What's the market message from higher bond yields

Key points:

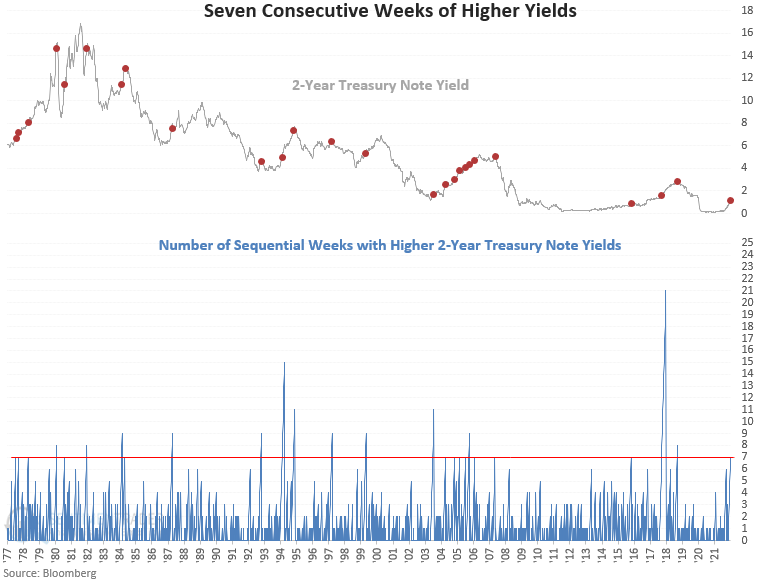

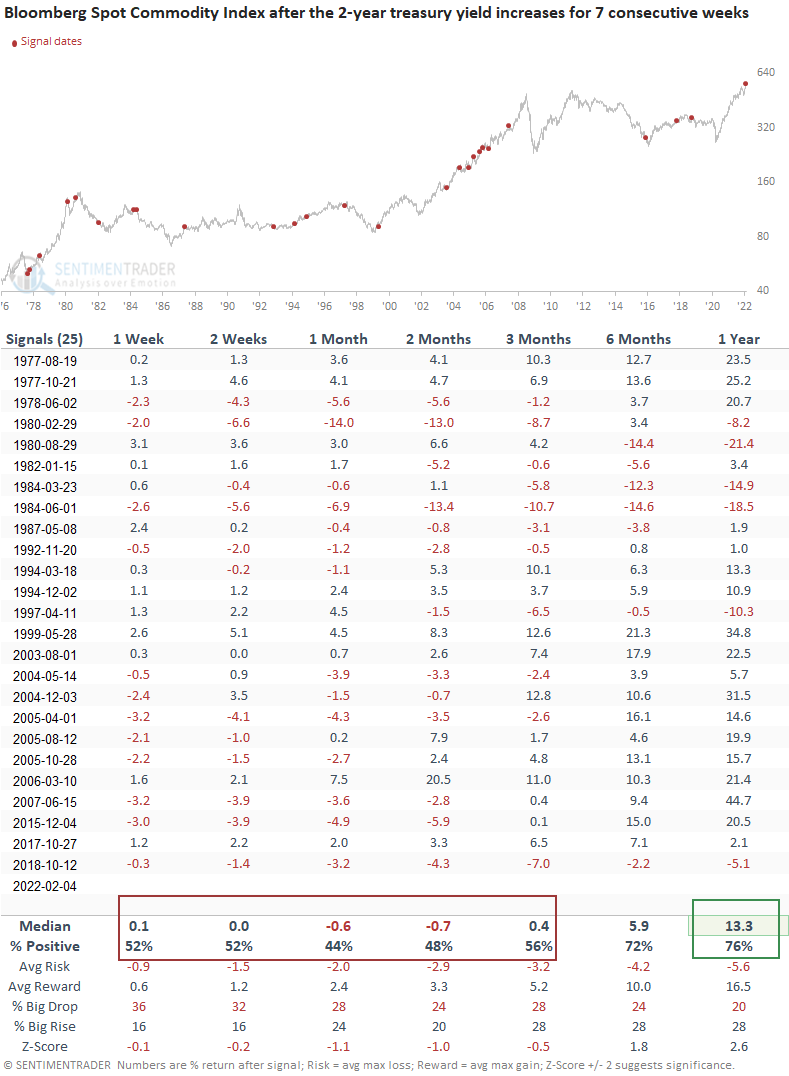

- The 2-year Treasury note yield has increased for 7 consecutive weeks

- Stocks show tepid results on a short to medium-term time frame

- Bond yields continue higher in the near term

- Commodities show neutral results on a short to medium-term time frame

What's the impact of higher yields on stocks, bonds, and commodities

Let's conduct a study to assess the outlook for stocks, bonds, and commodities when the 2-year treasury note yield increases for 7 consecutive weeks. I screened out repeats by requiring the count to reset to zero before triggering an additional signal.

Since 1977, only 5 out of 25 signals coincided with a significant peak in the 2-year yield.

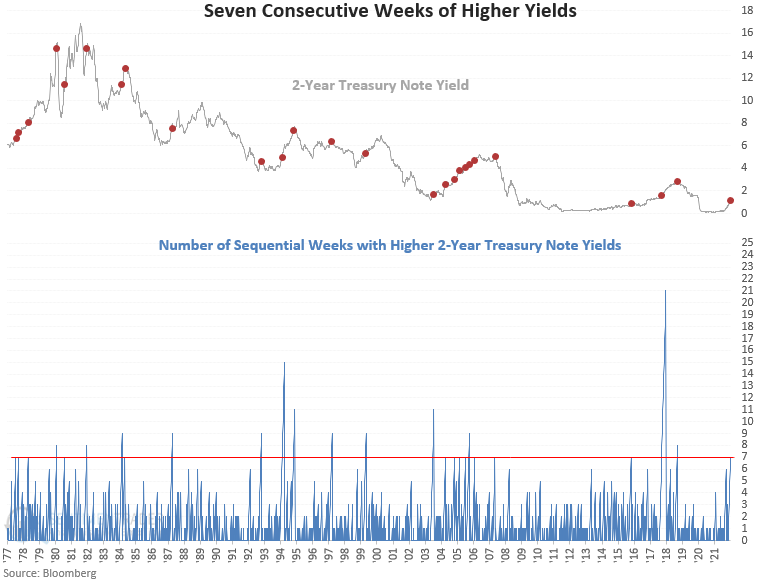

Similar streaks show tepid gains for the S&P 500

This signal has triggered 25 other times over the past 45 years. After the others, S&P 500 performance and win rates show somewhat tepid results on short to medium-term time frames. However, the 1-year win rate suggests that similar increases in bond yields do not kill a bull market.

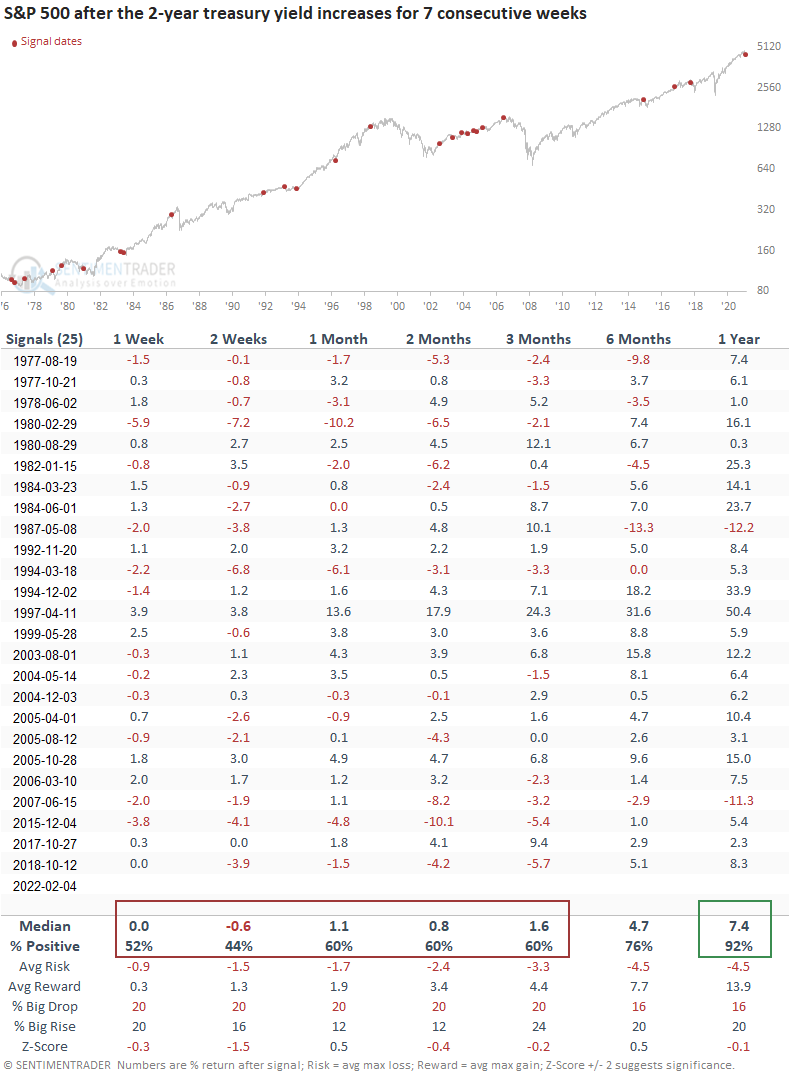

Similar streaks show yields could continue higher in the near term

The 1-month time frame suggests the 2-year yield could continue to increase in the near term. The June 2007 signal is the only time yields peaked and fell across all time frames.

