What it Means When Global Markets Are Outpacing the U.S.

Global markets are picking up, and many of them have been hitting new highs.

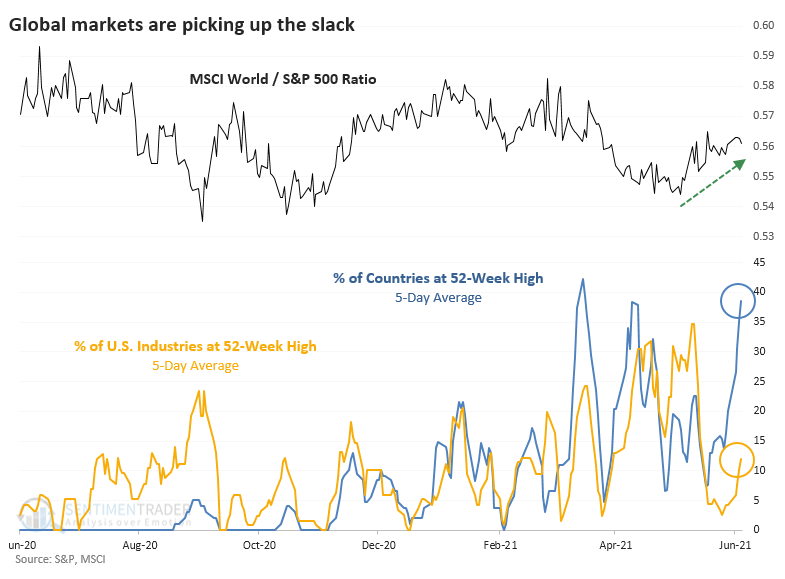

Dean has noted a pickup in absolute and relative trends in many global markets, and several developing markets have been triggering internal breadth thrusts. The momentum has been enough to push 30% or more of global indexes to fresh highs in recent weeks.

This is interesting because the percentage of developed countries at a 52-week high has greatly exceeded the percentage of U.S. industries at a new high, as pointed out by Willie Delwiche. This is a stark change from last summer when there were many more U.S. industries at new highs than overseas indexes. This is consistent with some stagnation among stocks within the S&P 500.

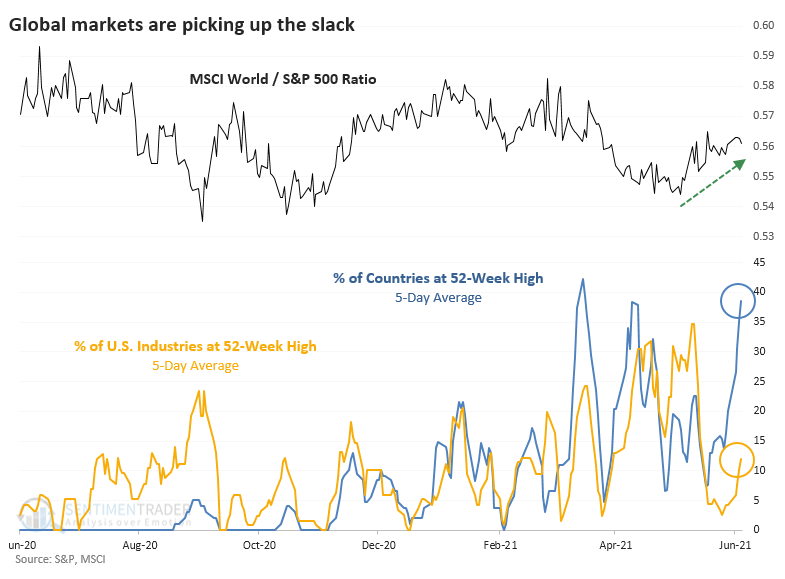

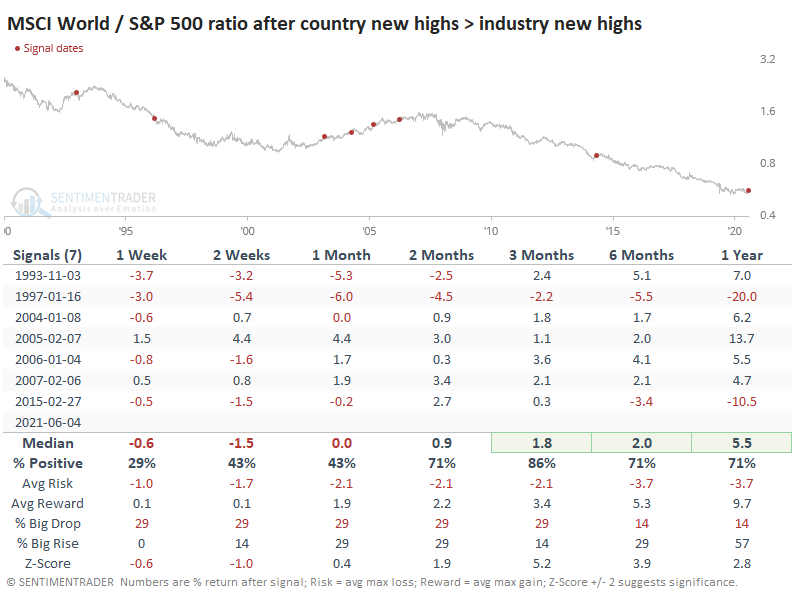

RETURNS AFTER COUNTRIES LEAD INDUSTRIES

It's not like scenarios like this were a bad sign for the S&P 500 going forward. On the contrary, it usually rose, or if it lost ground, those losses were minor.

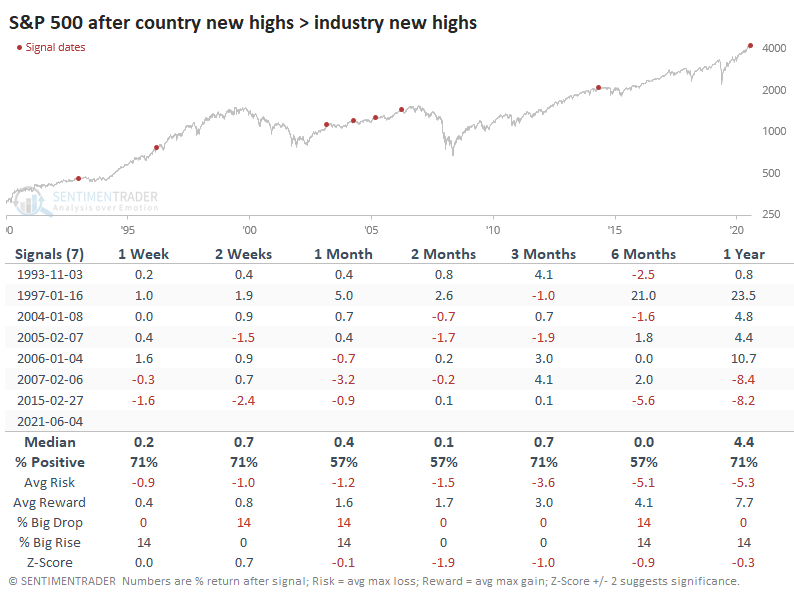

This was a better sign for world markets over the medium-term. The MSCI World Index (excluding the United States) showed some short-term weakness but consistently rose over the next 2-6 months.

A RELATIVELY GOOD SIGN FOR OVERSEAS

This means that the ratio between the two indexes tended to fall back in the short-term, then rise over the medium-term. There was only one loss over the next three months. That one was a complete failure.

As Dean has pointed out repeatedly, signs like this tend to keep going. Many overseas markets are seeing thrusts, or at least positive trends both in an absolute sense and relative to the S&P 500. It's not a sure thing, but it is a decent sign suggesting that there are better places to look for equity exposure than the usual go-to indexes like the S&P 500.