What I'm looking at - Cass Freight Index, strength of the trend, more breadth, Put/Call

Here's what I'm looking at:

Trade war data

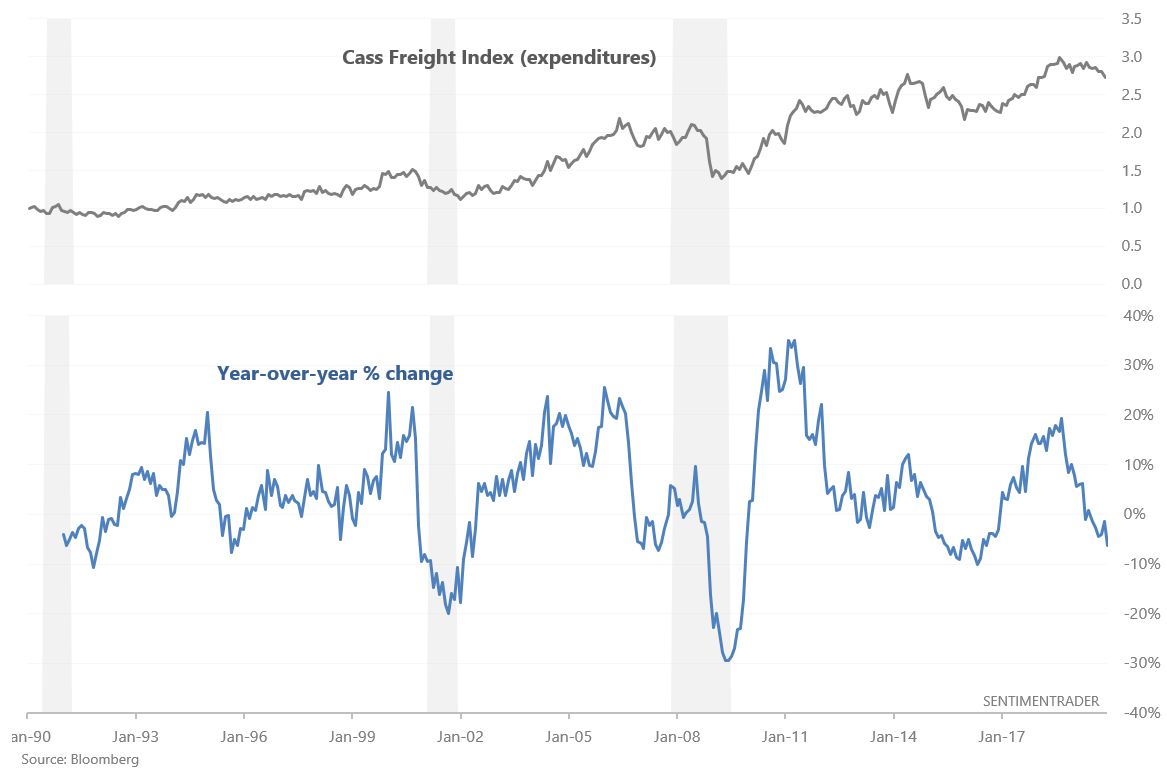

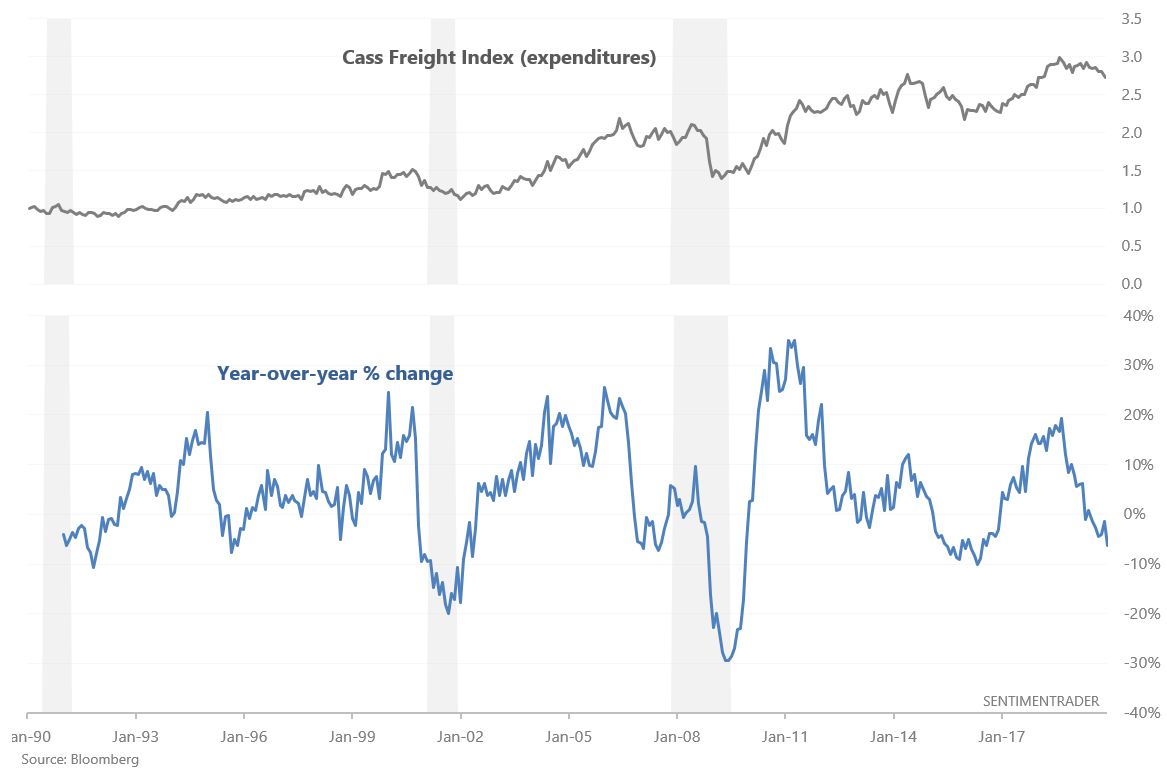

With the U.S. and China having signed a trade deal, it'll be interesting to see if manufacturing and trade-related economic data will turnaround in 2020. Thusfar it has not. The Cass Freight Index (Expenditures), which measures North American freight expenditures, has fallen more than -6% over the past year:

This may seem alarming, because this typically happened in an earnings recession or economic recession. However, it isn't a clear bearish sign because it can also occur towards the end of a period of economic weakness (see 1991 and 1995 cases). So while the S&P's forward returns weren't terrific, they weren't terrible either.

Overall, manufacturing and trade-related data remains weak. Perhaps this is due to the ongoing effects of the trade war. Either way, these sets of economic data are not the best leading economic indicators, hence why I am not too concerned about them.

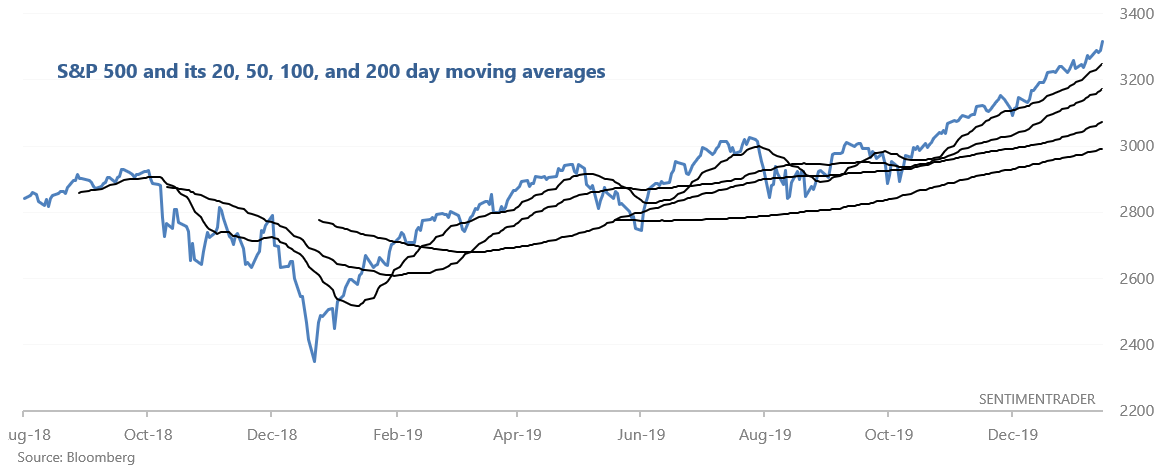

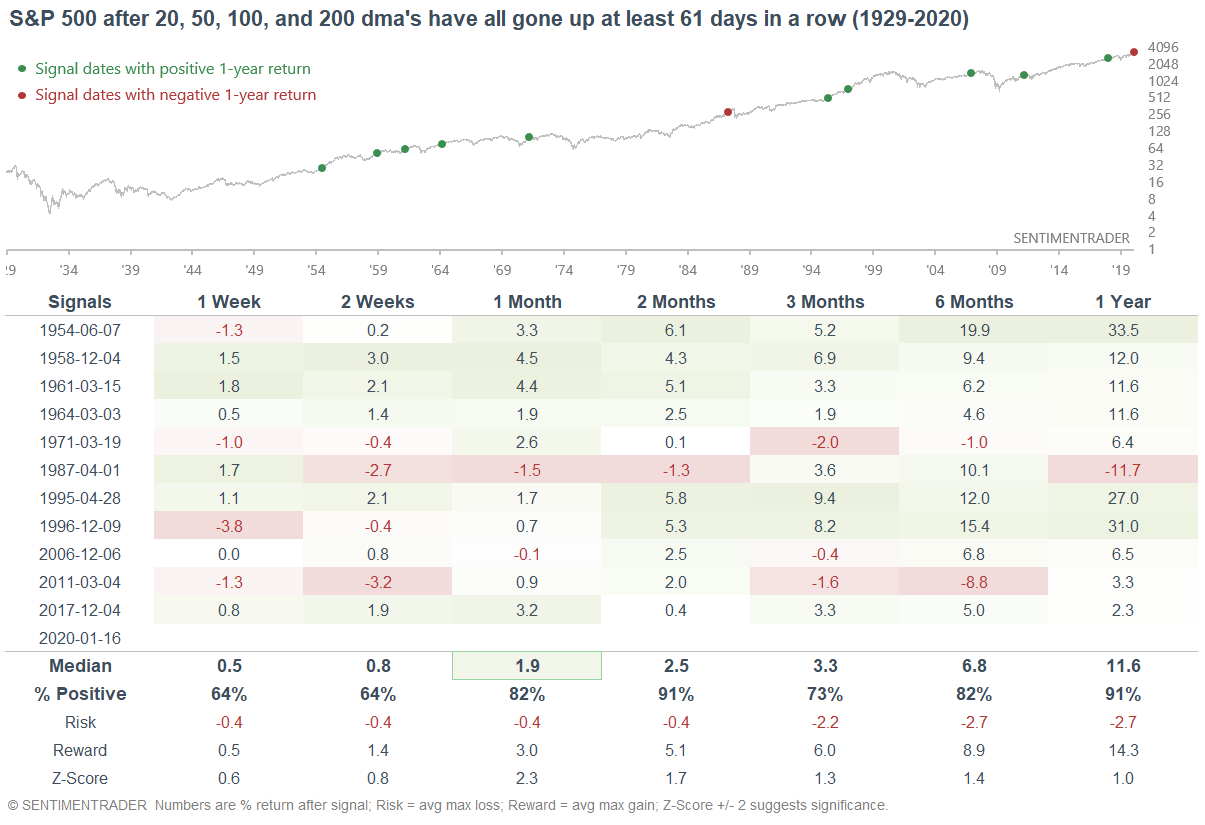

Strength of the trend on every time frame

The U.S. stock market's rally over the past 3 months has not seen any meaningful pullback. As a result, various moving averages have all been consistently trending higher. For example, the S&P's 20 dma has gone up 61 days in a row, the 50 dma has gone up 67 days in a row, the 100 dma has gone up 97 days in a row, and the 200 dma has gone up 148 days in a row. All in all, it's rare for a rally to be so consistent on multiple times frames.

When the rally was this consistent in the past, the S&P's returns over the next few months were mostly bullish. This tends to be a feature of momentum studies, which can conflict with sentiment from time to time.

Strong breadth (continued)

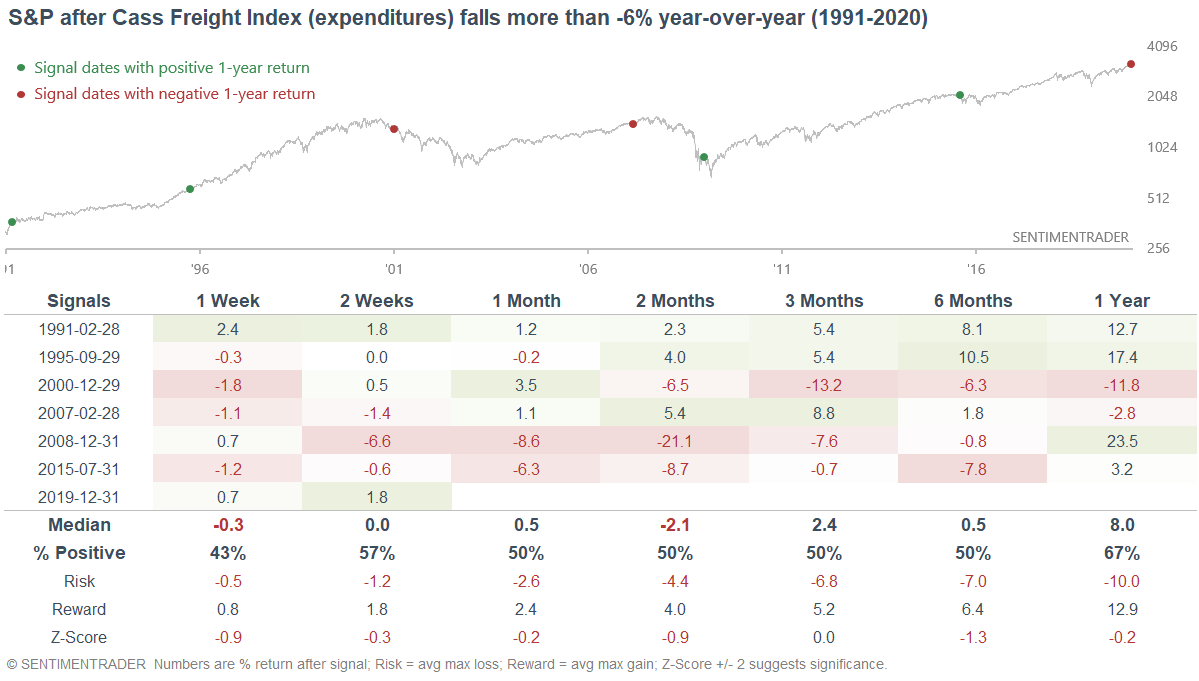

