Wheat has wilted, and investors have given up

Key points:

- Wheat prices have plunged more than 40% over the past year, and sentiment has soured

- Optimism toward that market is in the bottom 1% of readings since 1991

- Despite commodities' notorious boom-and-bust cycles, low optimism has a decent track record of preceding a bounce

Wheat has plunged, and investors assume it's going to keep going

Commodities enjoyed a huge run from April 2020 through June 2022 and have been mired in a steady melt since then. Among the most prominent victims has been wheat, which just declined to a one-year low.

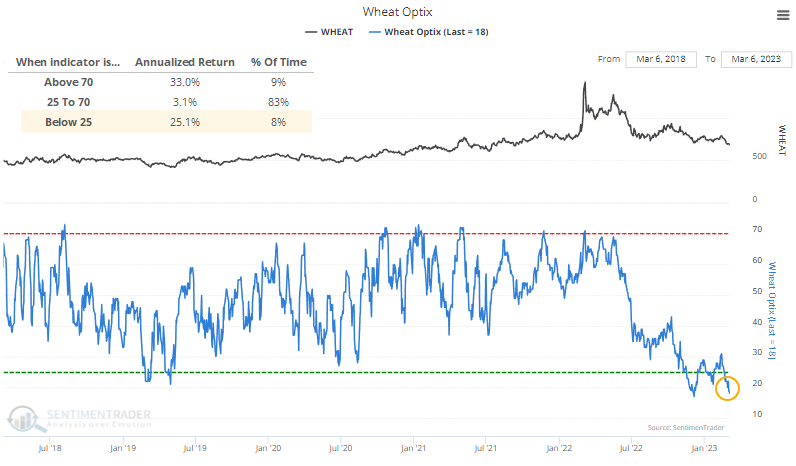

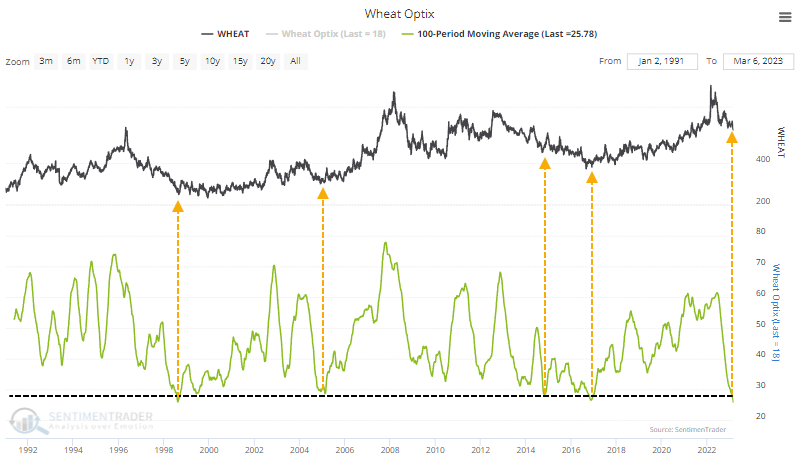

Investors have been giving up, with surveys showing low optimism and speculators placing increasing bets on the short side. That has pushed its Optimism Index below 20, the 2nd-lowest reading in the past five years and in the bottom 1% of readings since 1991.

Like many commodities, wheat has frequent boom and bust cycles. Its worst returns tend to occur in the mushy middle, with very low and very high sentiment readings tending to precede the best returns.

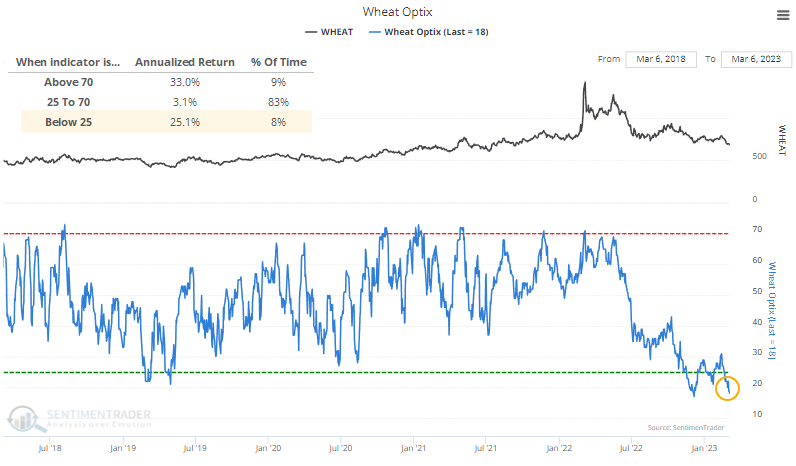

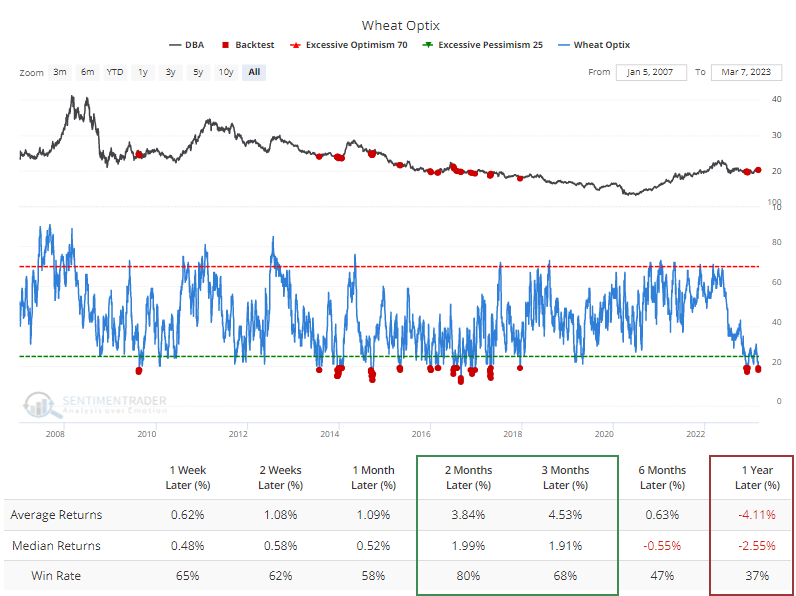

The table below shows wheat's forward returns when the Optimism Index dips below 20 for the first time in at least 50 days. Even though many of these were triggered during multi-year bear markets, the contract sported a decent tendency to rebound over the next three months. One concern is that the last signal also preceded the worst three-month return, raising the potential that some more significant shift has occurred.

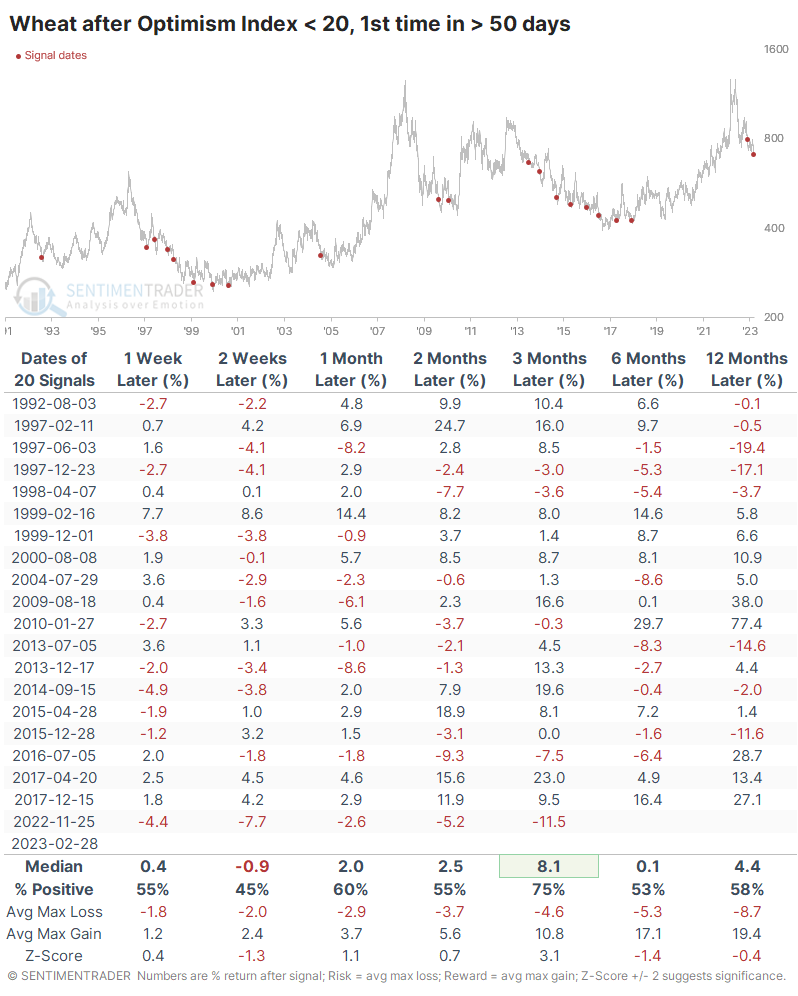

One potential tailwind is that sentiment has been depressed for a while. The 100-day moving average of the Optimism Index just dropped below 26, the lowest reading in history. After other stretches of extremely low sentiment, the declines tended to moderate at worst.

According to Bloomberg calculations, among a broad group of popular U.S.-based ETFs, the DBA fund has the highest correlation to wheat prices. This excludes the more obvious WEAT fund, which can sometimes be thinly traded.

According to the Backtest Engine, when wheat's Optimism Index has dropped below 20, the DBA fund sported a positive return over the next two months 80% of the time. That's not terrible, given that a downtrend dominated most of the study period.

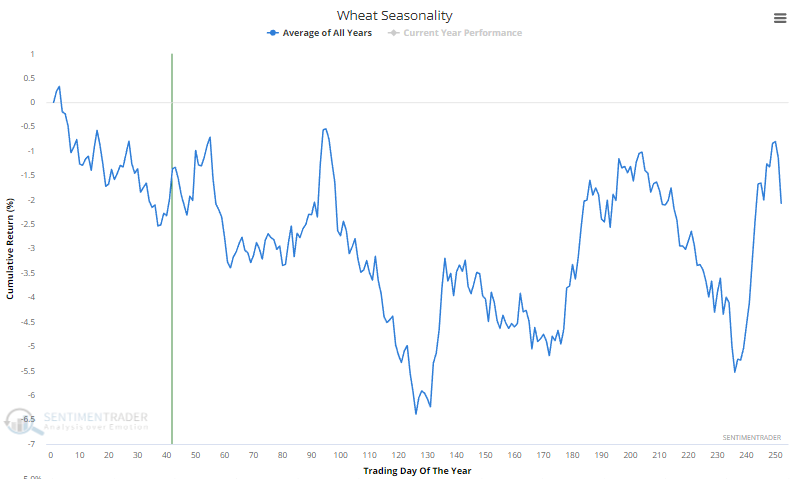

One hiccup is seasonality, which is not in wheat's favor. While seasonal biases for commodities can be difficult to rely on due to issues like futures contract roll methodologies, this version shows a headwind.

What the research tells us...

Commodities are prone to extended boom and bust cycles, making time counter-trend rebounds and declines challenging. For wheat, there are modestly compelling signs that the contract has suffered a large enough loss, over a long enough time, to generate a large amount of pessimism. And when it has declined to this degree in the past, it has a decent tendency to rebound in the months ahead. The boom-and-bust pattern so far looks similar to the ones in 1997 and 2008, so long-term investment in a contract like this is suspect.