What the "smart money" is saying about finance and tech stocks

Some of the world's most famous investors have turned bearish towards equities over the past 2 weeks. Buffett hasn't made any big investments, Stan Druckenmiller isn't bullish on stocks, famous VC Chamath Palihapitiya is urging caution, and David Tepper is saying that stocks are the 2nd most overvalued during his career:

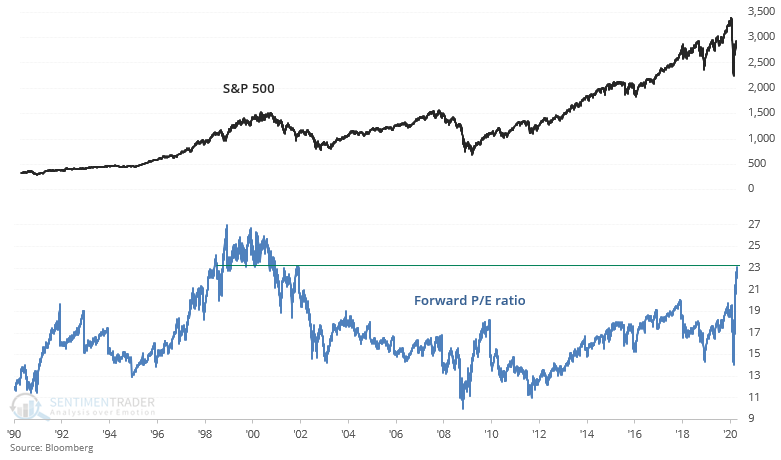

For starters, I never pay too much attention to what others are saying, even if they're considered "smart money". Even the smart money gets it wrong sometimes, which is why it's always better to do your own analysis instead of turning bullish/bearish just because so-and-so was bullish/bearish. But there are certain facts that support these investors' bearishness. For example, the S&P 500's forward P/E ratio is at its highest level since the late-1990s:

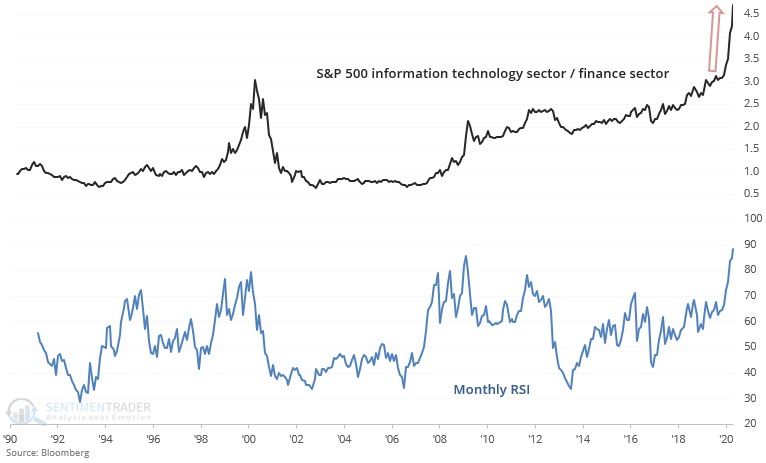

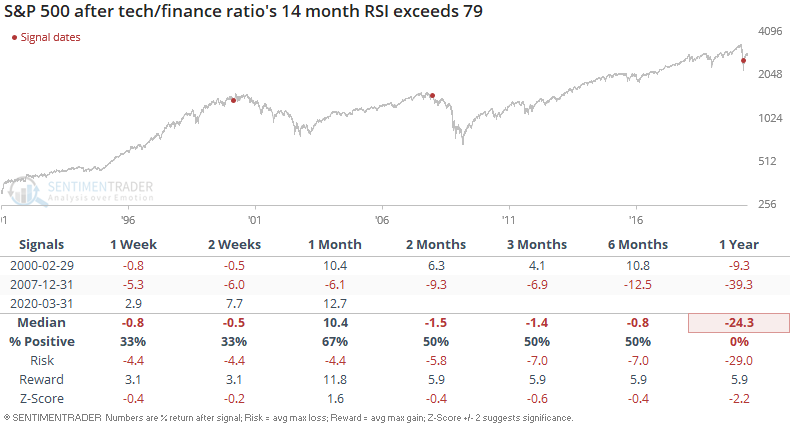

Tepper isn't bullish on bank stocks or tech stocks. Interestingly enough, the tech sector vs. finance sector ratio has gone parabolic, pushing its 14 month RSI to the highest level ever:

This was not a good sign for U.S. equities in the past since it happened near the start of 2 most recent bear markets (2000-2002 and 2007-2009):

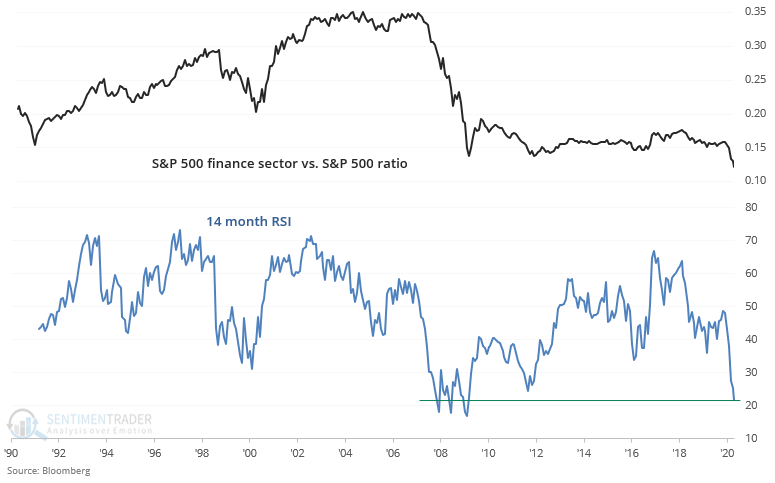

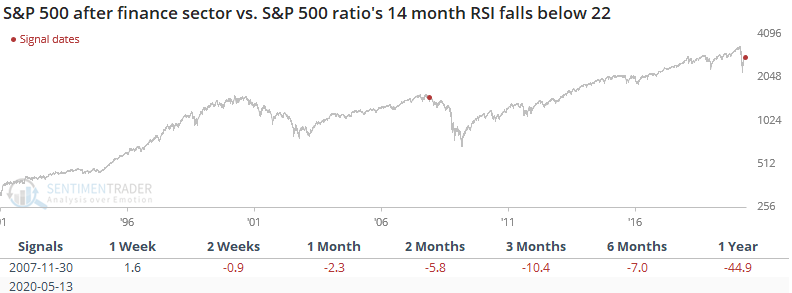

Even if we don't compare finance against tech, finance has still significantly underperformed the broader market. The S&P 500 finance vs. S&P 500 ratio's monthly RSI is also extremely low:

Once again, this is how the 2007-2009 bear market started:

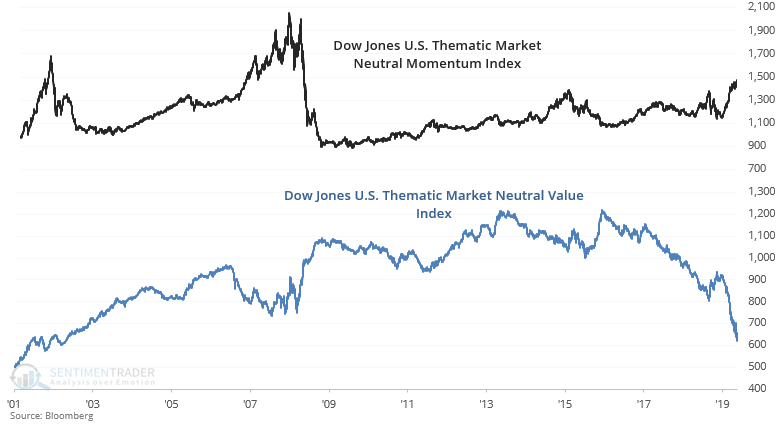

And lastly, momentum continues to significantly outperform value:

Comparing 100 day rates-of-change shows that this is the largest outperformance in momentum vs. value ever. The last time this happened was during the 2008 bear market (bearish for stocks), but it also happened near the stock market's bottom in October 2002: