What I'm looking at - Building Permits, USD, MACD buy signals

Here’s what I’m looking at:

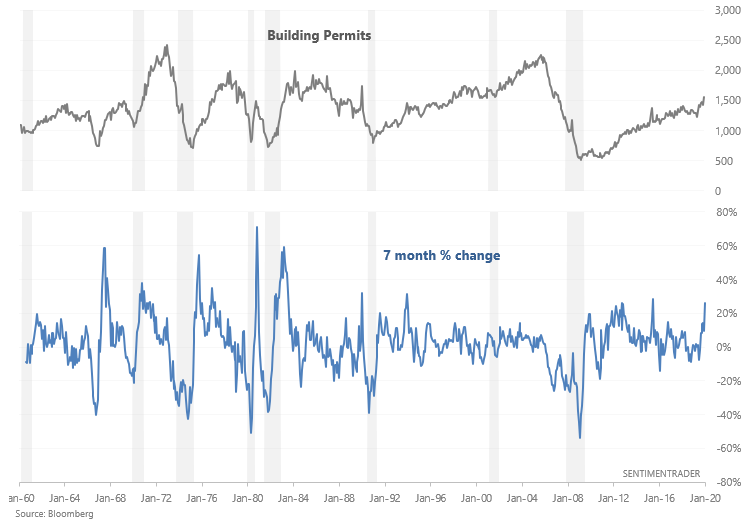

Building Permits

The stock market continues to rally. Sentiment is high, momentum is extreme, etc. But one of the things that the stock market has going for it, at least for a longer term basis, is the fact that the U.S.' fundamentals are still ok. Housing, a key leading sector for the U.S. economy, continues to improve.

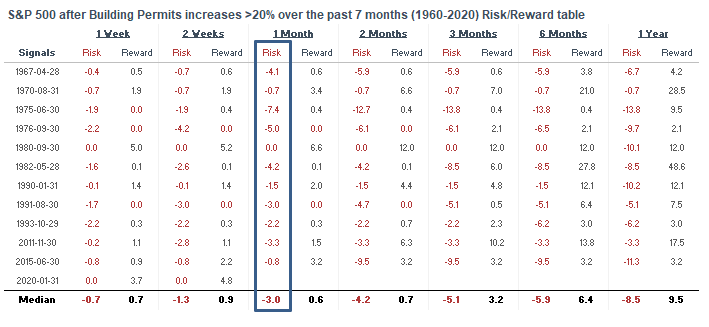

Building Permits are up more than 25% over the past 7 months, which makes this a positive factor for the Macro Index.

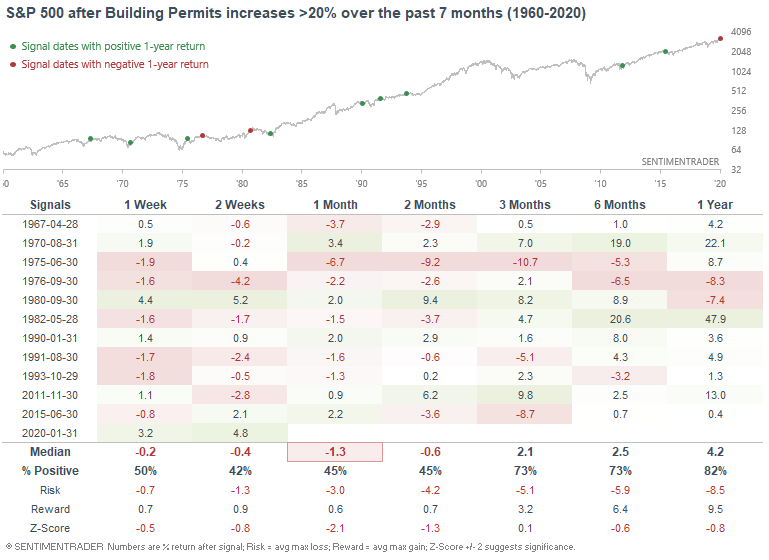

When Building Permits jumped this much this quickly, its returns over the next month were a little weaker than average. This is because a jump in Building Permits tends to occur after an economic & stock market recovery - eventually these recoveries need to take a breather. What typically happens is:

- Stock market falls, economy deteriorates and Building Permits fall. (i.e. 2nd half of 2018)

- Stock market rallies, economy improves and Building Permits jump. (i.e. 2019-present)

Here are the S&P 500's drawdowns over the past month:

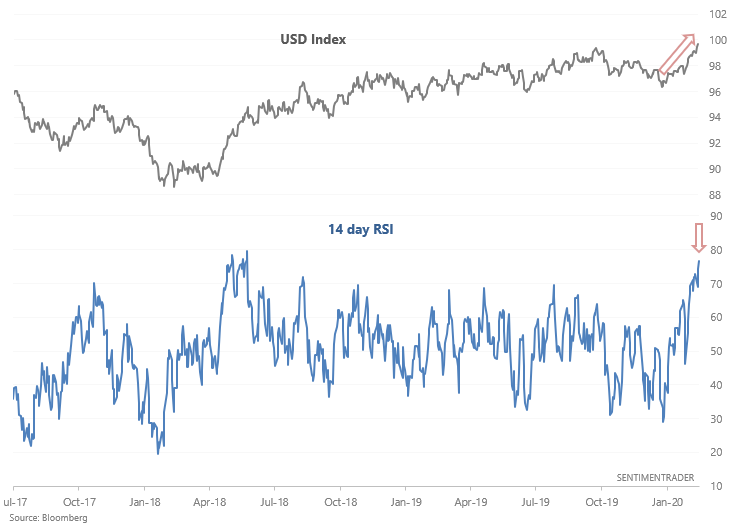

USD

The U.S. Dollar Index continues to trend higher, pushing its 14 day RSI to the highest level since mid-2018:

As is usually the case, high momentum can be interpreted in 2 ways:

- The market needs to reverse, or...

- The market will chop around for a while, wash out some of the extreme momentum, then continue going in the direction of its previous trend.

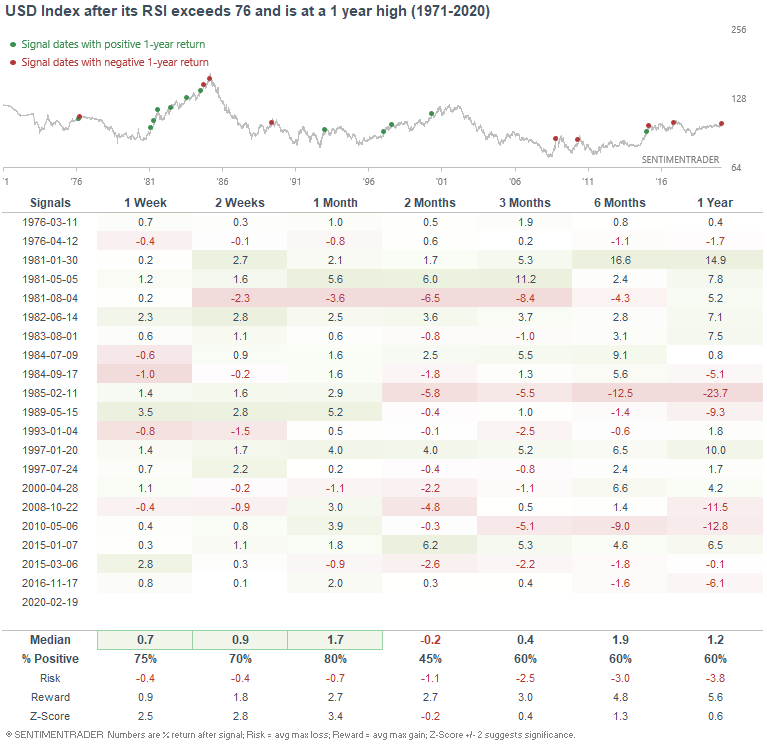

When the USD Index was at a 1 year high while RSI exceeded 76 in the past, the USD's returns over the next month were quite bullish. Momentum doesn't die that easily. However, returns over the next 2 months were weak, particularly if we exclude the many cases during the 1981-1985 USD bull market:

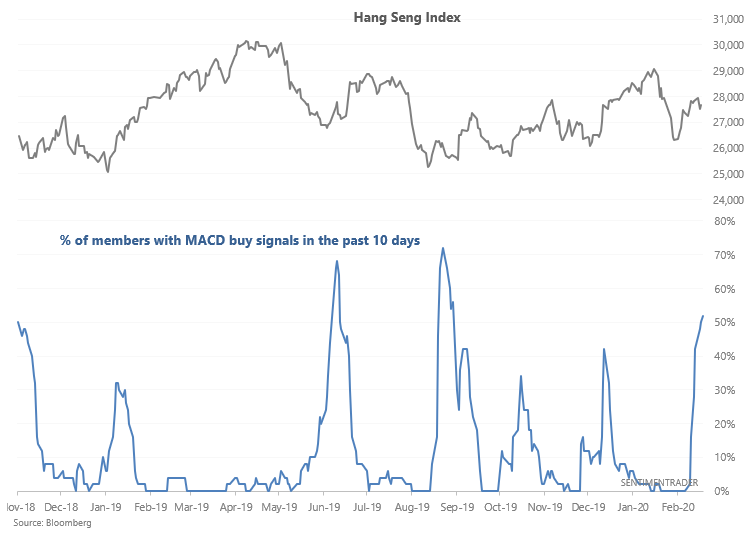

MACD

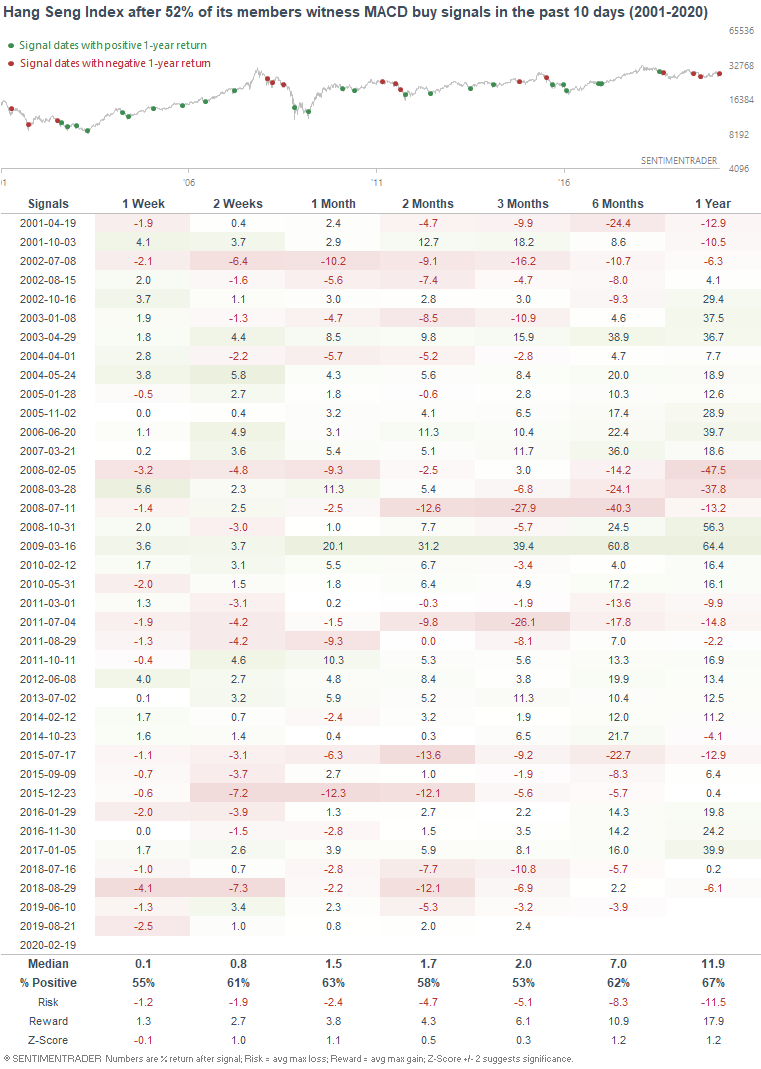

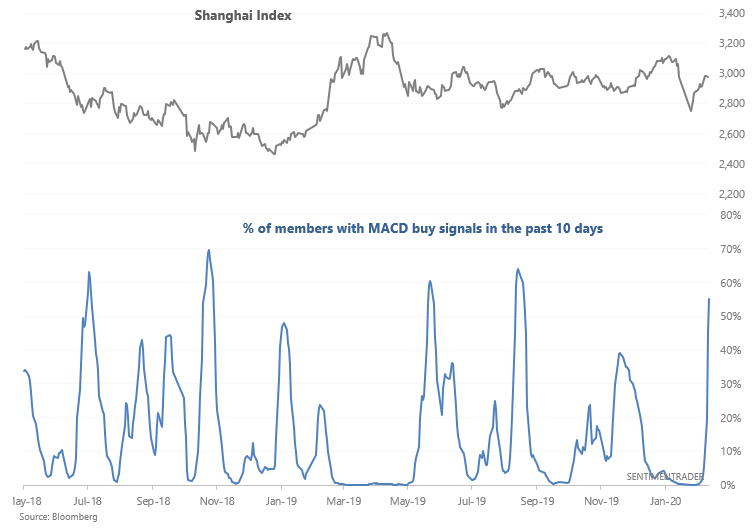

And finally the recent dump-and-jump in many China/HK stocks has caused the "% of members with MACD buy signals in the past 10 days" to spike. While it's easy to assume that a jump in MACD buy signals is bullish and a jump in MACD sell signals is bearish (some financial marketers may try to convince you of that), that hasn't always been the case historically.

When a large % of Hang Seng members witnessed MACD buy signals, the Hang Seng's forward returns were mostly mixed. Nothing terribly compelling.

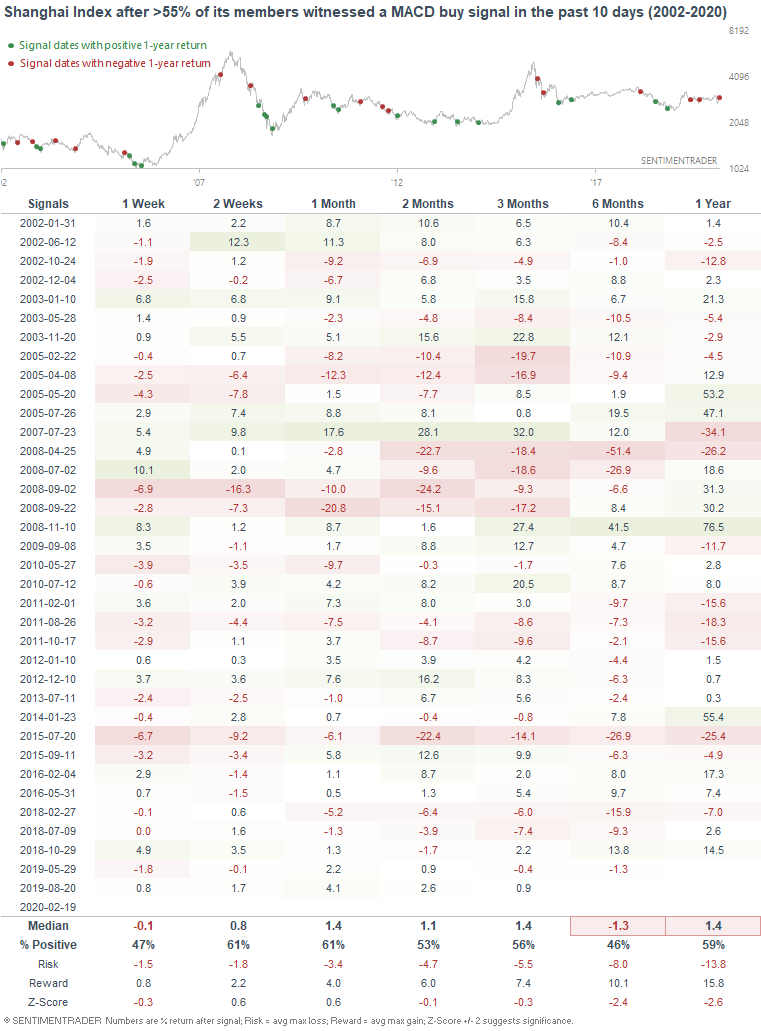

And similarly, when a large % of Shanghai Index members witnessed MACD buy signals...

the Shanghai Index's forward returns were mixed, with the exception of a slight bearish tendency over the next 6-12 months.

Personally, I don't find MACD breadth to be that useful in terms of market timing. Stories involving this indicator can sound really smart (depending on how you spin it), but personally, I do not use this for my own trading. If you haven't already, please watch this video for a more sober view of MACD.

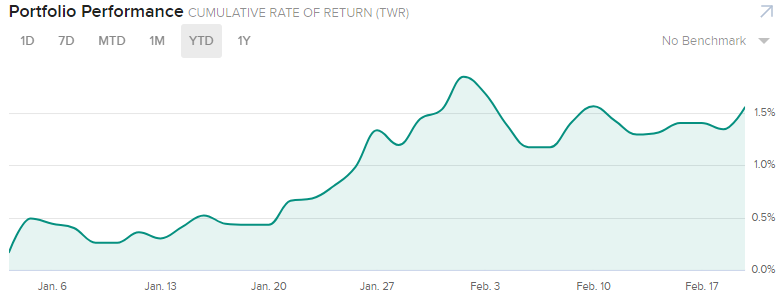

My trading portfolio

My trading portfolio is allocated 50% in the Macro Index Model and 50% in the Simple Trading Model With Fundamentals. At the moment I have instituted a discretionary override and gone 100% long bonds (instead of long stocks) due to the extreme nature of many of our core indicators, even though some of these core indicators aren't in the models.

Performance YTD 2020:

My trading account is up 1.55%

Currently 100% in bonds