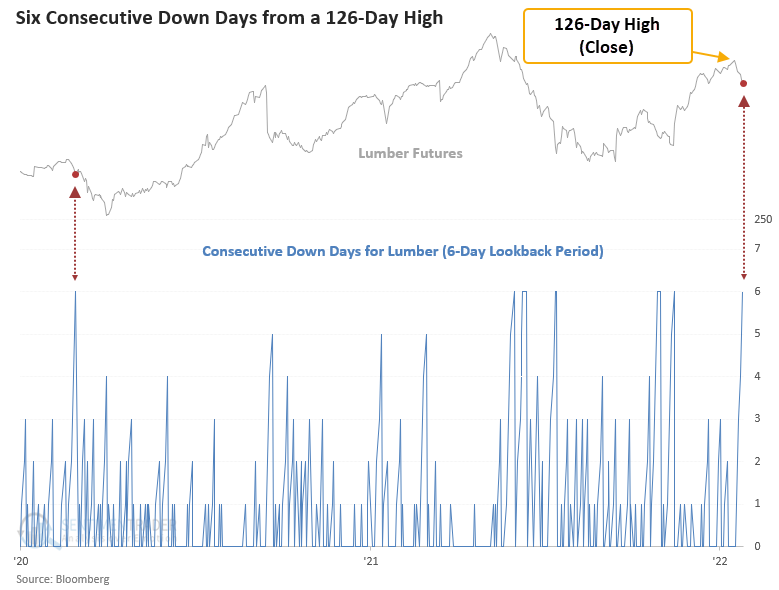

What's the market message from lumber prices

Key points:

- Lumber futures have declined for 6 consecutive days from a 126-high

- Lumber, homebuilders, and economically sensitive stocks have struggled after other signals

Lumber as a real-time economic indicator

Lumber has finally succumbed to the pressure of rising interest rates and the federal reserve pivot on policy. With single-family home prices near record highs and interest rates on the rise, does the signal from lumber foreshadow a slowdown in the housing market that could impact homebuilding stocks? And, if housing falters, should we expect other economically-sensitive industries to feel the strain of rising interest rates. Let's conduct a study to assess the outlook for lumber, homebuilders, and other economically sensitive stocks when the commodity declines for 6 consecutive days from a 126-day closing high.

