What I'm looking at - Industrial Production, housing's comeback, VVIX, U.S. Dollar drop, loans

Here's what I'm looking at:

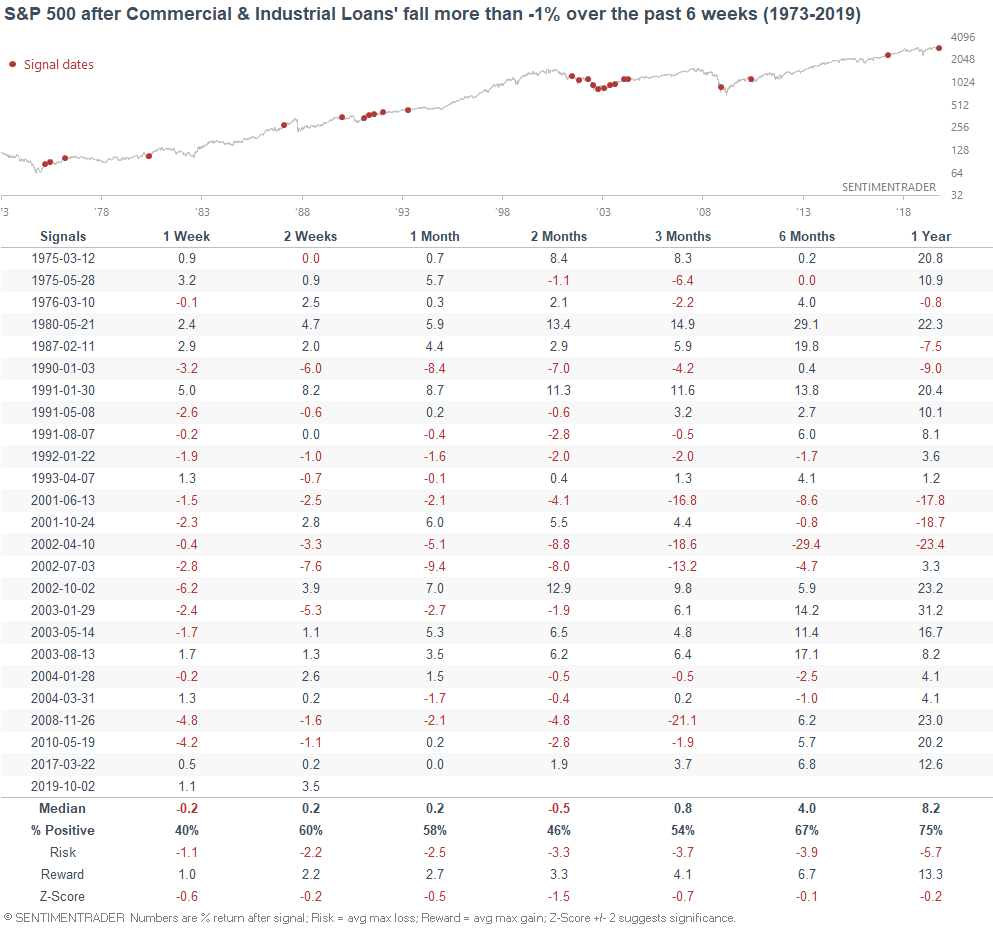

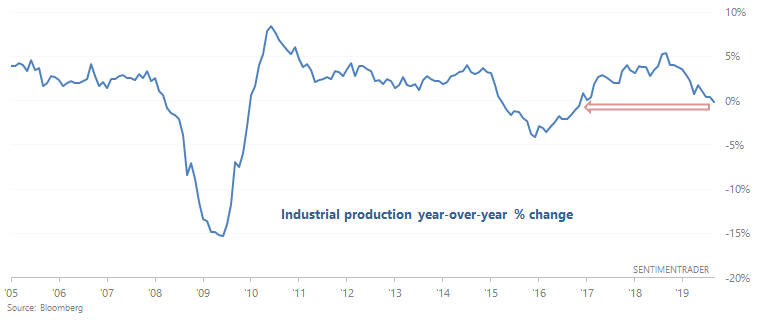

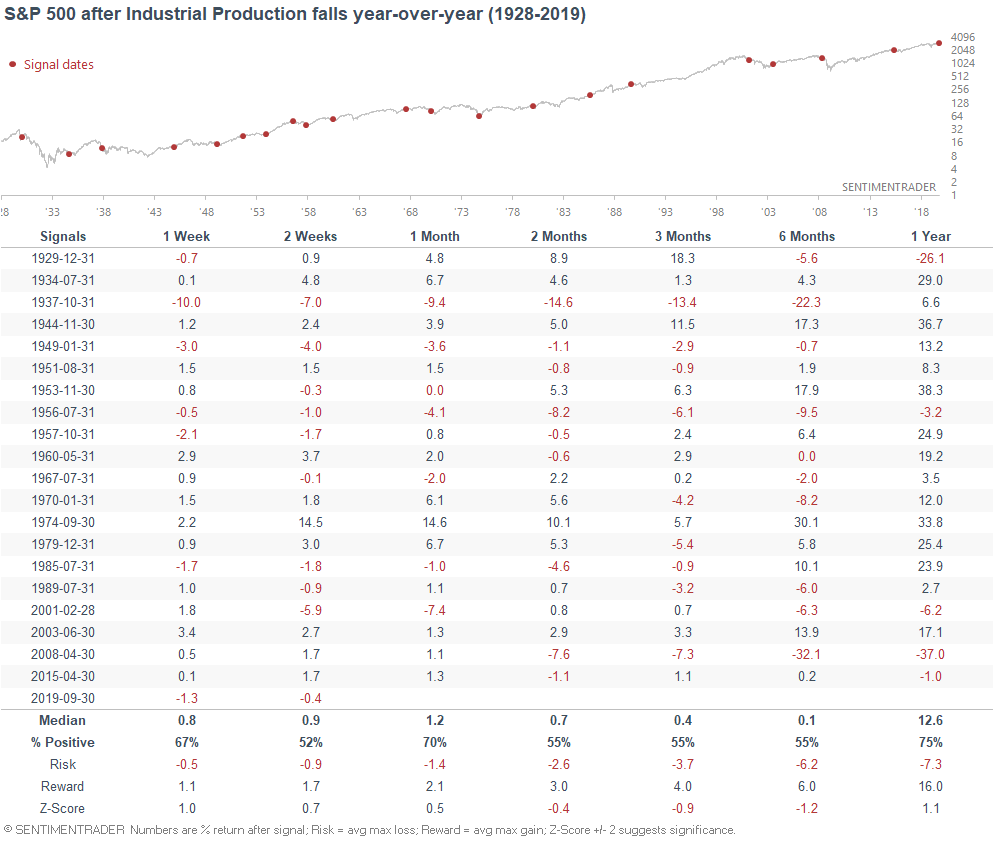

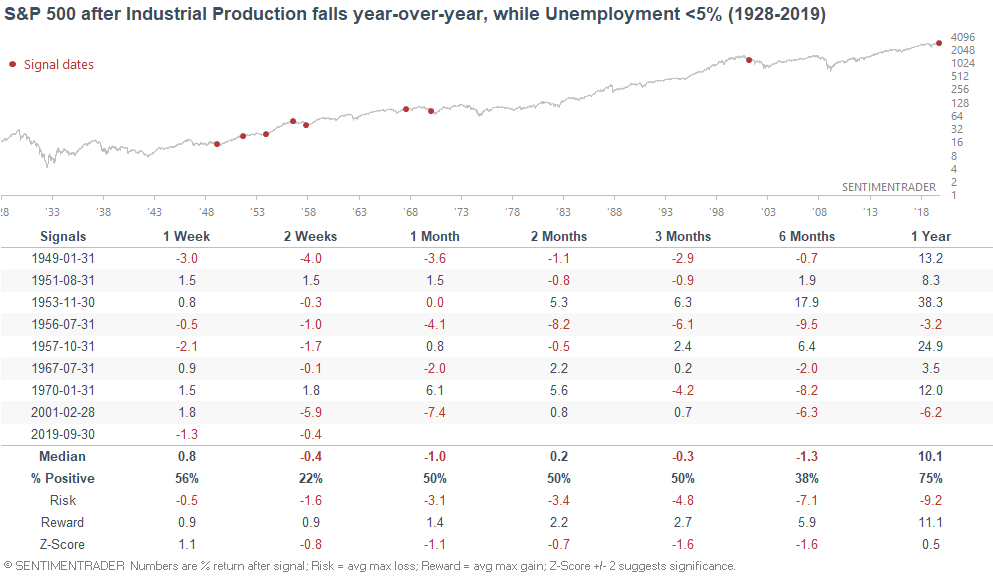

Industrial Production

The latest reading for Industrial Production fell -0.14% year-over-year. By now, most manufacturing-related indicators are in contraction-mode:

When this happened in the past (YoY Industrial Production turned negative), the S&P's returns over the next 6 months were worse than random, with large downside risk (primarily because many of these signals occurred in a recession).

And if you isolate for the late-cycle cases (i.e. Unemployment is also under 5%), the S&P's 3-6 month forward returns were more bearish:

Overall, manufacturing remains a bearish factor for macro. However, no data point (especially a fundamental data point) should be taken in isolation. The weakness in macro right now coincides with strength in housing and the labor market.

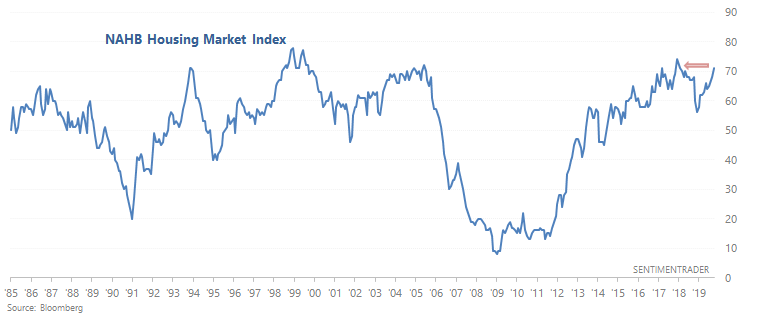

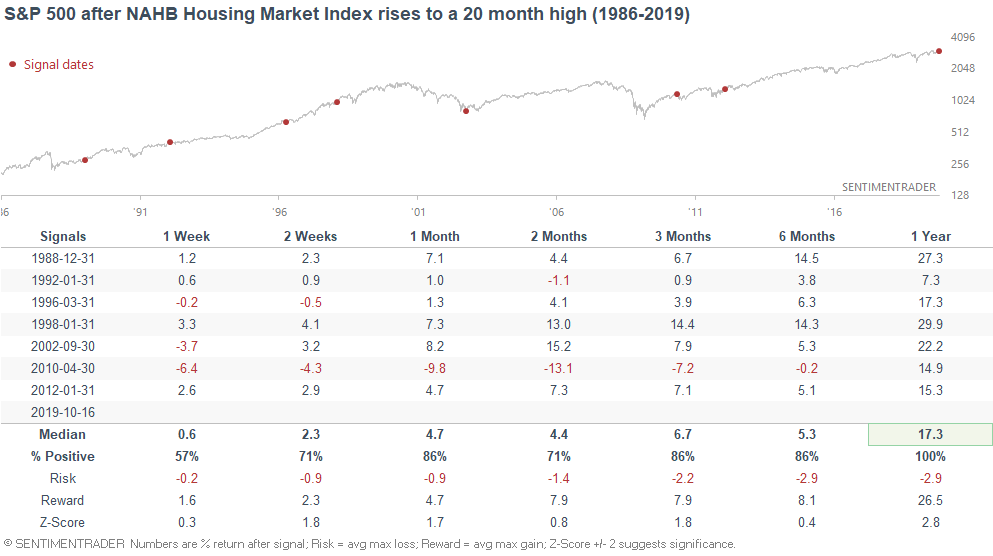

Housing's comeback

While much is said about the yield curve, trade war, and manufacturing, macro watchers generally are not looking at the rebound in housing. And right now, housing continues to improve. The NAHB Housing Market index has increased to a 20 month high:

Housing indicators are extremely useful as leading indicators for the U.S. economy. For example, they were weakening in the 2nd half of 2018 (before the December crash), and have been strengthening since the very start of 2019. When the NAHB Housing Market Index rose to a 20 month high in the past, the S&P's returns over the next year were extremely bullish.

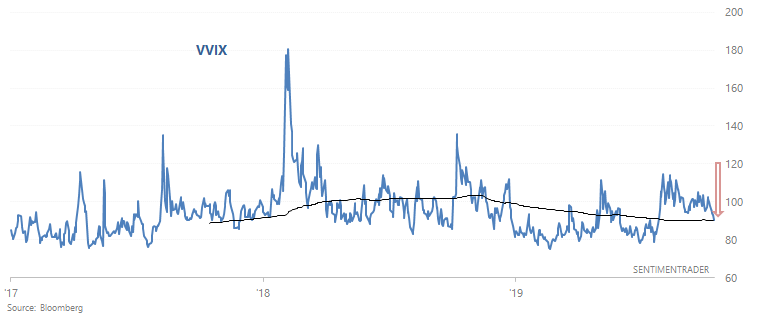

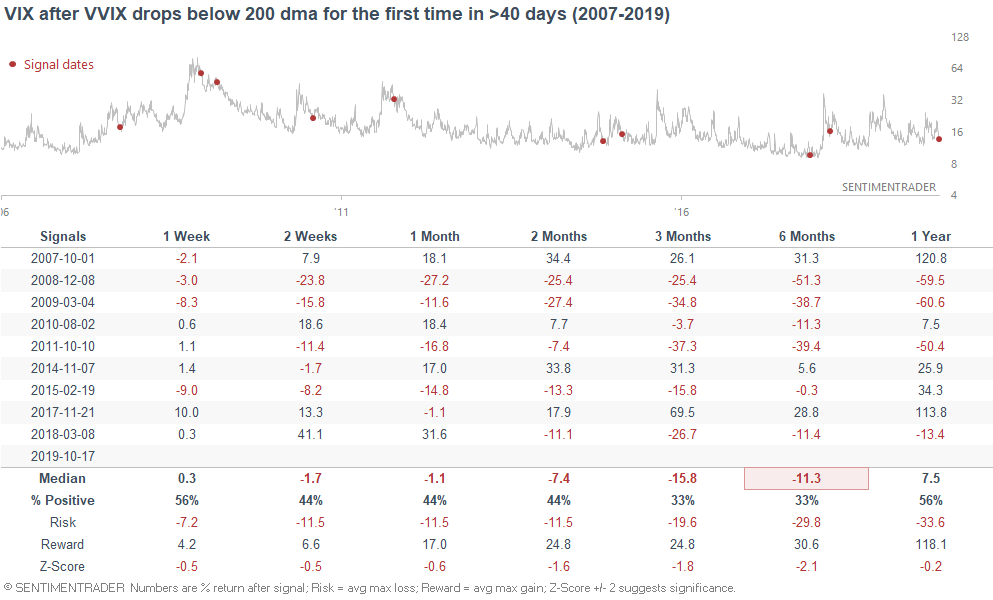

VVIX

The VIX of VIX Index has fallen below its 200 day moving average for the first time since July as stock market volatility subsides:

When it did so in the past, the S&P's forward returns were no different from random, but VIX's returns over the next 3-6 months were more bearish than random:

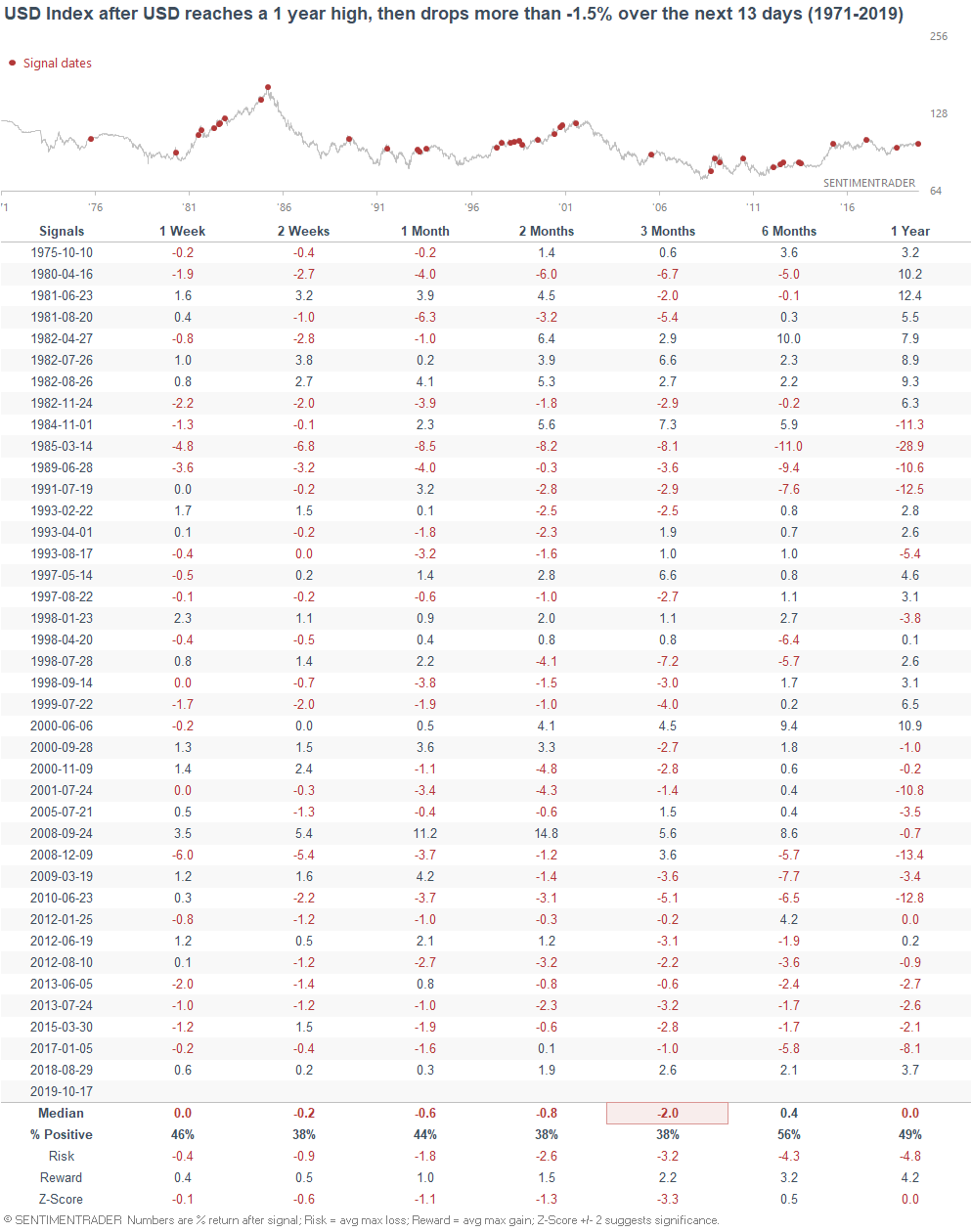

Dollar's reversal

The U.S. Dollar Index reached a multi-year high in late-September, and since then has dropped like a stone.

Such rapid reversal patterns are rather common, and aren't great for the U.S. Dollar Index. When this happened in the past, it typically led to continued weakness for the dollar over the next few months. This pattern has been especially bearish for the dollar over the past 10 years, leading to losses for the Dollar almost every time over the next 3 months:

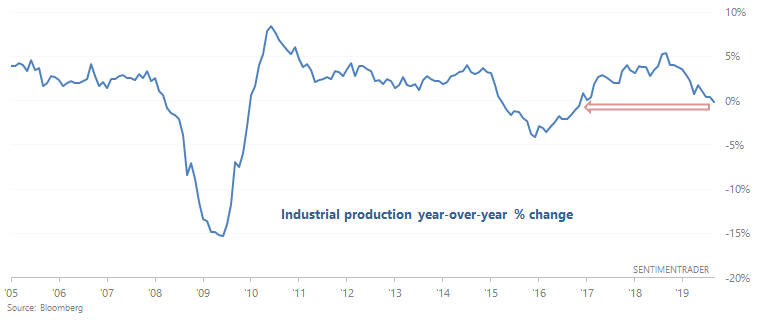

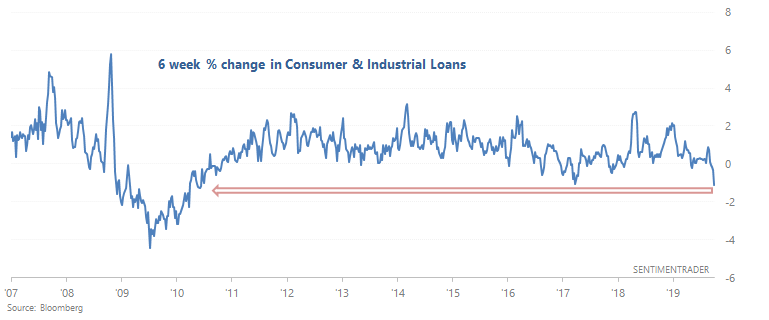

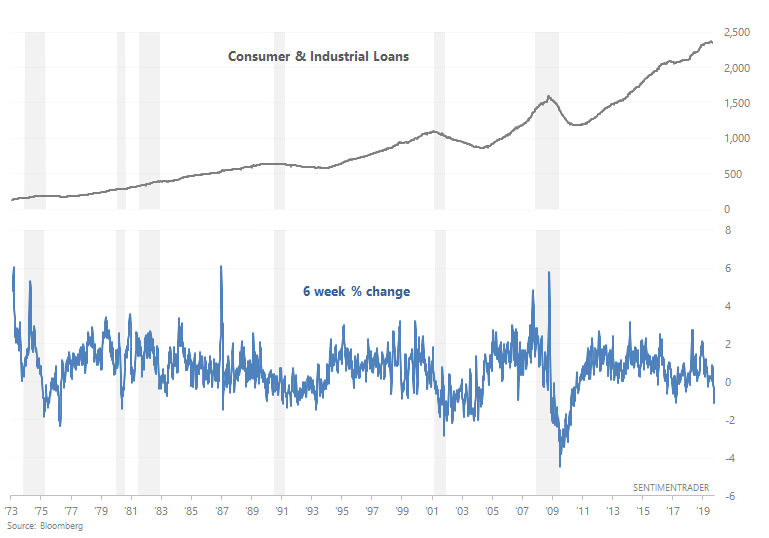

Commercial & industrial loans

As popular analyst Otavi Costa noted, commercial and industrial loans declined by the most since 2008. This was a pretty popular complaint in 2017, when analysts and media firms were asking "if the economy is so good, then how can commercial and industrial loans be falling?"

But if we look at a longer chart, it's clear that this can also happen during economic expansions. It is not exclusive to bear markets and recessions:

When this happened in the past, the S&P's forward returns were more bearish than random, but it wasn't a particularly strong and consistently bearish factor for stocks: