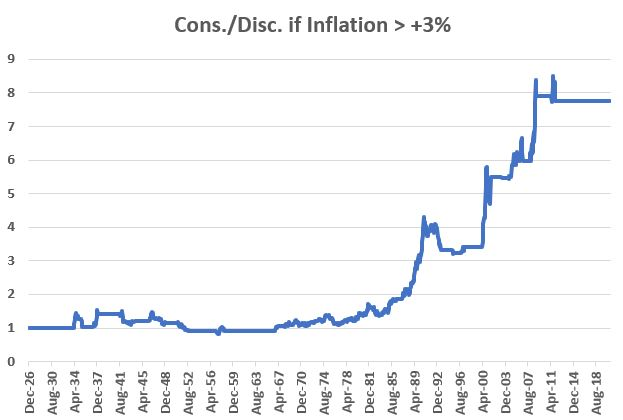

One factor that few investors take into consideration when allocating between the two is inflation. As it turns out, such analysis may offer an edge. To illustrate this point, let's focus on a strategy that looks solely at inflation to decide whether to be in the staples or discretionary sectors.

The chart below shows the relative performance of consumer staples versus consumer discretionary ONLY when inflation was very high.

There are many factors that can influence the relationship between staples and discretionary sectors. Still, it appears that factoring inflation into the equation may offer investors an important - and little-recognized - potential edge.

| Stat Box With another round of big up days, the S&P 500 has enjoyed 32 more days with a 1% gain than a 1% loss over the past year. This is a record number dating back to 1926. |

What else we're looking at

- A more in-depth look at performance in staples and discretionary depending on inflation levels

- Defining a risk-off signal based on trends and breadth, and where it stands right now

- What happens when gold first crosses above its medium-term moving average

- The "smart money" is nearing a record short in one commodity market