What are tech insiders thinking?

Key Points

- The conventional wisdom suggests that technology has had its "day on the sun" - and that a major decline, ala, 2000-2002 may be in the offing

- Technology company insiders appear to disagree and have been aggressively buying shares of their own companies

- Seasonality and sentiment may also be lining up as positives for technology

The state of the technology sector

The chart below displays price action for XLK (Technology Select Sector SPDR Fund) for the past three years.

There are two things to note:

- Tech has enjoyed a phenomenal run (really since the 2009 low)

- Tech is presently below its 200-day moving average

It is important to remember that there is nothing magic about moving averages. Sometimes a drop below a long-term average indicates the beginning of a major decline, and other times it ends up being nothing but a whipsaw (i.e., anyone who sold on the breakdown is forced to buy back in at a higher price).

The current narrative is that tech has now run out of gas and is destined to experience another major bear market, ala 2000-2002 and 2007-2009. And the reality is that is one of the possibilities. The bottom line regarding price action is that investors may be wise to remain wary as long as XLK trades below its 200-day moving average.

But some reasons to question the narrative exist

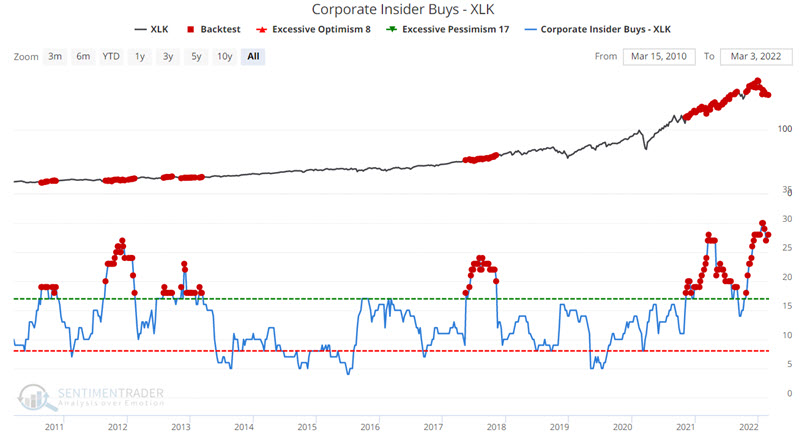

I try hard never to focus too much on any one piece of data. But I have to admit, insider buying in the technology sector keeps popping up on my radar - and seems completely counter-intuitive based on everything I read and hear in the financial press. Ticker XLK (the upper line in the chart below) tracks an index of S&P 500 technology stocks. The lower line in the chart below represents open market purchases by corporate insiders for companies XLK.

The chart below highlights each week when this indicator showed a reading of 17 or higher.

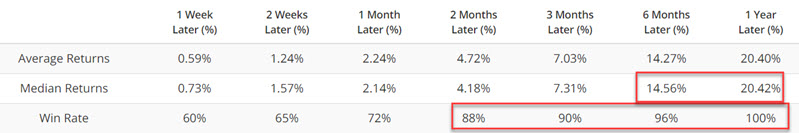

The table below displays a summary of the results.

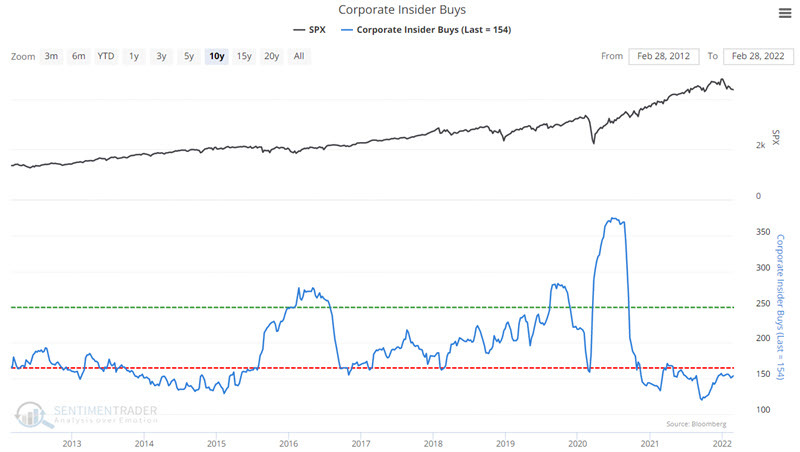

To put the recent buying by tech insiders into perspective, note the relatively low level of overall Corporate Insider Buys in the chart below.

Based on the bearish conventional wisdom narrative and the low level of insider buying in general, the persistent and enthusiastic buying by tech insiders stands completely apart and seems to make no sense at all. So the question becomes, "Are tech insiders crazy, or do they know something we don't know?" What might cause these executives to ignore the doom-and-gloom pundits and buy heavily instead?

Tech earnings

The chart below (posted by Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co., Inc.) shows the forward 12-month operating margins for stocks comprising the S&P 500 Information Technology index.

The chart above implies that business is good in the tech sector and perhaps explains why insiders might remain bullish.

Tech seasonality

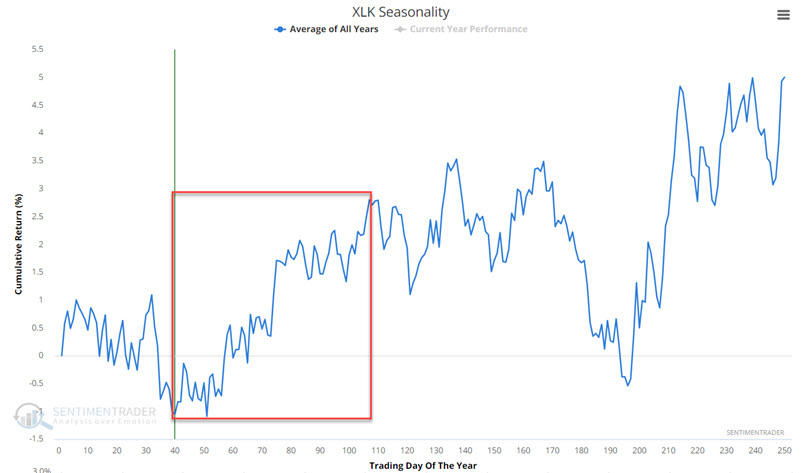

The chart below displays the annual seasonal trend for XLK. Note that we have entered a favorable seasonal period.

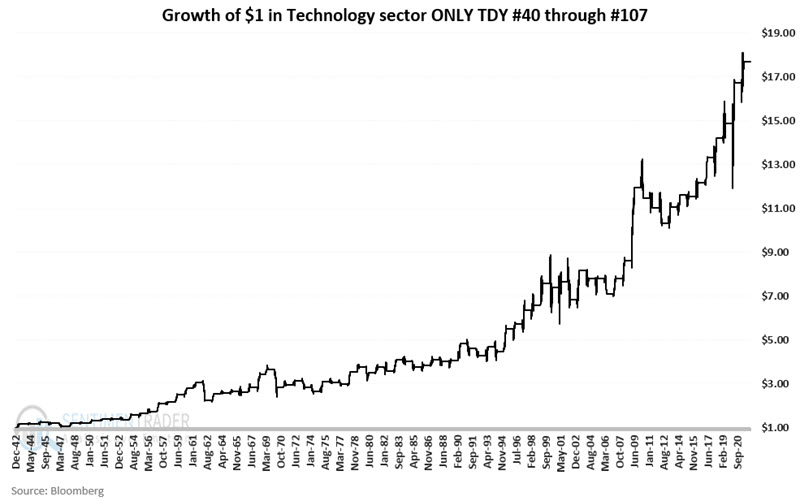

For 2022, this period extends from the close on 3/1/2022 through the close on 6/6/2022. So far this latest period is off to an abysmal start. Is it time to throw in the towel, or a buying opportunity, ala tech insiders? It is impossible to say for sure. Nevertheless, the table below displays the hypothetical growth of $1 invested in the S&P 500 Technology Index only during this favorable seasonal period from 1942 through February 2022.

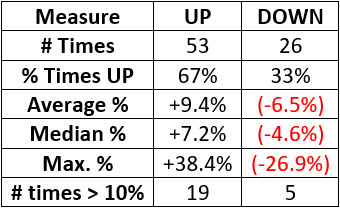

The table below displays a summary of the results.

Overall market sentiment

As Jason points out here, bearish advisors outnumber bullish advisors for the first time in two years. As he highlighted, tech stocks tend to perform very well in the year ahead under this scenario. See the numbers for Technology and Communications (i.e., information technology) in the table below.

Does this mean that tech stocks are setting up for another big upleg? Not at all. Macro economic factors such as inflation, rising rates, war and soaring energy prices continue to overwhelm the stock market at present. But it does suggest being open to the possibility - especially since tech insiders have clearly demonstrated their collective outlook by engaging in an ongoing buying binge despite all of the negative factors just mentioned.

What the research tells us…

Until price demonstrates that the tech sector is not about to plunge into a bear market, caution remains in order. The information above should not be interpreted as an immediate "buy" signal. The real point is that is that investors should not assume that the current bearish narrative is inevitable.

Insiders are not always right. However, they are typically not terribly wrong when they act in concert. The level of buying by tech insiders is a clear sign that collectively, they see some potential positives that they believe will result in higher tech stock prices (why else would they invest their own money?). If tech will rebound, the current seasonally favorable period is as good a time as any for that to begin.

The bottom line for tech investors is to be patient but be ready to act.