What The Breakout In Small Caps Might Mean

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

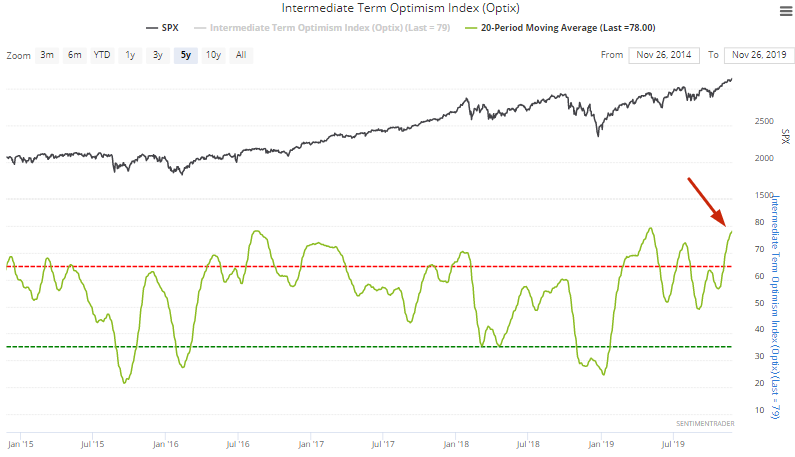

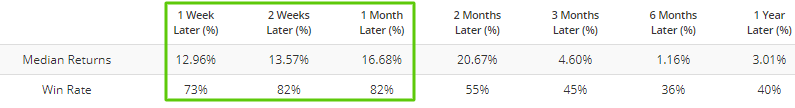

Intermediate Term Optimism Index

With the stock market pushing higher relentlessly, sentiment remains elevated. Our Intermediate Term Optimism Index's 20 day average has risen to 78, one of the highest levels in years. The last time this happened was in April, just before stocks pulled back.

When this happened in the past, the S&P 500's returns over the next few weeks were poor. In addition, returns over the next year were mostly bullish, as extremely high sentiment is a hallmark of very strong trends. Due to the momentum effect, the stock market's trends tend to weaken before major peaks.

And such elevated stock optimism usually preceded a spike in the VIX "fear gauge".

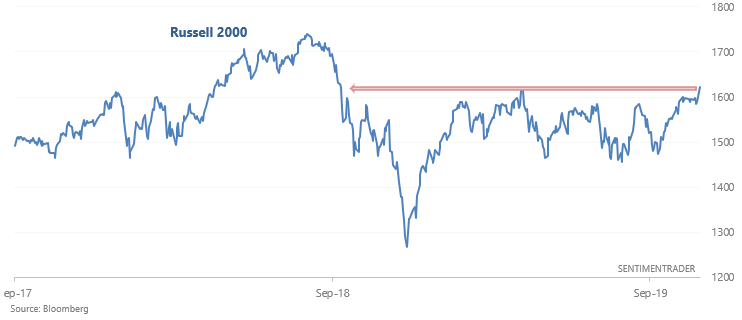

Small caps breakout

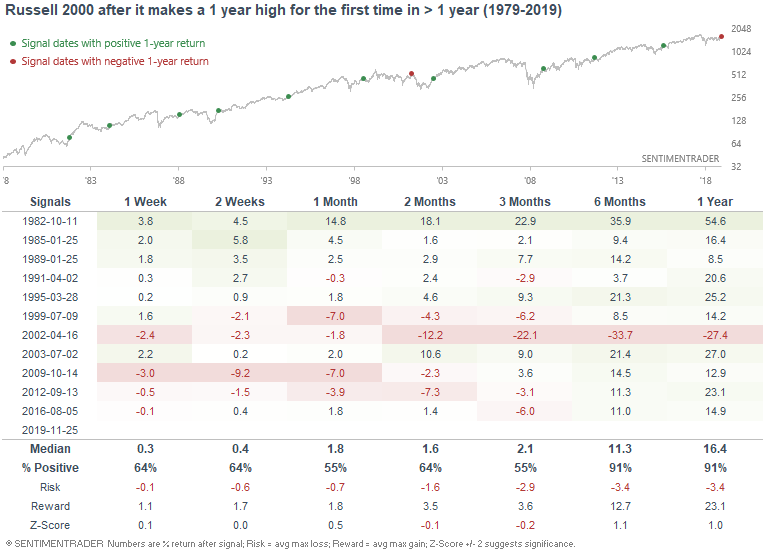

With the U.S. stock market continuing to make all-time highs, small caps are finally catching up. The Russell 2000 has broken out to a 1 year high.

When it did so in the past, the Russell's returns over the next few weeks and months were mixed, but were almost exclusively bullish over the next 6-12 months. The one big exception was in 2002, as stocks fell in one last wave during the 2000-2002 bear market.

We also looked at:

- What happens when the VIX drops below 12 for the first time in months

- The VIX put/call ratio has been spiking

- Healthcare sector sentiment is extremely optimistic

- Cocoa sentiment is high, too

- What happens when stocks rally but money supply drops

- New home sales are surging

- Small-cap and S&P breadth is recovering

- Gold's VIX index has plunged