We're officially in a recession

The U.S. is "officially" in recession. According to the National Bureau of Economic Research (NBER), the business cycle peaked in February. No big surprise there.

This is a conservative group, and by the time they declare a peak in the cycle, there has to be a lot of evidence that it has actually peaked. So by the time they make the declaration, markets could have moved significantly. And usually have.

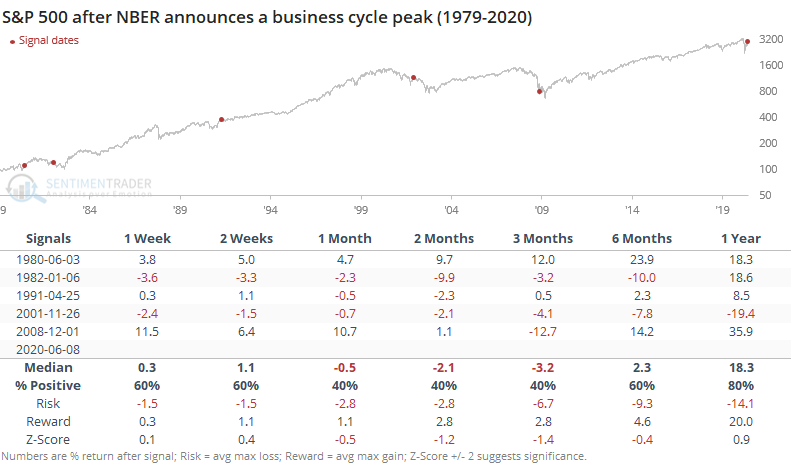

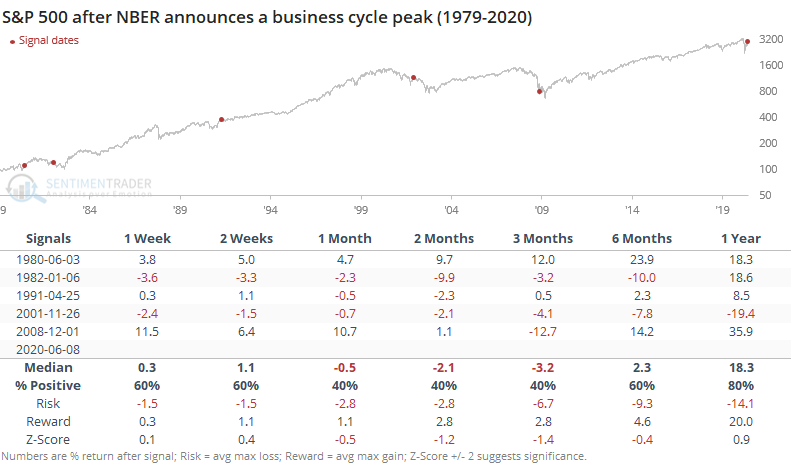

The table below shows returns in the S&P 500 after the NBER announces a business cycle peak. Note that the signals are as of the date of the announcement, NOT the peak of the cycle.

Over the medium-term, the S&P suffered some severe volatility a few times, once to the upside and twice to the downside. The others showed only minor losses. By a year later, though, the S&P showed a positive return each time except for 2001. The cycle peaks announced in 1980 and 1991 occurred once stocks had already quickly recovered from the bulk of their recession-anticipating declines, much like now.

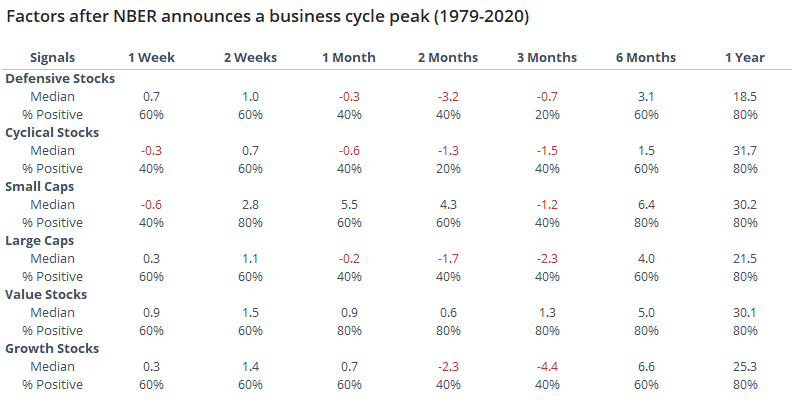

Among factors, there wasn't as clear a pattern as we might expect. Both cyclical and defensive stocks saw losses over the next 2-3 months, though cyclical stocks enjoyed a much larger average return over the next year. Same goes for small-cap and value stocks.

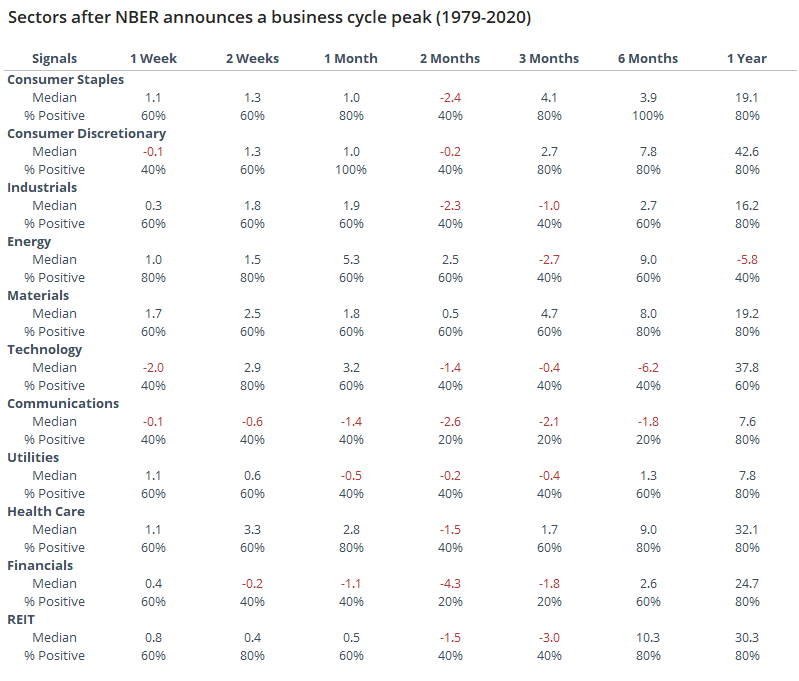

Among sectors, staples did well, but surprisingly so did discretionary stocks, especially over the next 6-12 months. Tech, communications, and financials tended to suffer the most over the medium-term.

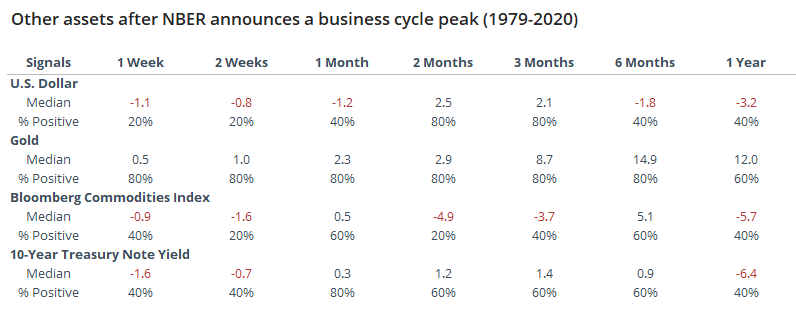

For other assets, the dollar and gold both tended to rally over the medium-term, but commodities did not.

Economic reports have a strong tendency to be backward-looking, and economic projections aren't much better. For this organization, in particular, their record at highlighting business cycles may be a good one in hindsight, but it's not much use to investors in real-time.