What I'm looking at - CNN Fear & Greed, Chemical Activity Barometer, silver's 2 year high, SLV Optix, SKEW

With the stock market still volatile amid heightened "recession fears", gold and silver continue to rally. Here's what I'm looking at.

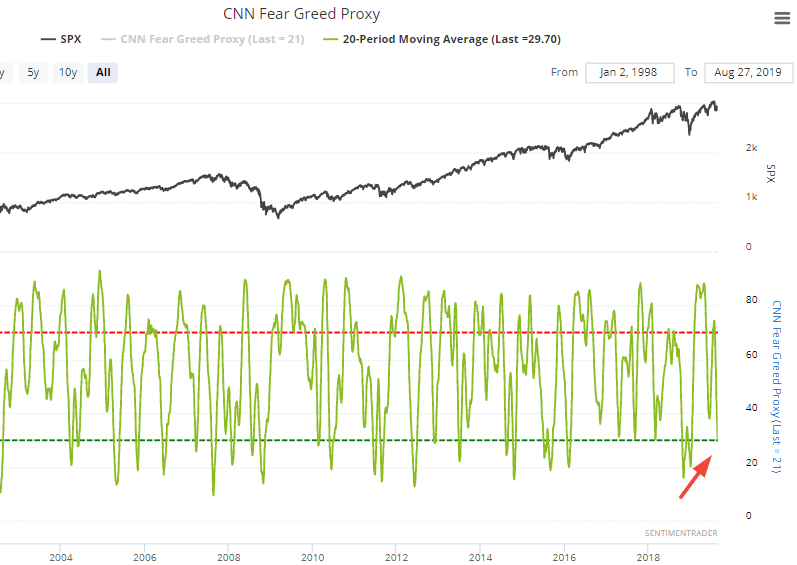

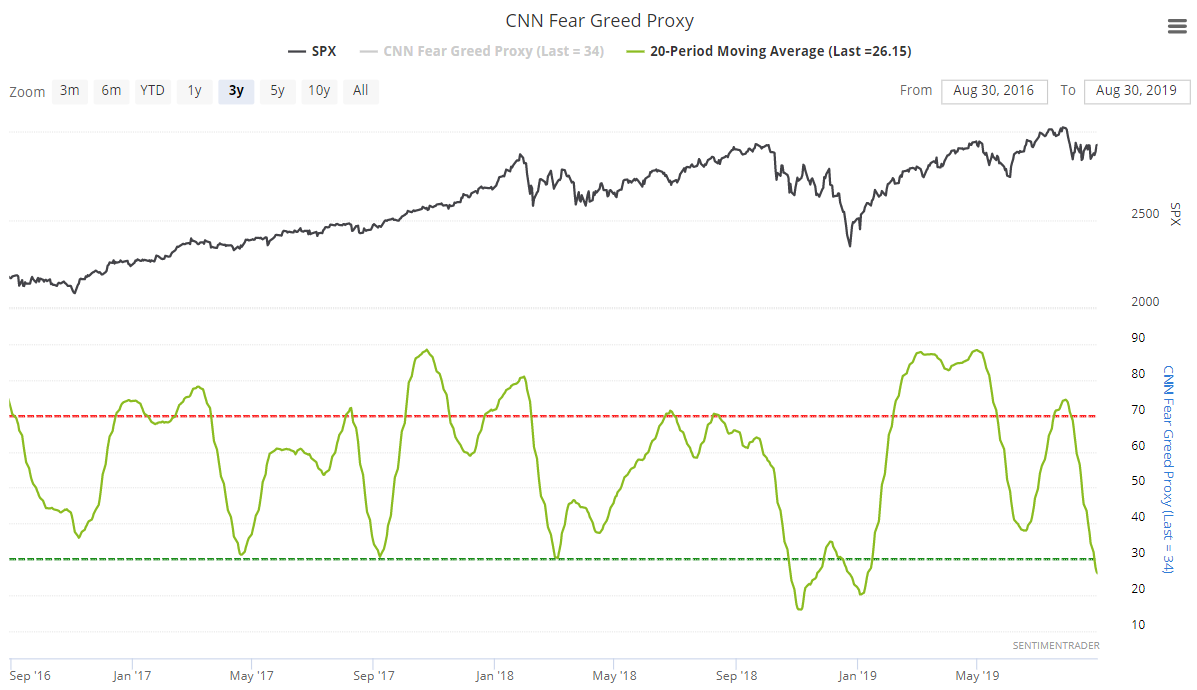

CNN Fear & Greed

As the stock market continues to swing sideways with continuous talk of an impending "recession", various sentiment indicators continue to show pessimism. Our proxy for the popular CNN Fear & Greed Index's 20 day average has fallen below 30.

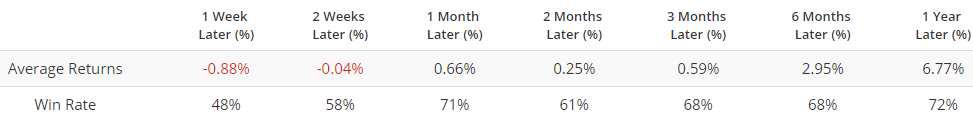

When CNN Fear & Greed's 20 dma fell below 30 in the past, the S&P often rallied over the next month.

This was particularly true if we isolate for the cases in which the S&P was above its 200 dma. I.e. when sentiment is pessimistic while stocks haven't fallen significantly, the stock market usually rallies because the market is exaggerating widespread fears (e.g. "recession", "yield curve").

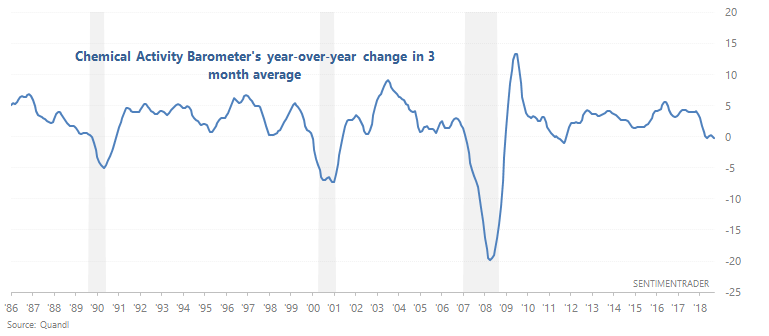

Chemical Activity Barometer

The Chemical Activity Barometer is a useful leading indicator for Industrial Production. With the manufacturing sector weak, the Chemical Activity Barometer's year-over-year change in 3 month average has been below 0% for 2 of the past 6 months. Readings below 0% are not good, because they often coincide with recessions.

Here's what happened next to the S&P 500 after similar year-over-year declines in the Chemical Activity Barometer.

As you can see, the S&P's forward returns over the next year are more bearish than random. There were a few false signals (e.g. no recession in 2012), but overall this was not a great sign for the economy and stock market. As I've mentioned over the past 2 weeks, manufacturing continues to be a weak point in the U.S. economy.

