What I'm looking at - breadth warnings, USD's drop, gold's rally

Here's what I'm looking at:

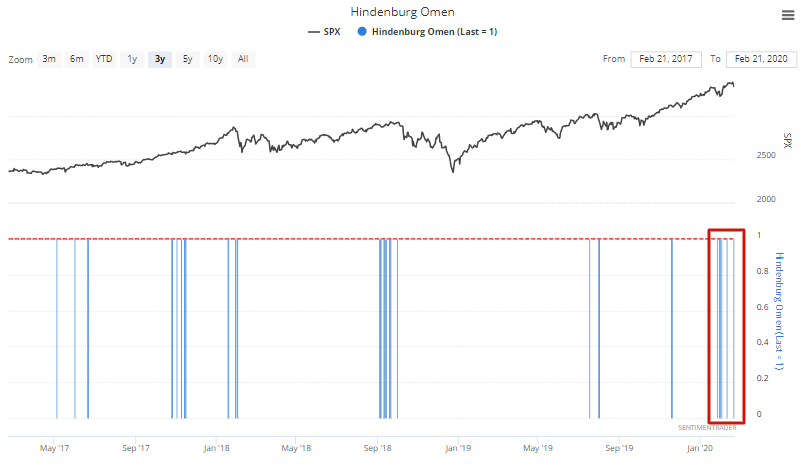

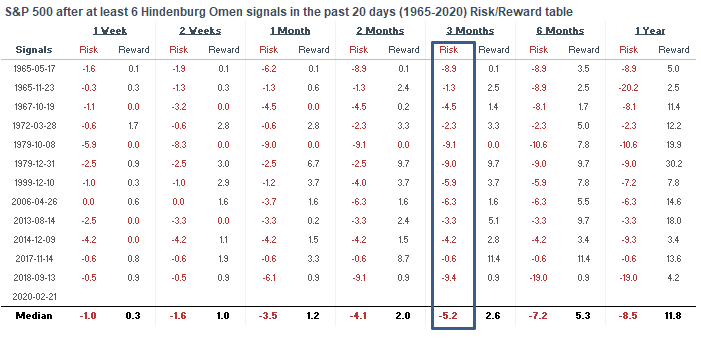

Breadth warnings - Hindenburg Omen

The Hindenburg Omen has triggered again for the 6th time over the past 19 trading days. Some market watchers have noted that the Hindenburg Omen hasn't been a particularly effective bearish signal recently (it has marked more bottoms than tops). That's primarily because many of the S&P 500's recent pullbacks have been shallow, so any indicator thusfar has "failed" at predicting a pullback. It doesn't mean that the Hindenburg Omen overall is ineffective. No indicator works 100% of the time - indicators will invariably go through stretches when they work extremely well and other stretches when they don't work well.

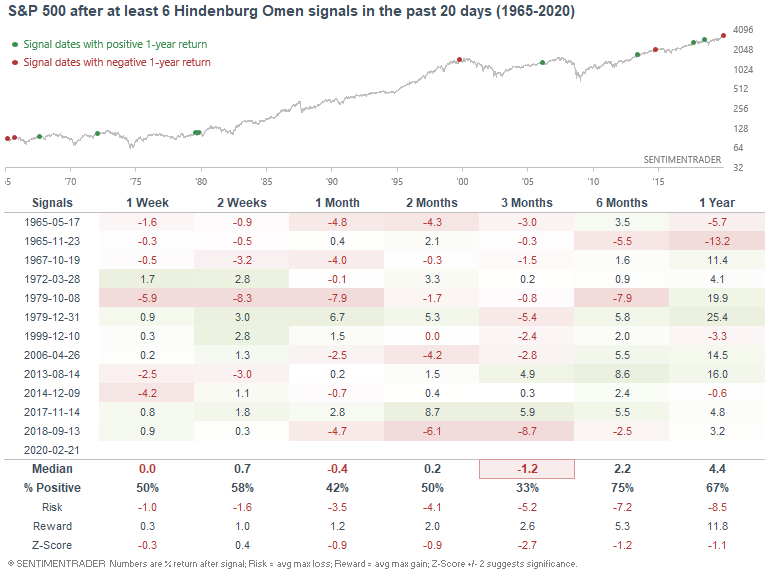

With that being said, a cluster of 6 Hindenburg Omen signals in 20 days is bearish for stocks over the next 3 months.

Several of the 3 month forward cases saw large drawdowns:

Several of the 3 month forward cases saw large drawdowns:

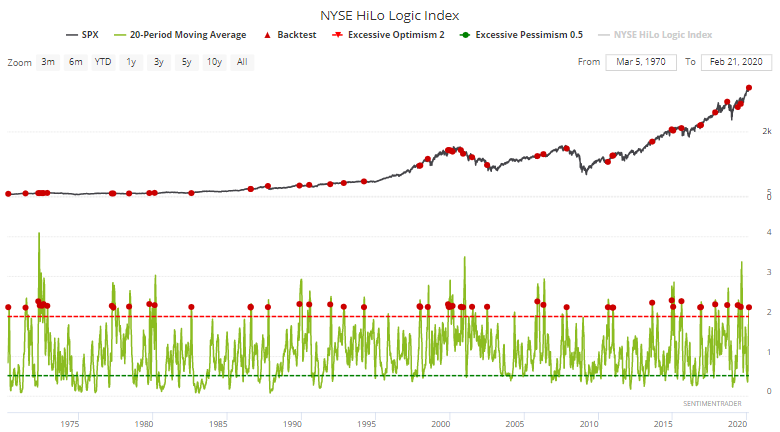

Breadth warning - HiLo Logic Index

The HiLo Logic Index, a "split" breadth indicator which is of great use when applied to trading models, has remained elevated over the past few weeks. Its 20 day average is currently above 2.21, which historically led to worse-than-random returns for the S&P 500 over the next 1-3 months.

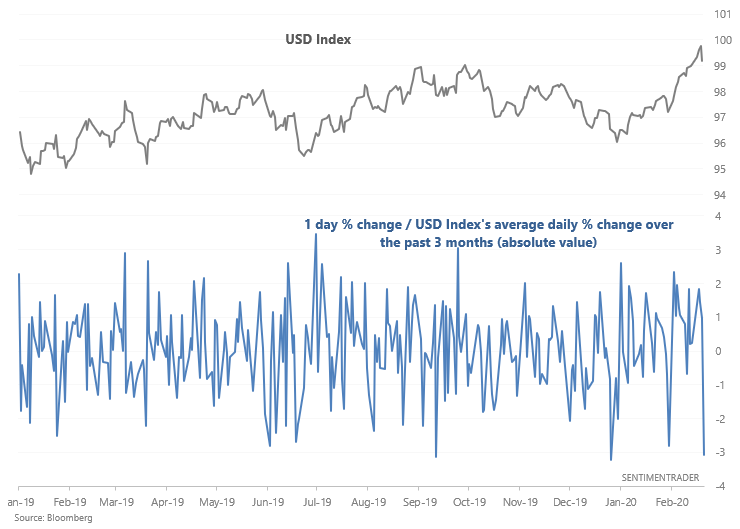

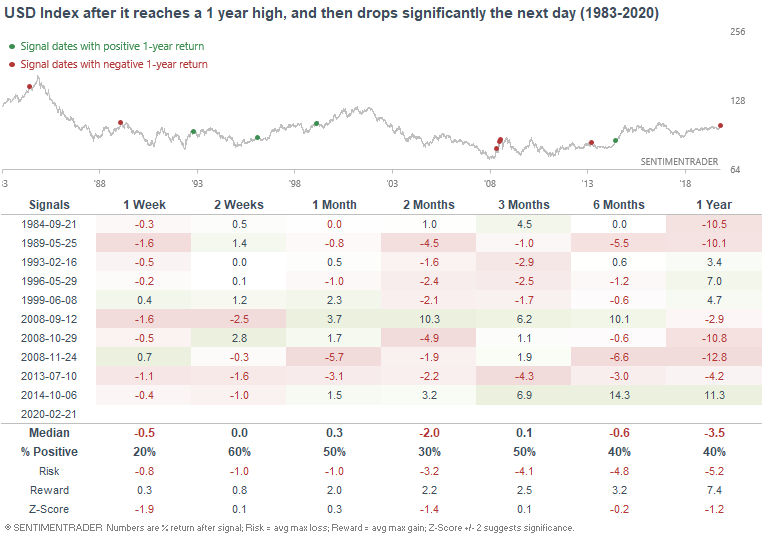

USD Index

It wasn't just tech's decline today that was shocking. The USD Index dropped sharply after a strong rally that pushed the USD to multi-year highs. If we look at the USD Index's 1 day % change vs. a 3 month average of daily % changes, this was a rather abrupt reversal in the USD's uptrend.

When the USD Index reached at least a 1 year high and then dropped like a stone (defined by the above chart < -3), the USD Index's returns over the next week were bearish. Most sudden reversals in the USD's uptrend led to more downside over the coming weeks.

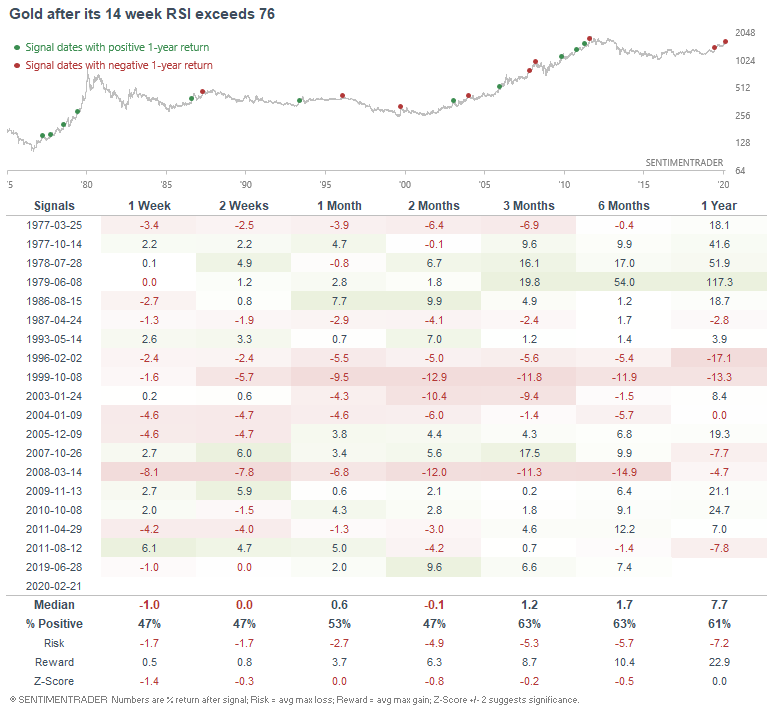

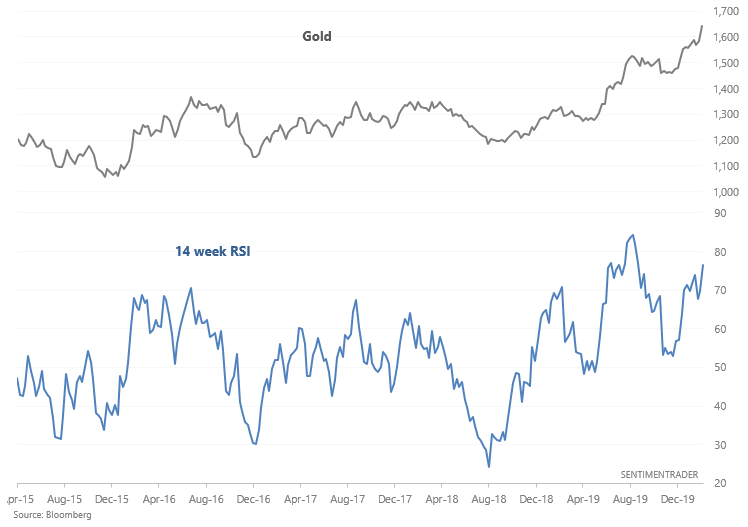

Gold

And finally, gold's surge has pushed its weekly RSI above 14.

This led to worse than random returns for gold over the next week.