What you need to know about the year end rally

Key points:

- One of the more favorable times of the year starts the week of Thanksgiving and runs through year-end

- The market is likely to be showing a year-to-date loss when this year's favorable period begins

- Down years still showed above-average performance during these windows

The year-end rally period starts this week

There are many different takes on year-end seasonality, and none of them are necessarily the "right" one.

From my perspective, the year-end rally period starts at the close on Friday the week before Thanksgiving and ends at the close on the last trading day of the year.

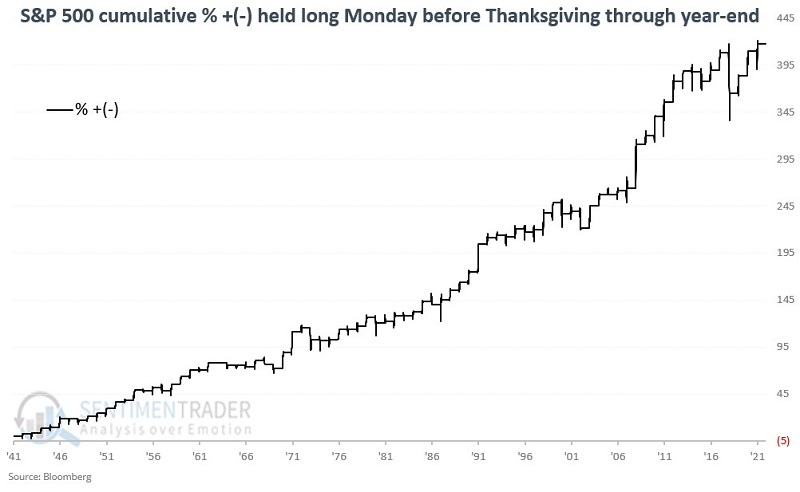

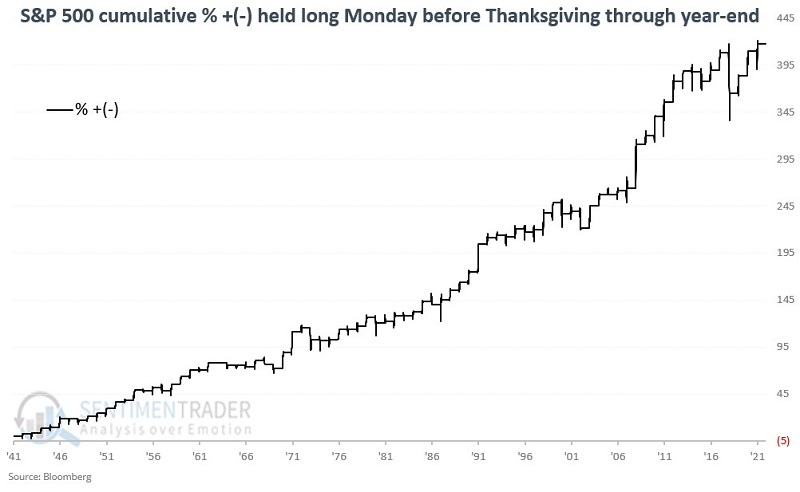

For testing purposes, we will use daily closing prices for the S&P 500 Index. The chart below displays the cumulative percentage return for the S&P 500 Index held long only during this period starting in 1942.

The bad news is that on a year-to-year basis, there is no way to predict how the market will perform during this year-end period. The good news is that the long-term trend slopes from lower left to upper right, showing long-term consistency.

The S&P 500 sported a positive return 73% of the time, but more impressively, average gains about doubled average losses, and the S&P was much more likely to enjoy a large gain than a large loss.