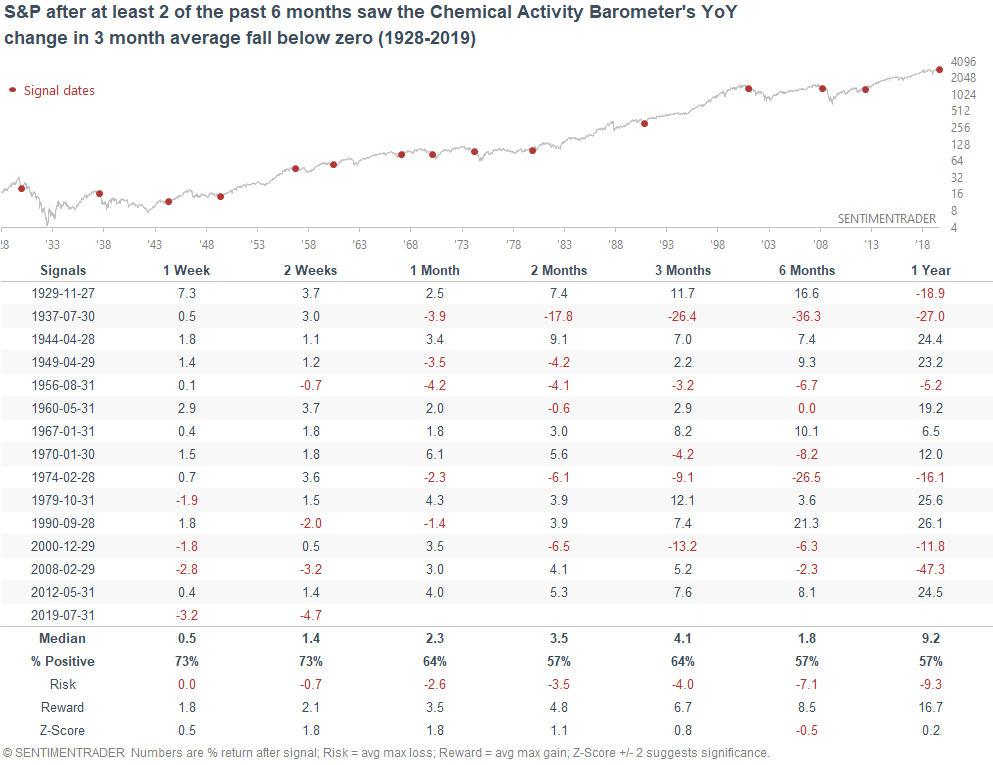

Silver

Gold and silver move in the same direction in the medium-long term. After lagging from June to mid-July, silver is finally outperforming gold. As a result, silver has surged to a 2 year high.

When silver surged to a 2 year high in the past, it often performed poorly over the next month.

Coupled with extremely overbought readings in precious metals and high sentiment, I am not optimistic on gold and silver for the next few months.

Silver's sentiment

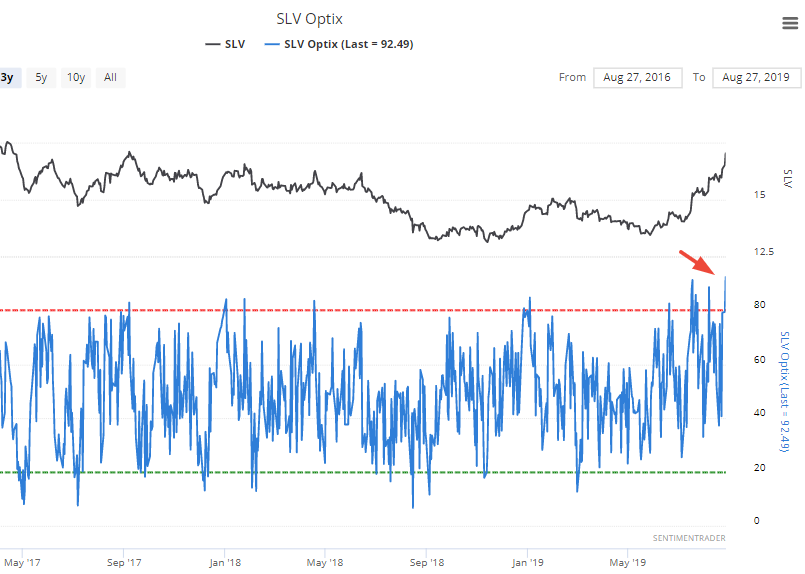

Speaking of silver's sentiment, SLV's (silver ETF) Optix has now exceeded 92.

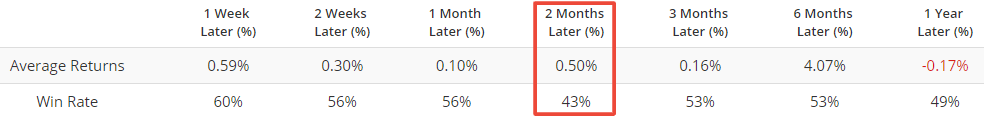

When this happened in the past, SLV was slightly more bearish than random over the next 2 months.

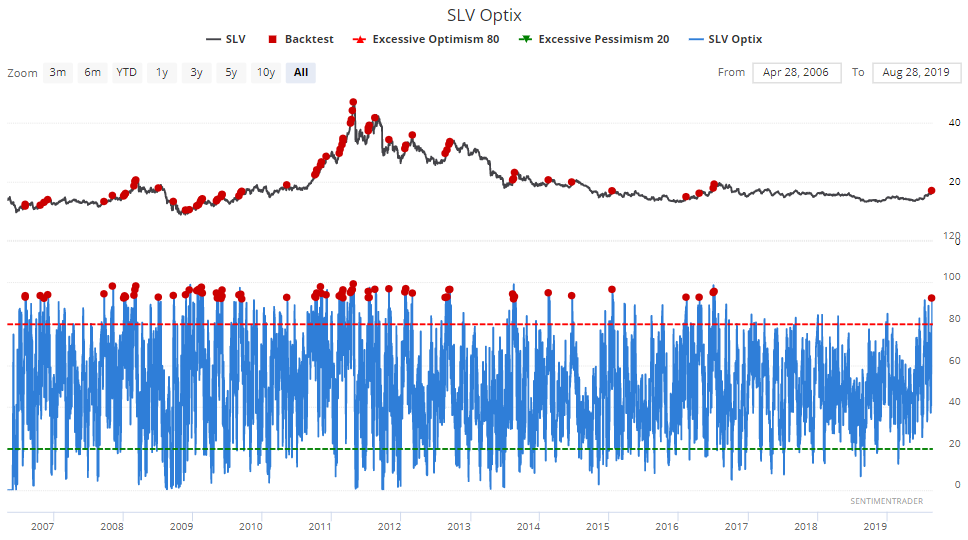

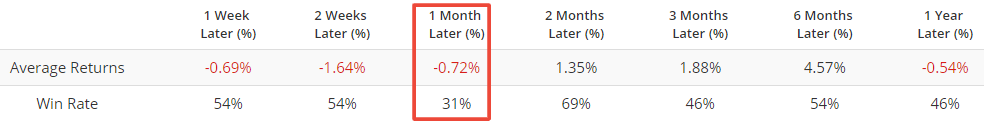

What's different about this SLV rally vs. all the other failed rallies over the past 6 years is that SLV's optix is consistently bumping up against high optimism. As a result, the 50 day average for SLV's optix has now exceed 62. When this happened in the past, SLV performed poorly over the next 1 month.

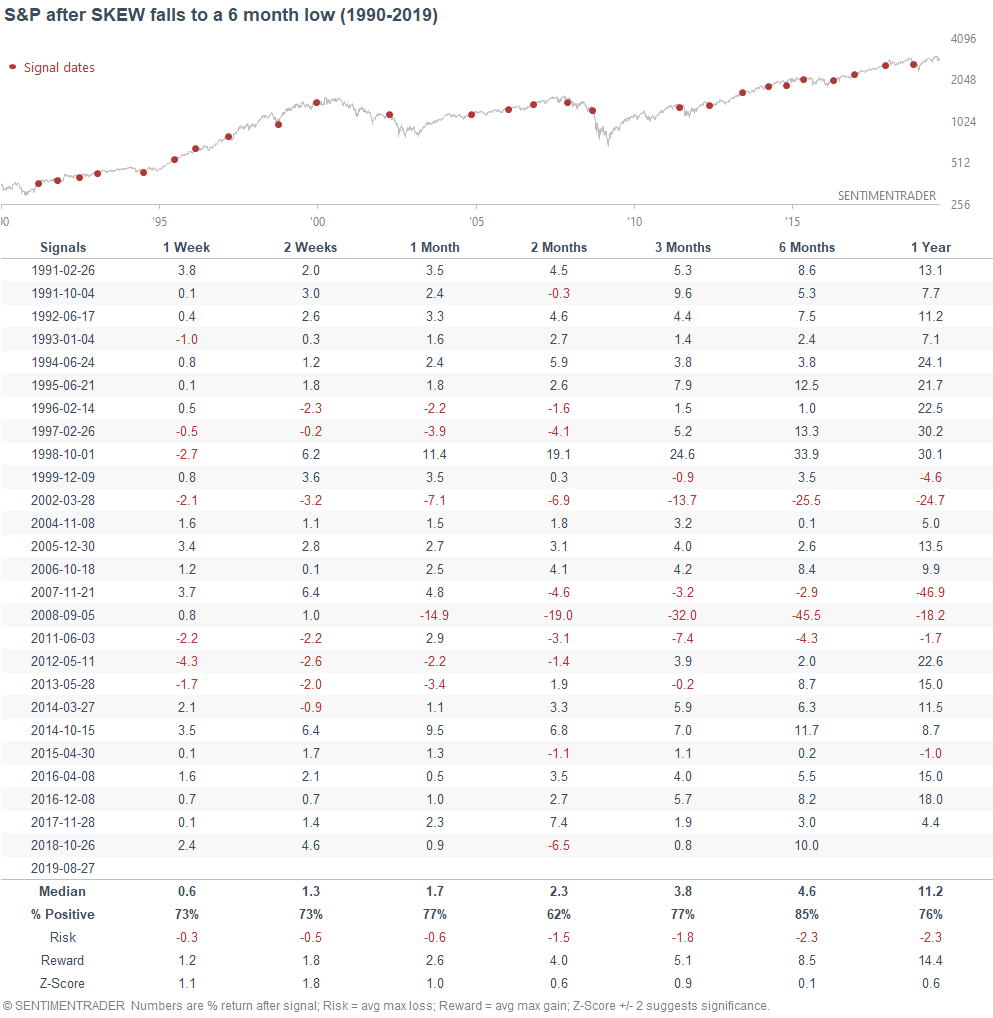

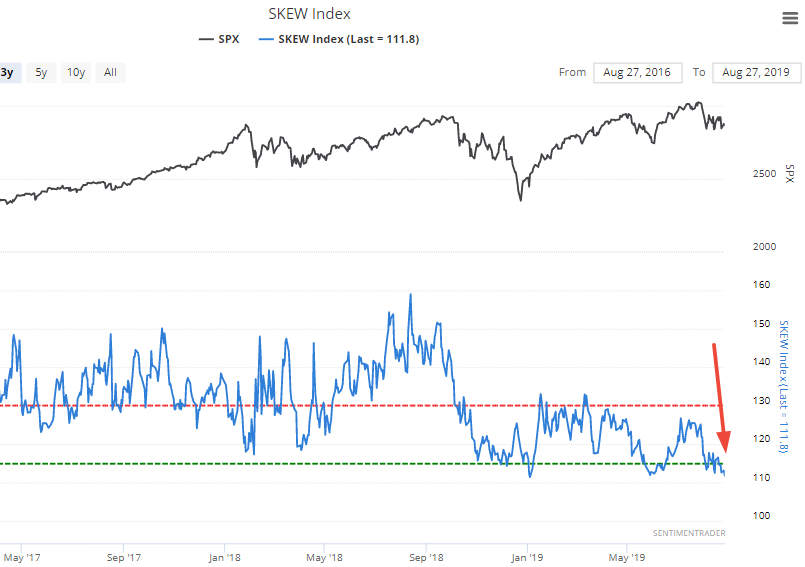

SKEW

The SKEW Index measures the perceived risk of a black swan event in the financial markets. SKEW basically "shows the risk of a swift, sharp drop in prices as determined by options traders in the S&P 500 index."

SKEW has fallen to a 6 month low. When it did so in the past, the S&P often rallied over the next month.