What I'm looking at - grind higher, Put/Call, rally's distance, S&P 500 breadth

Here's what I'm looking at:

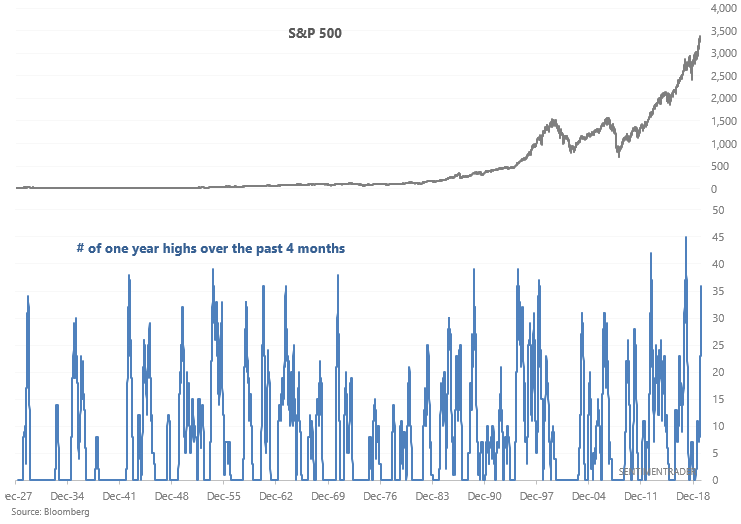

Grind higher

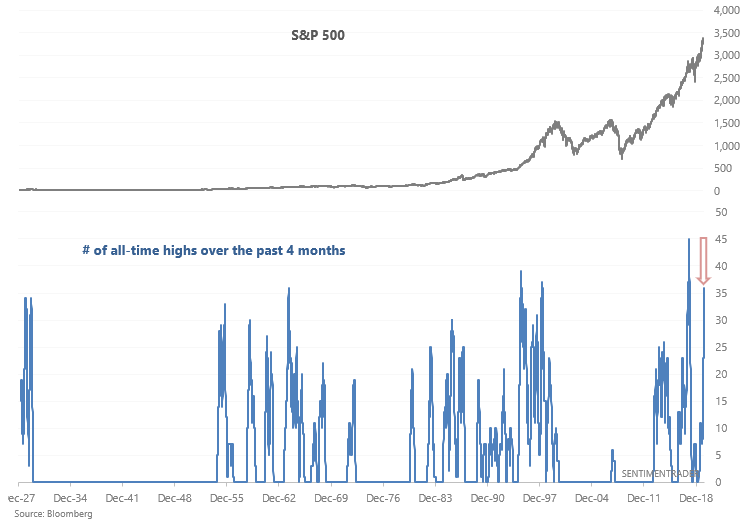

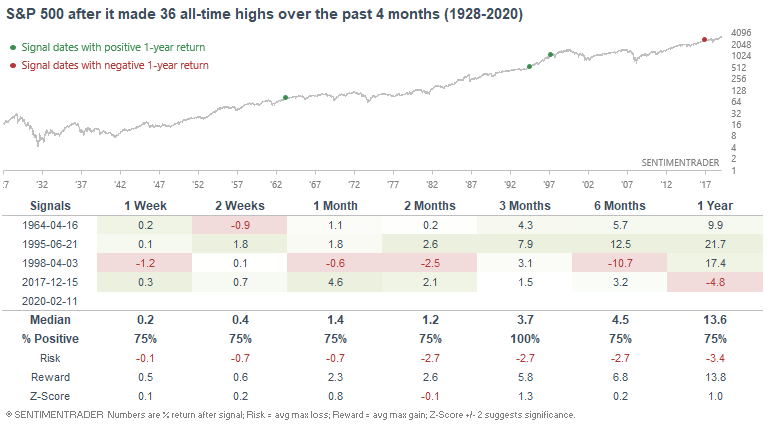

Another day, another all-time high. The market's rally continues, reminding me of the phrase "never short a dull market". The S&P 500 has made 36 all-time highs over the past 4 months, a feat that has been only matched 4 other times:

While it's easy to assume that this is short term bearish for stocks, that hasn't usually been the case historically:

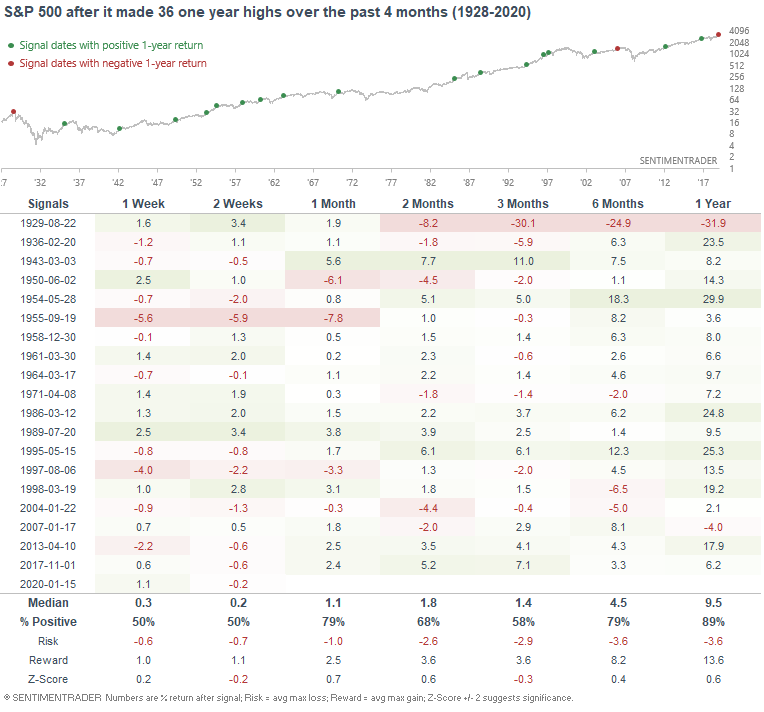

Granted, the sample size here is small, so let's relax the parameters and look at cases in which the S&P made 36 one year highs over the past 4 months:

Once again, this wasn't consistently bearish for stocks on any time frame. Eventually there was a pullback, but "eventually" is not very useful in terms of market timing.

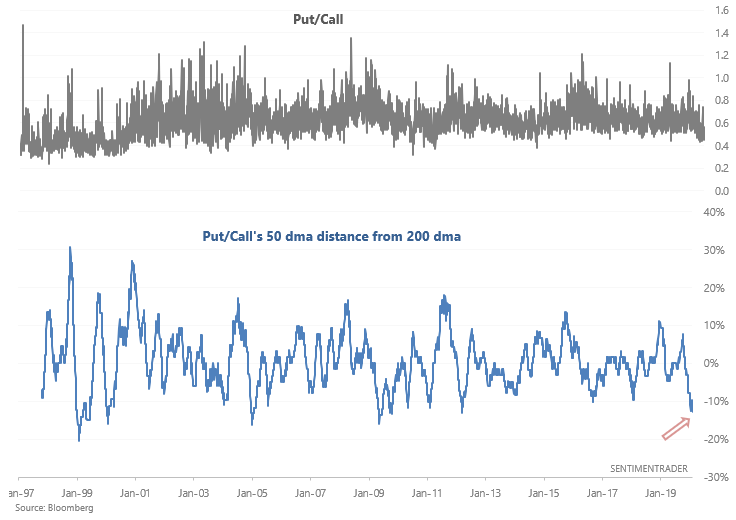

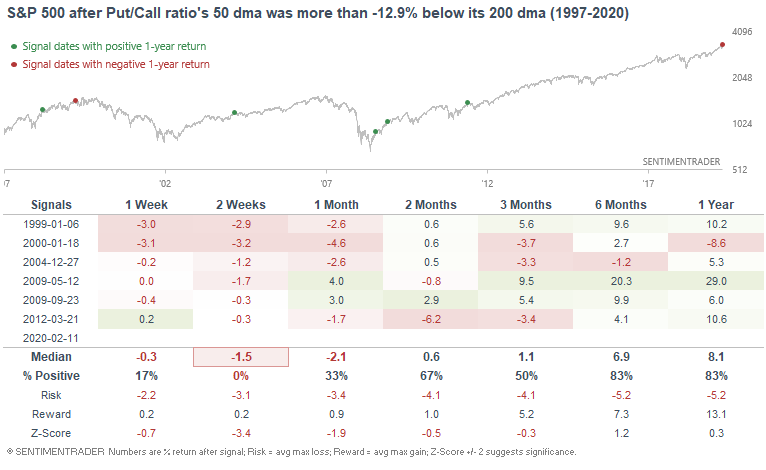

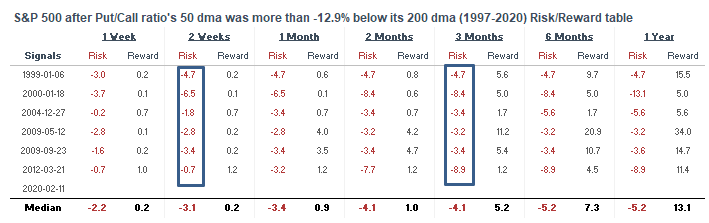

Put/Call

Sentiment was extremely optimistic in December and January. After a brief pullback a few weeks ago, the S&P has made new highs and sentiment is extremely optimistic again. The Total Put/Call ratio's 50 dma is almost -13% below its 200 dma:

The few other times this happened, the S&P 500 fell over the next 2 weeks:

Looking at the max drawdowns over the next 2 weeks - 3 months, all of the cases saw at least a -3% pullback from where the S&P is right now:

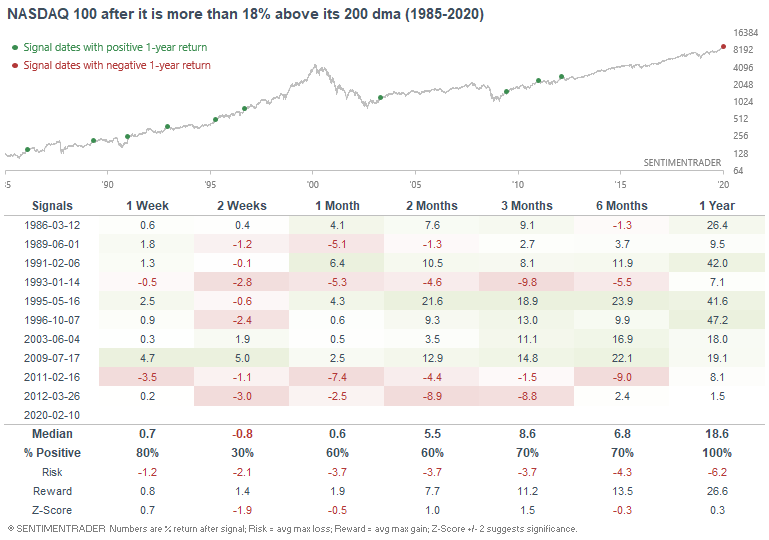

Rally distance

As several market commentators on Twitter have noted, the NASDAQ's surge has pushed it more than 18% above its 200 dma. This is one of the most extreme readings during this bull market.

When this happened in the past, the NASDAQ 100 often experienced weakness over the next 2 weeks. But beyond that, it was inconsistent as a bearish sign for stocks. The "NASDAQ's distance from its 200 dma" eventually fell, but HOW it fell wasn't consistently bearish:

- Sometimes the distance fell with the NASDAQ making a pullback (getting closer to its 200 dma)

- Sometimes the distance fell with the NASDAQ's rally slowing down, allowing the 200 dma to catch up.

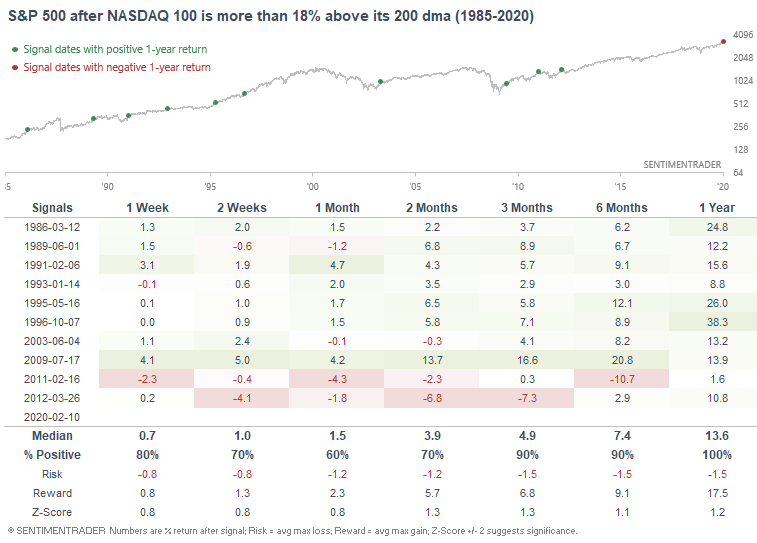

This wasn't consistently bearish for the S&P 500:

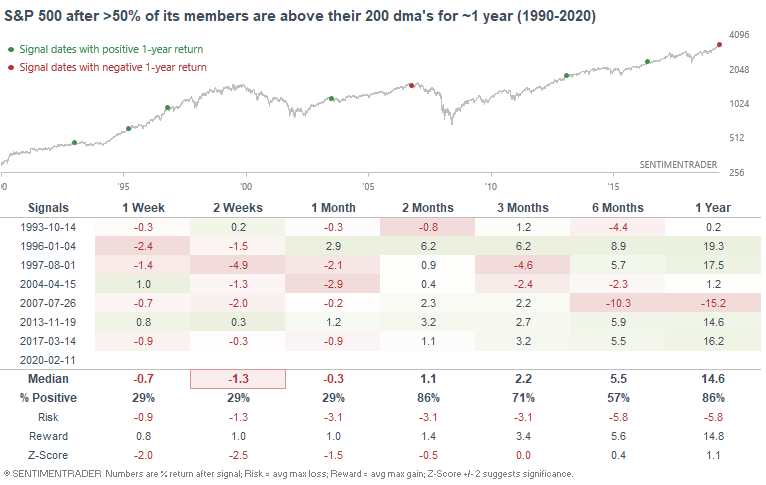

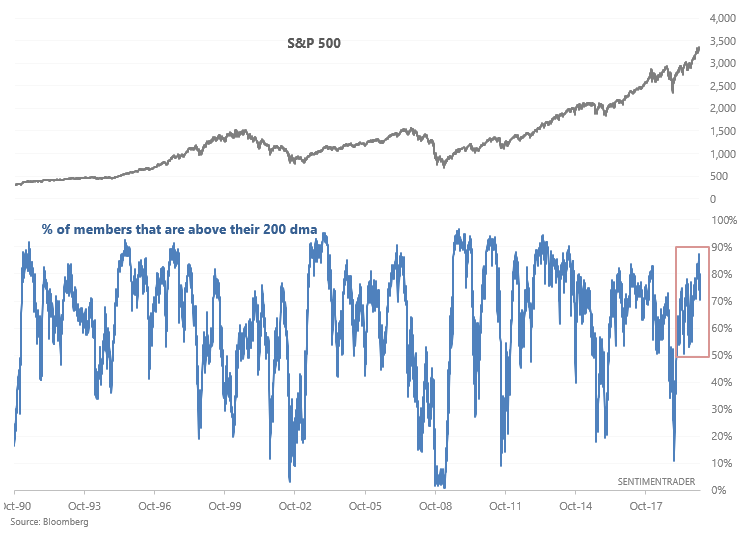

S&P 500 breadth

Speaking of 200 dma's, more than half of the S&P 500's members have been above their 200 dma for approximately 1 year:

All good things come to an end, and long streaks of decent breadth usually saw the S&P experience a pullback over the next month.