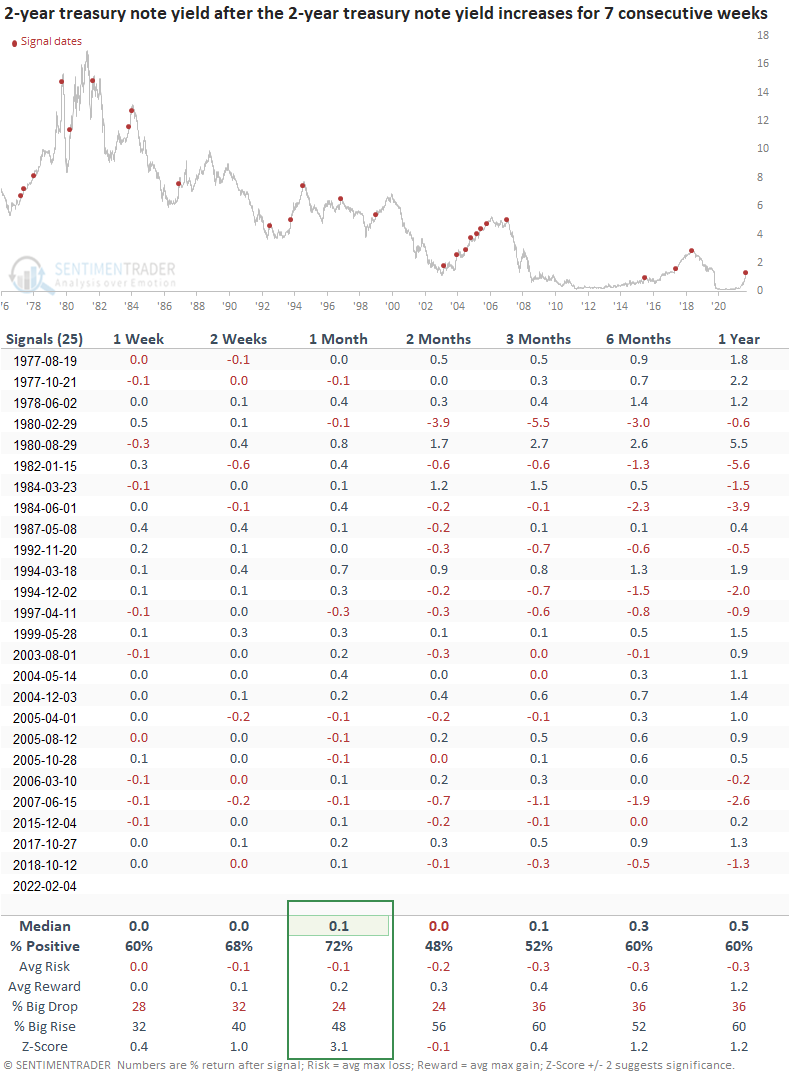

Similar streaks show commodities could struggle in the months ahead

Commodities offer flat to slightly negative returns on a short to medium-term basis. The long-term results look good, especially if commodities are in a bull market like 1970-80 or 2002-2008.

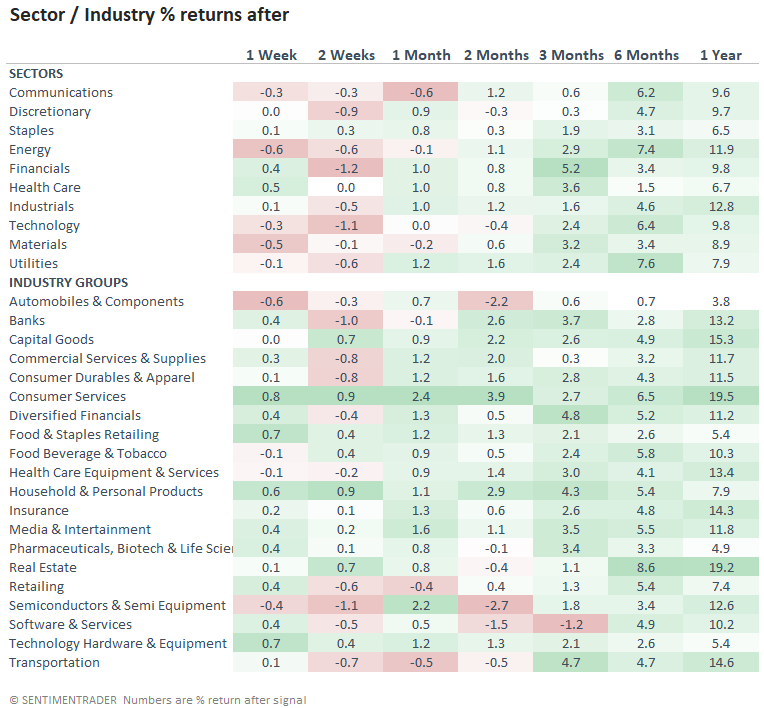

Sectors and industry groups confirm the broad market message

When we examine sectors and industry groups, the return patterns look similar to the S&P 500. One might expect soft results in the near term but significantly better days ahead, especially a year from now. On Tuesday, I highlighted a few bullish signals for financials. The yield study provides one more incrementally positive message for the sector.

What the research tells us...

What the research tells us...

When the 2-year bond yield increases for 7 consecutive weeks, assets such as stocks and commodities typically adjust to the higher cost of capital. Similar setups to what we're seeing now have preceded slightly flat to negative results for stocks and commodities on a short to medium-term basis. However, the long-term results suggest that the adjustment to higher rates is short-lived. Typically, consistent win streaks like the current one suggest yields can go higher in the near term.