What the Bear Flattener in Treasuries means for stocks

What the Bear Flattener in Treasuries means for stocks

The move in 2-year Treasury notes after the FOMC meeting on Wednesday seemed to significantly dampen investor sentiment in stocks.

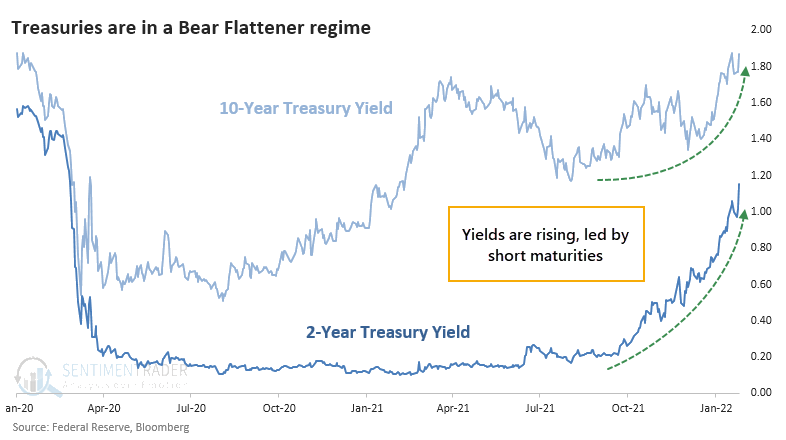

The gyration in Treasuries has been dramatic, with a bearish (for prices) bias. Yields have skyrocketed, especially on the short end of maturities, and especially especially on Wednesday, with the biggest jump in 2-year yields in almost a year.

The fact that 2-year yields rose more than 10-year yields means that the yield curve got flatter. When a flattening curve happens because short-term maturities rise faster than longer-term maturities, it's considered to be a Bear Flattener. This is considered to be a negative for stocks because it means that money is getting more expensive for consumers and businesses, and the Federal Reserve may be on the cusp of making it even more expensive.

There are an innumerable number of ways to measure this, using different parts of the curve and different time frames. For our purposes, we looked at 2-year and 10-year Treasury yields and their changes from 3 months ago.

The difference in next-day returns in the S&P 500 depending on the Treasury yield regime was significant, and not necessarily encouraging.

| Stat box Traders pulled more than $2.9 billion from the QQQ Nasdaq 100 fund on Wednesday, the 3rd-largest outflow in 15 years next to two days in September 2020. |

Bond pessimism and Utility stock returns

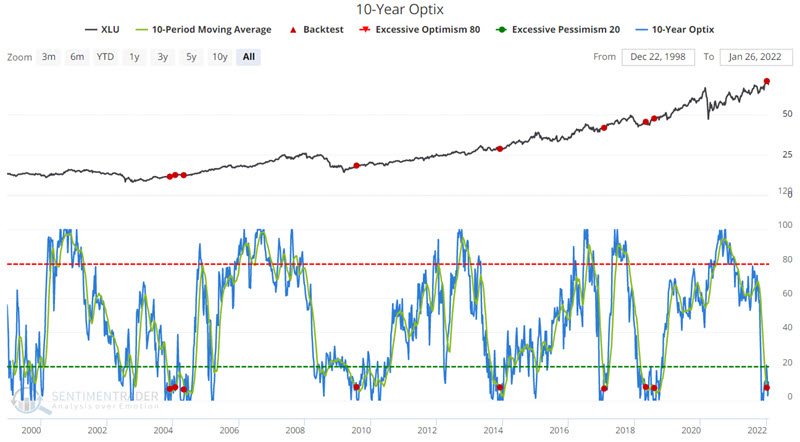

Ticker XLU (Utilities Select Sector SPDR Fund) serves as an investment proxy for the utility sector as a whole. With the possibility that the major stock market indexes may be dead money for a while, defensive sectors such as utilities may enjoy a stronger appeal, thanks to their below-average volatility and above-average dividend yield.

Few investors are aware of the relationship between the utility sector and bond investor sentiment. The chart below displays XLU and those times when the 10-day average for 10-year treasury Optix dropped below 8 for the first time in a month.

The two weeks after the 1/4/2022 signal witnessed significant weakness in the utility sector, which was par for the course after the other signals. If history proves an accurate guide, performance may steadily improve in the months ahead.