Wednesday Midday Color

Here's what's piquing my interest so far today.

Gold continues to rally. GLD just put in its best day in over a month while closing at a 9-month high. Lately, that's led to some backing-and-filling over the next couple of sessions, especially in recent years.

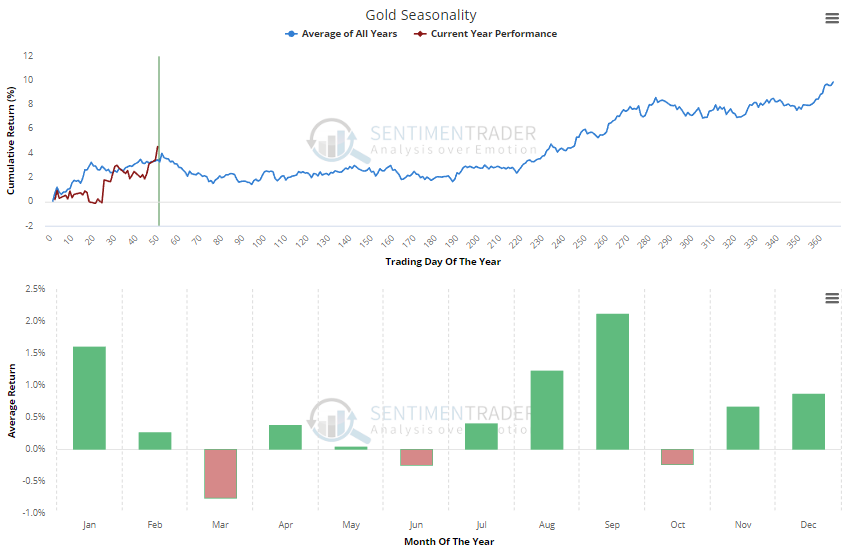

Not working in gold's favor is seasonality. Over the past 30 years, it has peaked right about now.

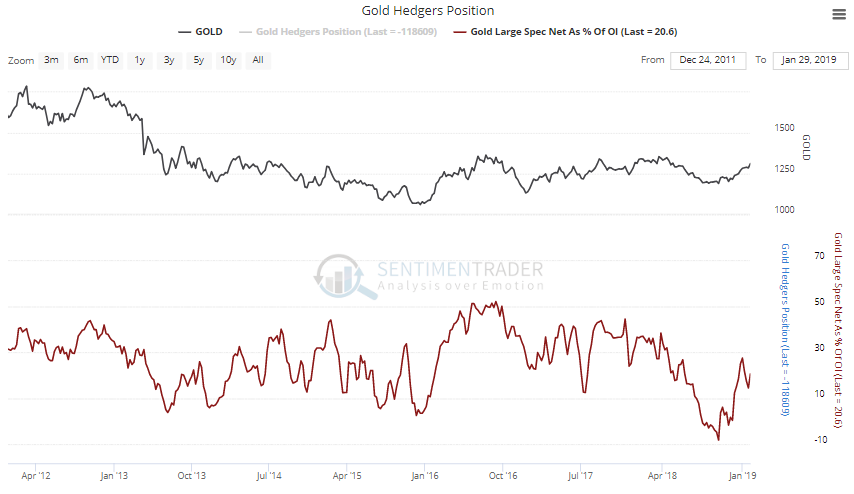

As a % of open interest, speculators in gold futures aren't back up to their recent extremes, though the data is a few weeks old.

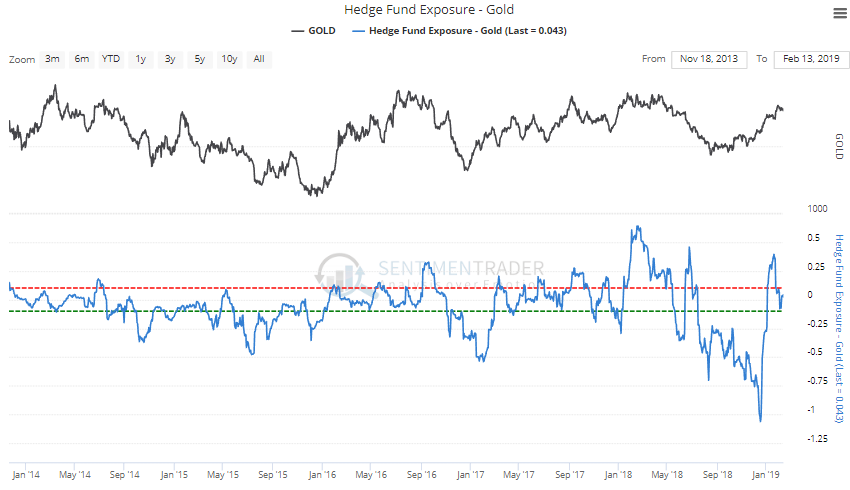

In the shorter-term, trend-following hedge funds have reversed their presumed short position.

In stocks, Tommy Thornton points out that some DeMark exhaustion signals have triggered on the S&P. The opposite are also triggering on the VIX. And it's getting close for gold, as well.

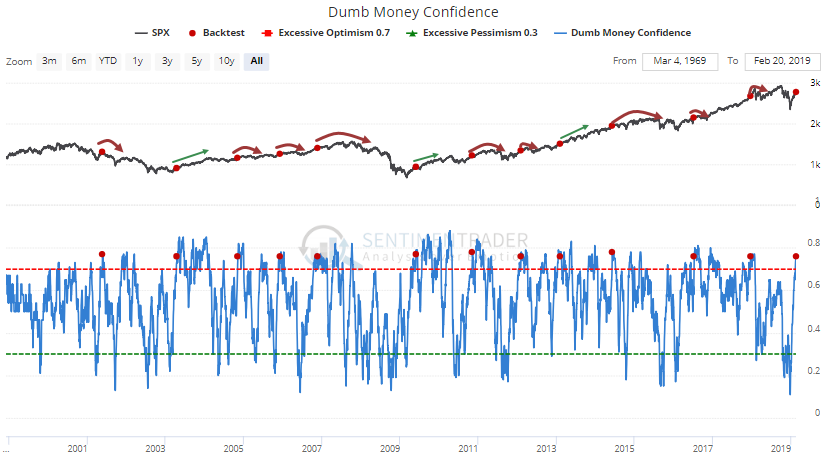

These signals are triggering as Dumb Money Confidence pushes above 75% for the first time in over a year. Other times led to further gains being given back, with the exceptions of the exits from the 2002 and 2008 bear markets, as well as the QE-fueled run five years ago.

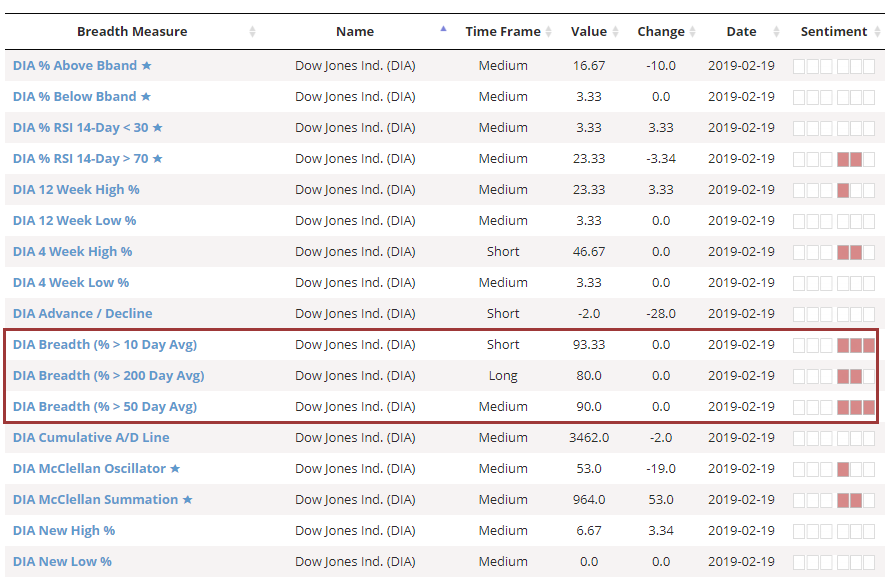

The Sector Breadth section is showing quite a few extremes, with many sectors and indexes showing wildly impressive numbers. The biggest risk is that it's so good, it can't get much better. Take the Dow for example.

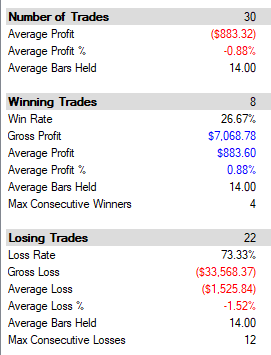

There have been 30 days in the history of the DIA fund when more than 90% of Dow components were trading above their 10- and 50-day averages, but fewer than 85% were above their 200-day averages. Over the next three weeks, DIA continued to rise only 8 times, while declining 22 times.

Overall, the tone is a continued amazement at the persistence of positive breadth, which is an excellent long-term sign, but there are a number of shorter-term warning signs. Not just in stocks, but other markets as well. There aren't many places with a well-defined, positive risk-reward ratio right now.