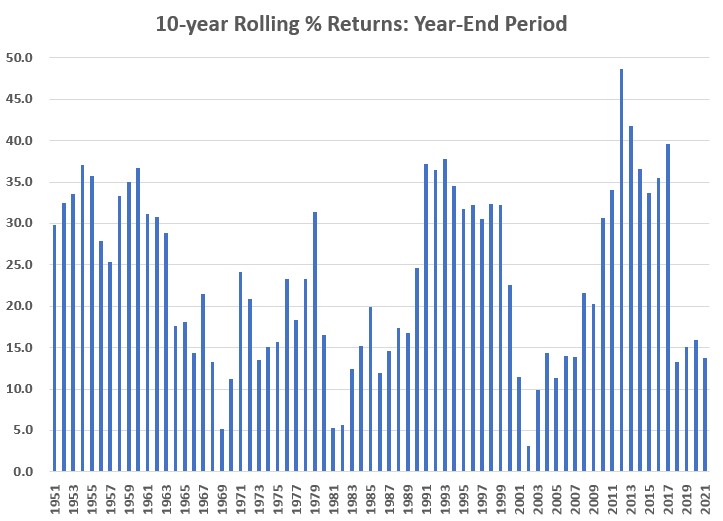

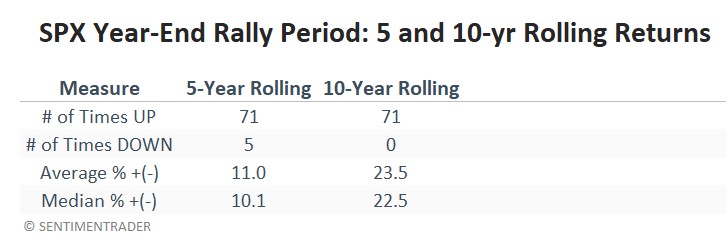

5-year and 10-year rolling returns and their impact on returns

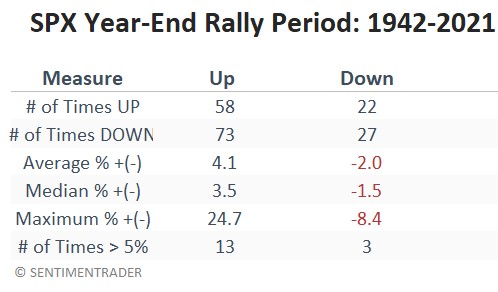

For these tests, we look at the cumulative percentage change achieved by holding the S&P 500 only during the year-end rally period over each 5-year and 10- year stretches.

The chart below shows the rolling 5-year returns, and the one below that shows the rolling 10-year returns.

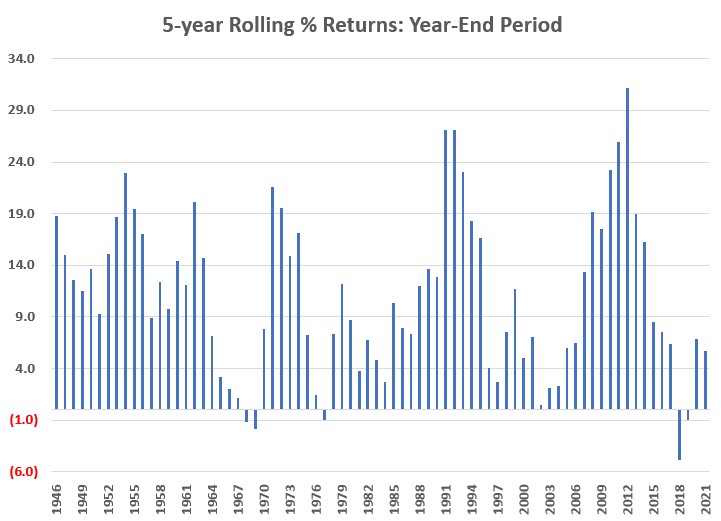

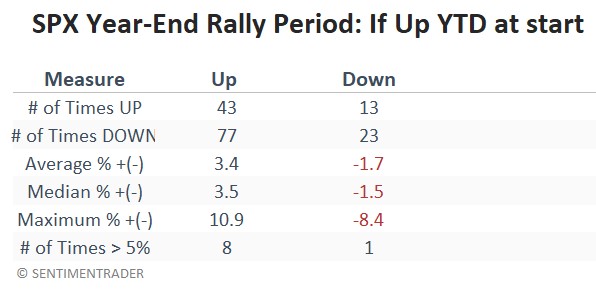

Results based on year-to-date performance

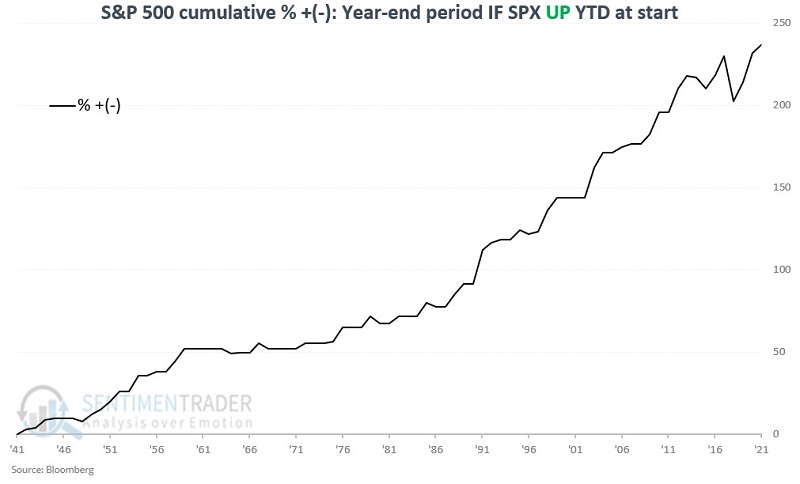

The S&P 500 will likely be at a loss for the year when this year's year-end rally period begins. To assess if this might matter, we looked separately at year-end rally period performance based on whether the S&P 500 was showing a gain or a loss as of the close on the Friday before Thanksgiving.

The chart below displays the cumulative S&P 500 percentage return for year-end periods when the S&P is up for the year as of the Friday before Thanksgiving.

During these years, the S&P gained 77% of the time, with returns that were heavily skewed to the positive side.

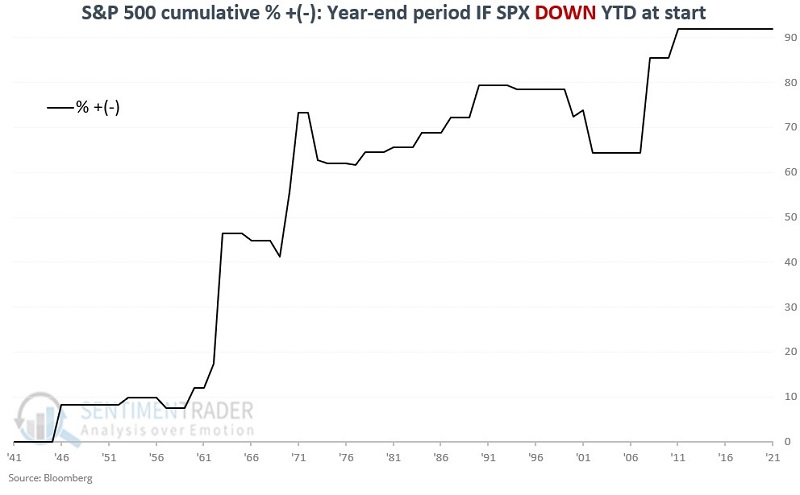

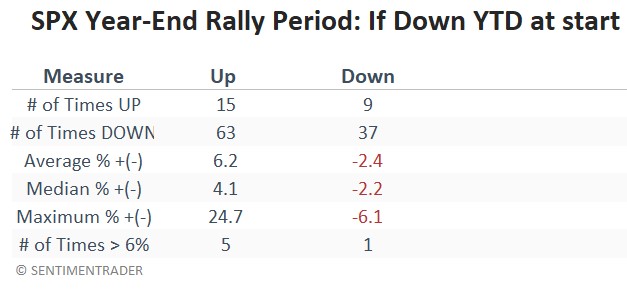

The chart below displays the cumulative S&P 500 return for year-end periods when the S&P is down for the year as of the Friday before Thanksgiving.

The year-end period Win Rate drops from 77% to 63% during these years. The good news is that results still skew significantly positive. Also, the median loss is just -2.2%. The worst losses were -6.1% in 1973 and -5.5% in 2002.

What the research tells us…

History suggests that investors should have a high degree of confidence in being in stocks during the week of Thanksgiving through the end of the year. While there is never any guarantee, and year-to-year results can vary greatly, the period has shown a bullish consistency that is very rare. Another striking thing to note is the relatively benign nature of declines during those years when the year-end rally period does show a loss.