What I'm looking at - S&P 500 Value Index, lots of chop, Taiwan, Germany Optix, UK Optix

Here's what I'm looking at:

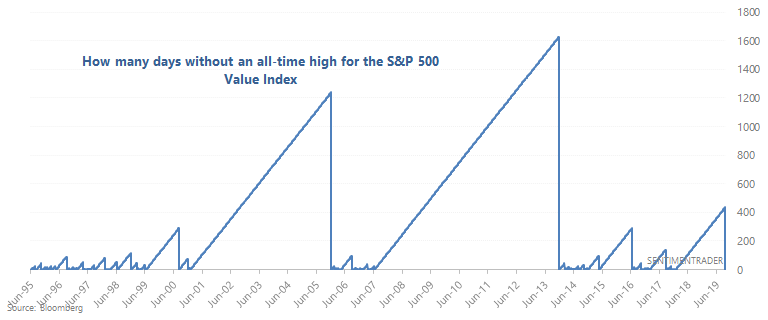

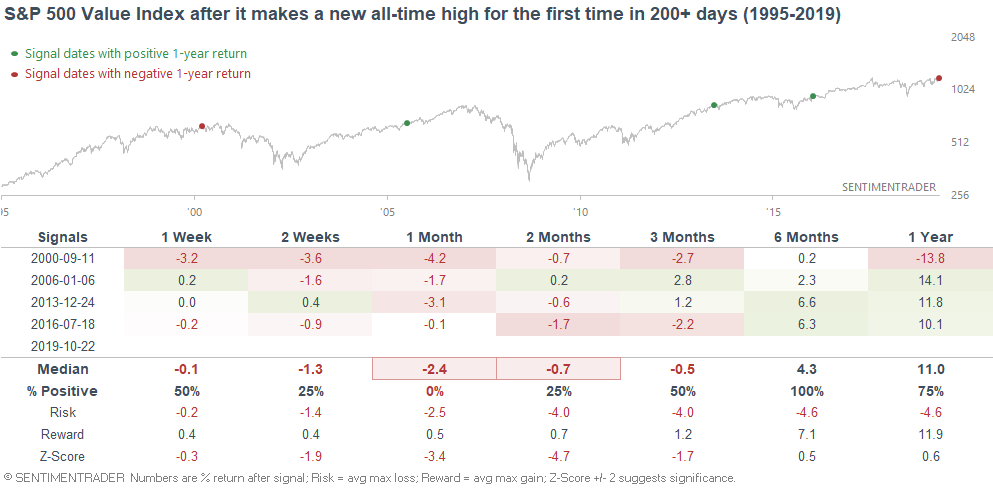

S&P 500 Value Index

As Bloomberg noted, the S&P 500 Value Index has broken out to a new all-time high:

This is the first new all-time high in 436 trading days:

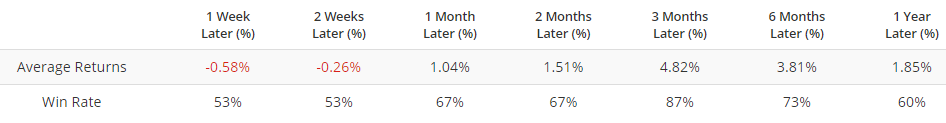

When the Value Index rallied to a new all-time high for the first time in 200+ days, it typically faced weakness over the next 1-2 months, even if it rallied further over the next 6 months:

*Keep in mind that the sample size is small.

Choppy

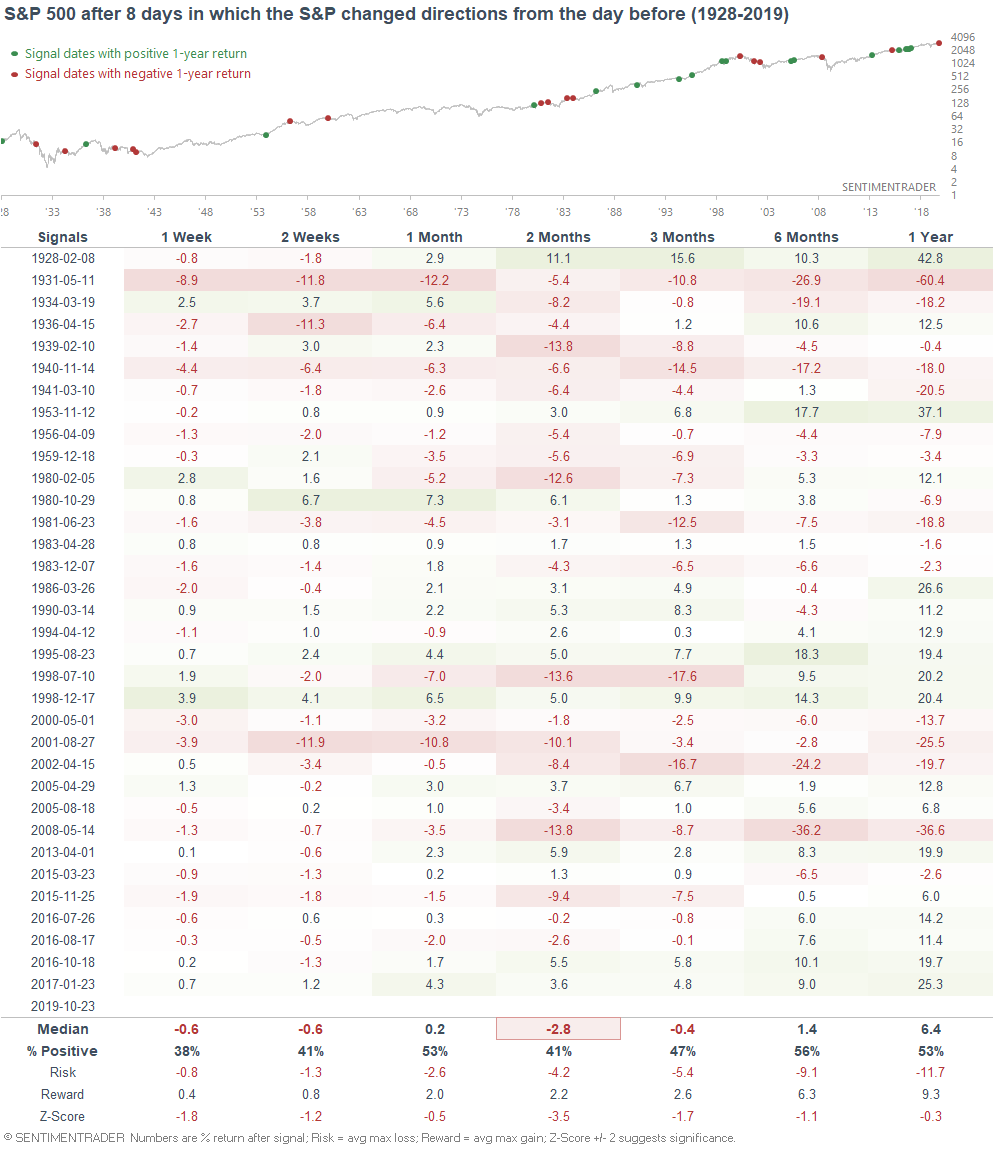

As Rob Hanna mentioned, the S&P has chopped up and down over the past 8 days, with each day going in a different direction from the previous day:

When the S&P chopped up and down for 8 days, its returns over the next 2 months were weak. Moreover, forward returns over the next year were consistently worse than random. This is because many of the bearish cases occurred during bear markets, which are notoriously choppy:

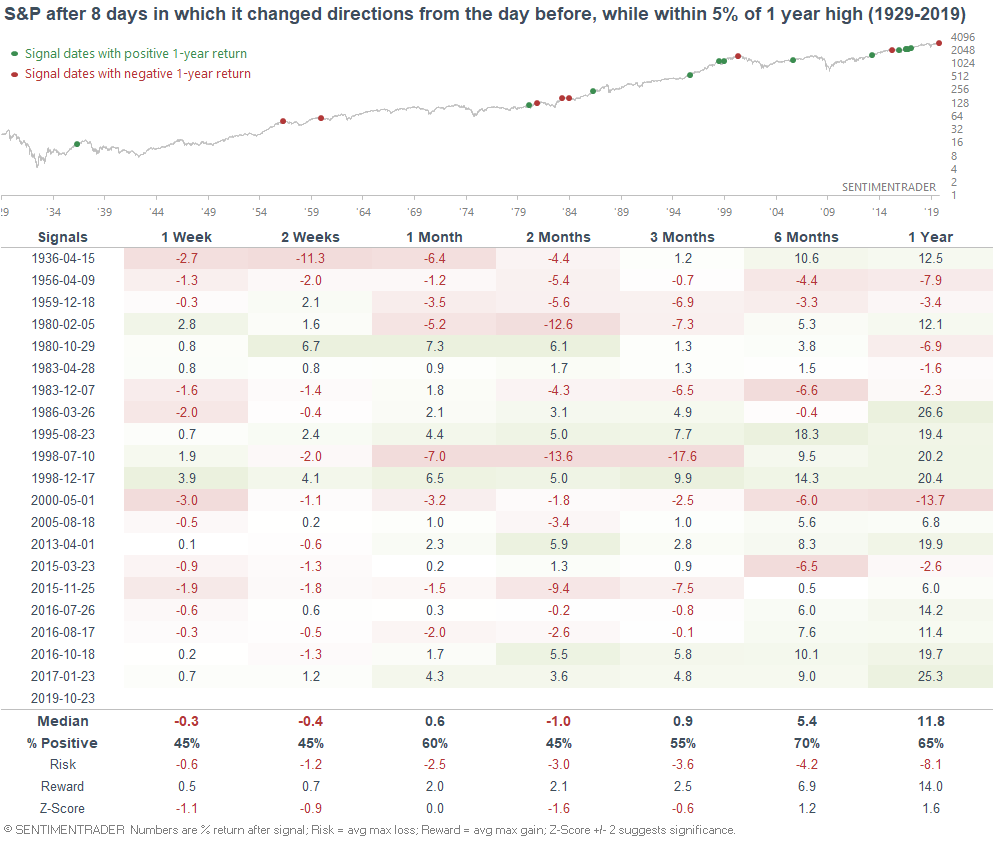

If we isolate for cases that occurred while the S&P was within -5% of a 1 year high, the S&P's returns become less bearish (particularly after 6 months), but there is still a slight bearish lean over the next 2 months:

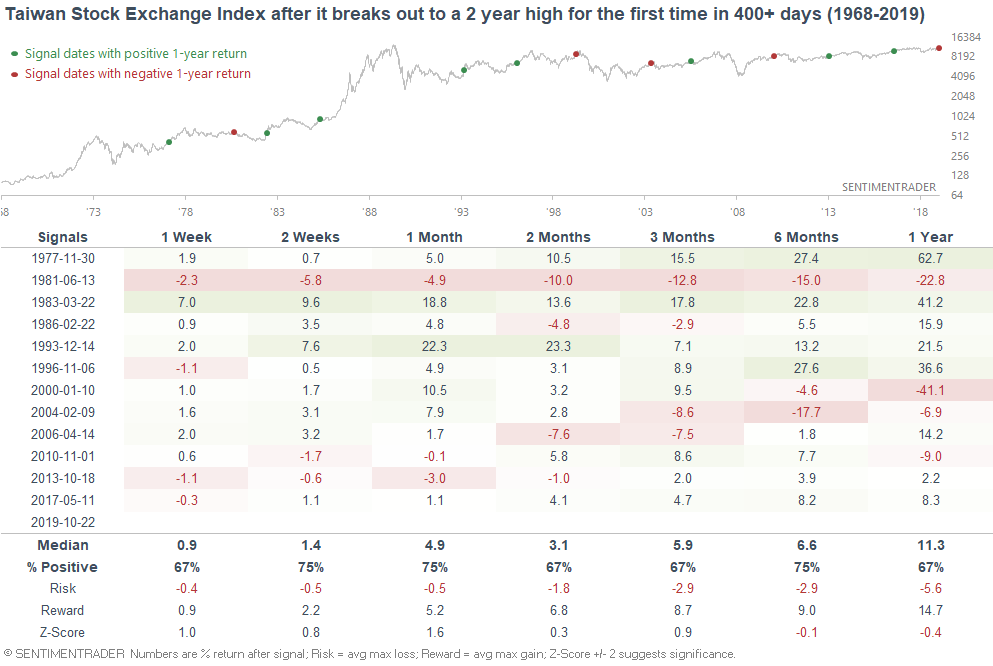

Taiwan

While the U.S. stock market continues to bounce around near all-time highs, other overseas markets (e.g. Germany and Japan) are breaking out. Add Taiwan to that list, which made a 2 year high:

When the Taiwan Index broke out to a new 2 year high for the first time in 400+ days, it typically rallied over the next 2-4 weeks:

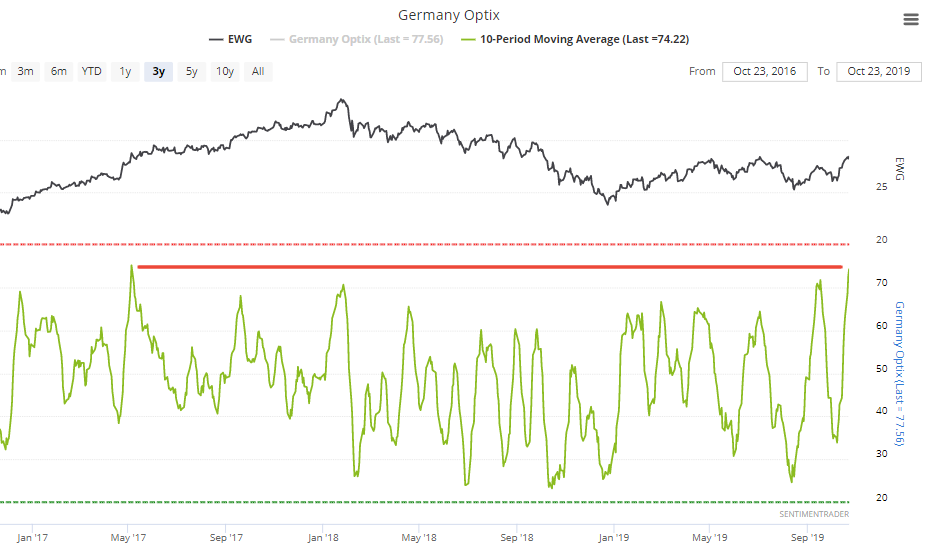

Germany Optix

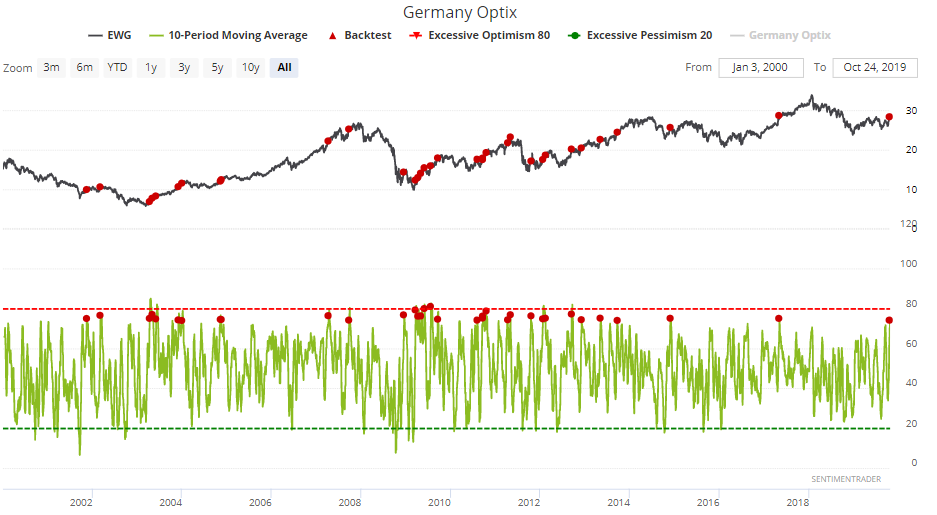

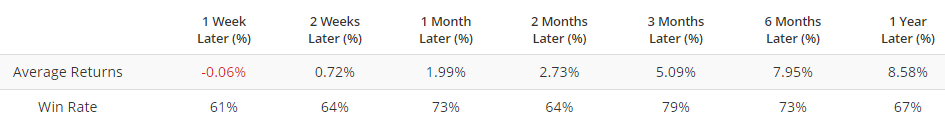

As German stocks continue to rally, Germany Optix's 10 day average has reached the highest level since 2017:

When Germany Optix's 10 dma exceeded 74 in the past, EWG (Germany ETF) rallied 79% of the time over the next 3 months:

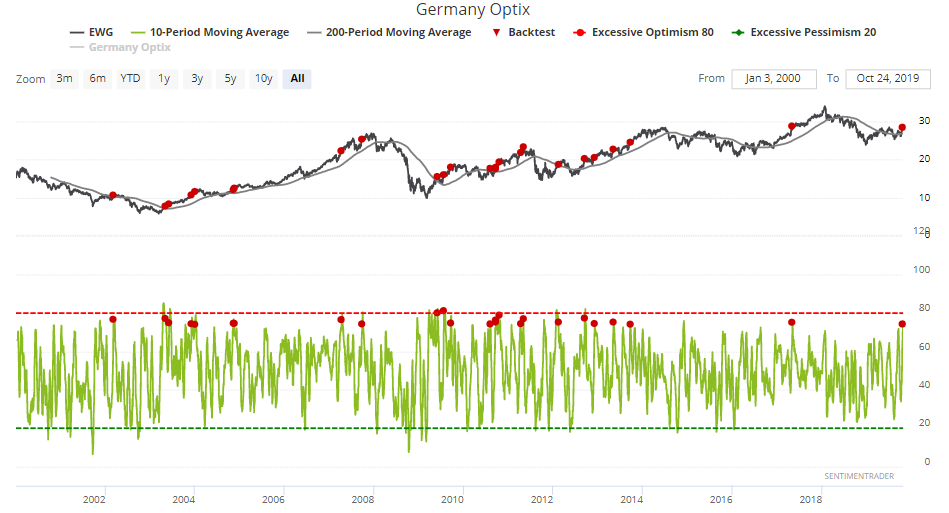

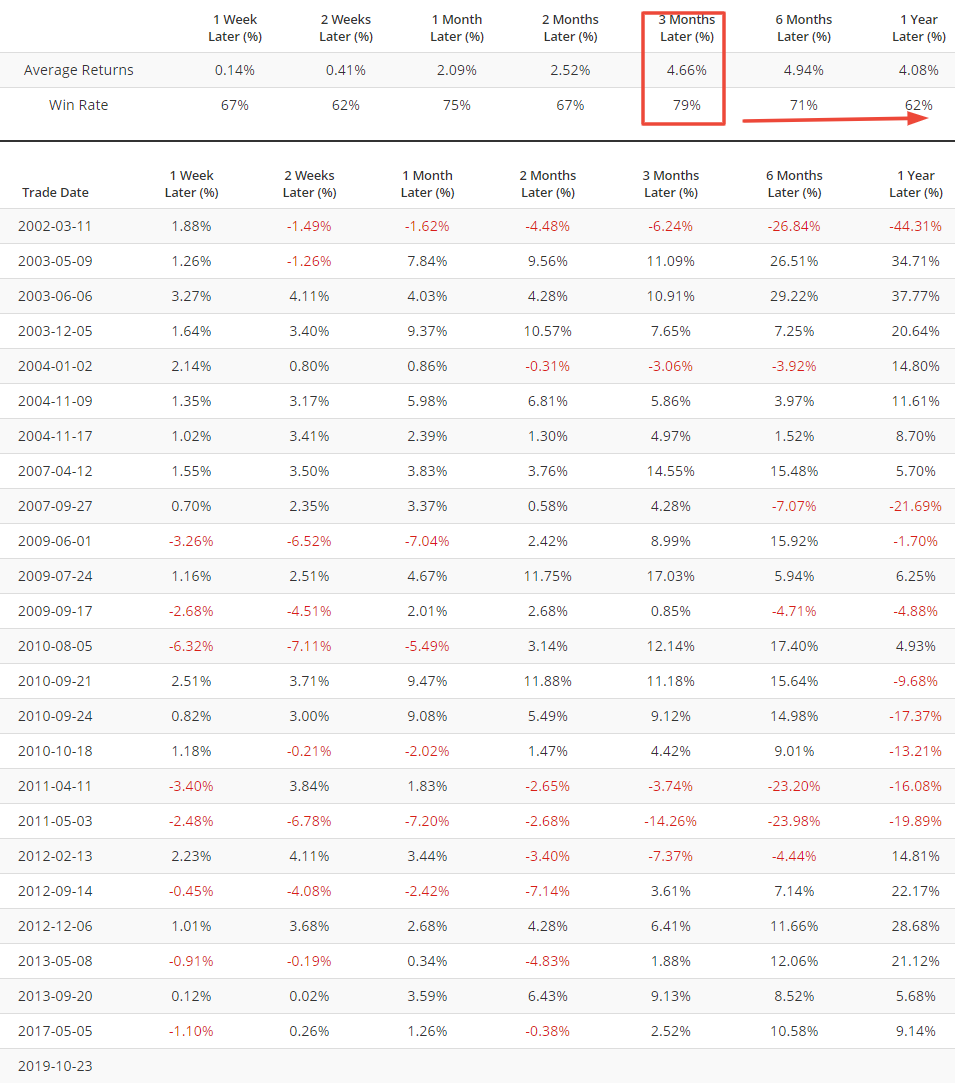

If we isolate for cases that occurred while EWG was above its 200 dma, the same bullish lean applies over the next 3 months. However, forward returns drop off after that:

Finally, if we remove overlapping cases over the past 50 days, EWG's forward returns over the next 3 months become even more bullish (but also drop off after that):

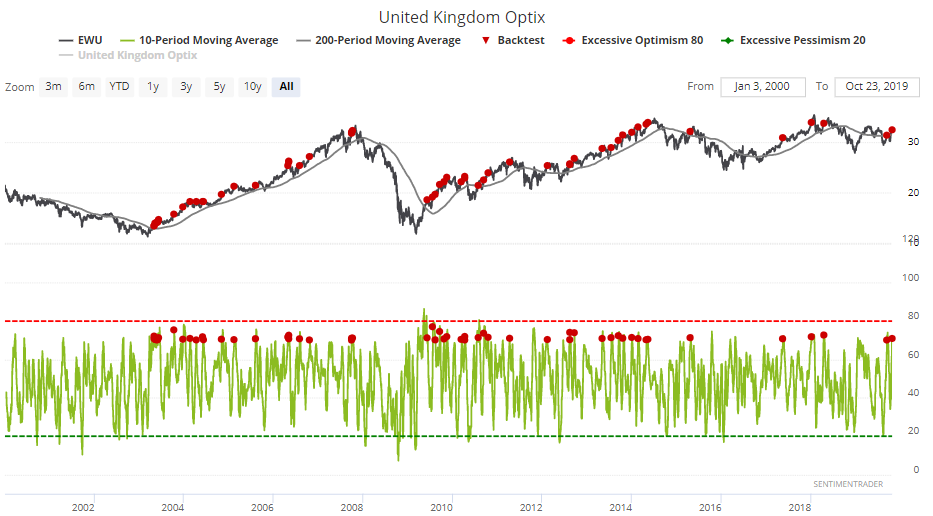

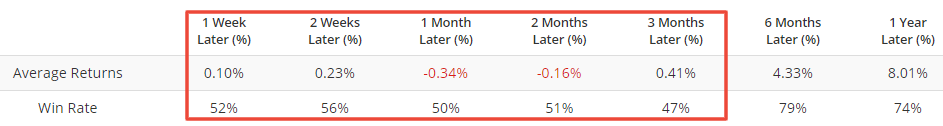

UK Optix

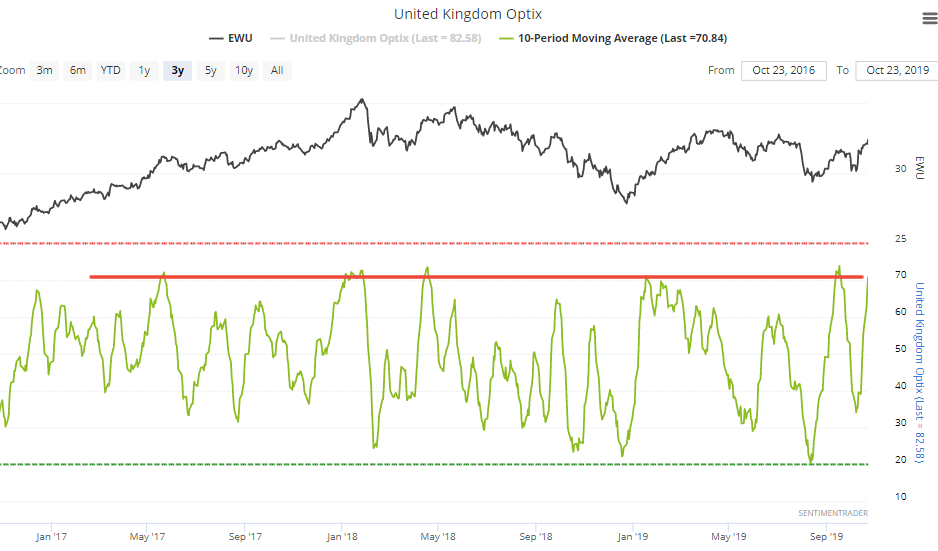

Similar to Germany Optix, UK Optix's 10 dma is also quite high as UK equities rally:

When Optix's 10 dma exceeded 70 in the past while EWU (UK ETF) was above its 200 dma, EWU's returns over the next 3 months were worse than random: