Wednesday Midday Color

Here's what's piquing my interest so far on this recovery day.

Breadth Moves

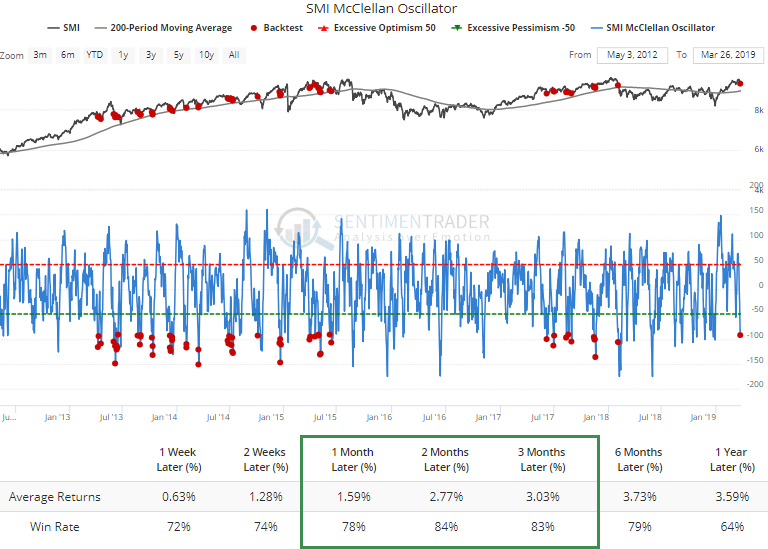

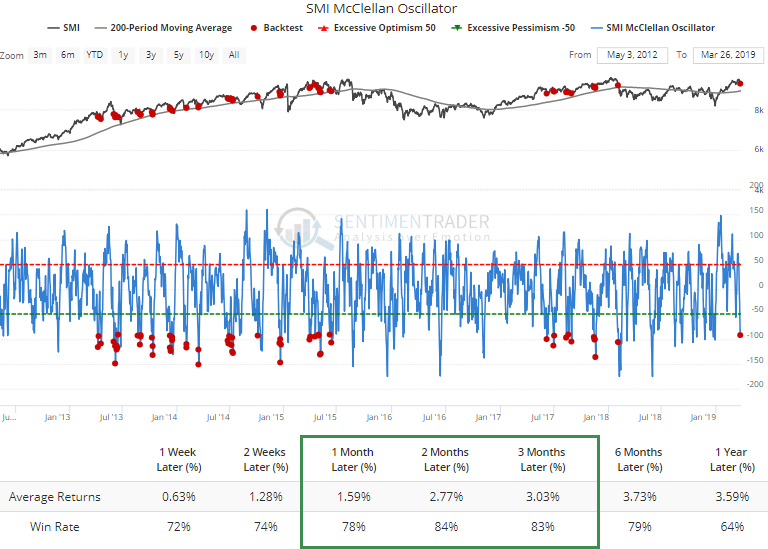

A somewhat swift dip in Swiss stocks moved the McClellan Oscillator below -90 for the SMI. Since that market's major low in 2011, readings like this in an uptrend have had a strong tendency to rebound. A caveat is that the biggest failure was the last one, in February 2018.

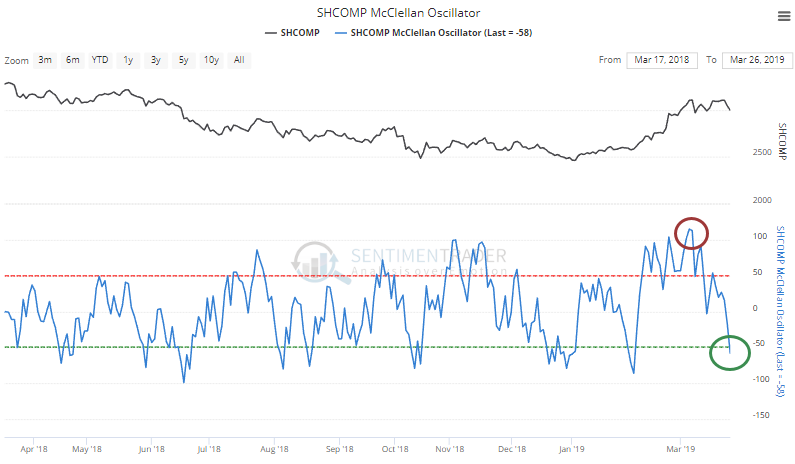

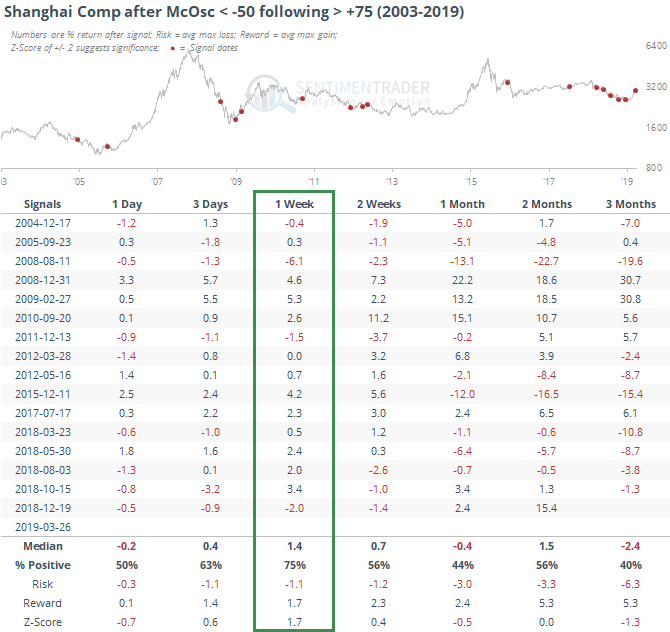

On the Shanghai, we're seeing the first oversold reading following what had been a historic impulse to the upside.

That has typically led to a rebound over the next week, but mixed after that.

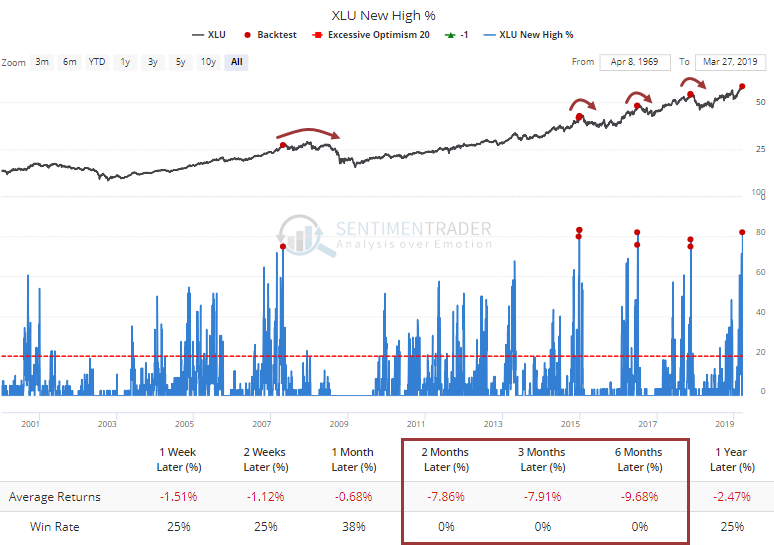

The surge into defensive sectors led to more than three quarters of utilities stocks hitting a fresh 52-week high. The sector has shown incredible momentum for such a normally staid group of stocks, but whenever so many of them have hit a new high at the same time, it hasn't been sustainable.

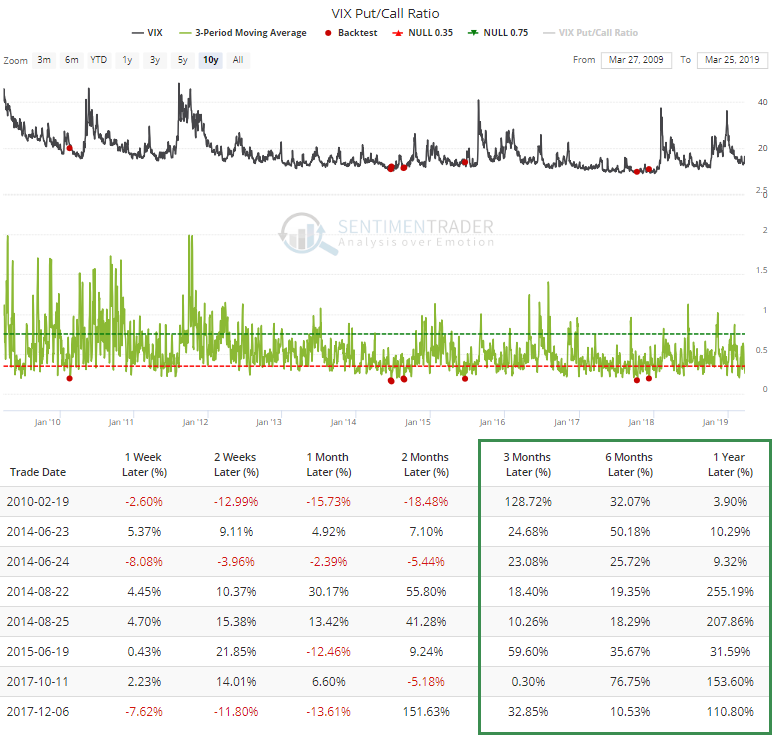

VIX Buyers

For the past three sessions, options traders on the VIX have traded 5 times more calls than puts. This is aggressive, and has been seen only a few times since the financial crisis. In 2010, the VIX continued to sink in the weeks ahead before spiking. The other times, a spike was quicker to evolve according to the Backtest Engine (h/t to Helene Meisler)

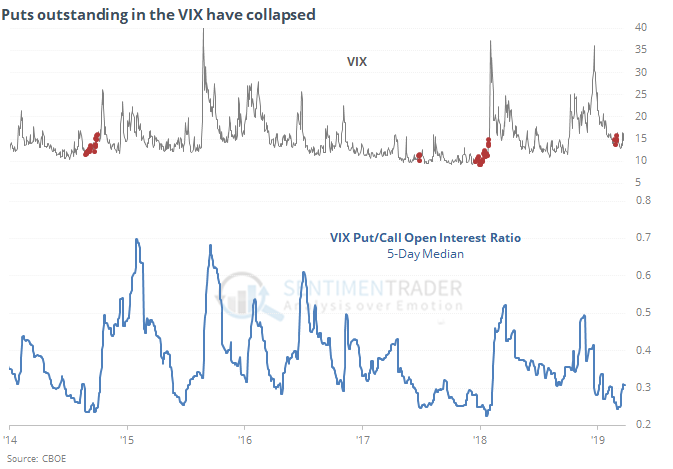

This is happening as the open interest in VIX put options has collapsed, while call open interest has increased. The 5-day median open interest ratio in the VIX is just now climbing from an extremely low level. It's been this low only three other times, all within the past four years, and all leading to a jump in volatility.

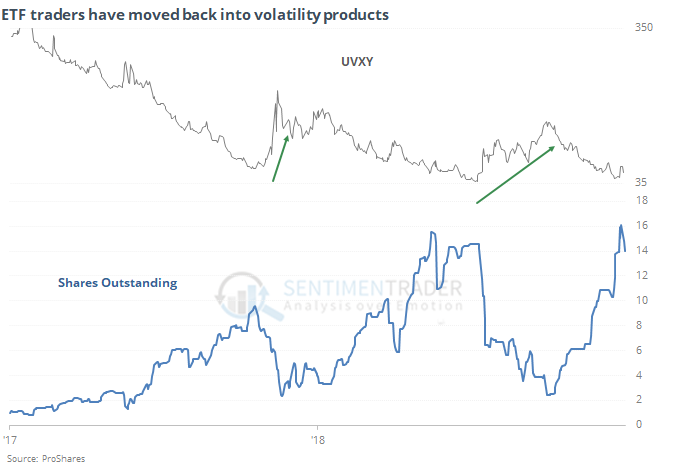

There has also been a surge in shares outstanding in VIX ETFs like UVXY. This usually happens when those funds collapse and are about to make another run higher.