What I'm looking at - growth vs. value, stocks vs. commodities, Hindenburg Omen, Shanghai Index

Here's what I'm looking at:

Growth vs. Value

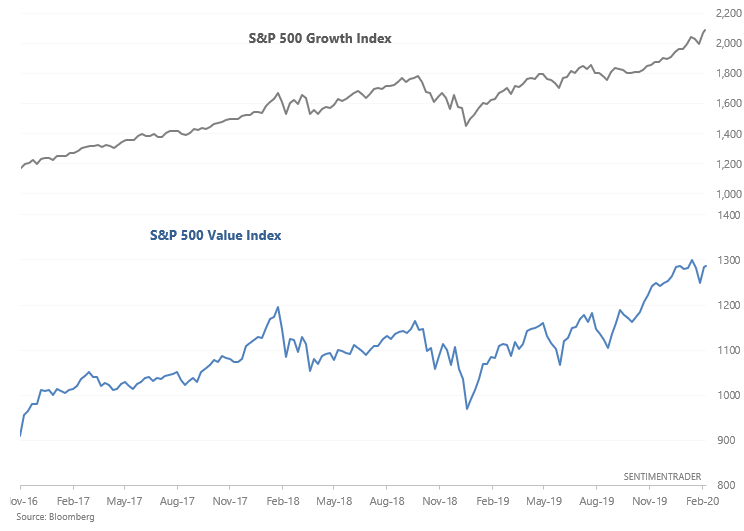

Growth has been all the rage throughout this bull market, and continues to be so. Tech continues its nonstop rally, and stocks like Tesla are popping. The following table illustrates the S&P 500 Growth Index vs. the S&P 500 Value Index.

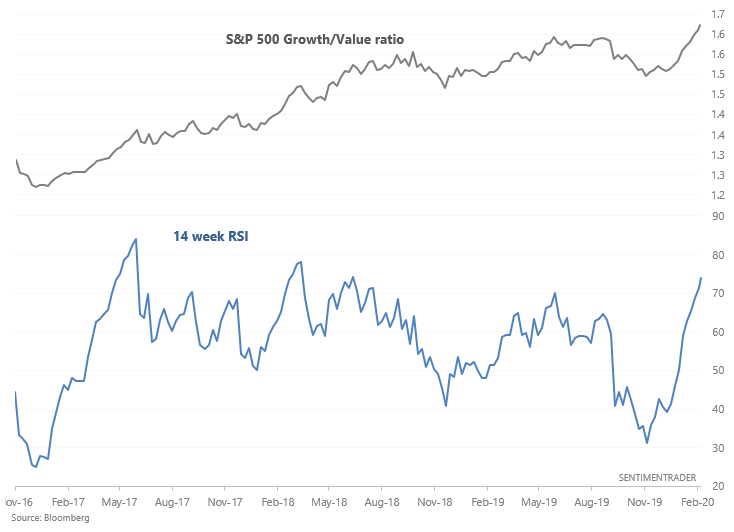

Turning Growth vs. Value into a ratio, it's clear that growth has surged over the past few months, pushing the ratio's 14 week RSI into overbought territory (i.e. >70).

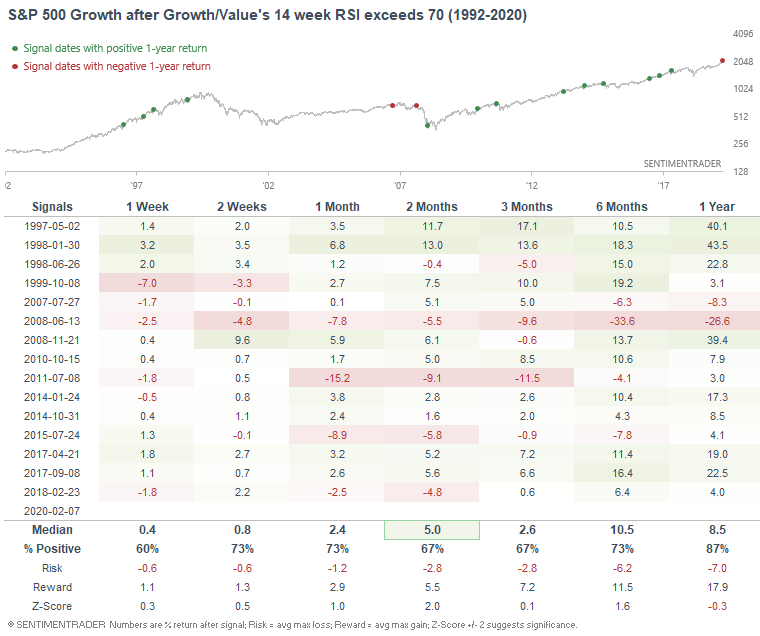

Does this automatically mean that growth will underperform relative to value in the near future? Not necessarily. Here's what happened next to the S&P 500 Growth Index when Growth/Value's 14 week RSI exceeded 70:

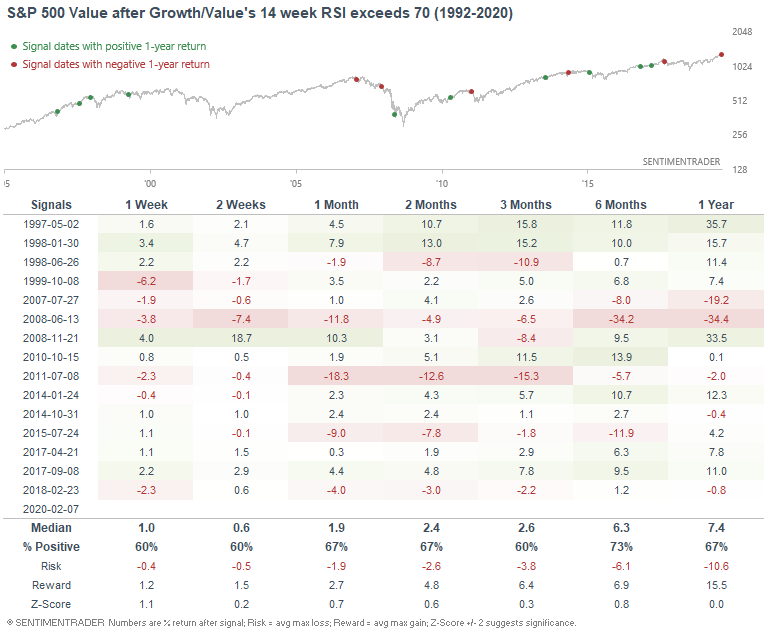

Here's what happened to the S&P 500 Value Index:

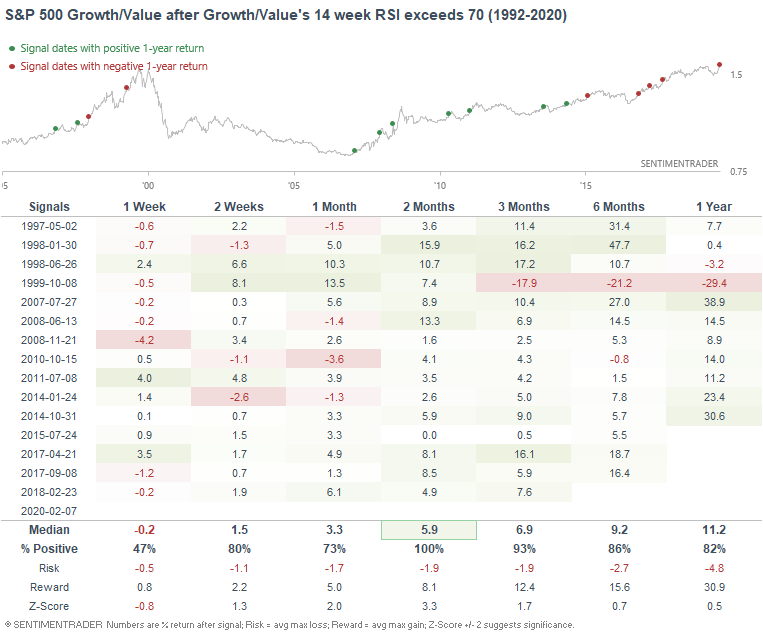

And here's what happened to Growth vs. Value:

In some cases, extreme momentum isn't a very useful contrarian sign. Instead, it's a sign that "strength begets more strength". In this case, strong momentum in Growth vs. Value usually led to Growth outperforming over the next 2 months.

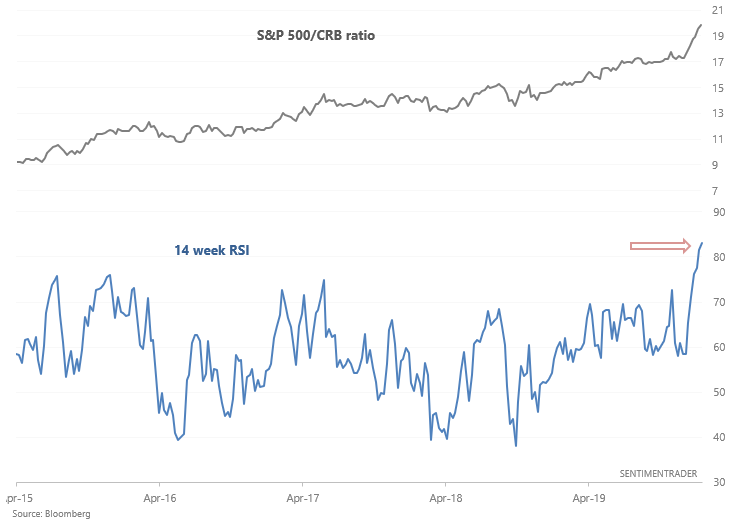

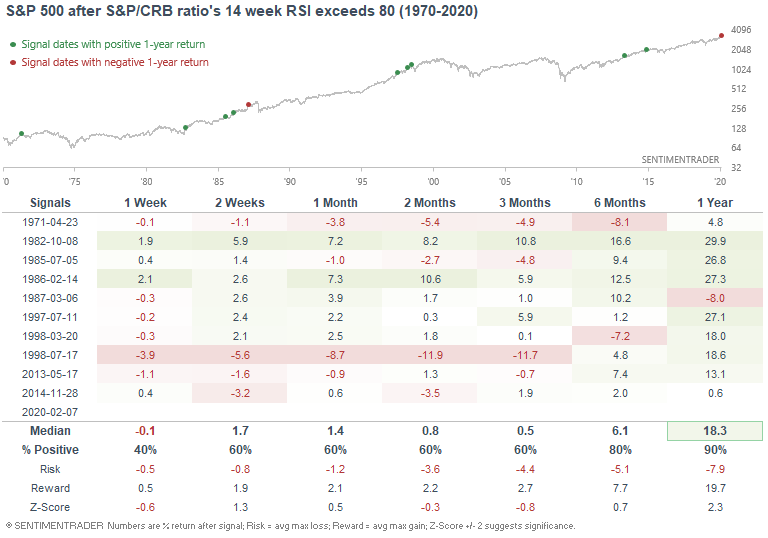

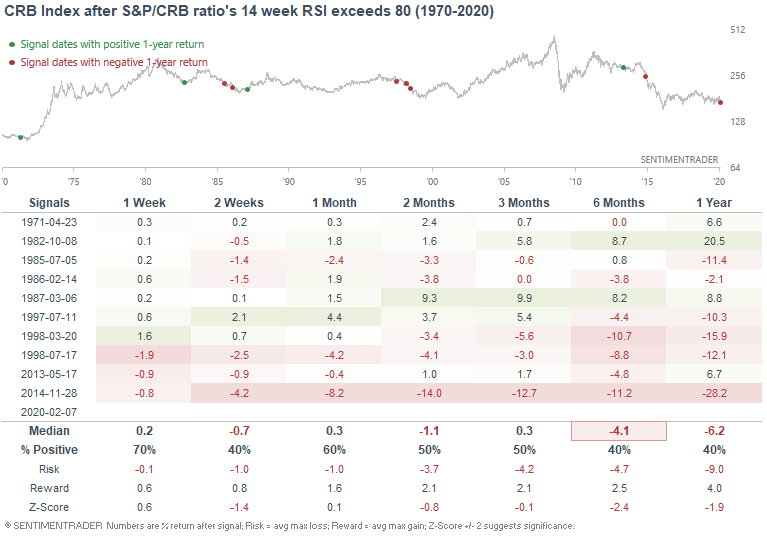

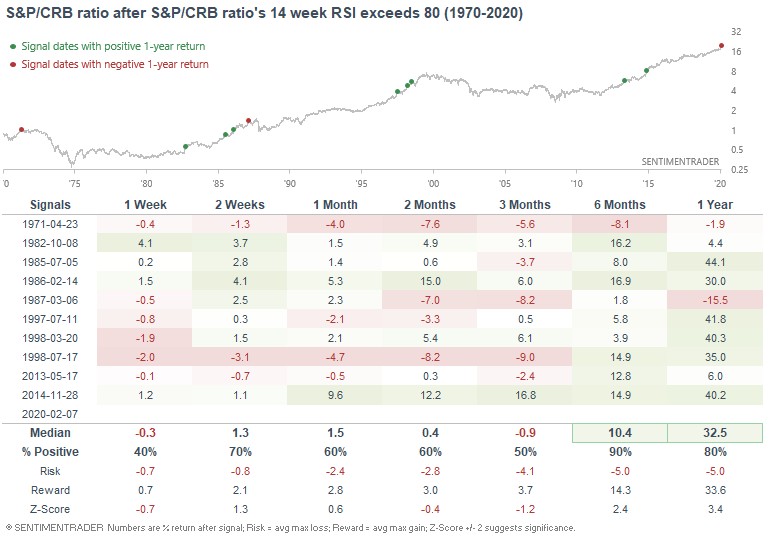

S&P vs. Commodities

Commodities have been hit hard by coronavirus fears while stocks seem to ignore such fears. As a result, the S&P:CRB ratio (stocks vs. commodities) has surged over the past few weeks and months, pushing its 14 week RSI into extremely overbought territory.

While this sometimes led to losses for stocks in the short term, it usually led to more gains over the next year:

In the meantime, this wasn't very bullish for commodities:

Overall, stocks outperformed commodities over the next 6-12 months. I've seen a bunch of traders on twitter call for a rebound in commodities relative to stocks. I got my start in trading with commodities (gold and silver). In all honesty, trading commodities is EXTREMELY difficult - much moreso than trading stocks. Personally, I'm wary of calling for a rebound in commodities vs. stocks. It will happen "eventually", but "eventually" can take a long time.

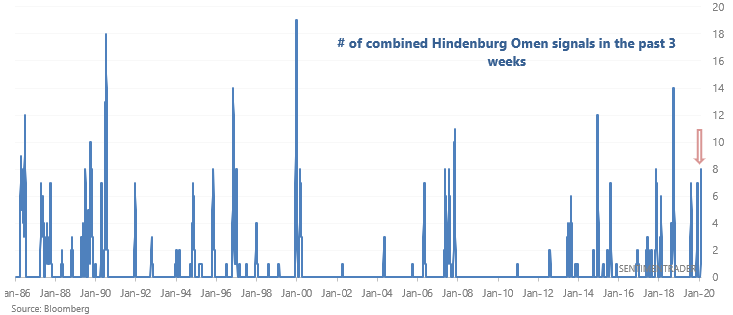

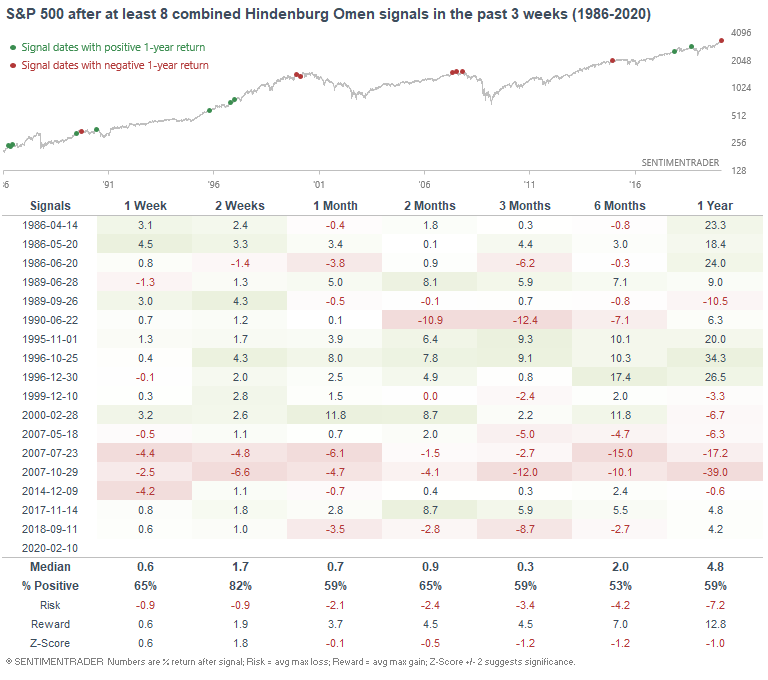

Hindenburg Omens

As Jason noted in yesterday's Daily Report, more Hindenburg Omen signals have been triggered on the NYSE and NASDAQ. The past 3 weeks have seen a combined 8 signals:

When a cluster of signals occurred in the past, the S&P's returns over the next 3-6 months were worse than random:

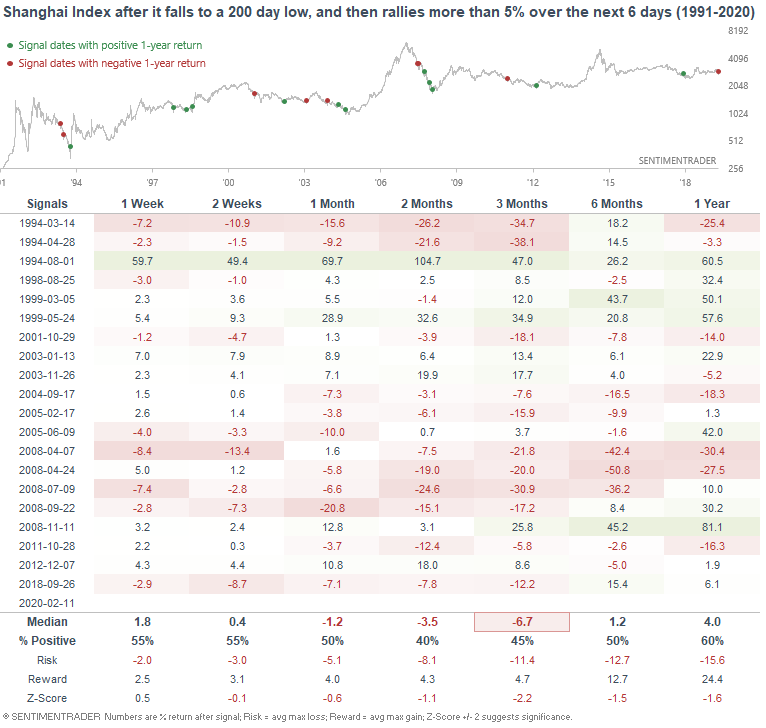

Shanghai Index

And lastly, Chinese equities tanked after the New Year holidays (on coronavirus fears) and have since rallied nonstop. Perhaps the Chinese government/central bank is supporting Chinese equities: I usually shy away from conspiracy theories, but in China's case the government does seem to play a larger role in markets.

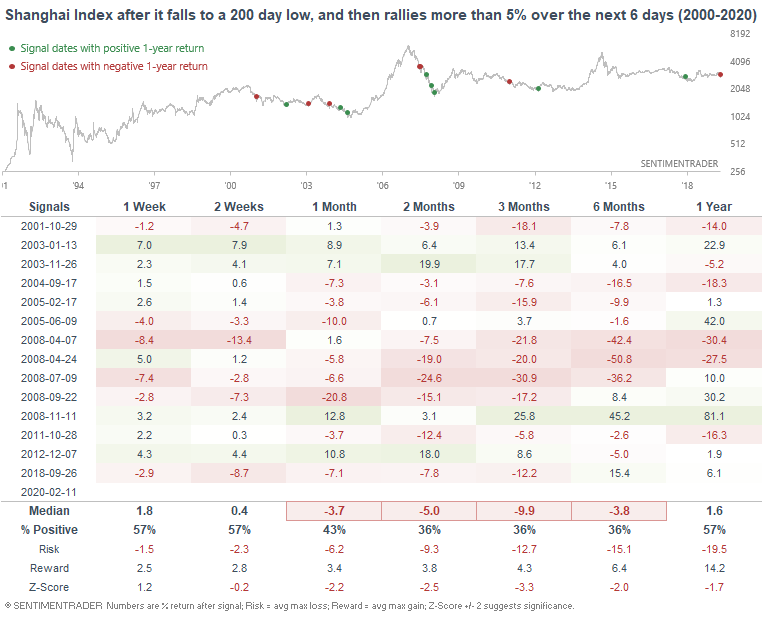

Regardless of why Chinese stocks have crashed and rallied nonstop, such rallies were usually not sustainable in the past:

If we look at cases from 2000-present, the Shanghai Index's returns over the next few months were even less bullish.

My trading portfolio

My trading portfolio is allocated 50% in the Macro Index Model and 50% in the Simple Trading Model With Fundamentals. At the moment I have instituted a discretionary override and gone 100% long bonds (instead of long stocks) due to the extreme nature of many of our core indicators, even though some of these core indicators aren't in the models.

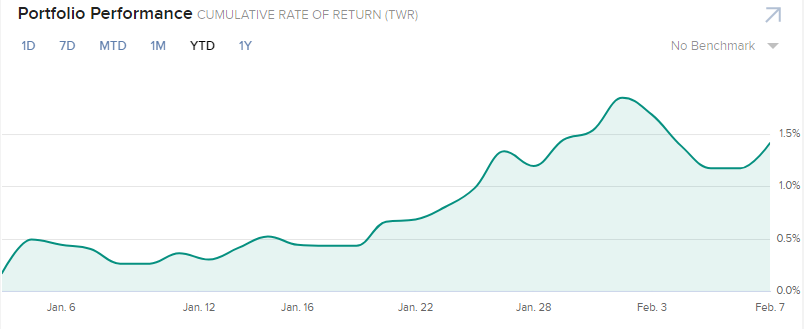

Performance YTD 2020:

- My trading account is up 1.41%

- Currently 100% in bonds