What the smart money is doing right now

Wall Street is selling (or rather, telling others to sell), but some traders are ignoring their advice.

One group bucking their recommendations is commercial hedgers in major equity index futures. Last week, they added even more contracts to their net long position in S&P 500, Dow Industrials, Nasdaq 100, and Russell 2000 futures contracts.

For the week ended last Tuesday, they were holding more than $82 billion worth of contracts net long, a record high. We've discussed this data many times over the decades; it's not perfect by any stretch of the imagination and can go through periods of acting kind of screwy.

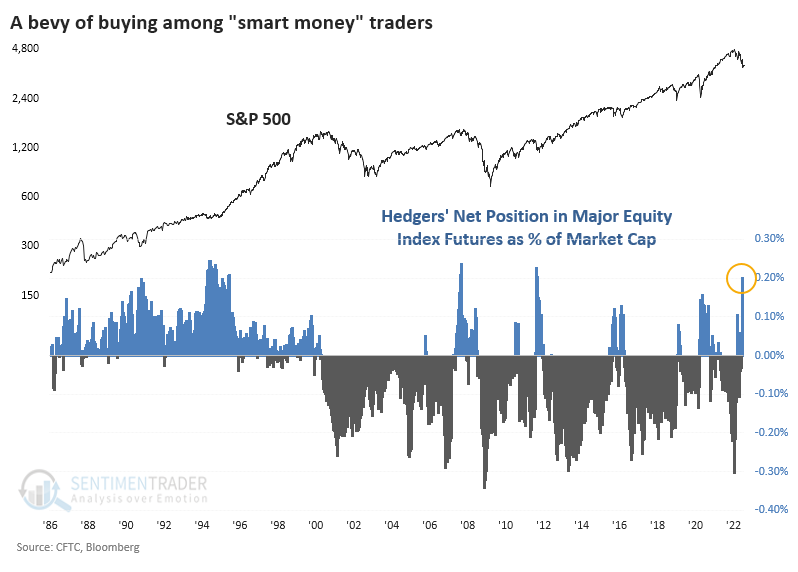

The chart below estimates the total amount of contracts held long or short by hedgers (not hedge funds), who are supposed to only be using the futures market to hedge their day-to-day business risks. They are specifically not to use futures contracts to speculate on rising or falling prices.

The chart adjusts hedgers' net position in equity futures by the market capitalization of the U.S. equity market. It just exceeded 0.2%, which is minuscule in absolute terms but is among the largest exposures they've carried in nearly 40 years.

At least someone is betting that the worst of the selling pressure is likely over.