Similar signals have preceded weak medium-term returns

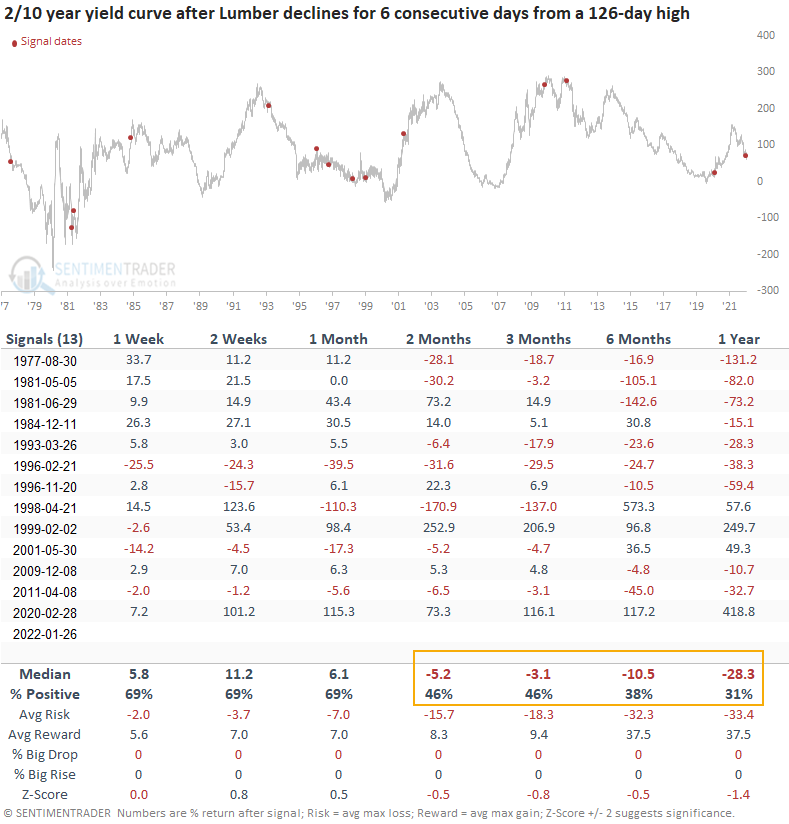

This signal has triggered 15 other times over the past 48 years. After the others, lumber future returns and win rates were weak across medium-term time frames.

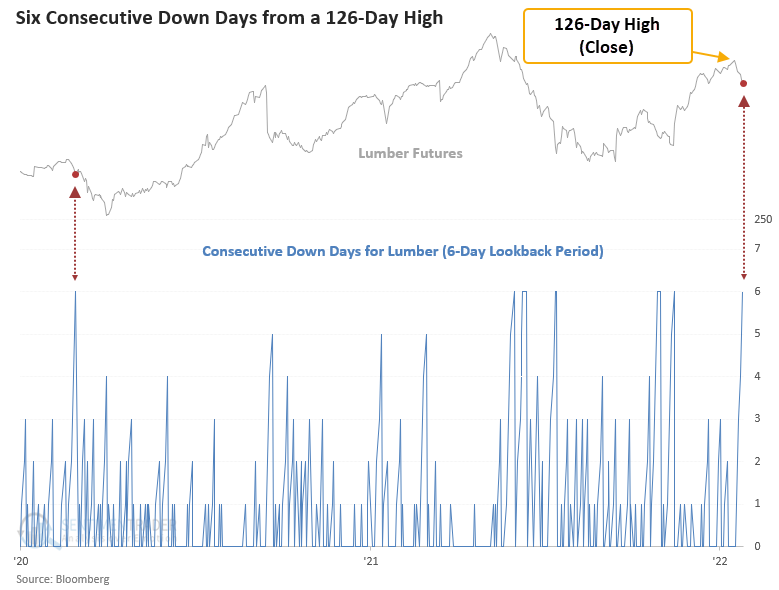

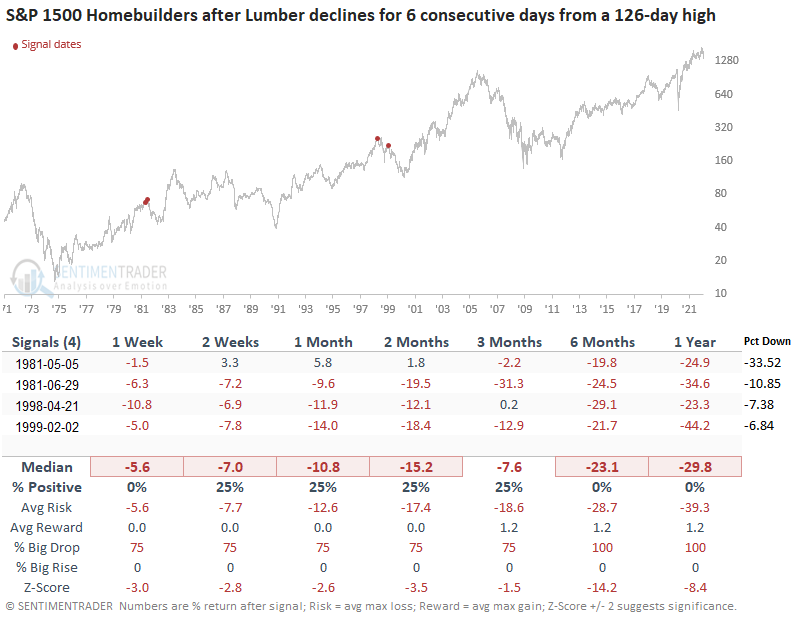

Let's apply the signals to homebuilders

Homebuilders show weak returns and win rates across short and medium-term time frames. The final column in the table shows how much homebuilders were down from a 252-day high when the lumber signal was triggered. So, despite a decline in all 15 instances, homebuilders still showed weak returns on a go-forward basis.

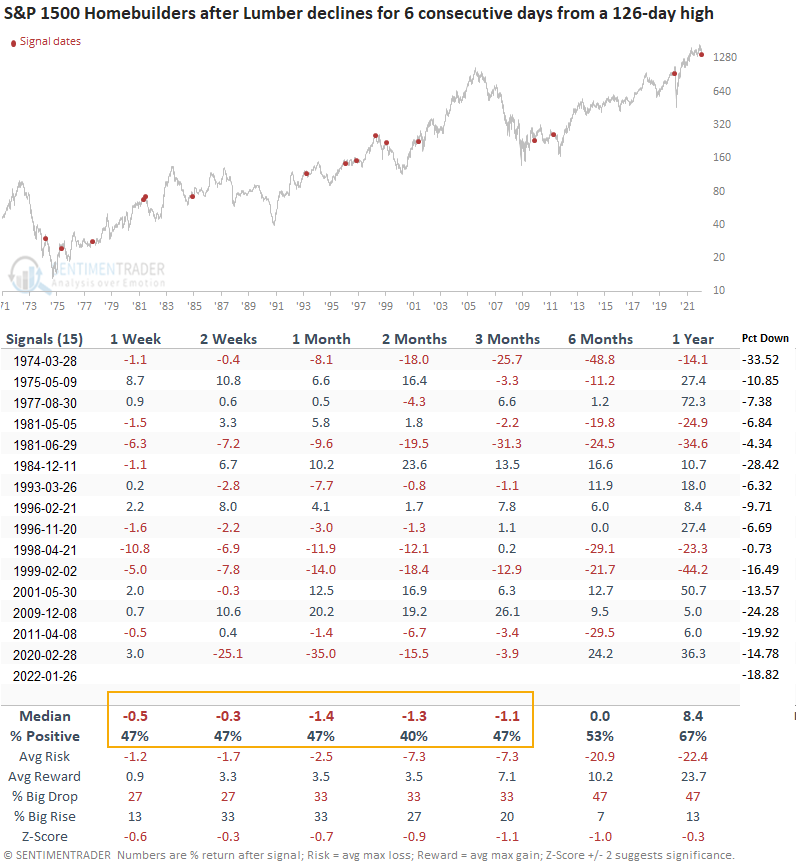

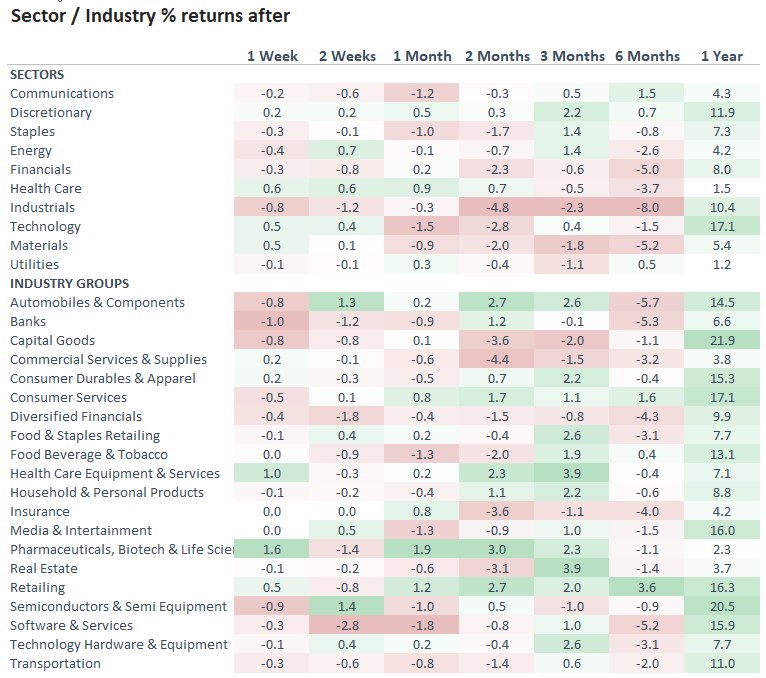

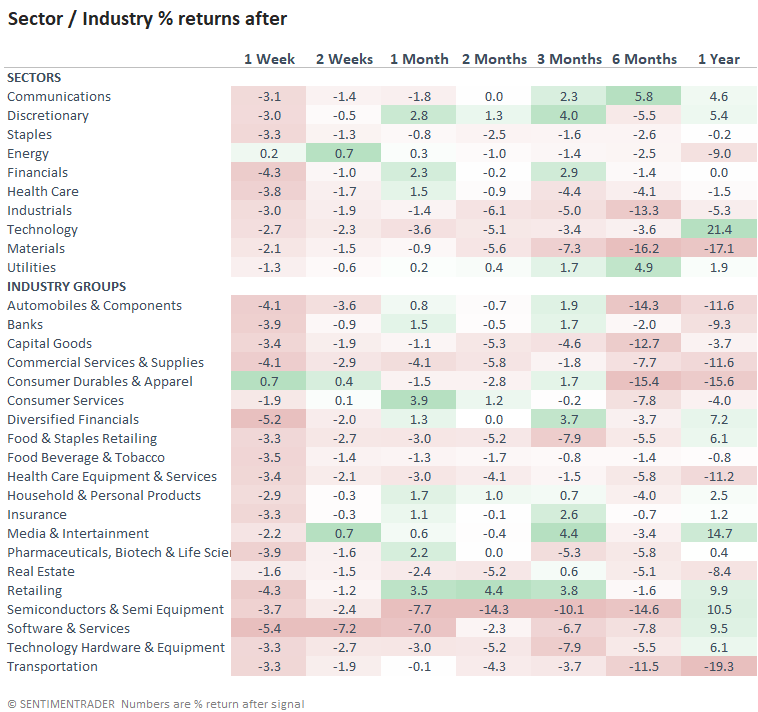

Let's apply the signals to sectors and industries

The sector and industry table confirms the message from homebuilders with weak short and medium-term returns for economically-sensitive groups like financials, industrials, and materials. Once the interest rate turbulence ends, the 1-year results suggest better days ahead.

Let's apply the signals to the yield curve

Let's apply the signals to the yield curve

The yield curve shows a potential for a short-term pop before falling on a medium and long-term basis.

Let's assess what happens under the current yield curve regime

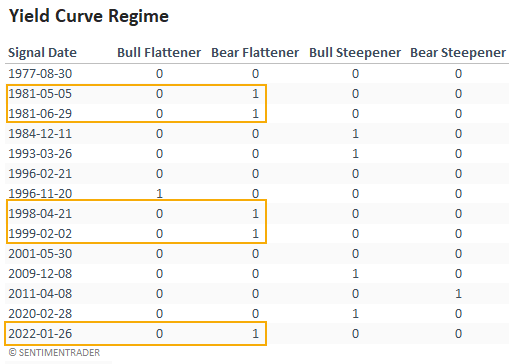

In a note on Thursday, Jason shared a model for the yield curve that suggests a bear flattener regime. If I apply the lumber signals to the yield curve regime, it shows 4 other historical instances.

Returns are weak. However, the sample size is tiny.

We get the same message from sectors and industries.

What the research tells us...

When lumber declines for 6 consecutive days from a 126-day high, the commodity foreshadows a potential economic shift that impacts cyclical industries. Similar setups to what we're seeing now have preceded declining prices for lumber, homebuilding stocks, and other economically sensitive groups on a short to medium-term basis.