Weekend summary: "this time is different"

I publish a weekly summary note which highlights what factors are most important to understanding the markets right now. These important factors may stay consistent from time to time (e.g. sentiment is consistently high over the past month), so each weekly summary will have some overlap with the previous one.

The past few months have been stunning.

The U.S. stock market has seemingly ignored many extremes over the past few months. As is typically the case when this happens, bulls are screaming "this time is different". It rarely ever is. Their argument centers around massive government intervention and stimulus, which "should" push stock prices and "real money" (e.g. gold and silver) through the roof.

While these factors may push stocks and precious metals higher in the long term, various extremes continue to suggest that these asset classes will probably pullback in the short term.

In this post I will highlight the most important data points and charts right now. These indicators primarily impact markets in the short-medium term. They are not meant for long term investing. So if an indicator is short term bearish for stocks, that DOES NOT mean stocks can't rise over the next year (long term).

Monitor these data points carefully but always think for yourself. Don't let arrogant marketers, financial media experts, and social media personalities push their thinking on you ("you are an idiot if you don't agree with me"). You are the master of your own portfolio. As always, I welcome those who disagree with me (feel free to email me your thoughts [email protected]).

So without further ado, we'll look at the following:

- Dollar pessimism and precious metals optimism

- Volatility

- Sentiment

- Options

- Incredible momentum

- Weak breadth

Dollar pessimism and precious metals optimism

There is no other word except "historic" to describe gold and silver's rally. Traders seem to have turned their attention away from tech darlings towards precious metals, with gold at new all-time highs and silver rapidly catching up.

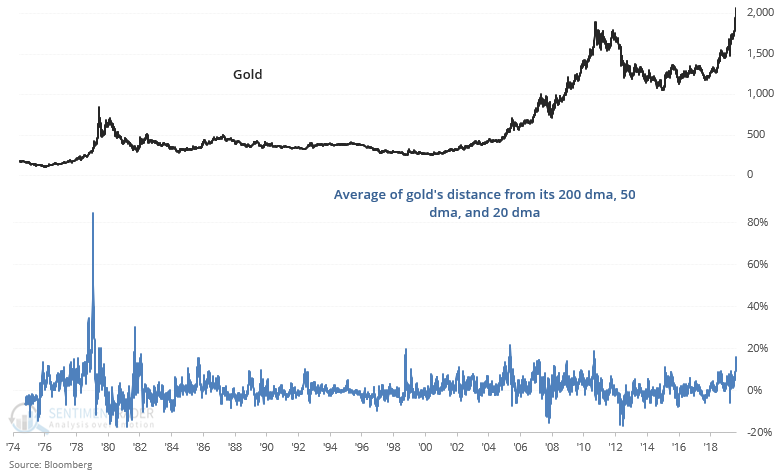

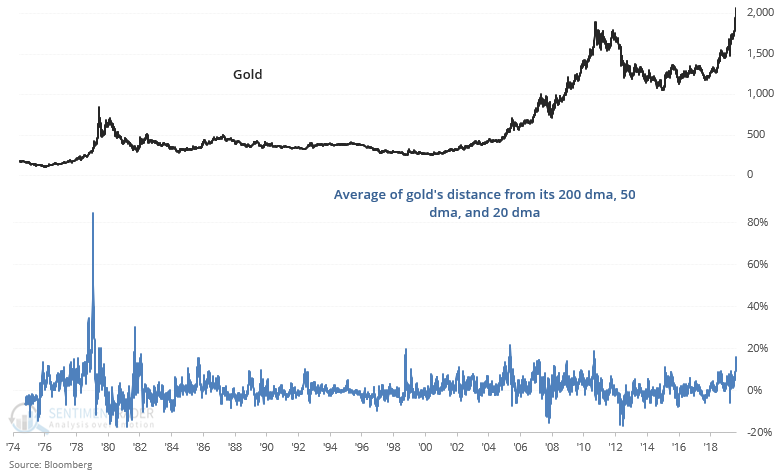

As I mentioned this past week, gold and silver deviated significantly away from their short term, medium term, and long term moving averages. A mean-reversion pullback is to be expected.

The past week saw stunning speculation in gold and silver while the U.S. Dollar sank.

Here's gold:

Here's silver:

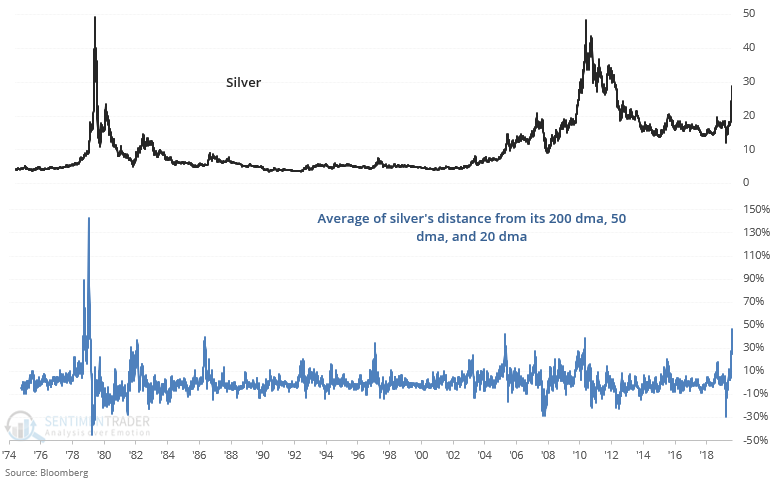

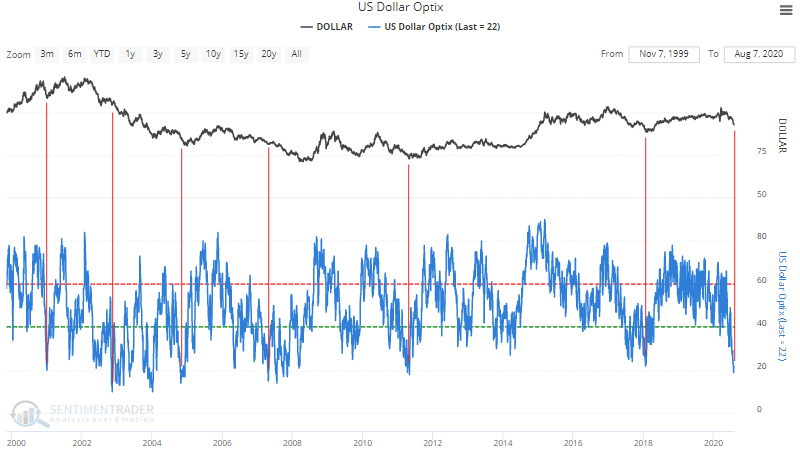

The U.S. Dollar collapsed as gold and silver surged. Dollar Optix is now at one of the lowest readings over the past 20 years. This consistently led to major medium term bottoms in the past 10 years. HOWEVER, this wasn't always an effective contrarian signal during a Dollar bear market (see 2002-2008). Sometimes Dollar sentiment could remain consistently low for weeks or months at a time before the U.S. Dollar bottomed:

Either way, watch out for a potential reversal in the USD, which could put short/medium term pressure on U.S. stocks.

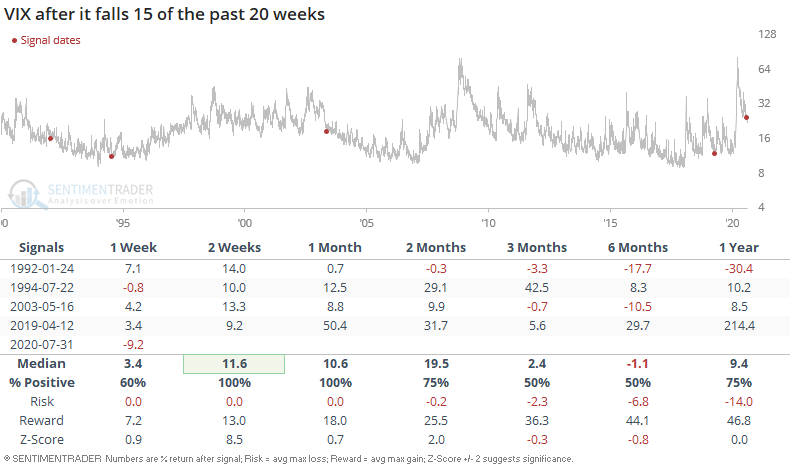

VIX

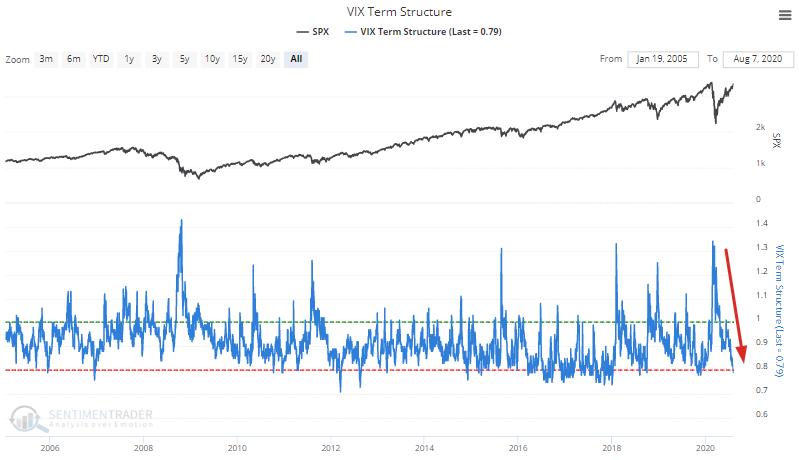

VIX's reversal mirrored the U.S. stock market's rally. VIX's term structure normalized after jumping into backwardation during the global market meltdown in March.

This is a short term bullish sign for VIX, as is the following chart. VIX has now fallen a RECORD 16 of the past 20 weeks:

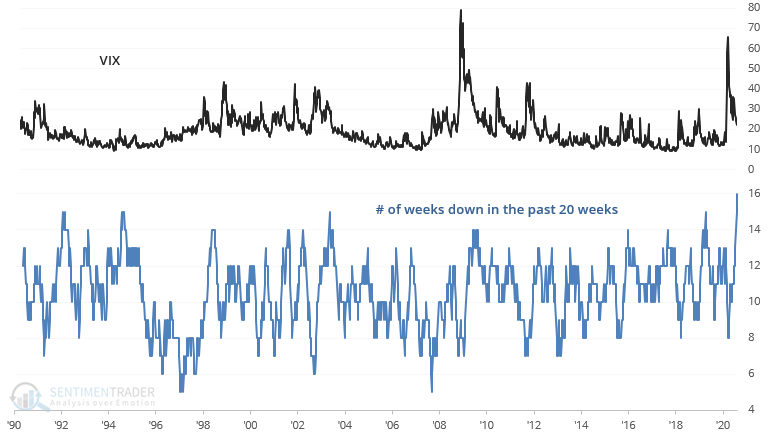

Less extreme cases of subsiding volatility usually led to a jump in VIX over the next few weeks:

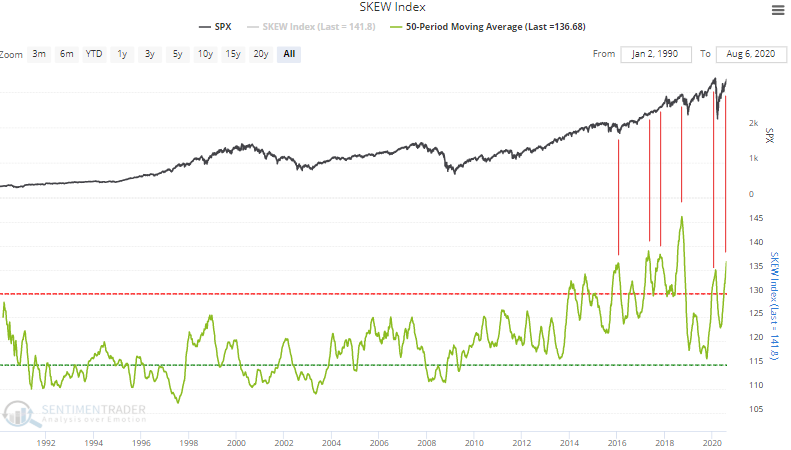

And as I originally mentioned this week (which others have copied), the probability of a black swan event according to the SKEW Index remains consistently high. This has been a decent bearish signal for stocks over the past 2 years, but before that was not particularly effective.

Sentiment

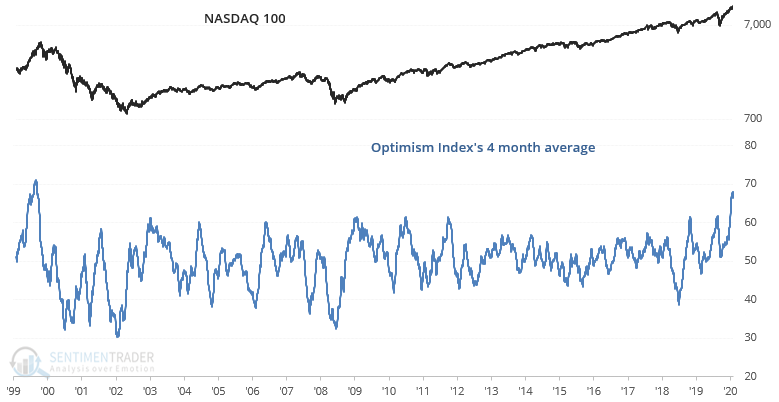

The stock market's stunning 4 month rally pushed various sentiment indicators to truly rare levels. Our S&P 500 Optimism Index's 4 month average is at a level where over the past 2 years, typically led to pullbacks/corrections.

Meanwhile, our NASDAQ 100 Optimism Index's 4 month average is at the highest level since the peak of the dot-com bubble. Once again, this doesn't necessarily mean that the U.S. stock market will crash 50-70% over the next 3 years, but this does suggest that investors and traders should be cautious going forward.

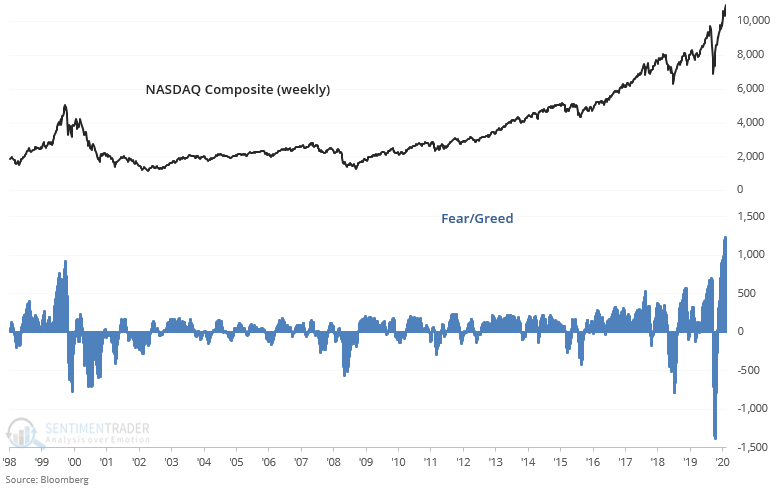

It's not just our sentiment indicators that are demonstrating extreme complacency. Bloomberg's Fear/Greed indicator for the NASDAQ Composite is at an all-time high. The previous 2 highs were in:

- Dot-com bubble. This historical case needs no rehashing.

- January/February 2020. Stocks plunged in March, pushing the Fear/Greed indicator to its lowest level ever. Extremes beget more extremes.

Options

As I'm sure you're aware of by now, options speculation has surged over the past few months. The surge in retail trading and options speculation is a concept that Jason first mentioned in mid-May (see here and here). Since then, this topic has been copied over and over on the internet/social media.

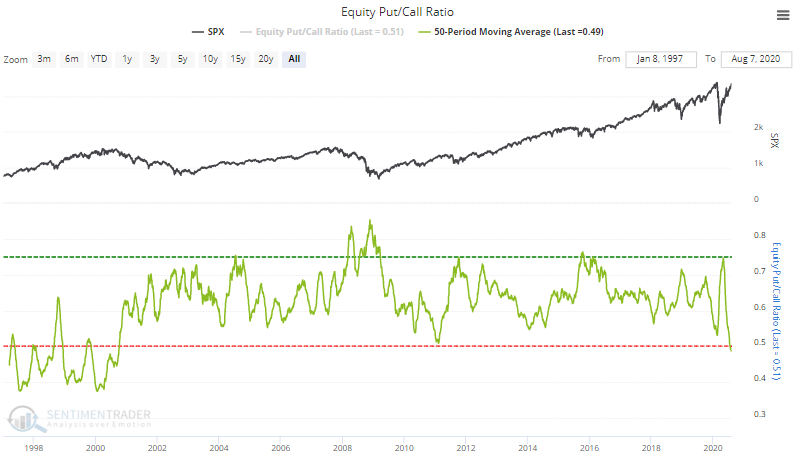

I'll just touch on this briefly. The Equity Put/Call ratio's 50 day average is at its lowest level in nearly 2 decades. Less extreme cases over the past 20 years led to sharp stock market corrections.

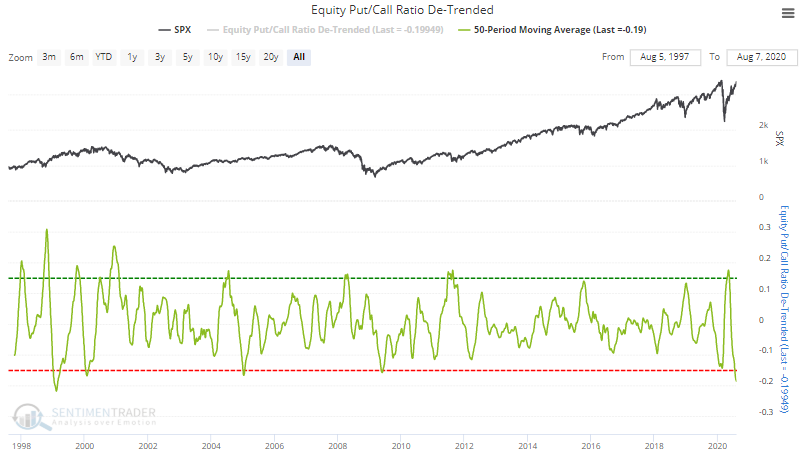

As popular as the Equity Put/Call ratio is, applying a moving average isn't the best way to look at this indicator. I.e. you'll notice that the ratio's 50 day average was consistently lower pre-2001. We created a De-Trended Put/Call Ratio to account for this upwards shift in the ratio since 2001. Once again, historical cases when the ratio was this low (below -0.19) led to worse-than-random returns for the S&P over the next 2-3 months:

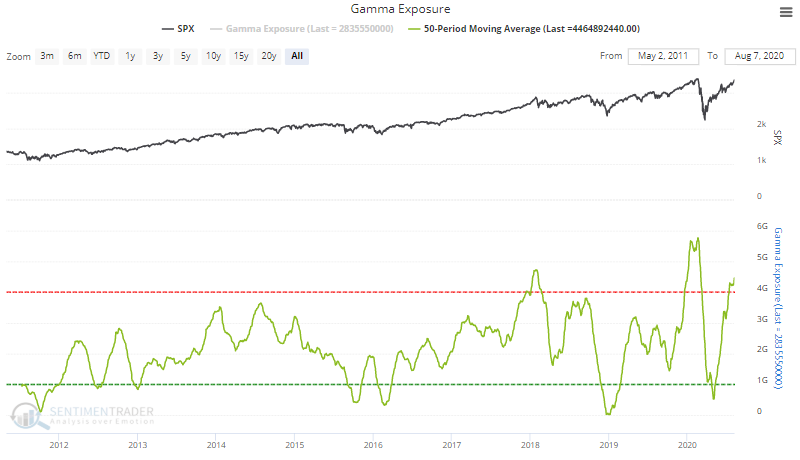

Speaking about options, Gamma Exposure remains extremely elevated. This is an idea I originally mentioned in June, so it's interesting how others are copying it now for their marketing material.

There have only been 2 other historical cases in which Gamma Exposure's 50 dma was this high. The first historical case led to a sharp correction in early-2018, and the second led to the stock market's crash this March:

Incredible momentum

A wild speculative orgy is particularly noticeable in tech stocks. The sensible and rational belief that "tech stocks should outperform during a pandemic" has turned into the irrational belief that "tech is a SCREAMING BUY at any price". Tech's strength is incredibly noticeable regardless of which time frame you look at.

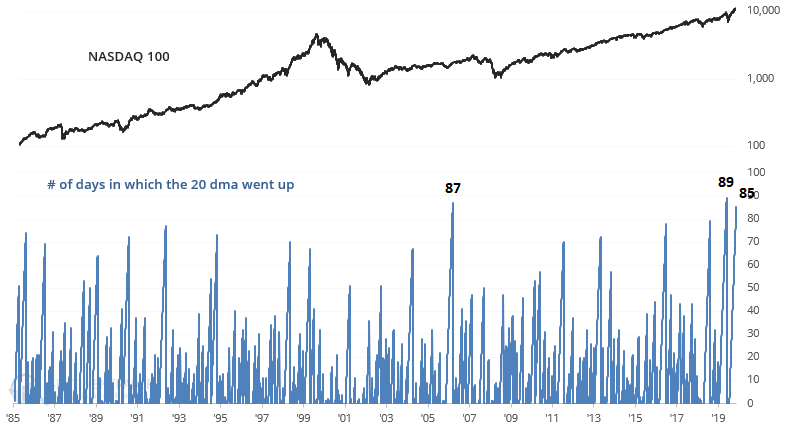

On a medium term time frame, the NASDAQ 100's 20 day moving average is up 85 days in a row. Only 2 other streaks were longer, and ended right around here:

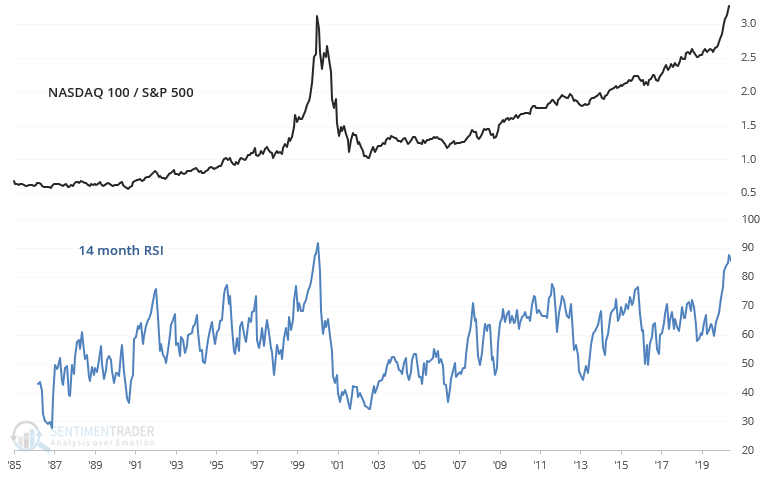

On a longer term time frame, the NASDAQ 100 / S&P 500 ratio's 14 month RSI is still at the highest level since the dot-com peak:

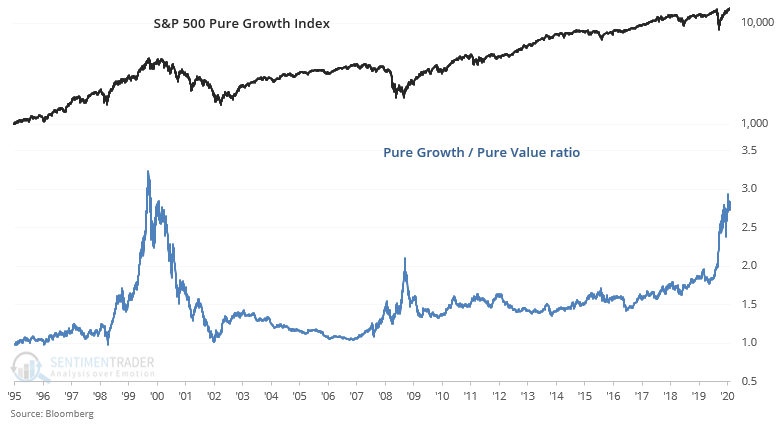

Again, this doesn't mean that a 50-70% stock market crash is imminent, but one has to wonder how much longer the "buy everything tech/growth" train can continue. Speaking of growth, the S&P 500 Pure Growth/Value ratio is also near its highest level since the peak of the dot-com bubble.

Weak breadth

I've discussed weak breadth over the past few months, and now breadth is improving somewhat. This is still a minor concern for stocks, but this isn't as significant as it used to be.

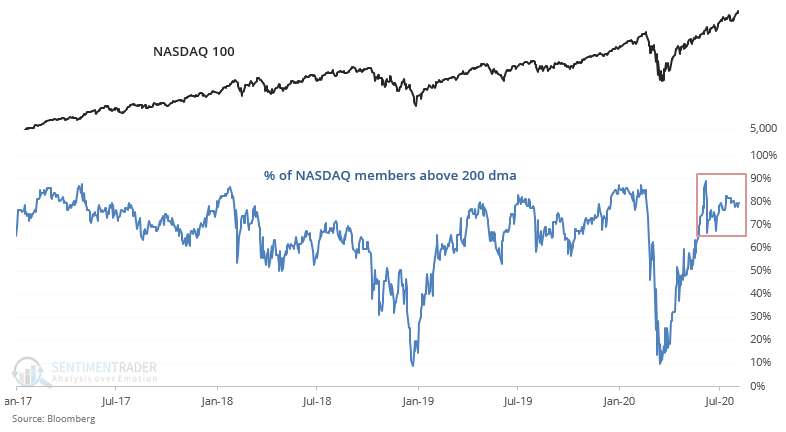

Just to reiterate, a large % of NASDAQ 100 stocks are firmly in a long term uptrend:

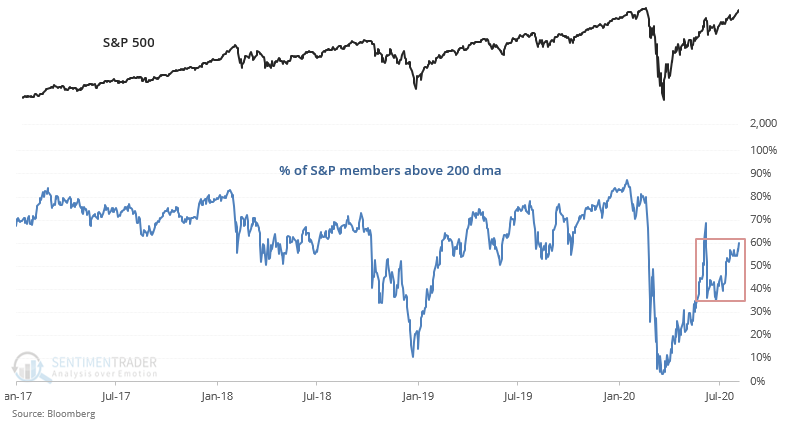

But the outside of tech, not as many of the S&P 500 stocks are above their 200 dma:

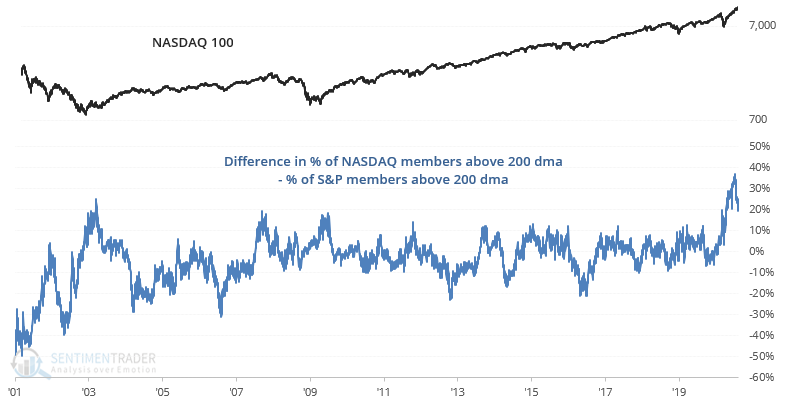

This created the widest gap between the % of NASDAQ stocks that are in an uptrend vs. the % of S&P stocks that are in an uptrend. I repeat, this is not an outright bearish sign, but one has to wonder how much longer this rally can be sustained without widespread participation:

Wrapping up

No one has a crystal into how the future will play out. Those who pretend that they do typically use arrogance to scare people into agreeing with them. Always remember that only you are responsible for your own portfolio. Look at data/charts like this carefully and with a skeptical eye. Always think for yourself.

With that being said, I hope these data points helped you understand some of the risks that the market faces right now. The U.S. stock market's rally is overextended, and this will probably lead to a pullback/correction in the weeks/months ahead. As always, stay alert and stay safe.

Regards,

Troy