When Gold Meets Japan (Part I)

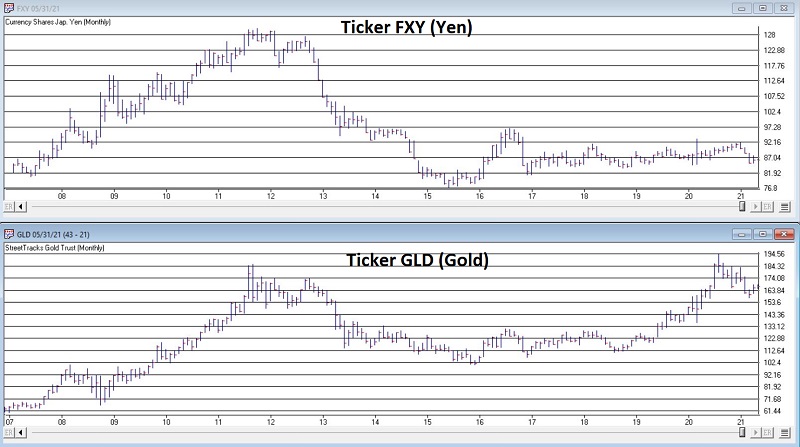

Some relationships are fairly obvious, and others are not. Not many people think much about the relationship between gold and the Japanese stock market and/or the Japanese Yen. The chart below (courtesy of AIQ TradingExpert) displays ticker FXY (Invesco CurrencyShares Japanese Yen Trust) and ticker GLD (SPDR Gold Shares).

A simple glance at the two charts reveals a clear degree of correlation between the Japanese Yen and Gold. In Part I, we will discuss one way to use a gold indicator to help identify the trend of the Japanese stock market.

GOLD RISK LEVELS

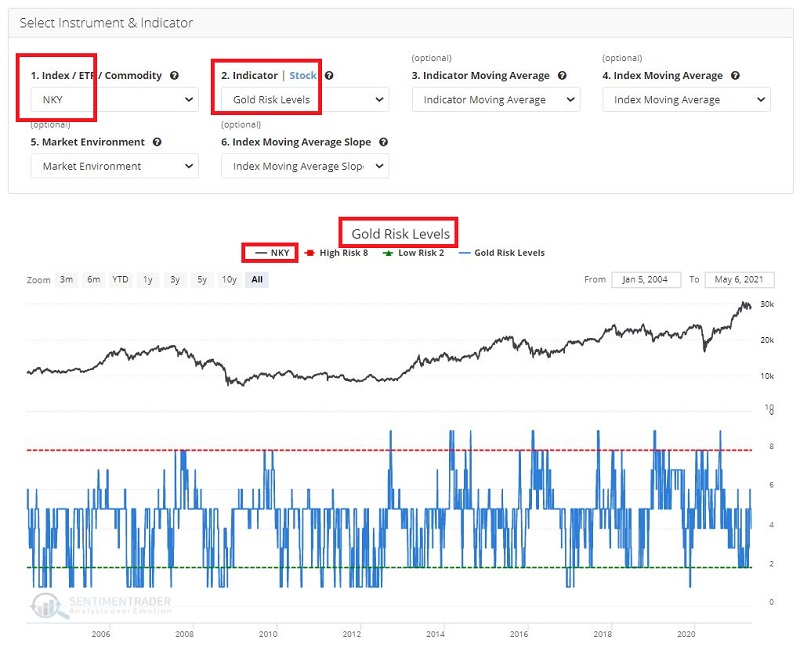

Gold Risk Levels is an indicator available on SentimenTrader.

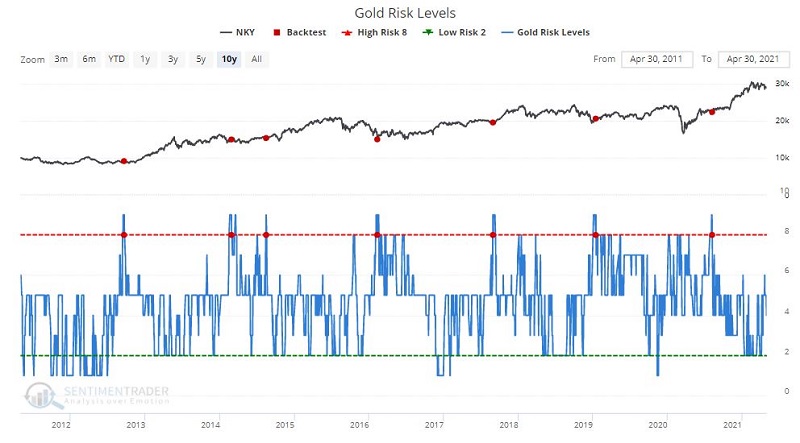

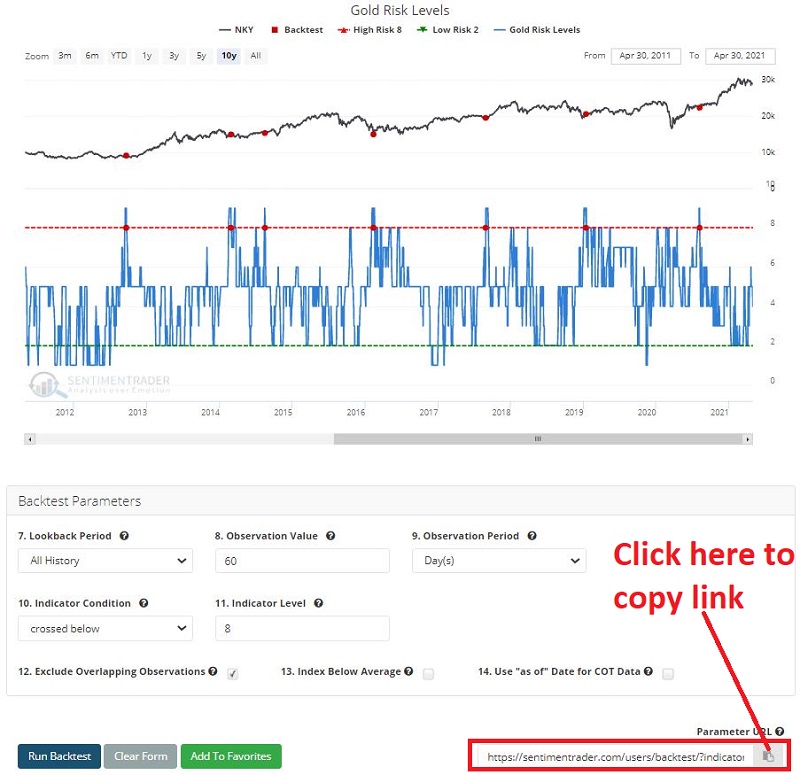

Clicking this link will load the following test into the Backtest Engine:

- Index = NKY (Nikkei Index)

- Indicator = Gold Risk Levels

- Looking for the Indicator to cross below 8 (Technical Note: This tests for a drop from above 8 to a value 8 or below)

- For the first time in the past 60 days

Clicking "Run Backtest" will launch the test and analyze the Nikkei Index's performance in the 1 to 12 months following a reading by the Gold Risk Levels Indicator that drops from above 8 to 8 or below for the first time in 60 days.

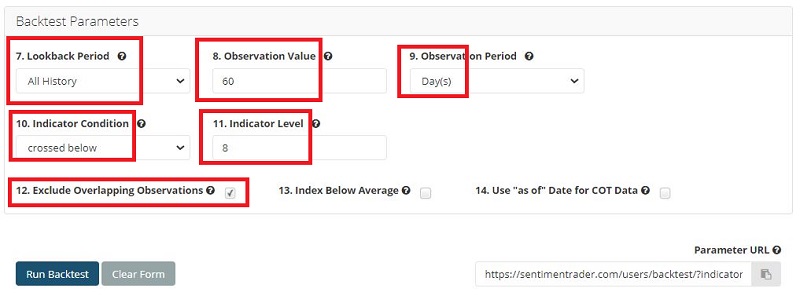

The chart below displays the handful of signals - all of which occurred within the last 10 years - using a red dot.

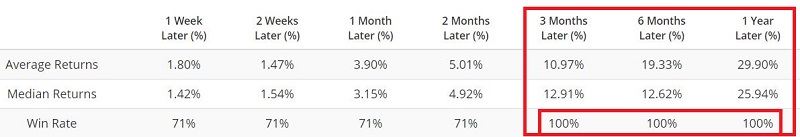

The table below displays the Summary of Nikkei Index performance results. Note the particularly favorable Average and Median Returns and Win Rates for the 3-month, 6-month, and 1-year periods.

The table below shows that signals were generated in 6 separate years and highlights the favorable 3-month, 6-month, and 12-month return for the Nikkei Index following each signal.

THE BOTTOM LINE

A reversal in Gold Risk Levels from a high level strongly suggests potentially favorable price action in the year ahead for the Nikkei Index.

SAVING THIS TEST FOR FUTURE USE

In a candor, this is not the most timely series of articles I will ever write. So we may want to save this test for future use when it is more relevant.

To save this test for future reuse:

- Click "Add to Favorites"

- Type in a descriptive test name (such as "Nikkei Index versus Gold Risk Levels cross below 8")

- Click "Save Favorite"

These steps will add this particular scan to your list of Favorites. Anytime you enter Backtest Engine, your Favorites will be listed at the bottom as per below.

Another alternative would be to:

- Click the file folder icon to the far right below the words "Parameter URL"

This will copy the entire test link to your clipboard. You can then paste the link itself into a document or spreadsheet and save it for future use.

In Part II, we will look at Gold Risk Levels versus the Japanese Yen.