What I'm looking at - Australia, developed markets, corporate bonds

Here's what I'm looking at:

Australia

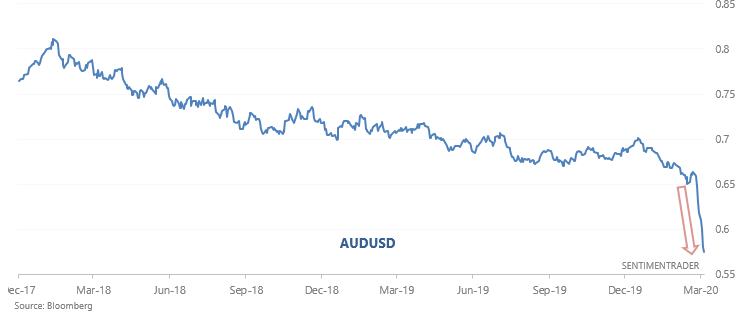

I've been thinking about diversifying my assets across different hard currencies after talking to a friend, and I started looking at Australia. The past few years have been rough for the Australian Dollar, to say the least, and the past few weeks have been brutal.

Here's AUDUSD:

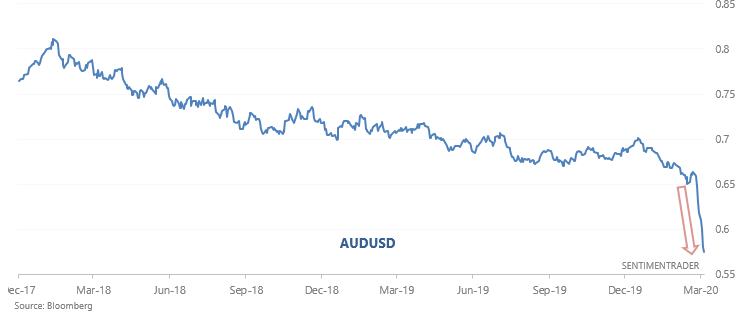

Here's the same chart, on a longer term basis:

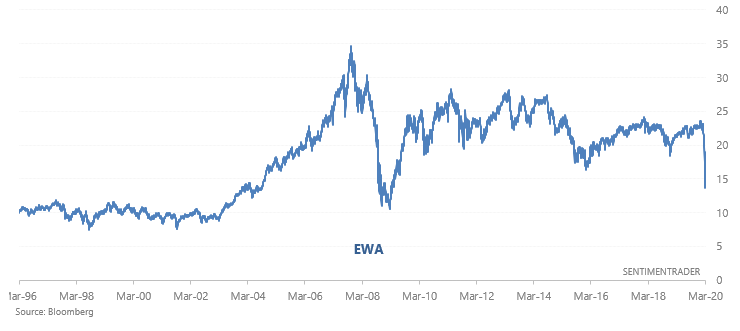

While the S&P/ASX 200 index has dropped -34.1% during this coronavirus-driven crash, the AUDUSD's decline has caused EWA (Australian ETF) to fall -43.2% from top to bottom.

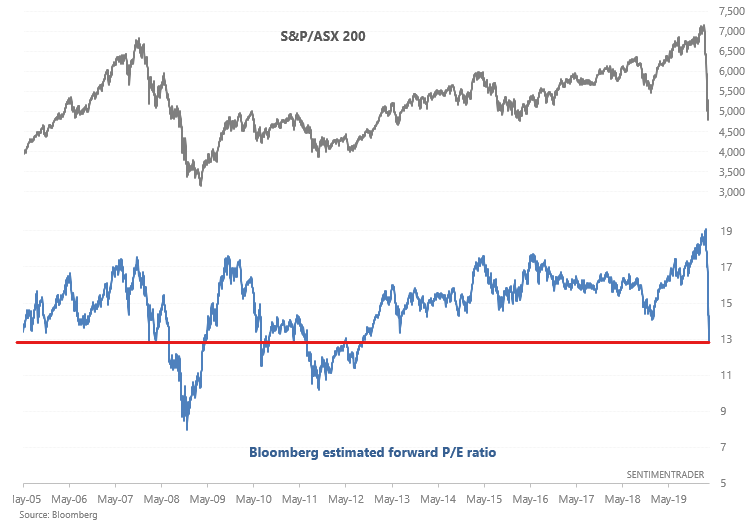

From a longer term perspective, this means that Australian equities valuations is MUCH more attractive. Earning yields - the reciprocal of valuations - matter on a long term basis (i.e. 10-20 years).

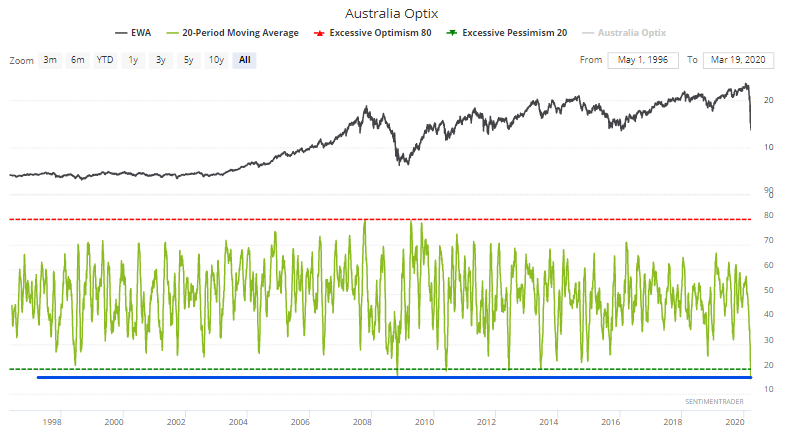

From a trading perspective, Australia Optix's 20 dma is the lowest its ever been - even lower than in 2008. Back then Australian equities chopped a bit lower, but the key point is that the worst of the selling was over.

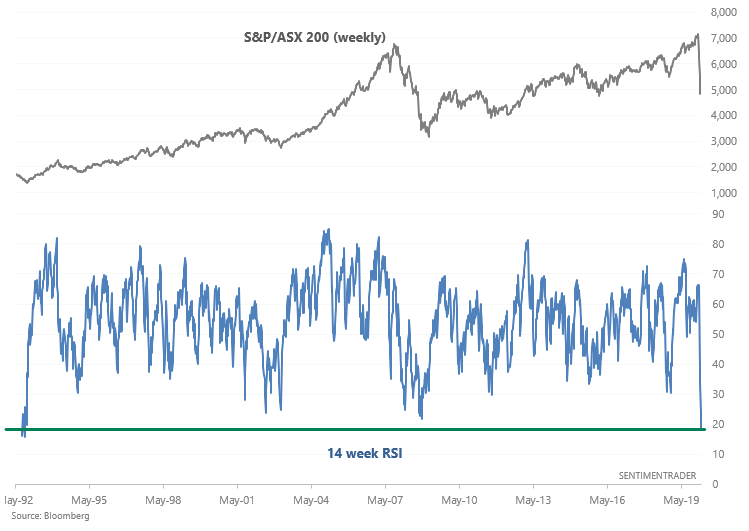

Meanwhile, the S&P/ASX 200's weekly RSI is among the lowest ever. Once again, lower than what we saw in 2008:

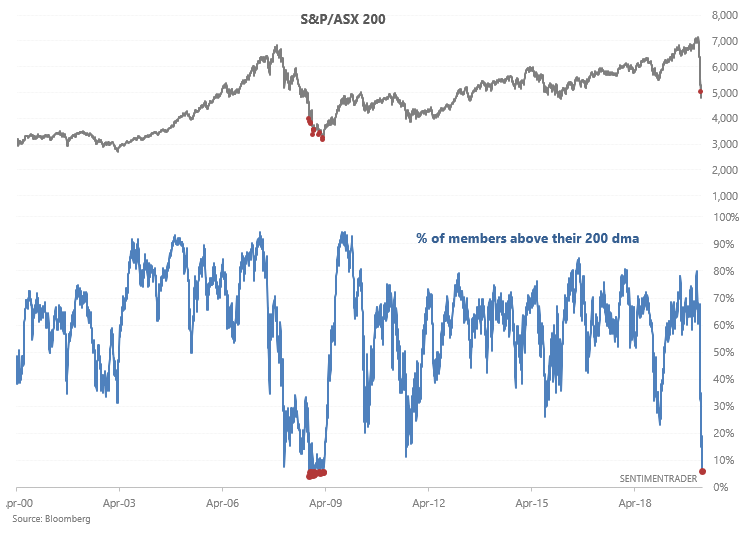

And the % of S&P/ASX members above their 200 dma can only be compared to that of 2008. Once again, back then the worst of the selloff for Australian equities was over. The S&P/ASX 200 surged over the next year, but not before making new lows.

Developed markets

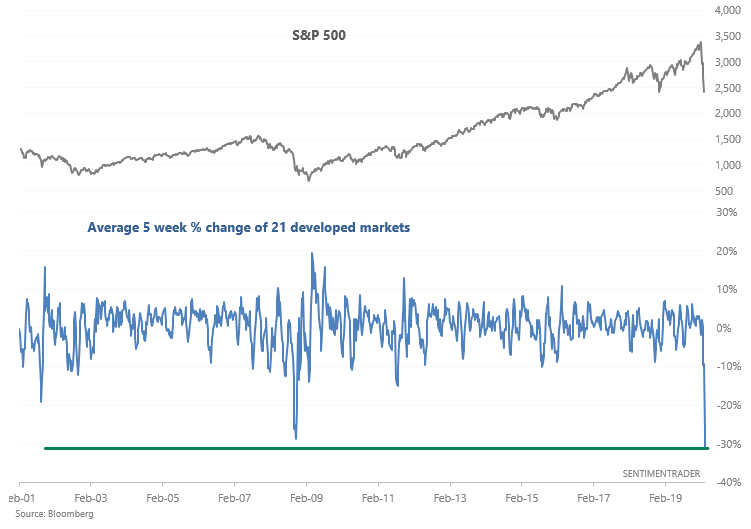

Internet usage has been up more than 20% of the past few weeks, no doubt driven by worldwide panic over coronavirus. Markets-websites have also seen a surge in traffic (everyone is glued to their screen when markets crash). There haven't been a lot of safe places for investors to hide. To get a sense of how widespread and shocking the selloff was, we can look at the average 5 week % change of 21 developed markets in the MSCI World Index (excluding Denmark and Ireland):

The average stock index has fallen -31.3% over the past 5 weeks, worse than in 2008:

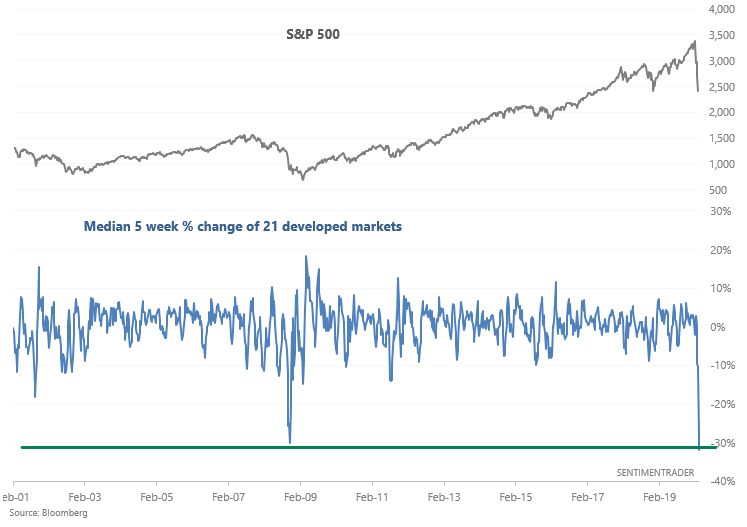

And the median stock index has fallen -31.8%, also worse than in 2008.

By then the worst of the selling was over. Most crashes are followed by a retest or marginal new lows. V-shaped rallies are rare, but not impossible. Focus on long term risk:reward if you're going to buy now.

Bonds

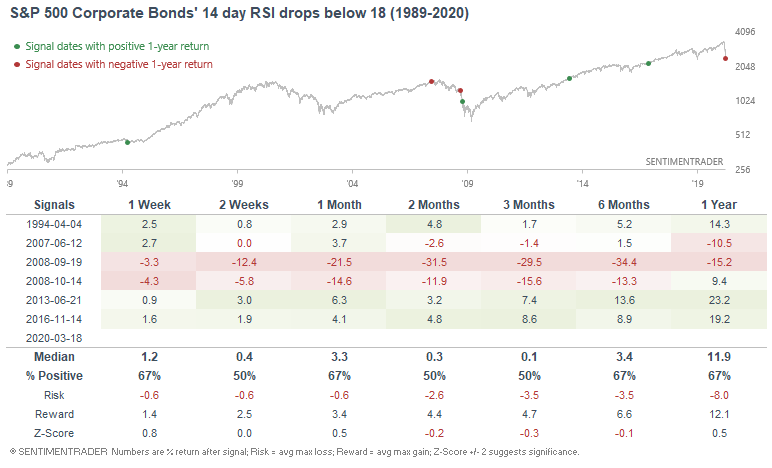

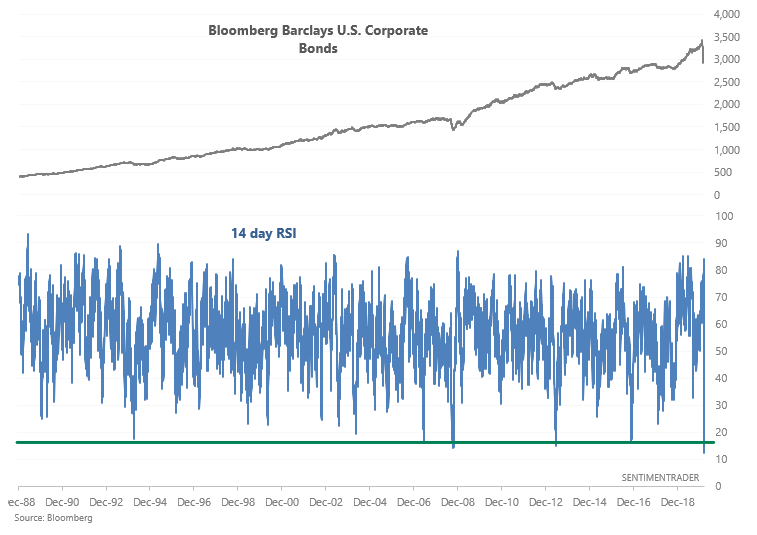

While bonds surged in the initial phases of the recent stock market crash, bonds are falling now. Corporate bonds' 14 day RSI is at its lowest reading ever.

This happened during the 1994 Great Bond Massacre, 2007-2008 global financial crisis, June 2013 taper tantrum, 2016 post-election risk-on environment, and now. Bearish historical cases in the following table were in September and October 2008. But I don't think it's very comparable, given than the Bloomberg Barclays U.S. Corporate Bond's RSI has never been this low before.