What happens when stocks soar during a bear market

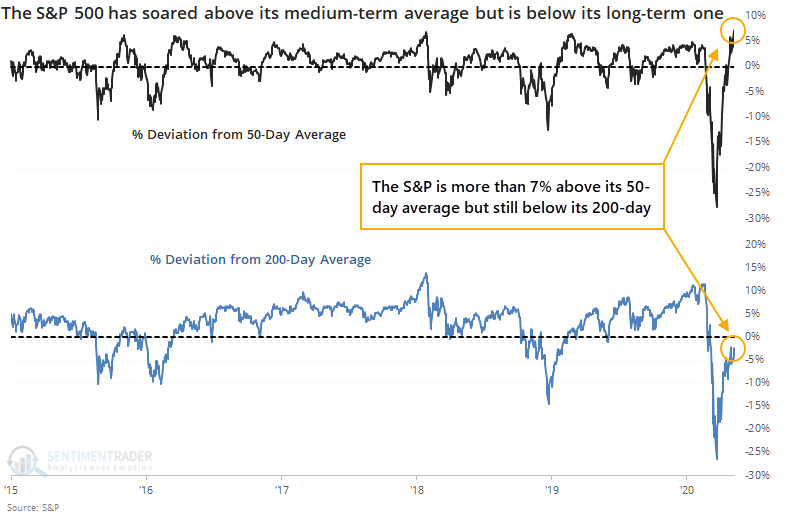

When stocks rocketed higher out of a selloff in the fall of 2011, buyers pushed the S&P 500 more than 7% above its 50-day moving average. It hasn't been that far above its medium-term average in the nearly 9 years since, until Friday.

The biggest difference between that time period and the current one is that the October 2011 rally also pushed the S&P above its long-term 200-day average. This time, stocks declined enough that even with the rally, the S&P is still trading below its 200-day.

When stocks have rebounded so much during a long-term downtrend, returns over the coming weeks and months are more fraught than if the long-term environment was more positive. And whether investors have enough oomph to keep pushing stocks higher in the coming week(s) will signify whether this is more likely the kick-off of a new bull market, or just a bear market rally.

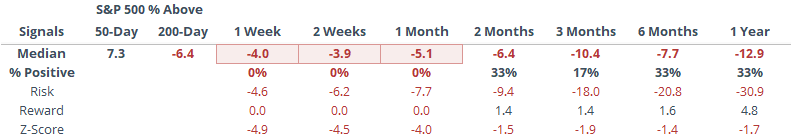

Below, we can see the S&P's forward returns if the first week following these signals was negative.

Only once did this lack of buying interest reverse itself over the next 3 months. Something to keep in mind depending on how the next week goes.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more detailed look at how stocks perform after these 50/200-day divergences

- The Cumulative Advance/Decline Line hasn't bounced nearly as much as the S&P 500

- The Nasdaq has rallied for 6 straight days - what that means for the broader market

- Our Optimism Index on QQQ is the highest in almost a decade

- Mutual fund timers are piling into Rydex funds

- The equal-weight S&P 500 can't keep up with the cap-weight version

- Internet stocks have skyrocketed

- What happens when the Nasdaq 100 is up more than 40% over 7 weeks