What I'm looking at - ex U.S. breakouts, Europe, CNN Fear & Greed, commodities, high yield bonds, breadth, put/call

Here's what I'm looking at:

ex-U.S.

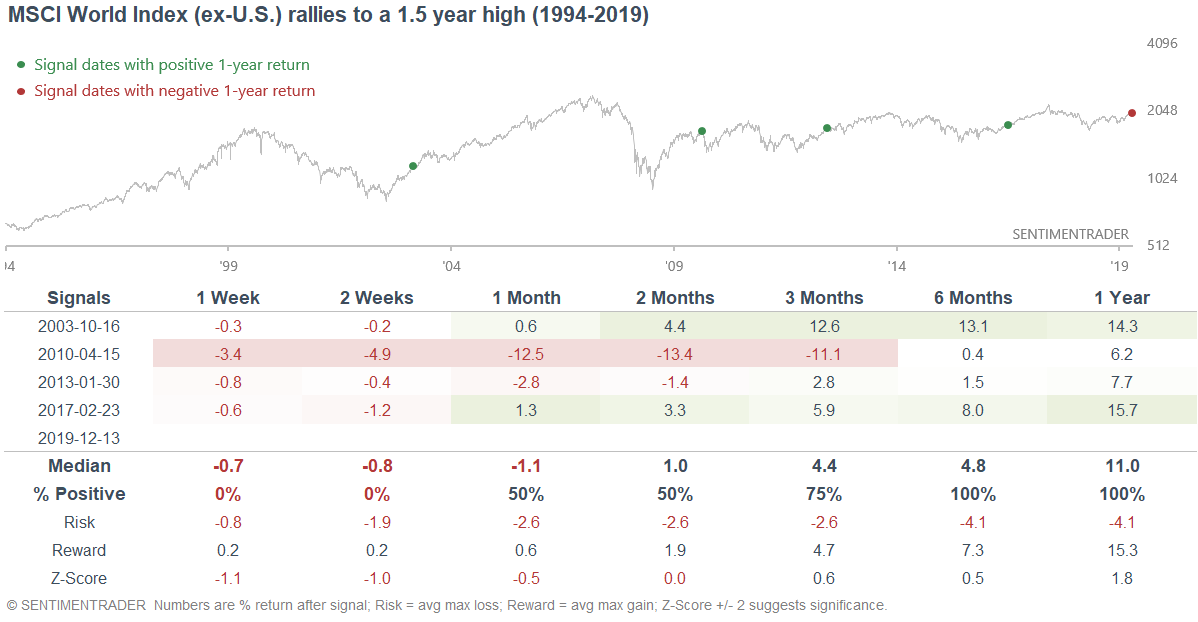

With stocks rallying around the world, various indices continue to breakout above prior resistances. One of these is the MSCI World Index (ex-U.S.), which has just made a 1.5 year high:

When it did so in the past, this index may have faced short term losses, but typically rallied over the next 6-12 months:

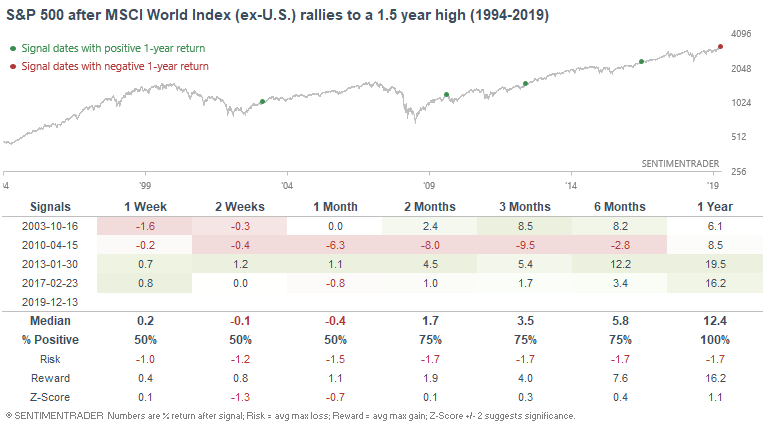

Here's what the S&P 500 did next:

Europe

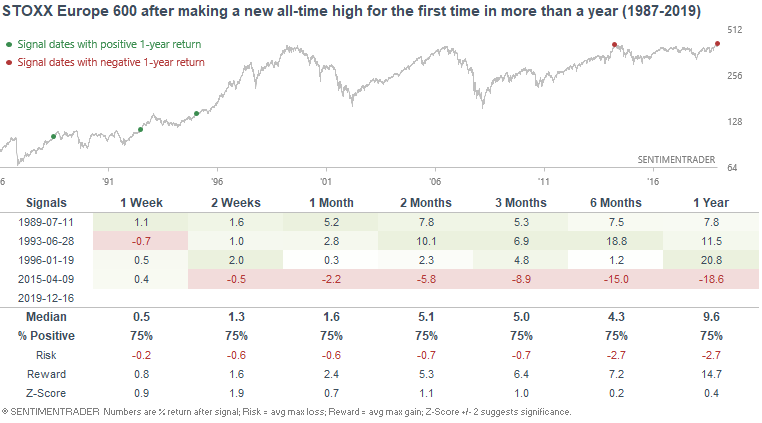

The STOXX Europe 600, which encompasses 90% of European stock market's market cap, recently made a new all-time high for the first time since 2015:

However, breakouts haven't always worked for the STOXX Europe 600. The last all-time high breakout failed miserably, with global stock markets swinging sideways amidst massive corrections over the next 9 months:

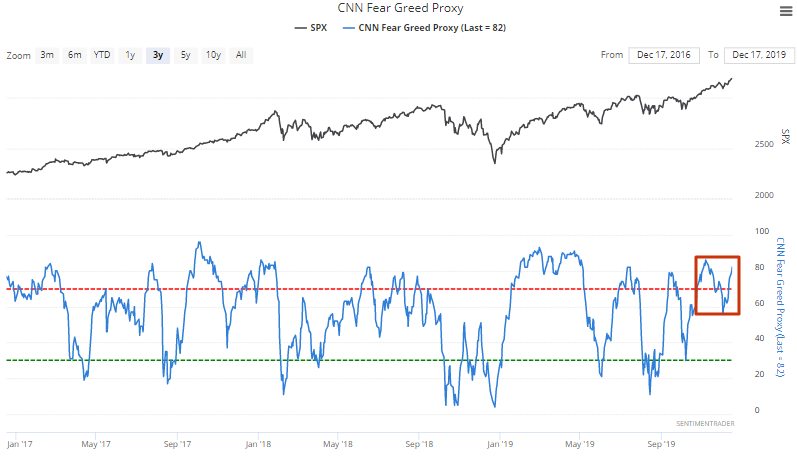

Sentiment

The popular CNN Fear & Greed Index remains elevated with the stock market's recent rally, and has now spent 46 days above 50 (center-line). Sentiment remains excessively optimistic, which is a feature of year-long bull markets but is short term bearish for stocks:

When sentiment was elevated for a long time according to the Fear & Greed Index, the S&P's returns over the next 2 weeks were below average:

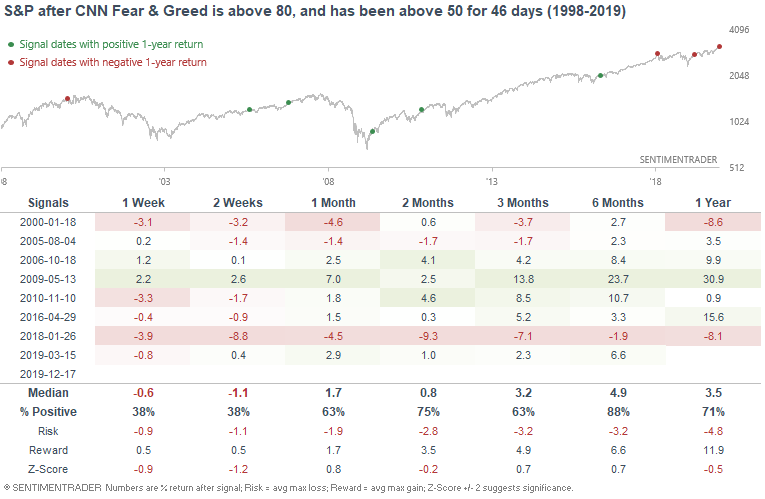

Commodities

After trending downwards throughout much of 2018 and 2019, commodities are finally starting to turn around. The CRB Index has broken out to multi-month highs, and its 50 dma has crossed its 200 dma for the first time in more than 1 year:

But when long downtrends in commodities first appeared to "end", that wasn't usually the end. The first "golden cross" in more than a year was typically followed by weakness in commodities over the next few weeks and months:

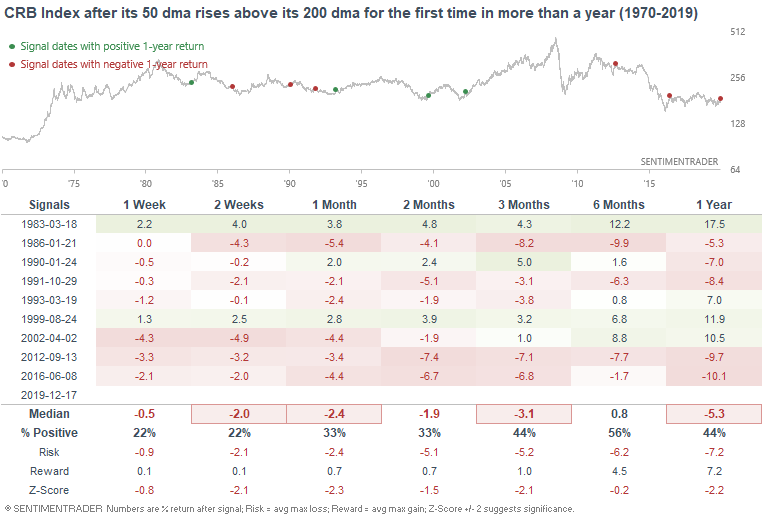

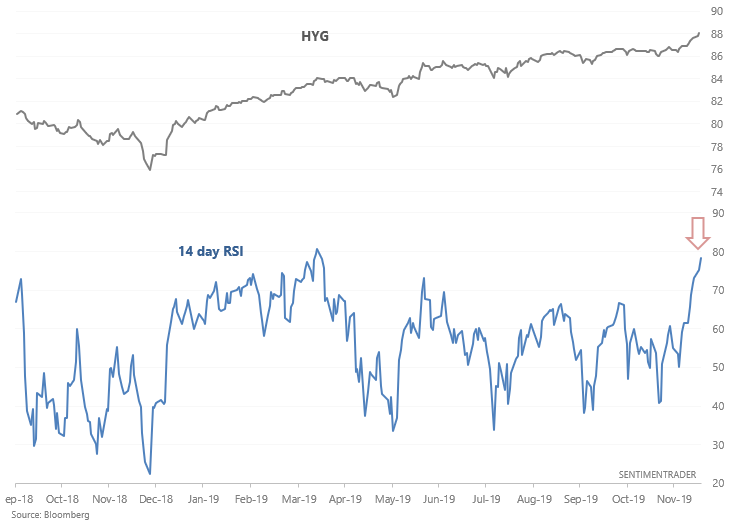

High yield bonds

High yield bonds have surged recently, pushing HYG's (High Yield Corporate Bond ETF) 14 day RSI above 78:

When HYG's momentum was this high, it almost always struggled over the next few weeks. And since high yield corporate bonds sometimes move inline with the stock market, this wasn't too good for stocks over the next few weeks either:

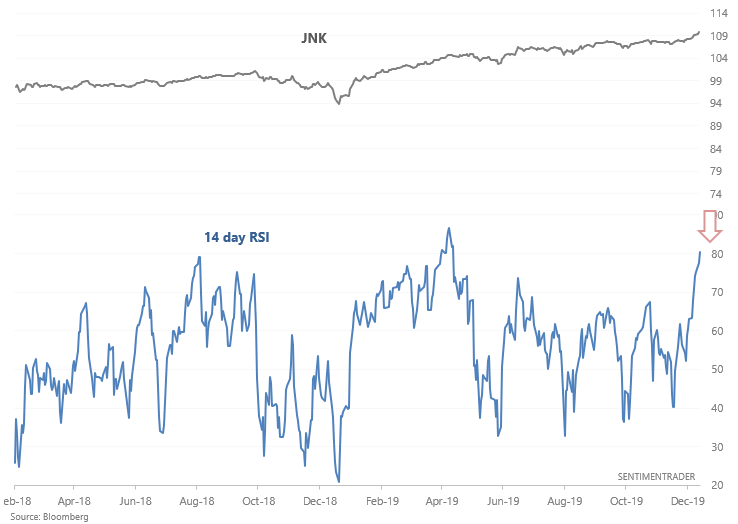

Similarly, JNK's RSI is extremely high:

This was bearish for JNK over the next 2-4 weeks:

