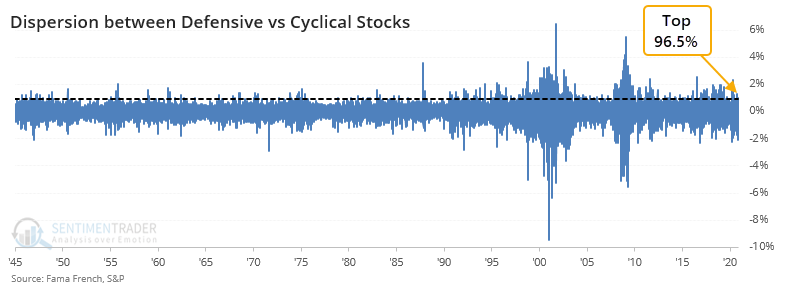

Whatever dispersion is, it just hit a record

Monday's session was one for the record books for multiple reasons.

There was a clear shift from former winners to former losers. The spread in daily returns between defensive and cyclical stocks on Monday ranked in the top 96.5% of all readings since 1945.

It was even starker between small- and large-cap stocks, with Monday's difference ranking in the top 99.9% of all readings.

And greater still between value and growth stocks. The shift from growth to value on Monday had never been more extreme in the past 75 years.

If we look at those charts, then it's not just Monday's activity that stands out, but the wild differences in returns that have been evident for months. When we look at the absolute difference in price changes between all 6 factors over the past 200 days, then we've seen one of the truly extreme risk-on vs risk-off environments ever.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- What happened in the S&P 500 when factor dispersion was so great

- More consistently, what happened to defensive / cyclical, small-cap / large-cap, and value / growth ratios

- There has been a surge of stocks in uptrends, and at new highs

- Looking at breadth thrusts in financials and the Nifty 50 index from India

| Stat Box In the finance sector, more than 69% of stocks have jumped outside of their Bollinger Bands. Nice. That's among the largest readings in 30 years, and has typically resulted in a breather over the next month. One year later, the sector was higher after 8 out of 8 signals by an average of 21%. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

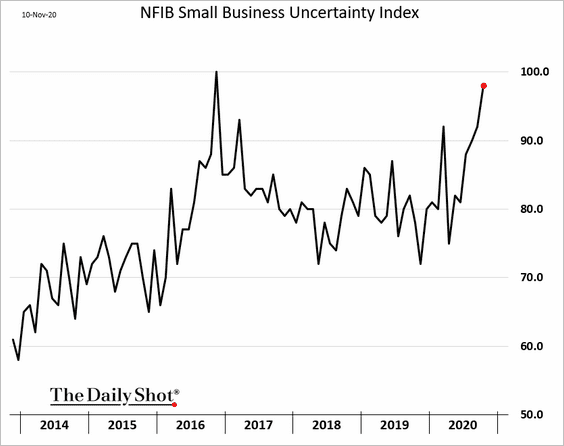

1. Small businesses are showing a big increase in uncertainty - Daily Shot

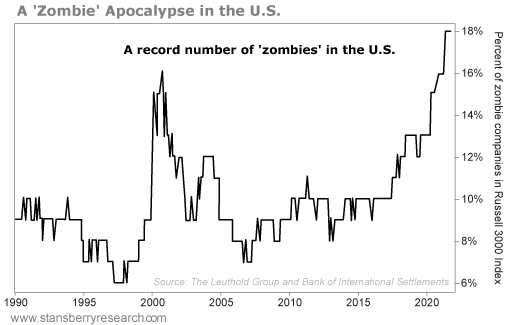

2. Bond investors have been forgiving enough that there is now a record number of zombie companies- Daily Wealth

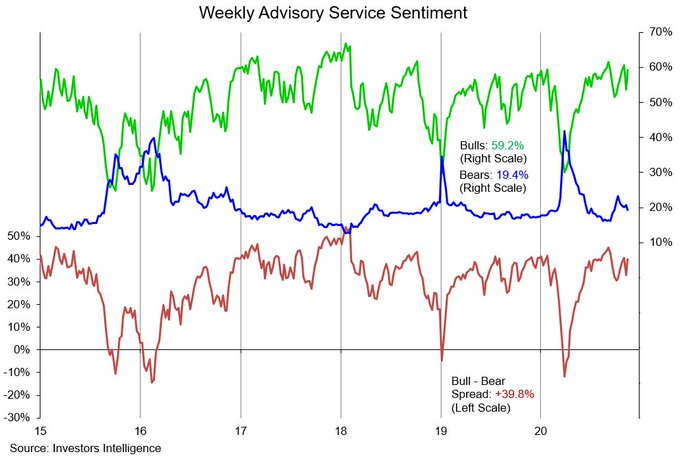

3. Newsletter writers don't care about all that, they're among the most bullish they've been in years - Willie Delwiche, CMT, CFA