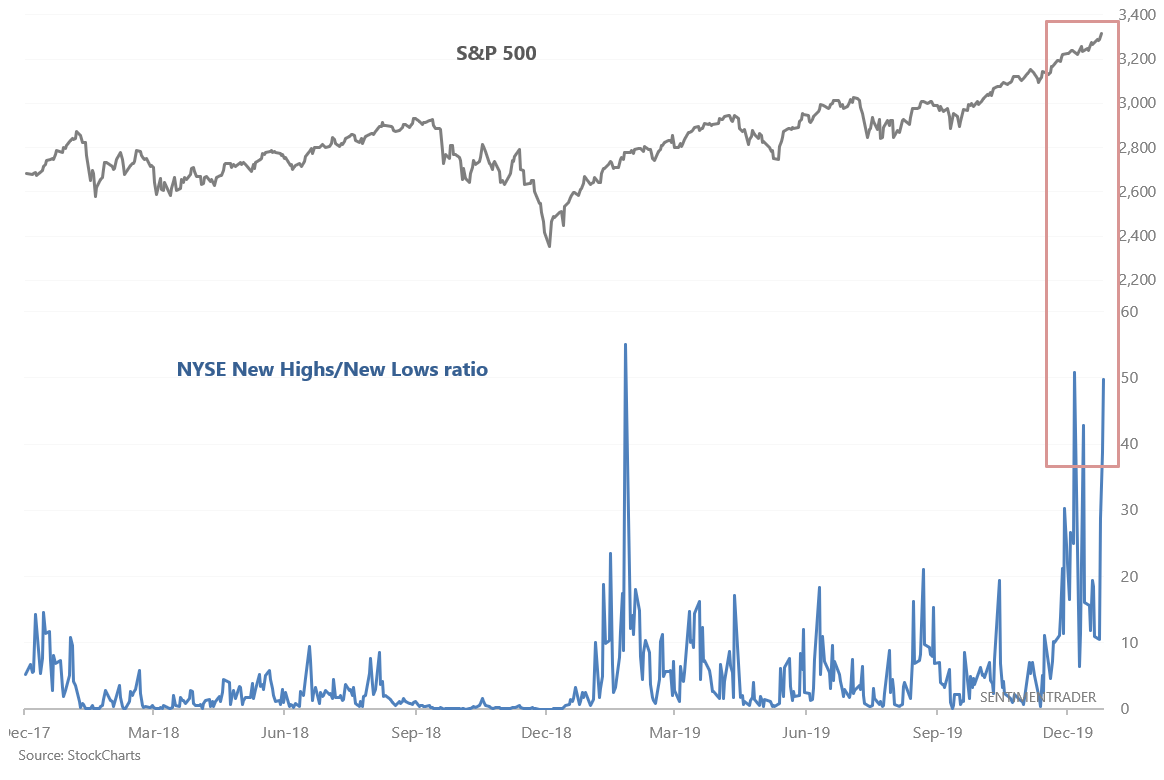

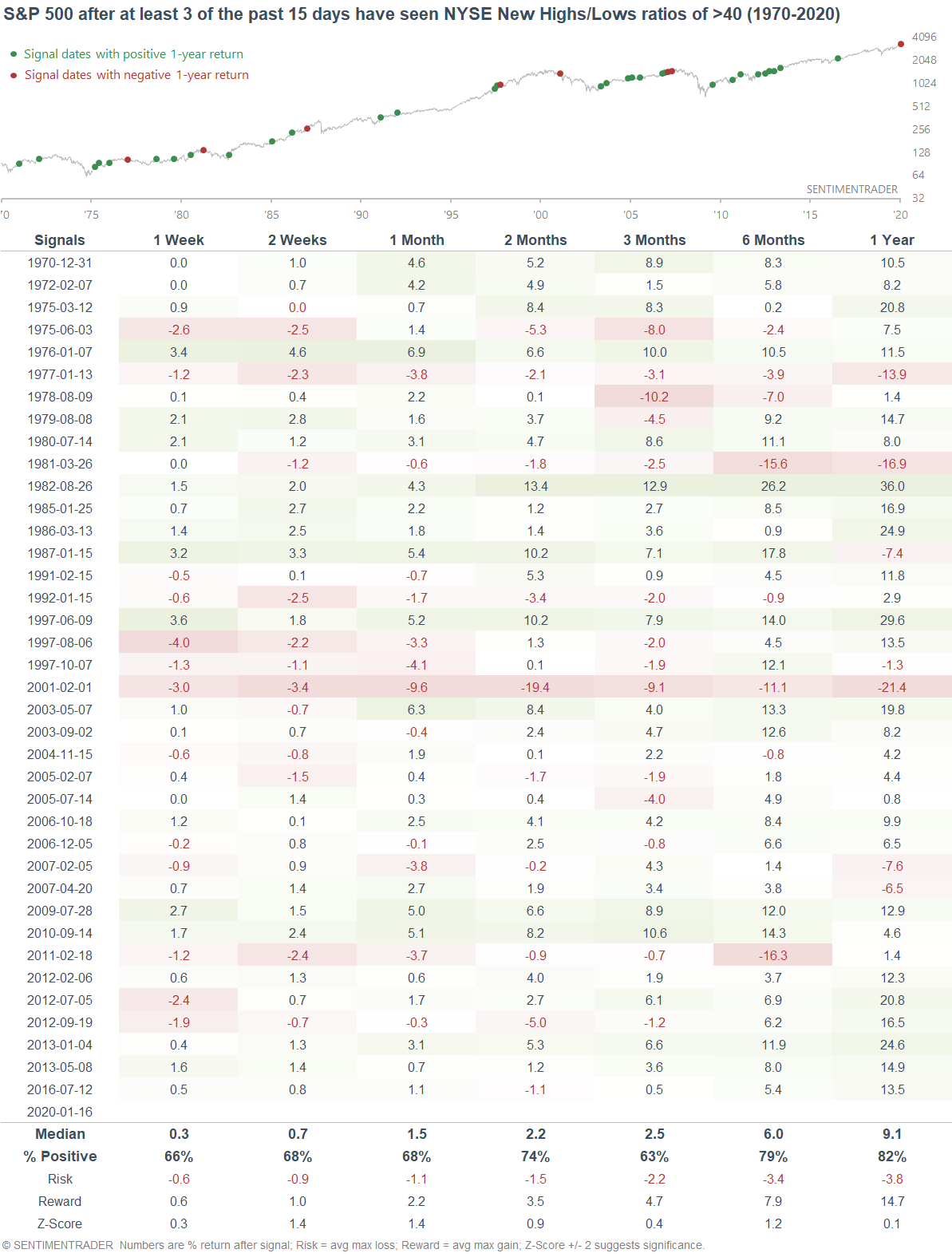

As stocks continue to jump higher, a large number of issues continue to make new 52 week highs compared to the number of issues making new 52 week lows.

When many securities continued to jump to new highs in the past, the S&P's returns over the next 6 months were more bullish than random. However, this wasn't a decisive all-clear sign though, since it did happen occasionally near market tops (particularly in the 1970s when the stock market was trending sideways for a decade).

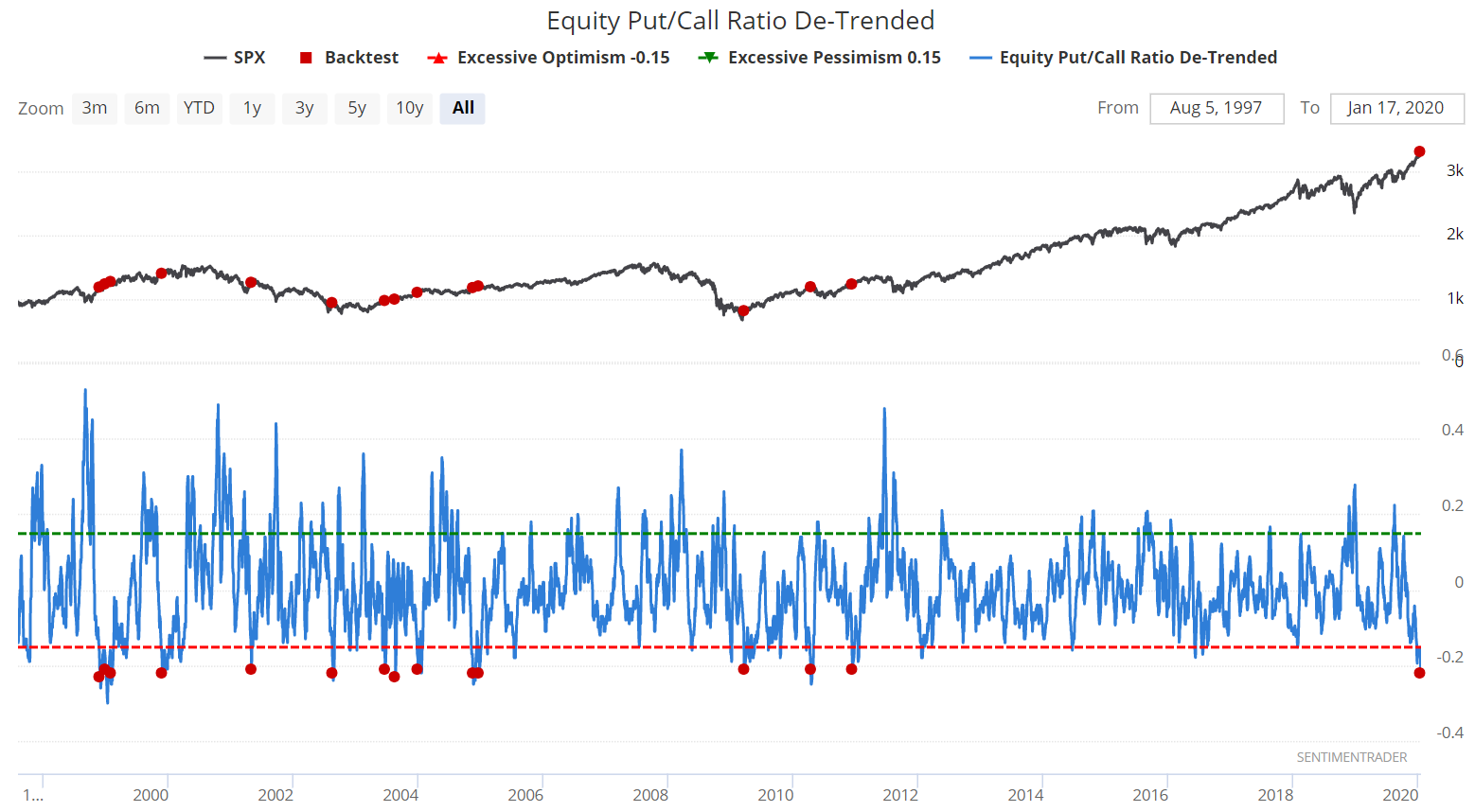

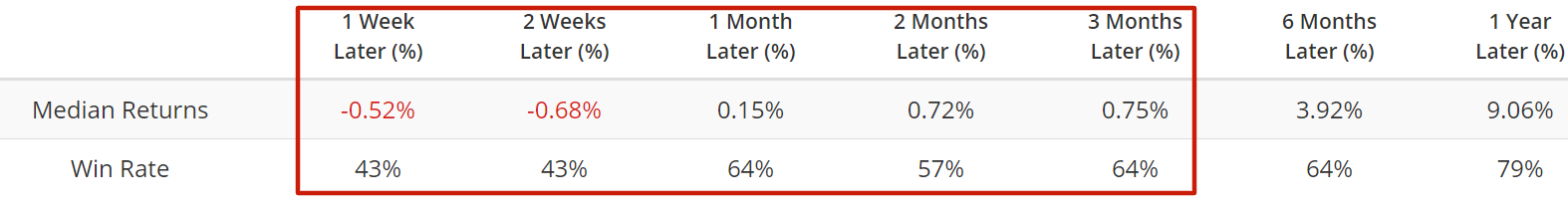

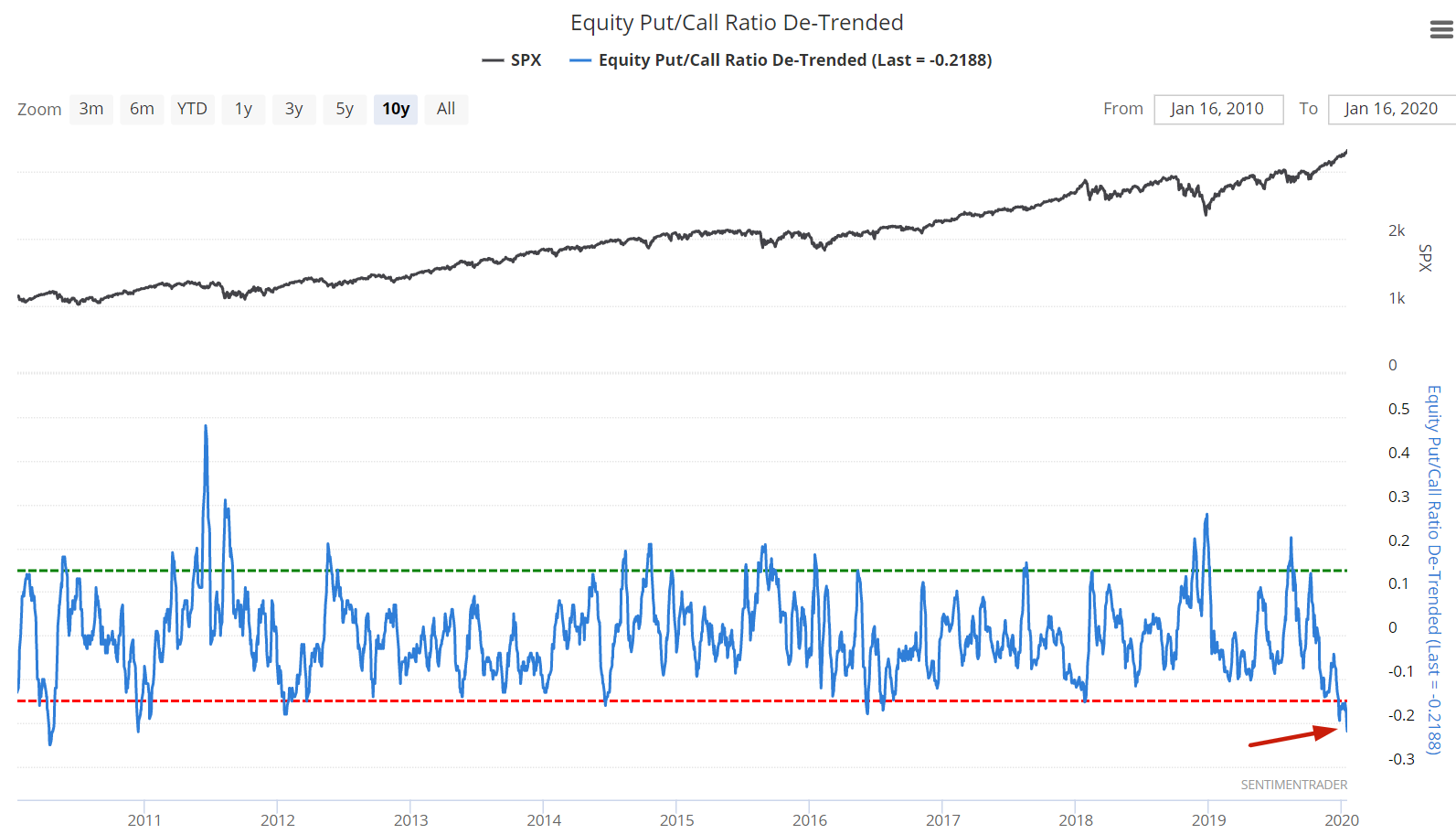

Equity Put/Call

And at the risk of sounding repetitive, sentiment remains extremely optimistic. The de-trended Equity Put/Call, which compares the put/call ratio's 10 dma against its 6 month average, has now dropped below -0.21. This level was last reached almost 10 years ago in 2010:

When the de-trended Equity Put/Call ratio was this low in the past, the S&P's returns over the next few weeks and months were worse than random (if we look for unique cases over a 1 month period):