What I'm looking at - sentiment froth?, new highs expansion, Hong Kong, New Zealand

With stocks hovering near all-time highs, here's what I'm looking at:

Sentiment

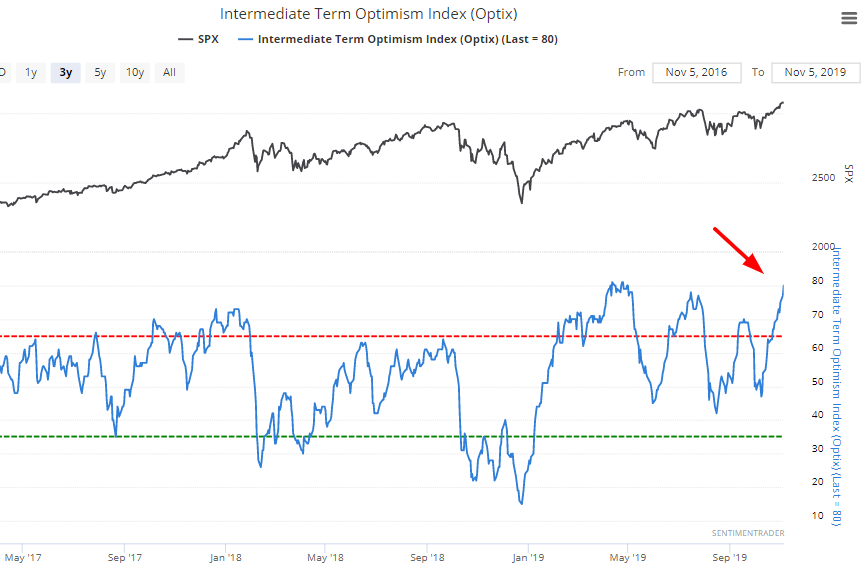

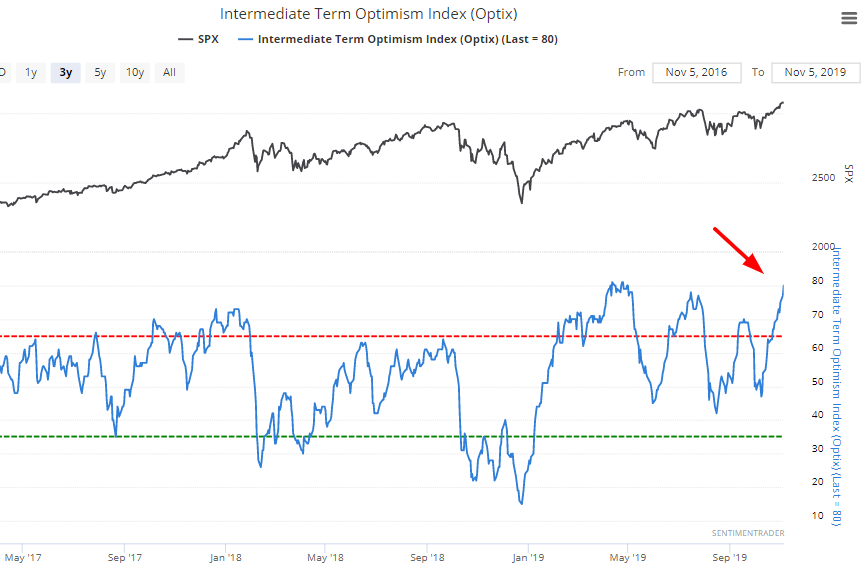

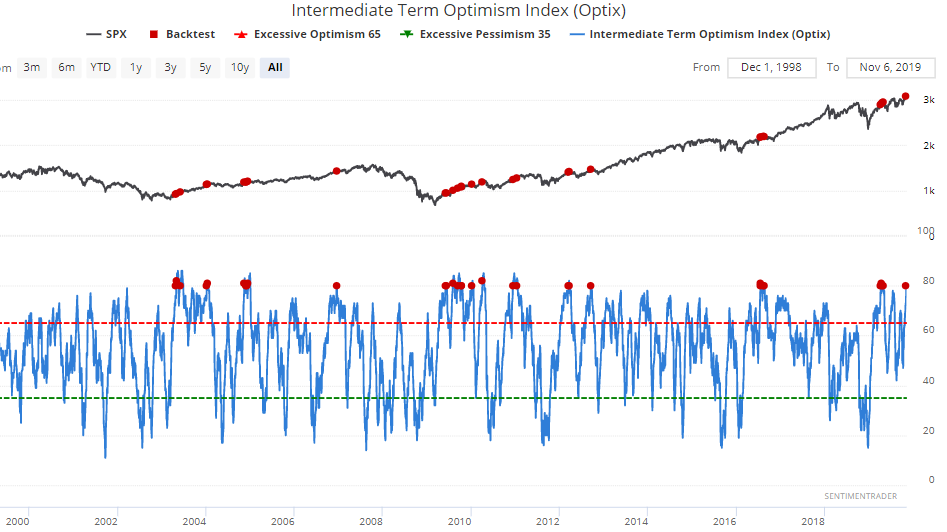

As the stock market continues to trend higher, various sentiment indicators are demonstrating higher and higher levels of excess optimism. For example, our Intermediate Term Optimism Index has reached 80, the highest level since April (just before stocks fell):

When this happened in the past, the S&P's returns over the next 2 months were worse than random, but over the next year were consistently bullish:

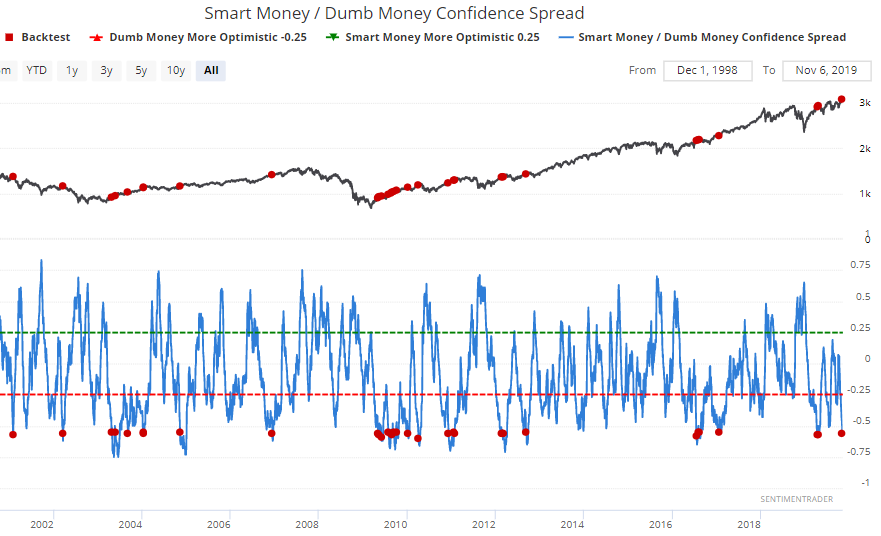

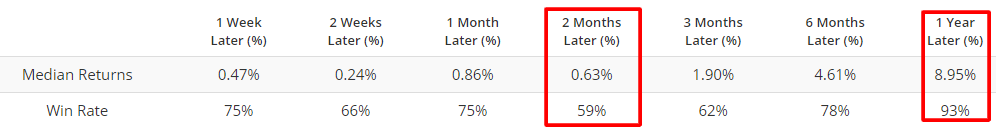

Meanwhile, our Smart Money/Dumb Money Confidence Spread has fallen to -0.56. Similarly, this was worse than random for stocks over the next 2 months, while usually bullish over the next 1 year:

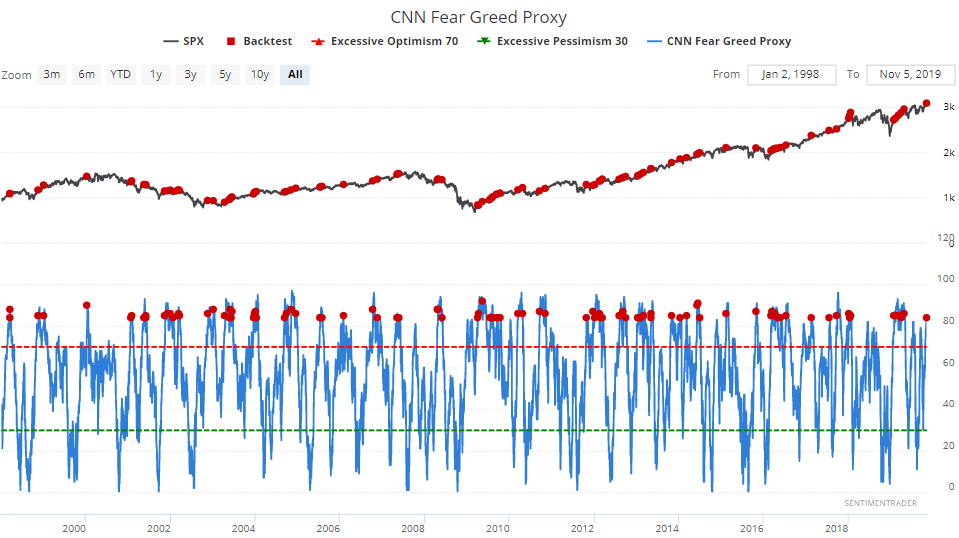

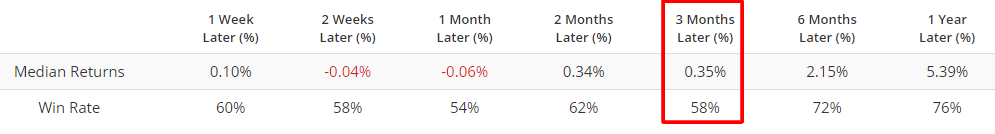

In addition, our CNN Fear Greed Proxy is now at 84. When this happened in the past, the S&P's gains over the next 3 months were muted:

Overall, sentiment will probably temper short-medium term gains going forward.

New highs

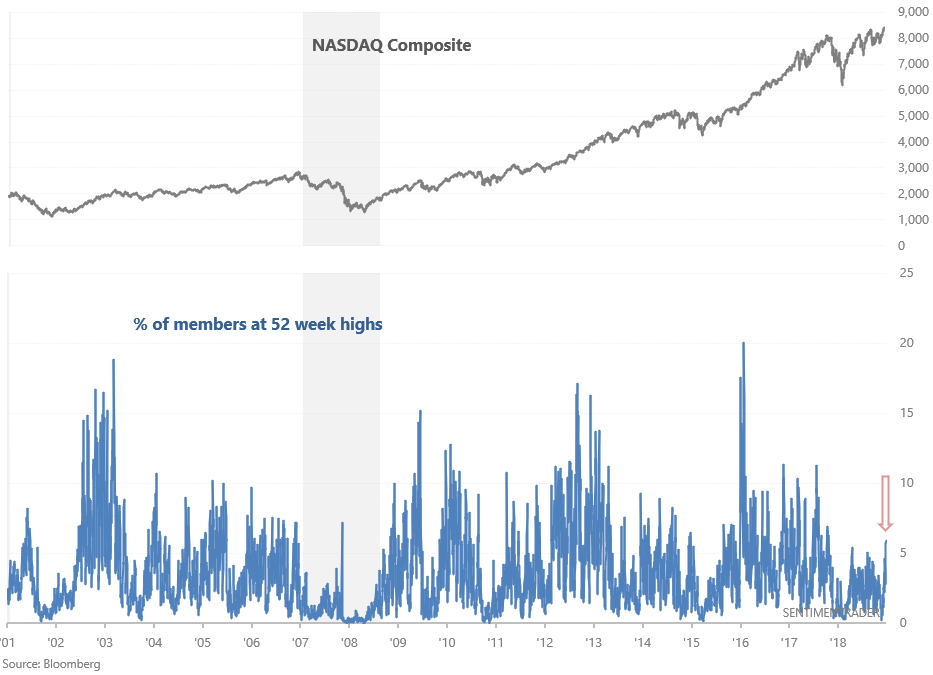

With the U.S. stock market trending higher, the % of NASDAQ Composite members at 52 week highs has reached levels last seen in September 2018:

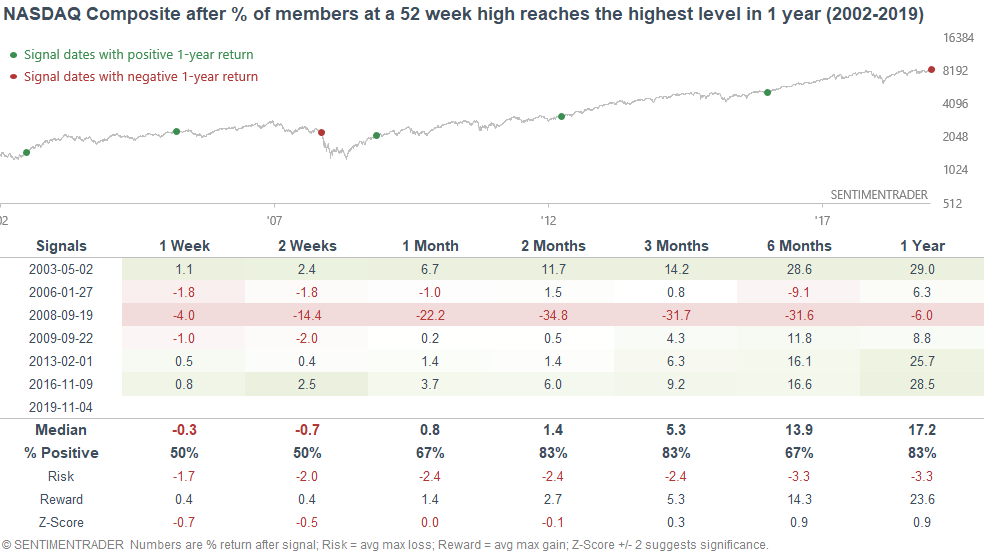

When new highs expanded to the highest level in more than 1 year, the NASDAQ's forward returns were usually bullish. The one big exception was September 2008, just before equities fell off a cliff:

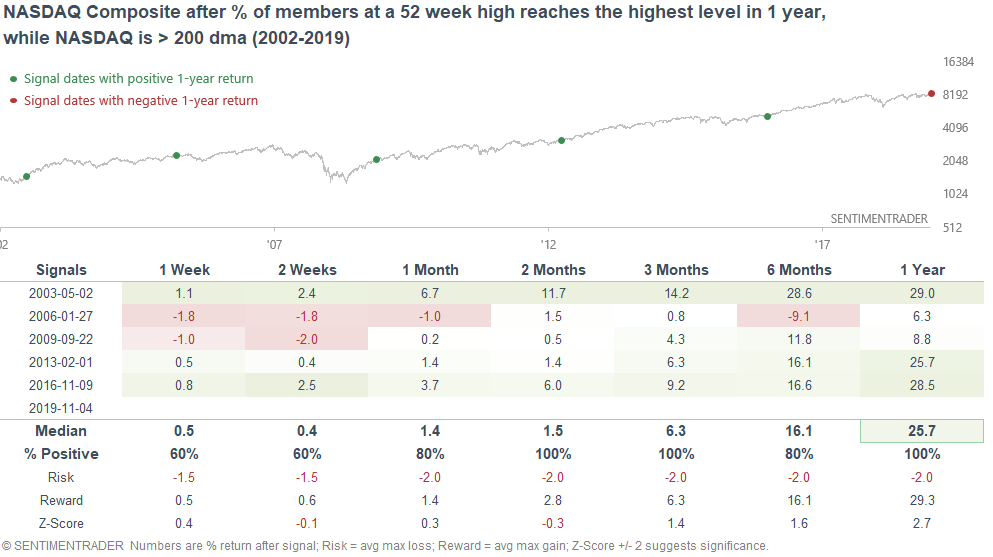

Of course, the global financial picture in September 2008 was very different from today (recession, stocks in a downtrend). With the U.S. economy still expanding and stocks at all-time highs, I don't think comparing today vs. September 2008 makes a lot of sense. So if we use a simple trend filter (when NASDAQ > 200 dma), the NASDAQ's future returns become consistently bullish:

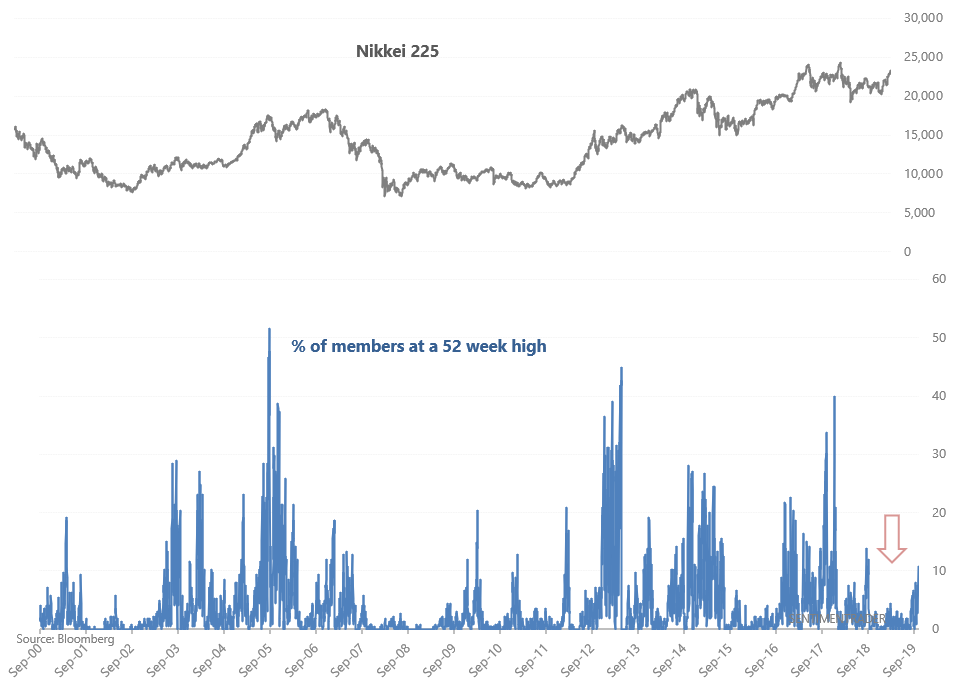

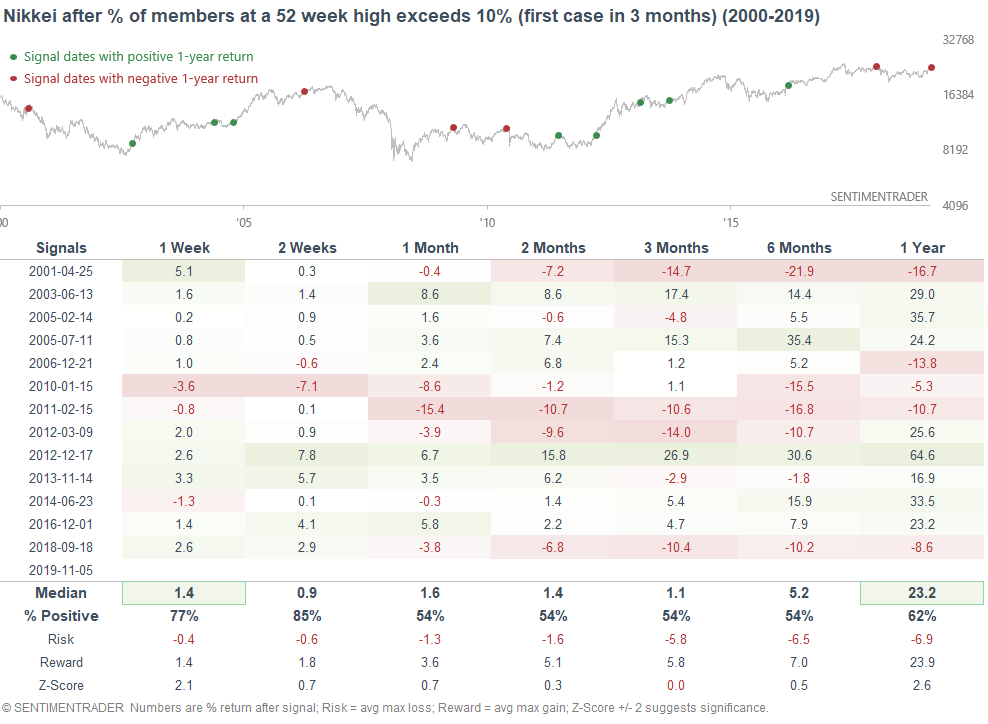

And with overseas equity markets breaking out, their accompanying breadth statistics continue to improve. For example, the % of Nikkei members at a 52 week high has now exceeded 10% for the first time since September 2018:

When the % of members at 52 week highs expanded to above 10% in the past, the Nikkei typically continued to rally over the next 1-2 weeks:

Hong Kong

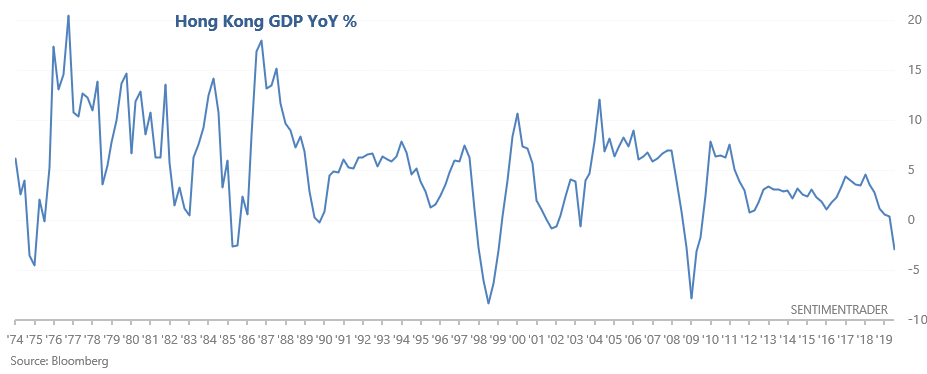

As multiple media outlets have noted, Hong Kong's economy is now in a recession, with year-over-year GDP at -2.9%:

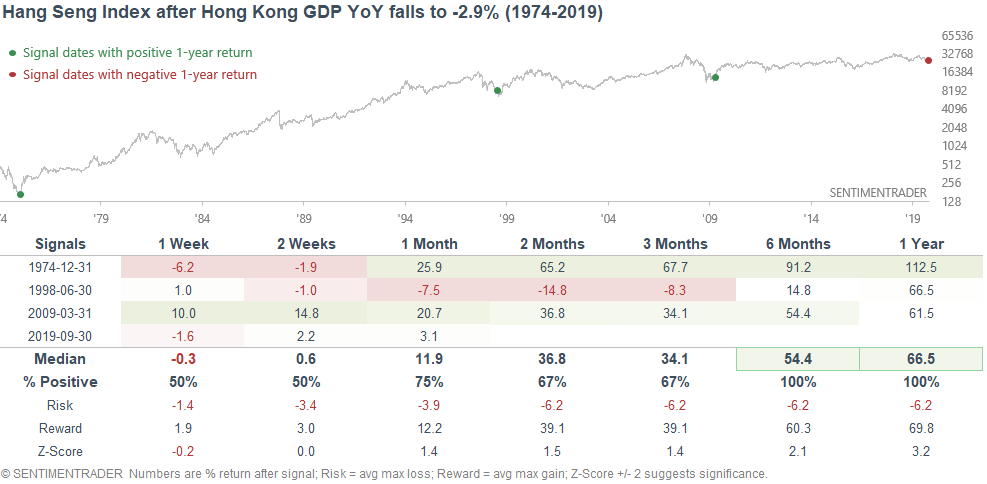

But when things were this bad in the past, it wasn't a clear bearish sign for Hong Kong equities. If anything, this typically occurred towards the end of a recession and bear market. Here's what happened next to the Hang Seng Index when GDP fell at least -2.9% YoY:

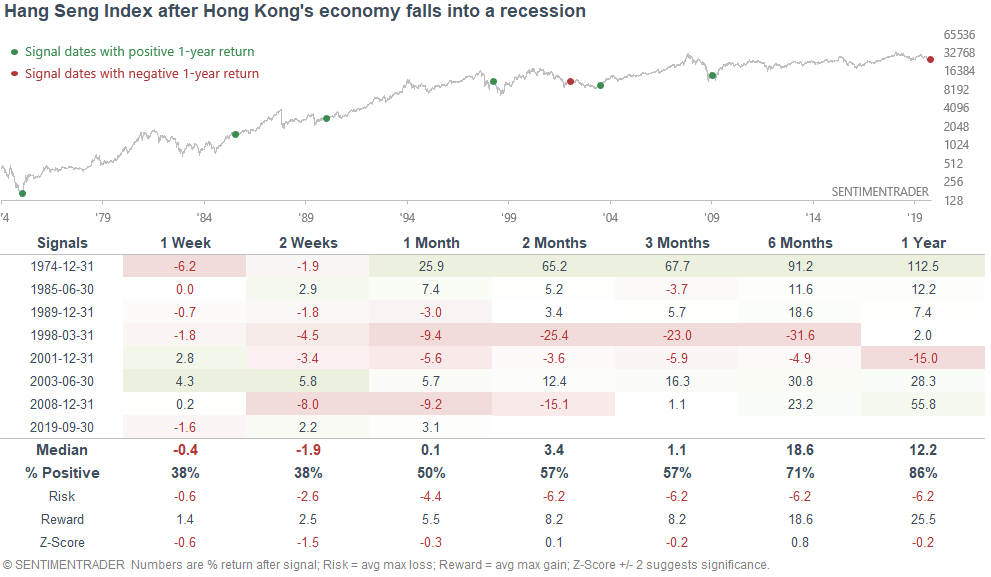

Even if we look at every case in which Hong Kong's economy slid into a recession, the Hang Seng Index's forward returns weren't consistently bearish. This is why I'm not a huge fan of GDP - it's a lagging economic indicator.

New Zealand

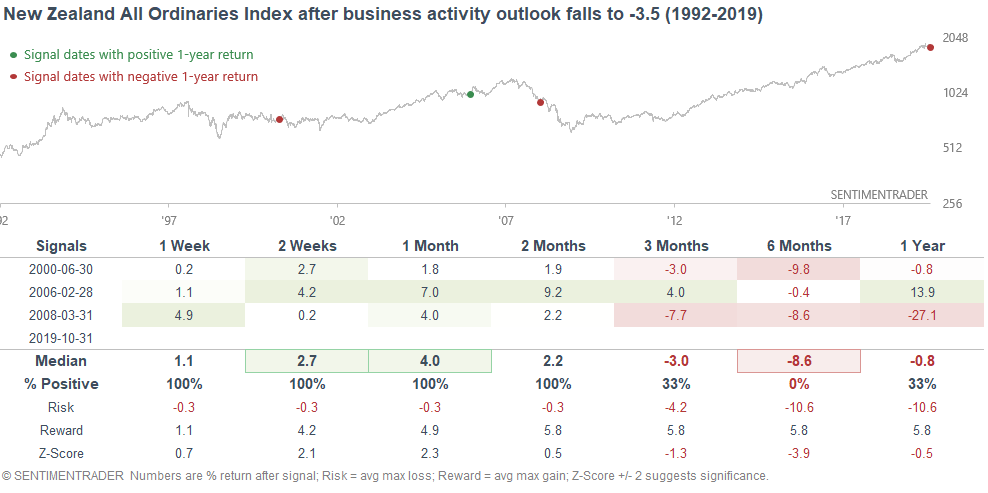

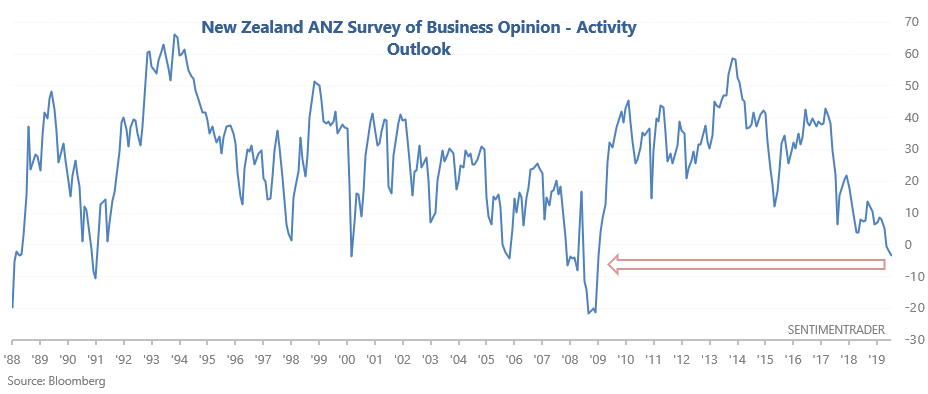

And lastly, the WSJ noted that New Zealand's business activity outlook is worsening, with the ANZ Survey of Business Opinion (Activity Outlook) at -3.5

The 3 other times this happened from 1992-present, the New Zealand All Ordinaries Index performed poorly over the next 6 months: