What the Record Run in Transports Meant for Stocks

Even in a market that can't seem to go down for more than a couple of days, one index stands out. Among all major indexes and sectors, few can match the persistence of stocks that haul stuff.

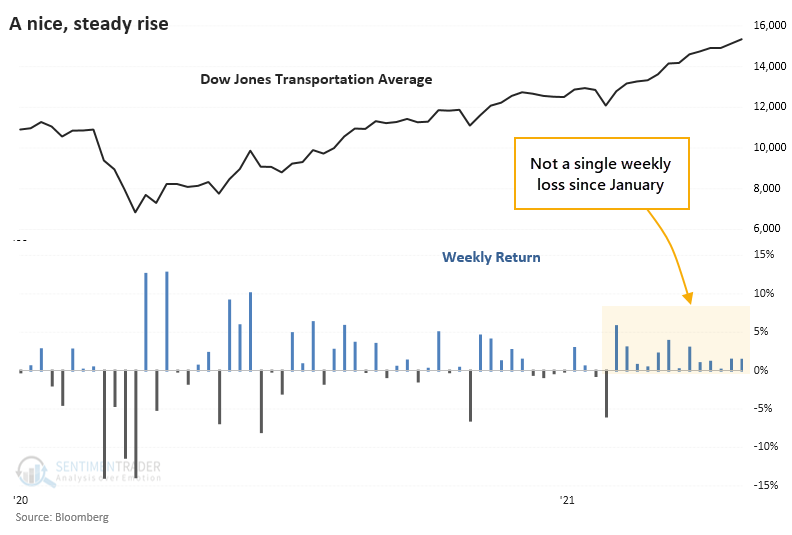

A RECORD STREAK WITH NO LOSSES

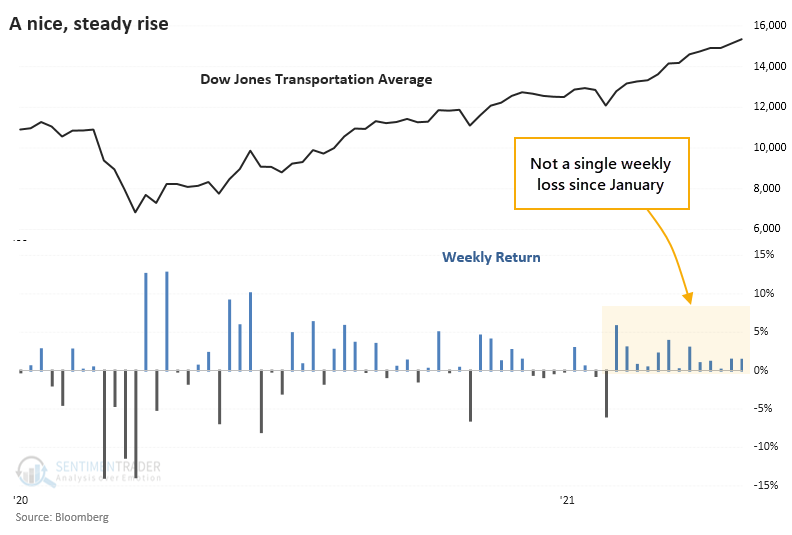

The Dow Jones Transportation Average just completed its 13th straight week with a gain. None of them were tremendous, but the persistence is incredible.

The Transports set a 122-year record for weekly persistence a couple of weeks ago. Last week just added to the gains.

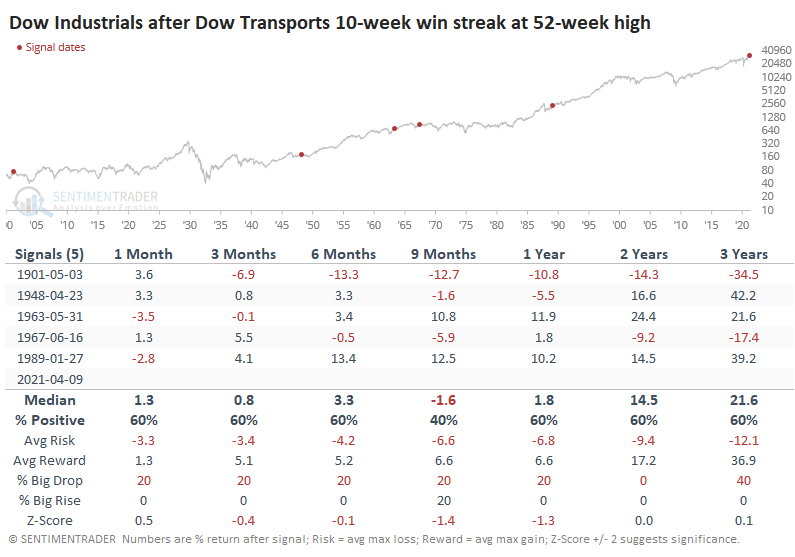

There weren't many streaks of 10 weeks of gains or longer, only 5 others when the index was trading at a 52-week high. So we're dealing with a tiny sample size and all the challenges it brings with it if trying to form any conclusion.