Breadth

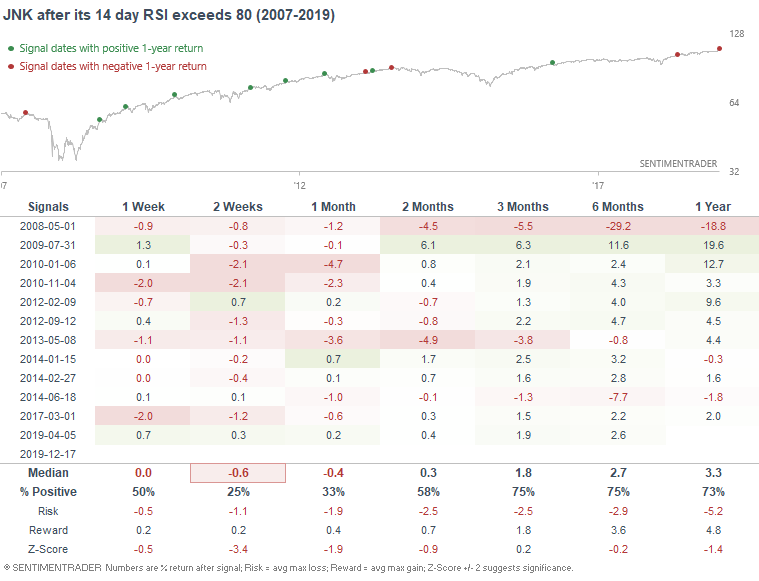

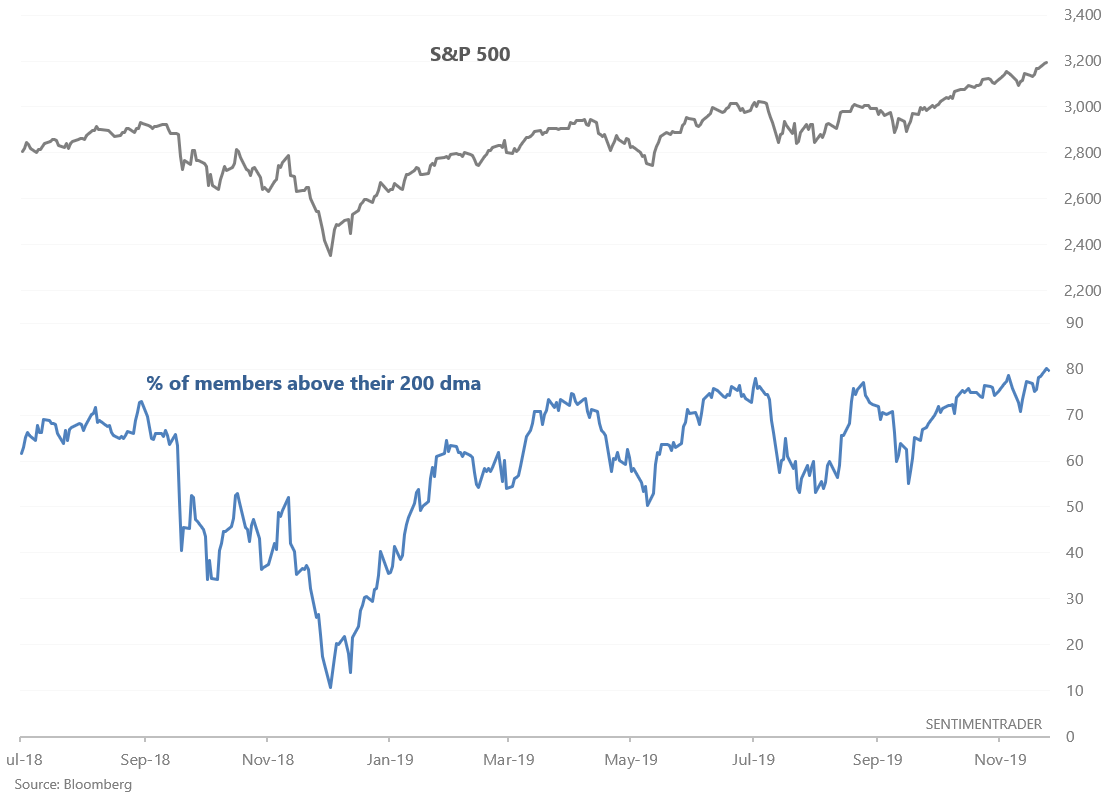

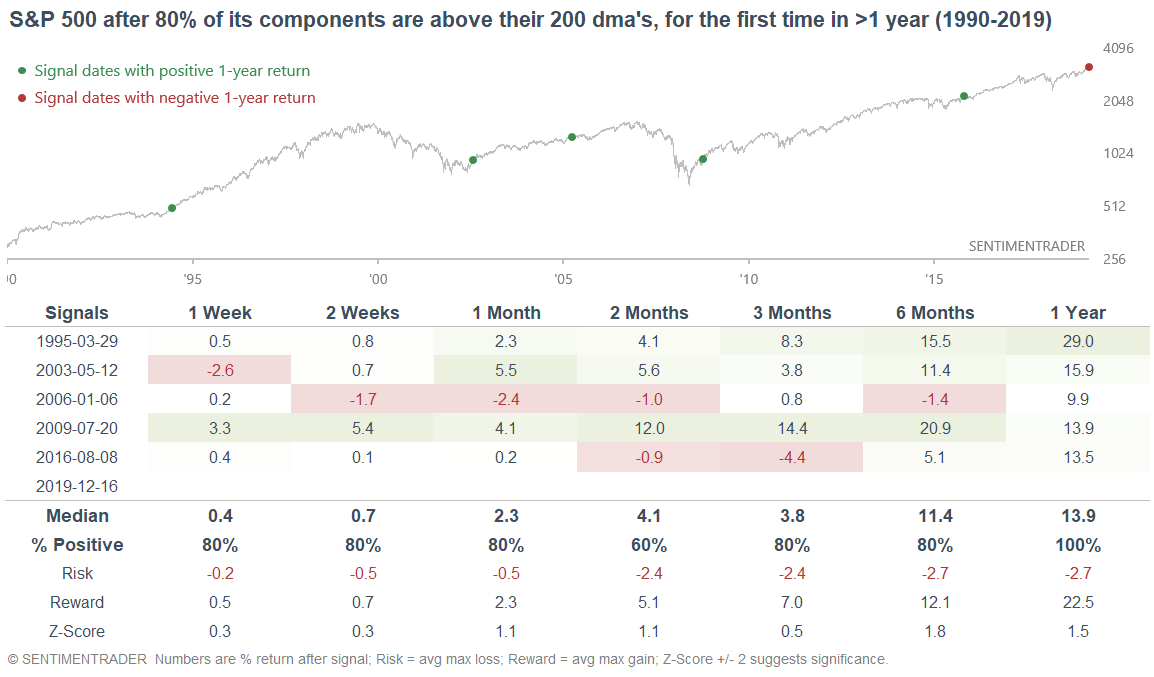

The U.S. stock market continues to rally relentlessly, pushing the % of its components that are above their 200 dma's (in a long term uptrend) to more than 80%:

When the vast majority of its components were in an uptrend for the first time in more than a year, the S&P's gains over the next year were almost double of their historical average:

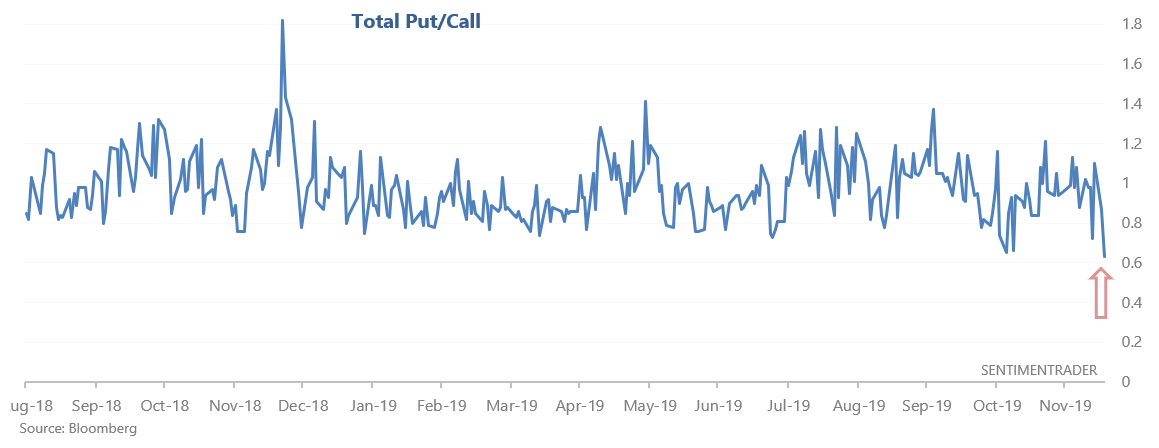

Put/Call

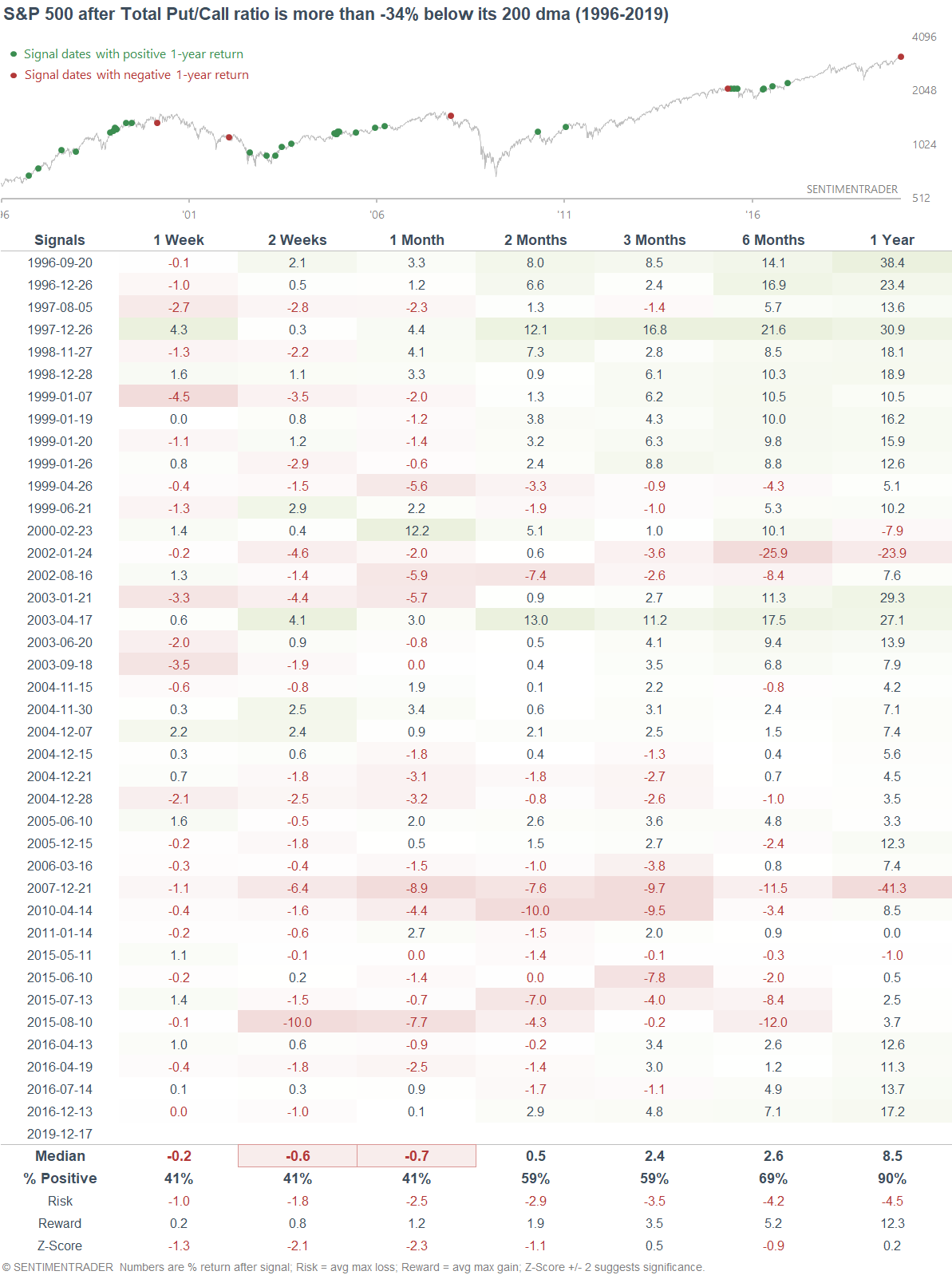

And lastly, the Put/Call ratio tanked yesterday:

Extremely low readings were typically followed by weakness in the S&P 500 over the next 2-4 weeks: