What I'm looking at - maximum fear, safe haven day, maximum oversold, USD volatility, AAII

What I'm looking at:

Fear is at a maximum

Fear is at a maximum right now. The kind of selloff we witnessed on Thursday can only be compared to some of the worst crashes in market history: October 2008, 1987, and 1929-1932.

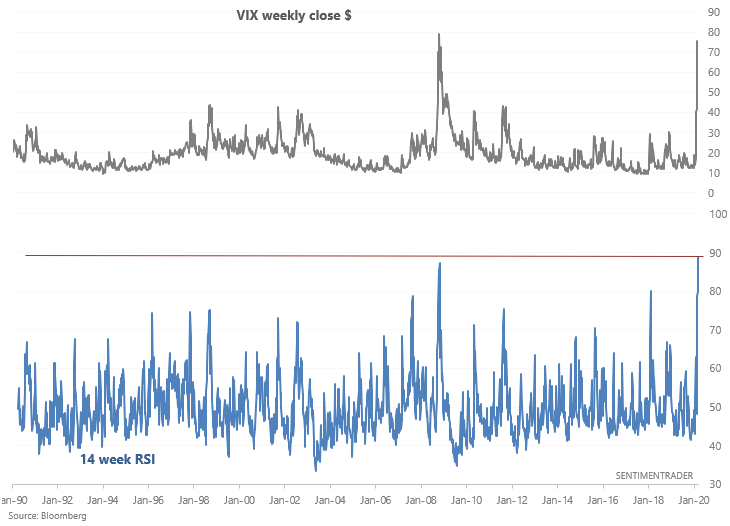

Here's a weekly chart for VIX using VIX's weekly CLOSE $:

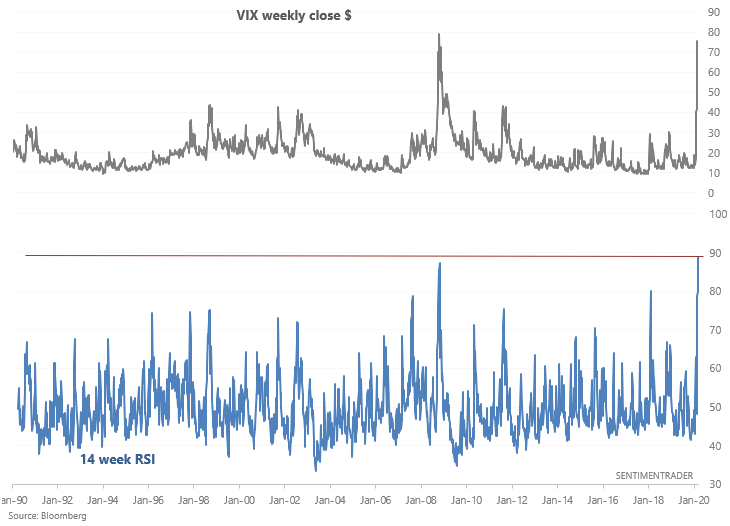

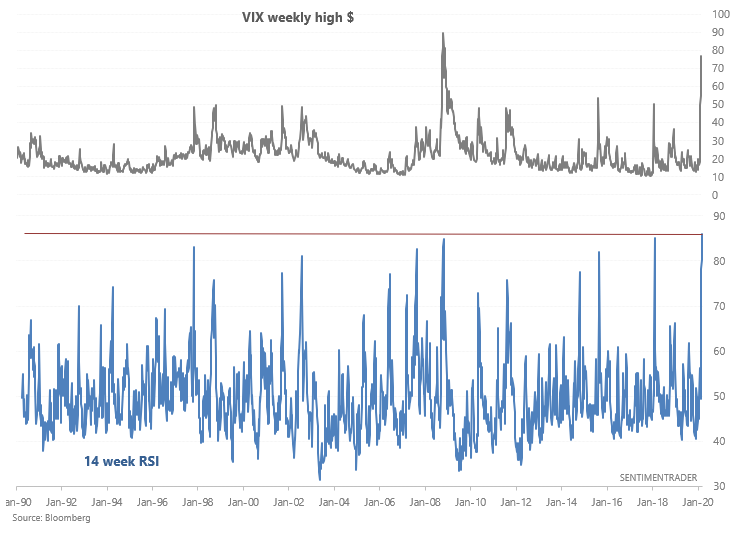

VIX's weekly RSI (using CLOSE $) is at 85, which is even higher than the worst of the 2008 crash. Granted, the week isn't over, so we'll have to use VIX's weekly HIGH $:

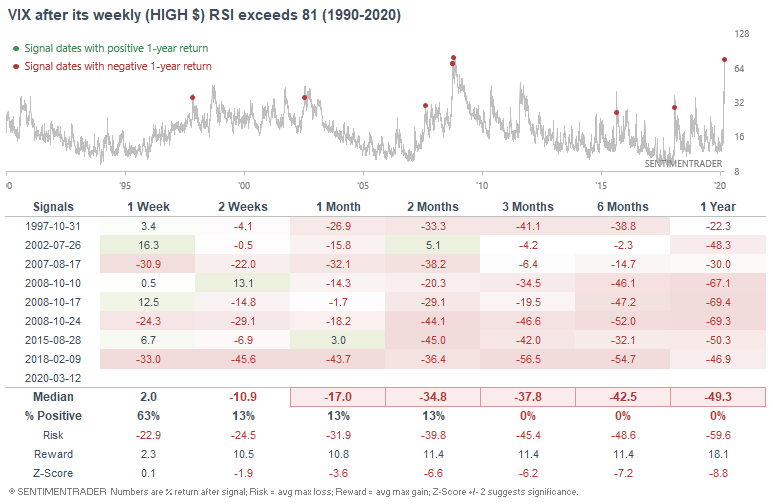

Here's what happened next to VIX after its weekly RSI exceeded 81:

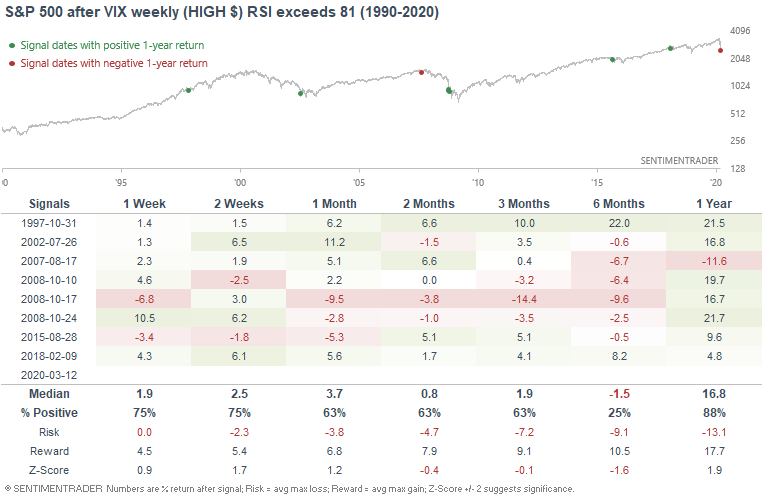

And here's what happened next to the S&P 500:

Overall, it's hard to imagine stocks going down much further. In times like this, it's better to focus on risk:reward than to try and catch the exact bottom.

Safe haven

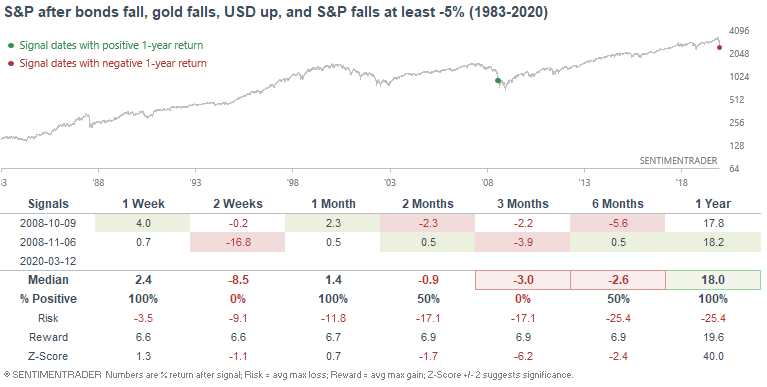

Thursday's stock market crash was a pure safe haven day, in a way that can only be compared to 2008. Supposedly safe haven assets like gold and bonds fell, stocks tanked, and the USD went up. From 1983 - present this only happened during the worst of the 2008 crash:

Back then, stocks were extremely volatile over the next few months, with massive rallies followed by massive retracements. But on a longer term basis, this was a terrific place to bet against the bearish crowd. Don't follow the herd.

Oversold

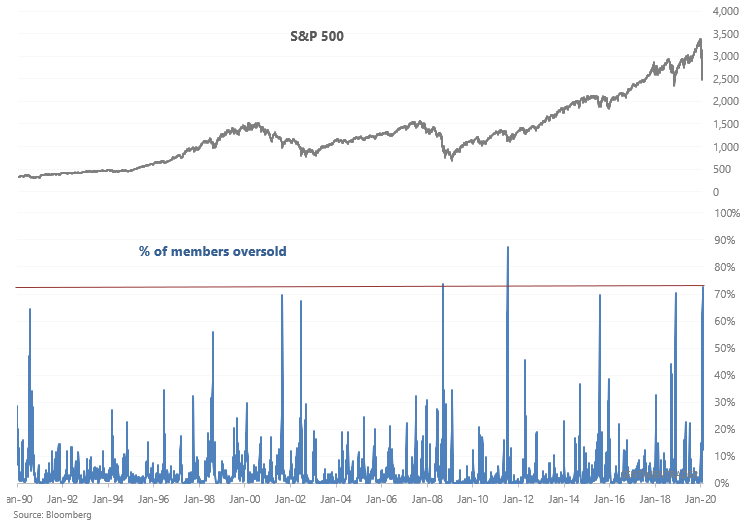

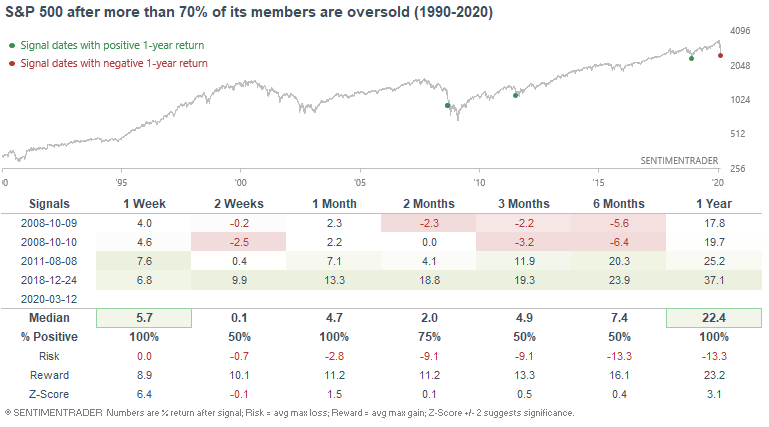

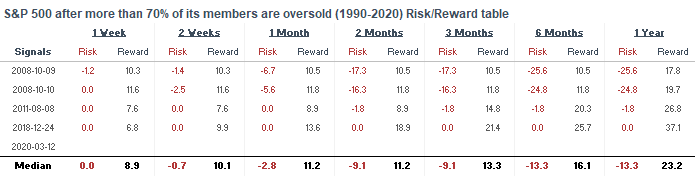

In another sign of extreme selling, 73% of the S&P 500's members are now oversold (RSI < 30). Such indiscriminate selling was only matched by October 2008 and the August 2011 crash:

When so many equities crashed at the same time in the past, the S&P 500 often rallied immediately and sharply:

Here's the S&P 500's risk:reward table:

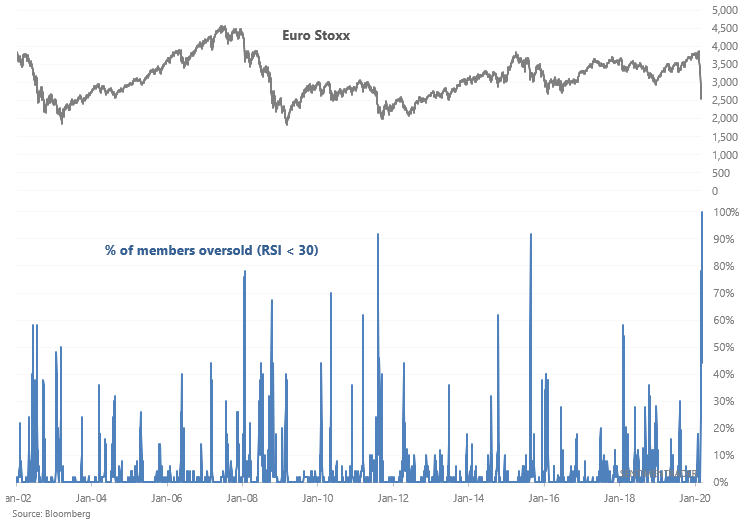

Over in Europe, the 100% of Euro Stoxx members are oversold. This has never happened before, not even during the height of the 2008 crisis:

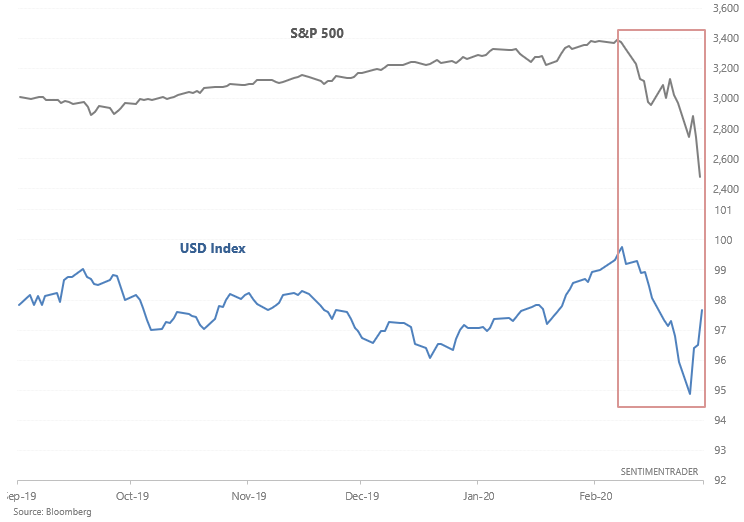

USD Index

The U.S. Dollar Index has been extremely volatile of late, which is quite normal when global equities selloff and investors rush towards safe havens. (Go from "cash is trash" to "cash is king").

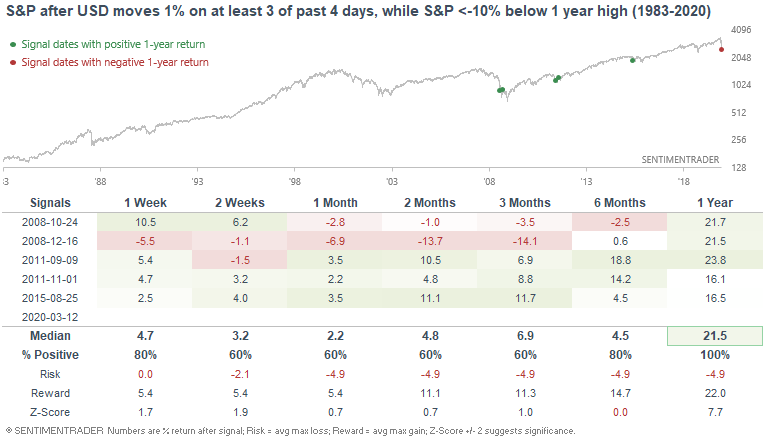

3 of the past 4 days have seen the U.S. Dollar Index move at least 1% (up or down), while the S&P 500 is far below its 1 year high. The only similar historical cases all saw the S&P 500 surge over the next year:

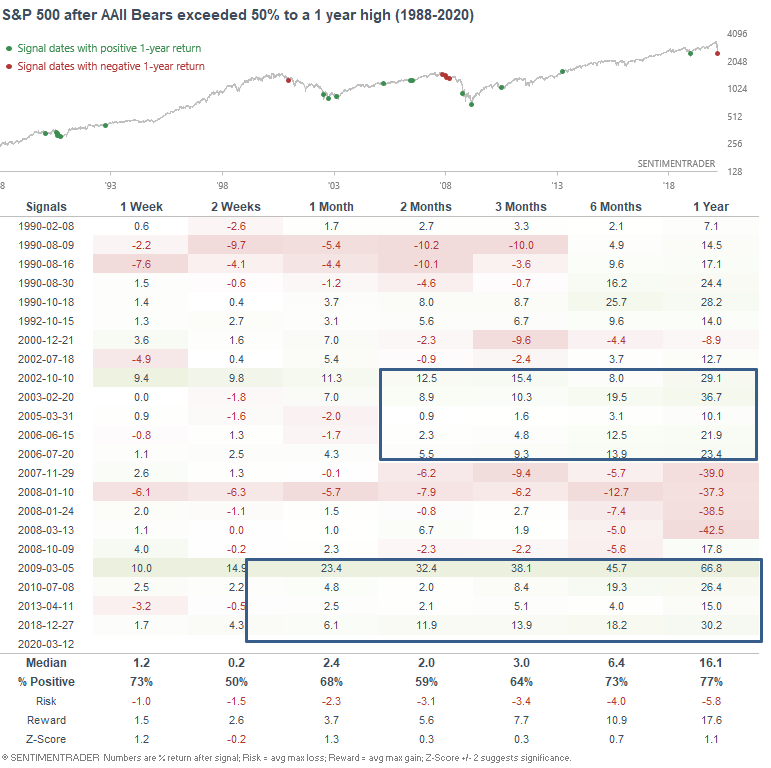

AAII

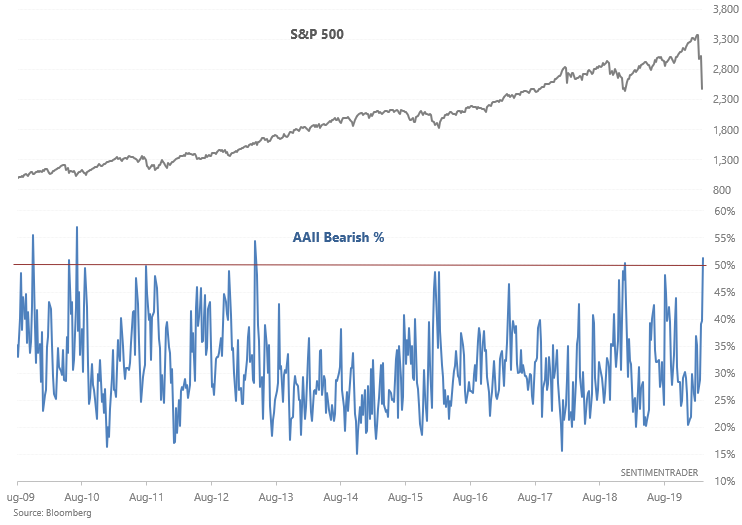

And finally, AAII Bearish % has risen above 50%, a level which in this bull market marked many significant bottoms (the last one being December 2018)

But if we look at every case in which AAII Bears exceeded 50%, it wasn't a clear bullish sign. This was bullish during bull markets, and not consistently bullish during bear markets: