What I'm looking at - tech correlations, everything rally, utilities, USD

Here’s what I’m looking at:

Tech rally

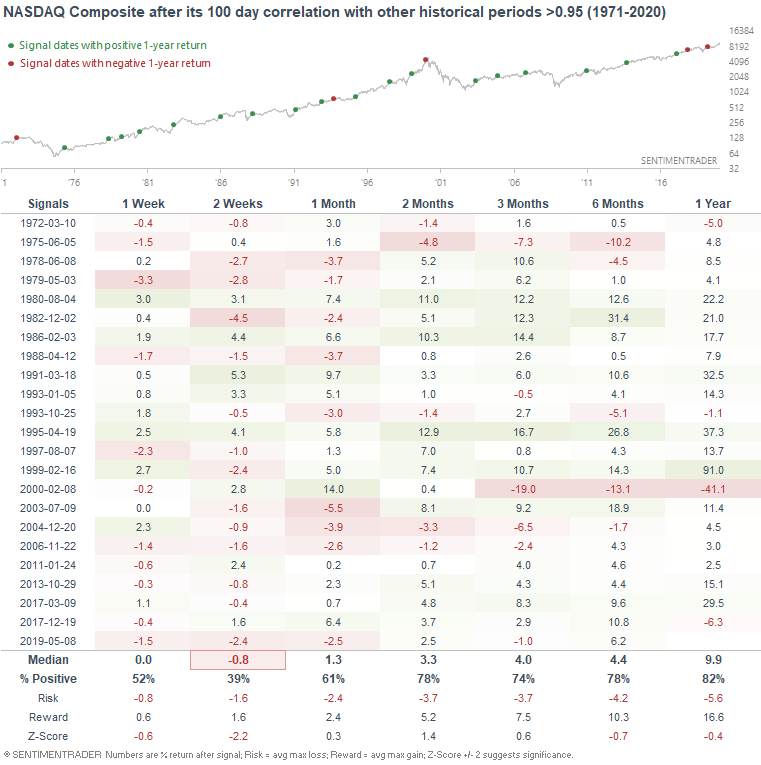

Without a shadow of a doubt, the stock market's rally has been driven by tech. The NASDAQ Composite, NASDAQ 100, and S&P 500 tech sector have surged since October, prompting bears to compare today vs. historical melt-ups that were followed by crashes (e.g. "today is just like 1999"). But as I've said before, the problem with overlapping 2 charts on top of eachother is that you tend to see what you want to see. If you're bearish, you're always going to "spot" the similarities between today vs. 1999. So in the interest of bias-free analysis, let's compare the NASDAQ Composite's rally over the past 100 days against other historical 100 day periods, and look at cases in which the correlation exceeded 0.95

1999-2000 was an extreme case. Looking at all the historical cases which were similar to today, the NASDAQ Composite's returns over the next 2 weeks were poor:

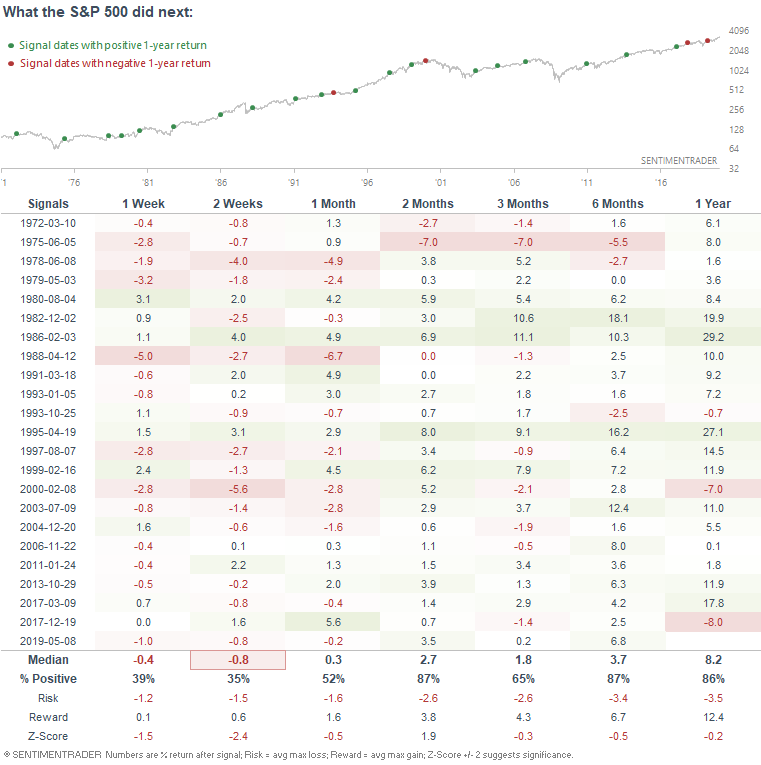

As were the S&P 500's returns over the next 2 weeks.

YTD - everything rallies

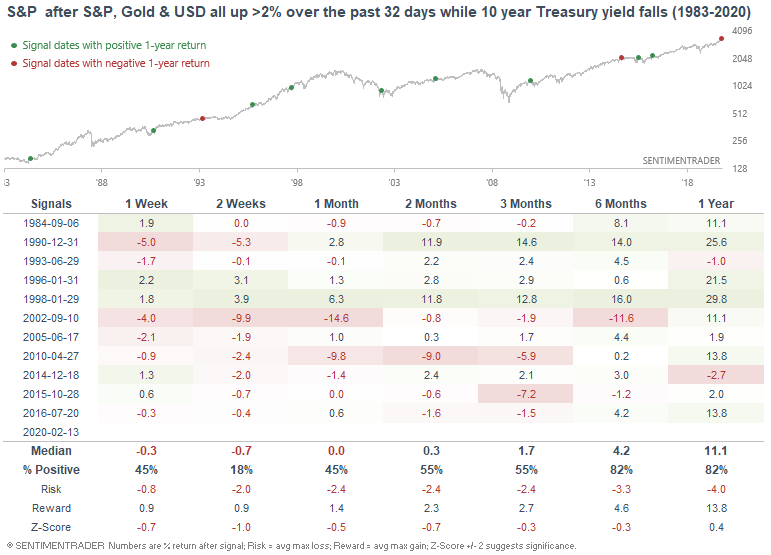

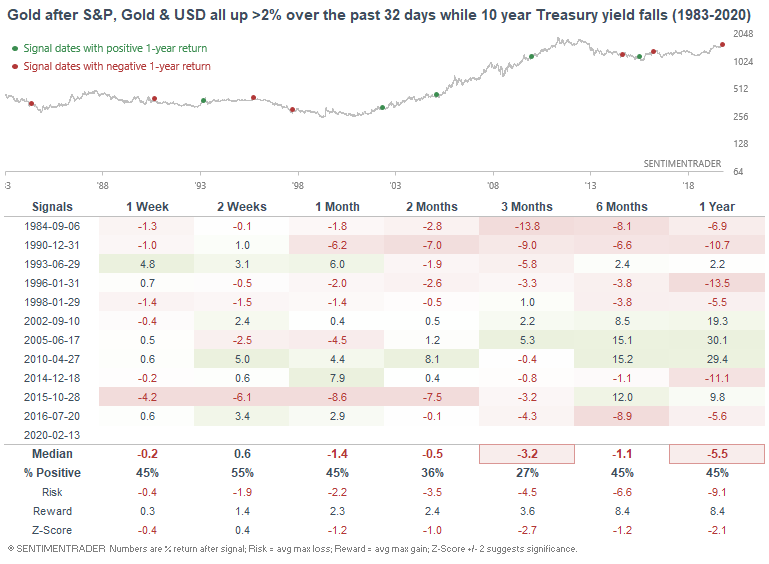

As the WSJ noted, everything has rallied this year so far. The S&P, gold, U.S. Dollar Index, and Treasury bonds are all up. Over the past 32 trading days (approximately 1.5 months), the S&P 500, gold, and USD Index have all rallied more than 2% while the 10 year Treasury yield has fallen.

When this happened in the past, the S&P's returns over the next 2 weeks were poor. This always led to a decline from 2002-present:

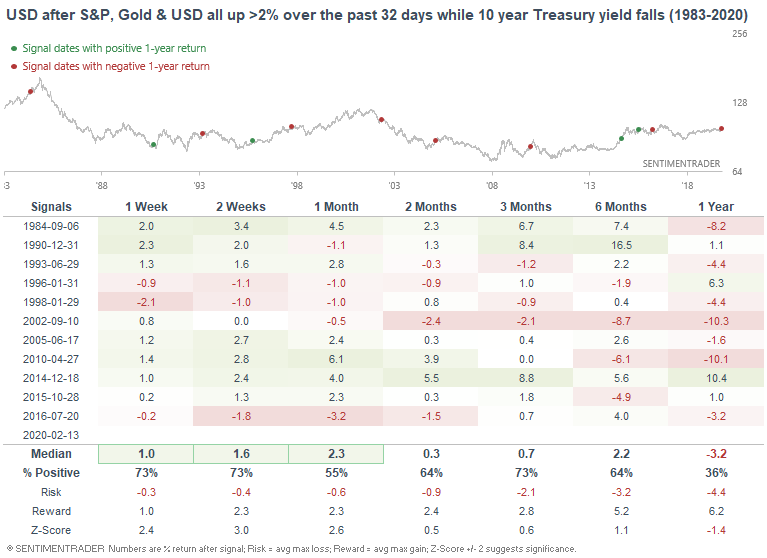

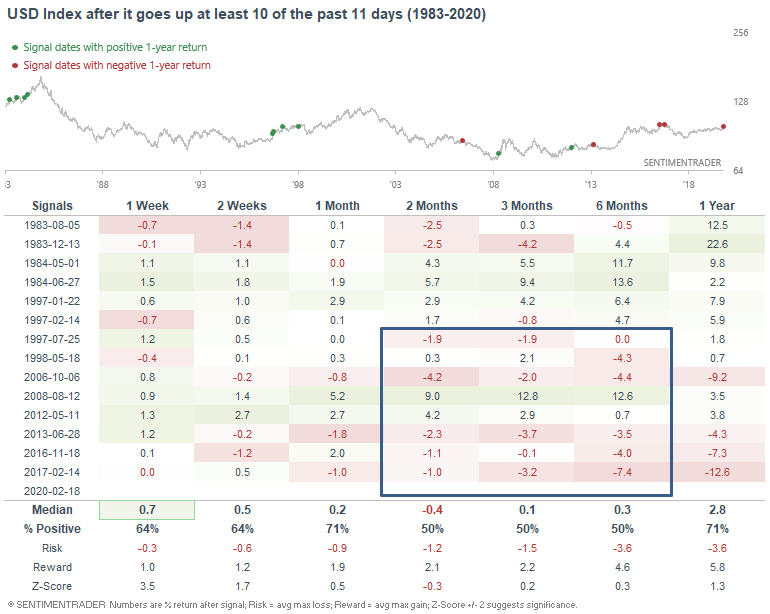

In the meantime, it usually led to more short term gains for the USD Index:

And gold's returns over the next few months were poor:

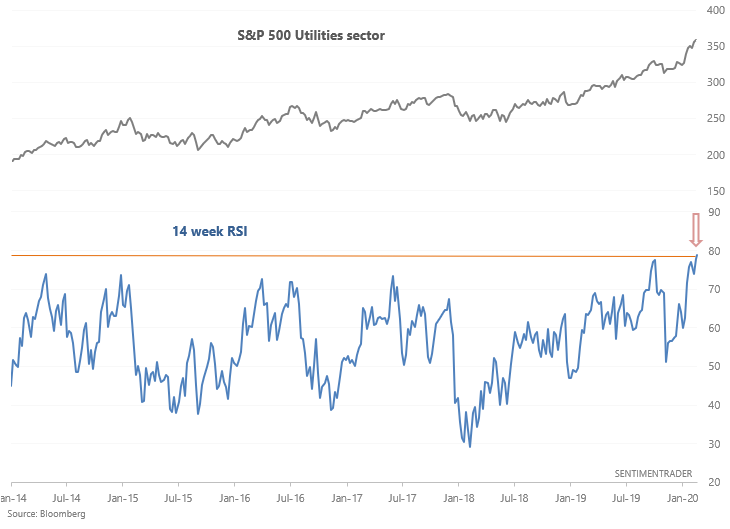

Utilities

Aside from tech, one of the strongest S&P 500 sectors is utilities. The utilities sector's 14 week RSI is at one of its highest levels in history:

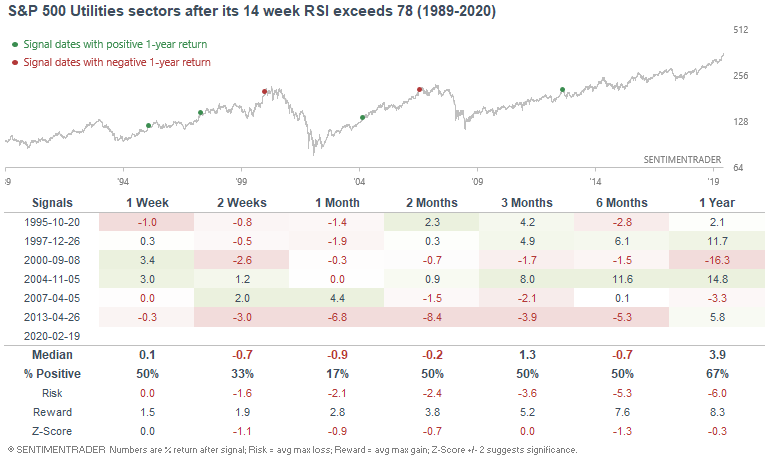

When utilities' momentum was this extreme in the past, the S&P 500 utilities sector usually suffered over the next 2-4 weeks:

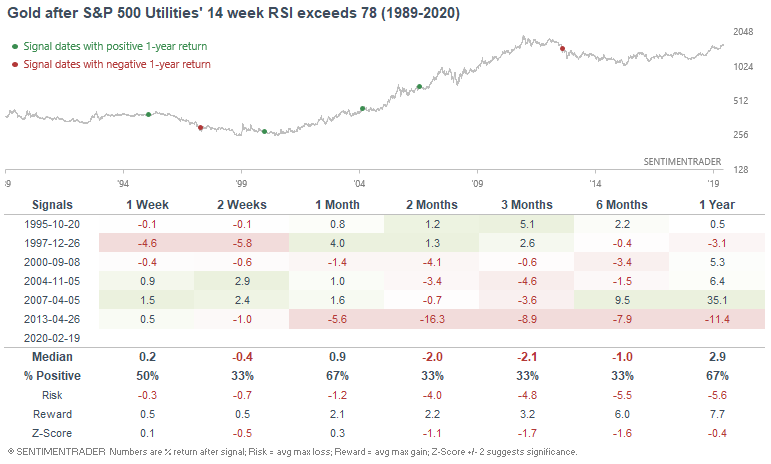

Meanwhile, gold didn't do too well either 2-3 months later.

Currency

And finally, the USD Index has rallied 10 of the past 11 days. This usually led to more short term gains for the USD, followed by losses over the next 2-3 months, particularly over the past 20 years:

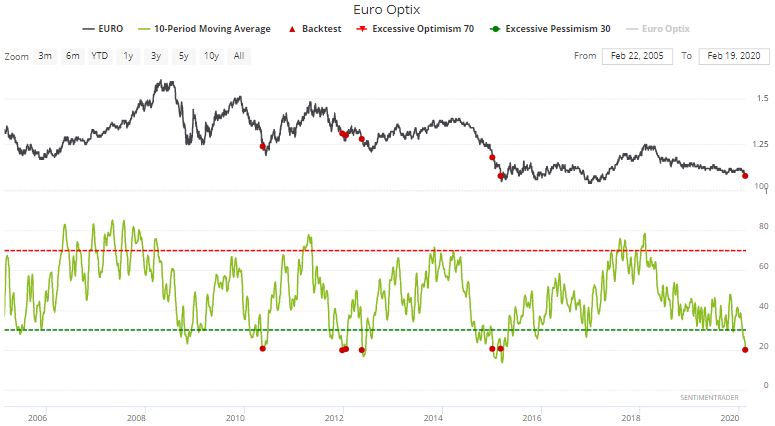

In addition, Euro Optix's 10 dma is extremely low. When this happened in the past, the Euro often fell a little more before bottoming.

*Take my currency thoughts with a grain of salt. I don't trade currencies in my portfolio right now, so I have no skin in the game.

My trading portfolio

My trading portfolio is allocated 50% in the Macro Index Model and 50% in the Simple Trading Model With Fundamentals. At the moment I have instituted a discretionary override and gone 100% long bonds (instead of long stocks) due to the extreme nature of many of our core indicators, even though some of these core indicators aren't in the models.

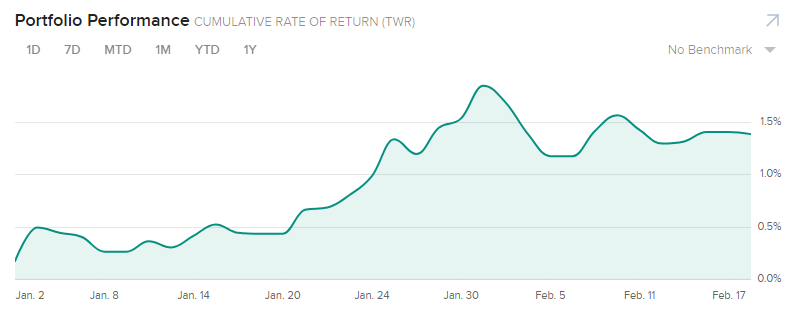

Performance YTD 2020:

My trading account is up 1.38%

Currently 100% in bonds