What's scaring investors right now

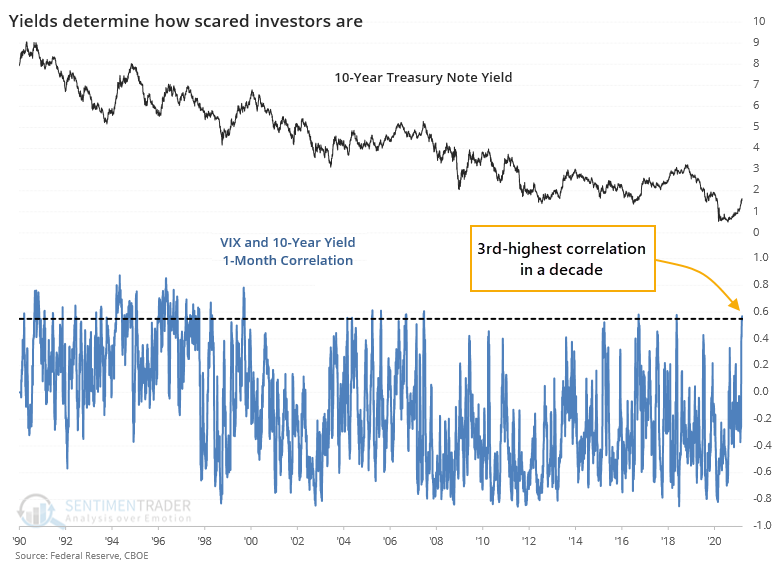

What's been scaring investors over the past month? Rising yields.

Maybe "scared" isn't the right word, since the VIX indicator, which measures options traders' estimate of future volatility, has mostly been dropping. So "influencing" is probably more appropriate. And over the past month, yields have been influencing the VIX at one of the highest levels in a decade.

The chart below shows a rolling 1-month correlation between daily changes in the VIX and 10-year Treasury yields. The higher the blue line, the more that yields seem to be influencing stock investors' volatility expectations.

Whether this matters is open to interpretation. So, let's put some numbers to it. We'll go back to the inception of the VIX and look for every time the 21-day correlation in daily changes between it and the yield on 10-year notes exceeds 0.55. This is on a scale of -1.0 (perfect inverse correlation) to +1.0 (perfect positive correlation).

When rising yields most influenced the VIX, over the next 3 months, the S&P 500 averaged a return of only +0.3% versus more than 5% when the VIX was being influenced by falling yields.

What else we're looking at

- Full details on S&P 500, VIX, and 10-year Treasury returns after high VIX / yield correlations

- What the opposite conditions led to

- A look at bonds vs. economic expectations

- An inflation model using core vs. reported CPI measures

| Stat Box For the 1st time in 4 years, more than 95% of stocks in Japan's Nikkei 225 index are above their 200-day moving averages. Over the past 15 years, our Backtest Engine shows that when this many stocks trade above their long-term averages for the first time in a year, the Nikkei was higher a year later 4 out of 5 times. |

Etcetera

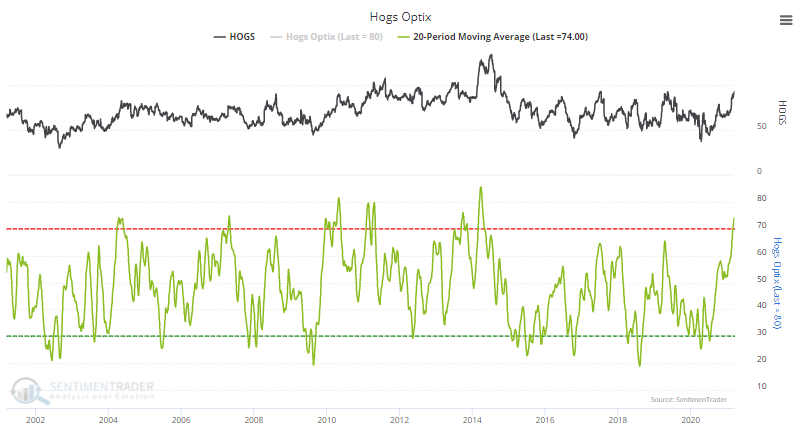

Get the butcher knife ready. The old trope, "Bulls make money, bears make money, but pigs get slaughtered," may be apropos now since optimism on hog futures is among the highest levels in history. A 20-day average of the Optimism Index is now the highest since 2014.

It's got the most optimism. Even as speculation rages in the stock market, the most overall optimism among markets is in hogs. Our Market Overview shows it's the market with the highest expectations built in. Bonds have the lowest.

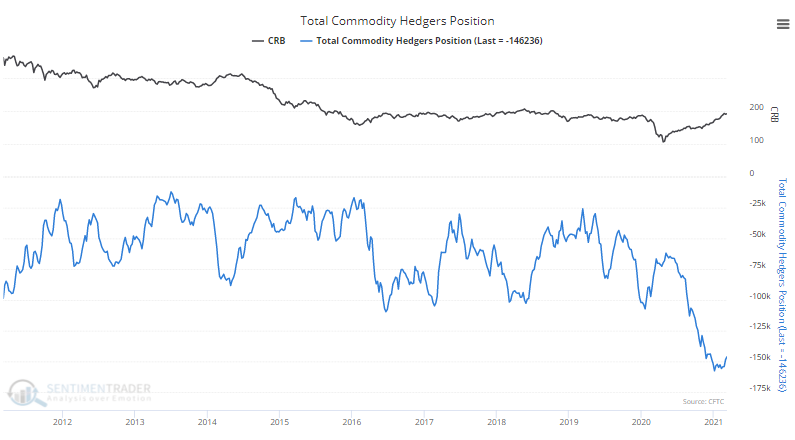

It's not just hogs. Optimism is high in many commodity futures contracts, and smart money commercial hedgers are betting against them (kind of). The net number of contracts on commodity futures among hedgers has plunged to an all-time record low.