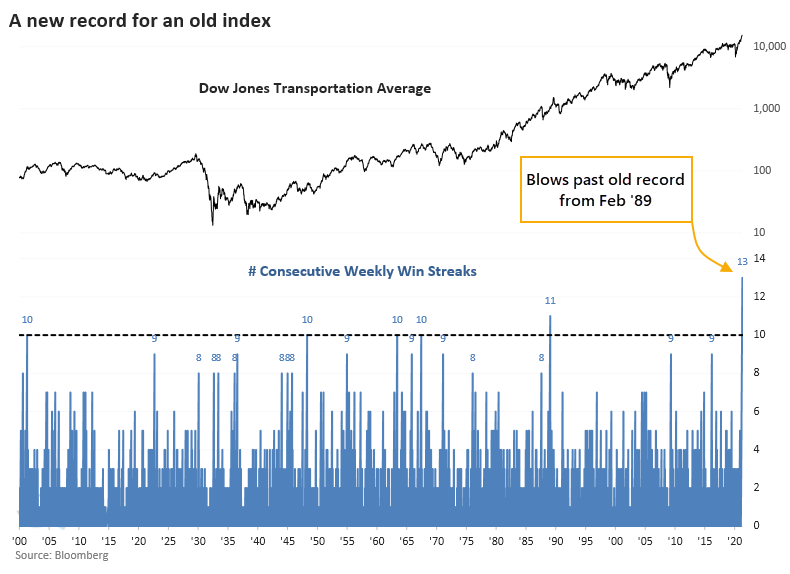

WHAT LONG STREAKS MEANT FOR FUTURE RETURNS

The handful of times Transports managed to do this, forward returns were sketchy over the next 6-24 months. Only 1 out of the 5 other signals managed to show a profit even 2 years later.

Presumably, such a run in stocks that should benefit from a strong economy should also be good for Industrial stocks. Indeed, the Dow Industrials performed better than Transports did after these signals.

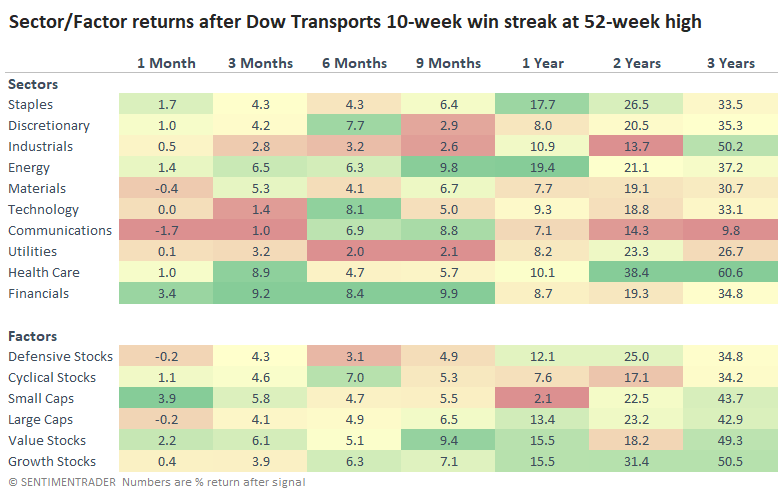

In terms of sectors and factors, Industrials were not the strongest performers.

Health Care and Financial stocks had the best returns overall, followed by Staples and Energy. The laggards were Communications, Utilities, and Industrials.

Among factors, Growth stocks tended to show the strongest returns across time frames, though Value wasn't too far behind on most of them or even exceeded the returns on shorter time frames. The other factors also see-sawed on performance depending on the time frame, with Defensive and Large-Cap stocks doing best over the next 1-2 years.

It's tough to put too much weight on something that's happened only a handful of times in 120 years. Perhaps the biggest takeaway would be that Transports seem unlikely to continue to run like this much longer and would likely underperform other indexes and sectors. For the months ahead, it should be a relatively good sign for Value stocks.