What I'm looking at - sentiment, Put/Call spikes, Treasury yields plunge, breadth reversal

Here's what I'm looking at:

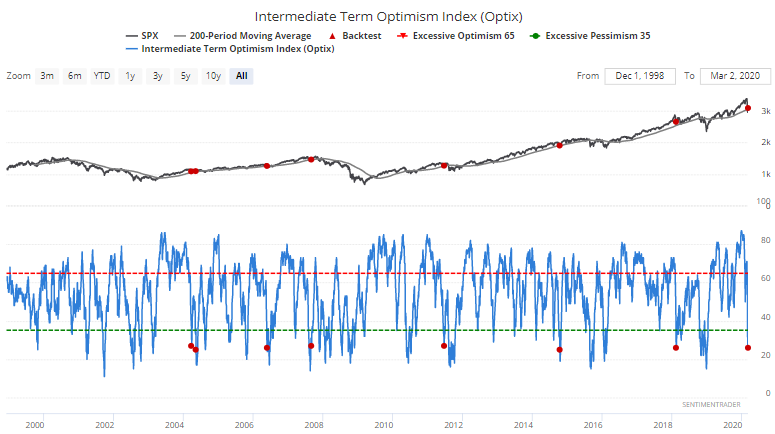

Sentiment

The stock market's recent crash has pushed sentiment down to levels of excessive pessimism. Our Intermediate Term Optimism Index is now at 26.

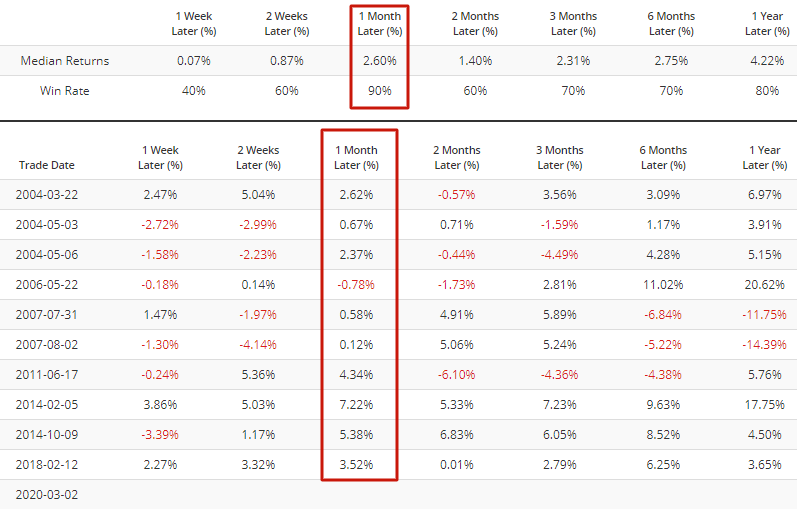

When this happened while the S&P was still above its 200 day moving average (above its long term uptrend), the S&P had a strong tendency to rally over the next 2-4 weeks:

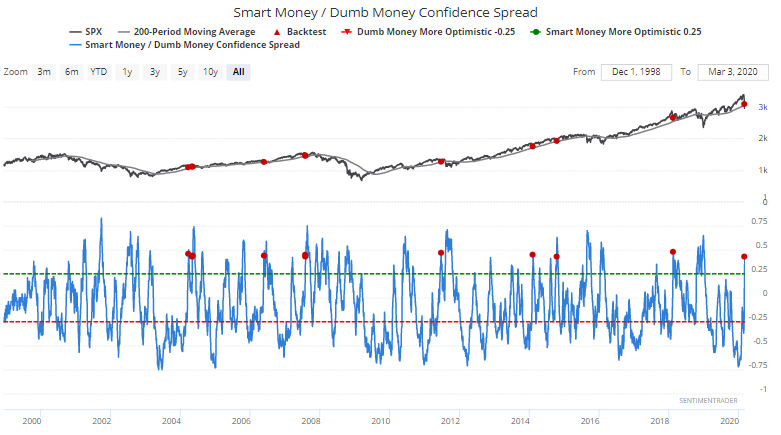

Similarly, the Smart Money/Dumb Money Confidence Spread is showing excess pessimism:

When this happened in the past while the S&P was still in a long term uptrend, the S&P's returns over the next month were almost uniformly bullish:

Put/Call

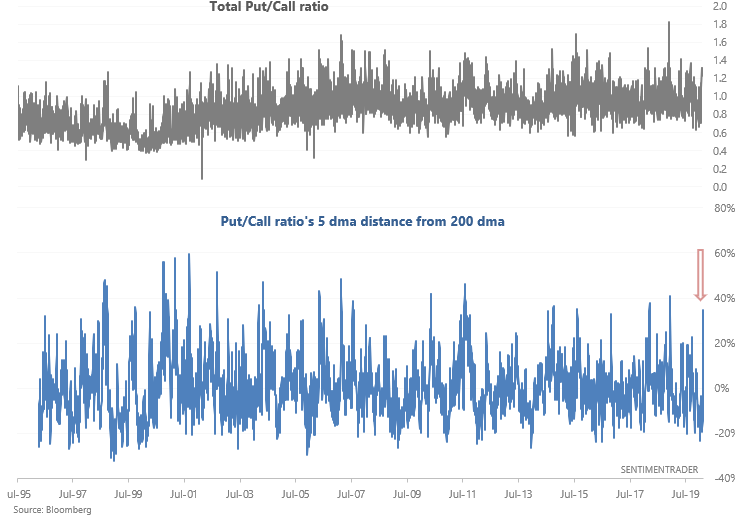

We were highlighting the extremely low Put/Call ratio from January-February as the U.S. stock market surged. But now that the U.S. stock market tanked, puts are back in fashion. The Total Put/Call Ratio's 5 day moving average is more than 34% above its 200 day moving average. The last time this happened was in late-December 2018, just before the stock market bottomed:

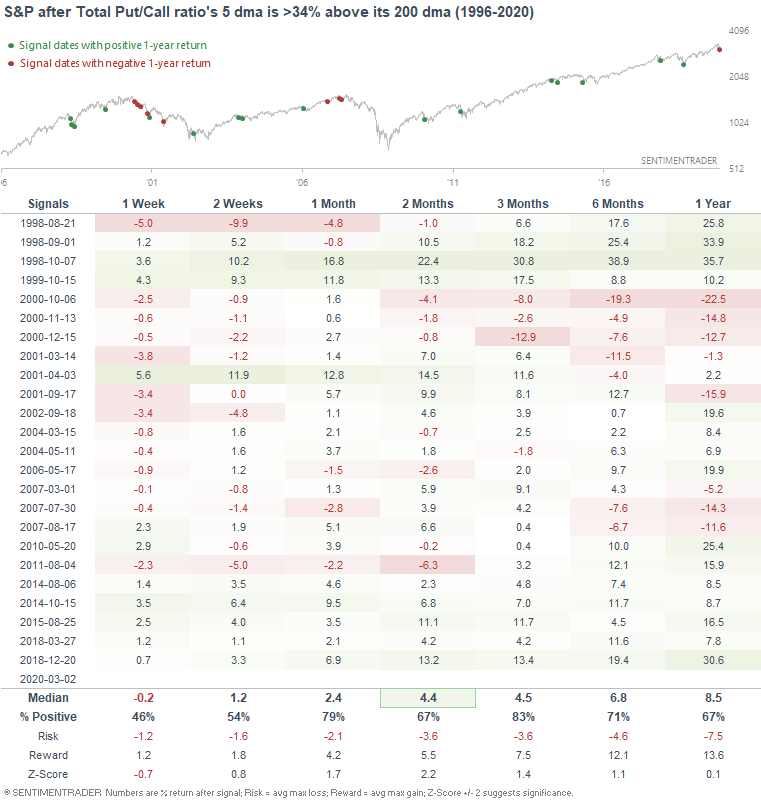

Such elevated Put/Call ratios have been quite bullish since 2014. But to avoid recency bias, here's every single historical case and what the S&P 500 did next:

Overall this was a bullish factor for stocks 1 month later with the S&P 500 rising 79% of the time 1 month later.

Flight to safe haven

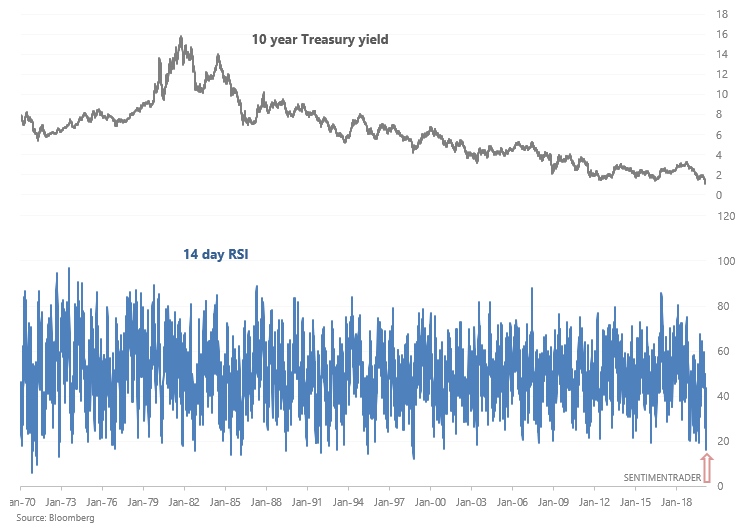

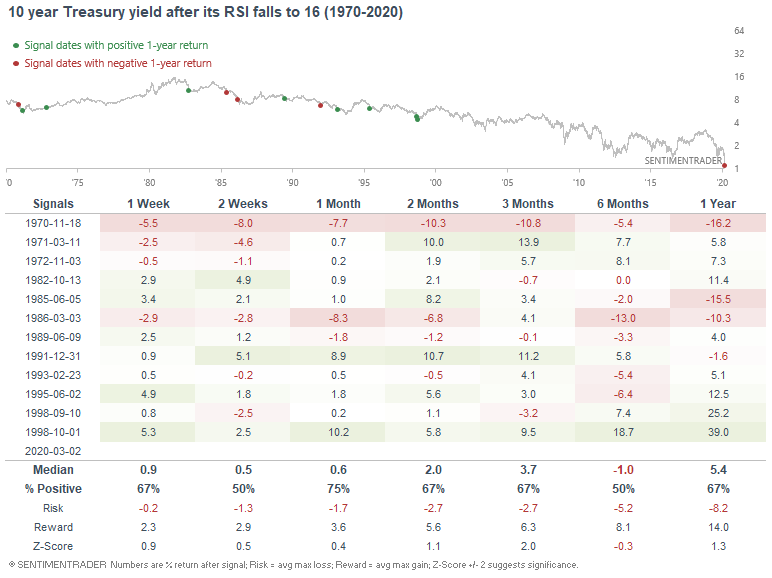

Bonds surged while stocks crashed last week. And despite yesterday's monster rally, bond prices continue to climb (while yields continue to fall). The 10 year Treasury yield's 14 day RSI has been pushed to one of the lowest levels ever:

When the 10 year Treasury yield was extremely oversold in the past (bonds were extremely overbought), the 10 year yield had a slight tendency to rise in the months ahead:

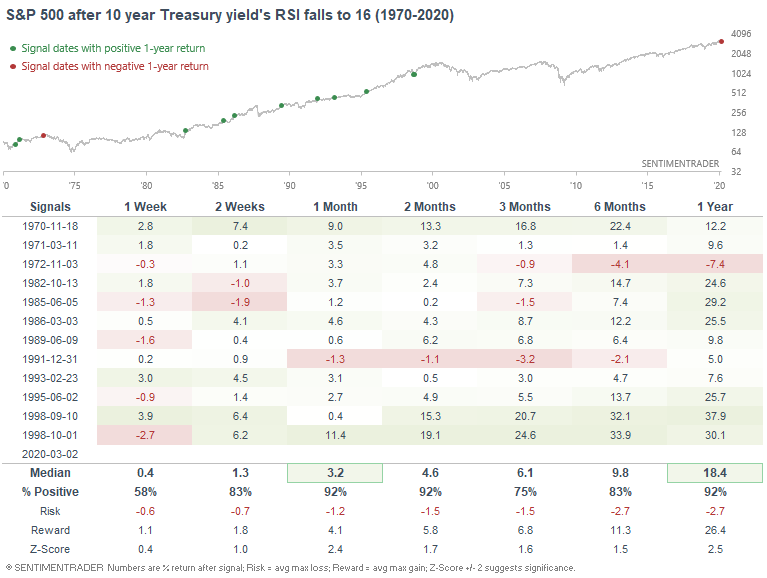

But more importantly, the S&P had a strong tendency to rally over the next 1-2 months since this usually occurred during a major market selloff.

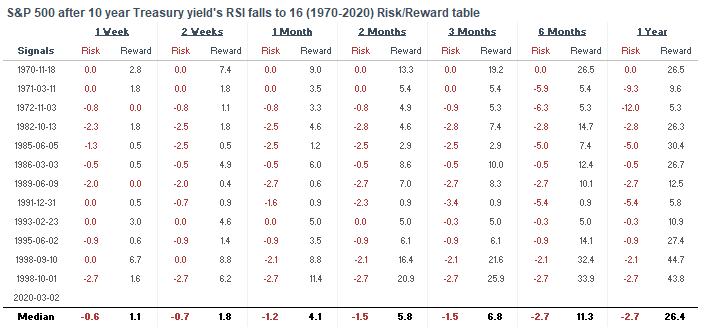

Here's the S&P 500's risk:reward table:

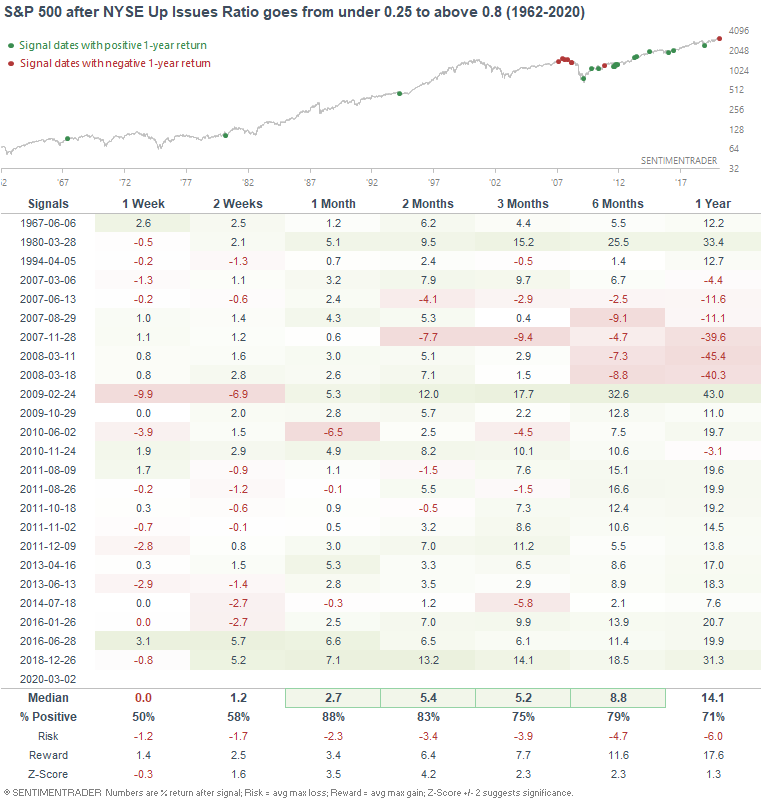

Up Issues

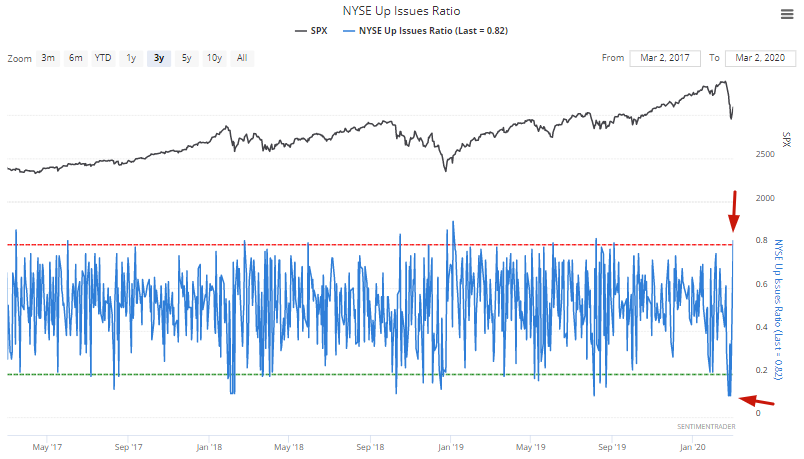

And lastly, the magnitude of Monday's rally was shocking. Just comes to show that extremes occur in both directions (last week's monster drop followed by Monday's monster rally). While most stocks were falling last week, most stocks rallied on Monday. The NYSE Up Issues Ratio went from 0.24 to 0.82:

Once again, the last time this happened was just after the stock market bottomed in late-December 2018. Overall, such strong market reversals (in terms of breadth) usually led to more gains for the S&P 500 over the next 1-2 months: