Wednesday Midday Color - Bond Bulls, High-Yield Breadth, Lagging S&P Stocks, Tech Values

Here's what's piquing my interest so far today.

Bond Bulls

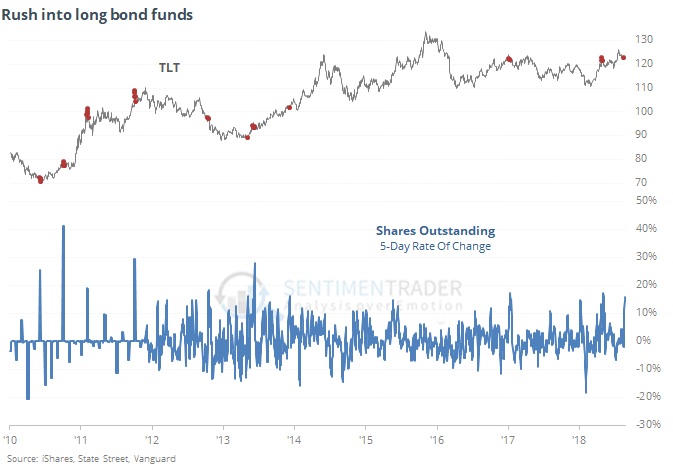

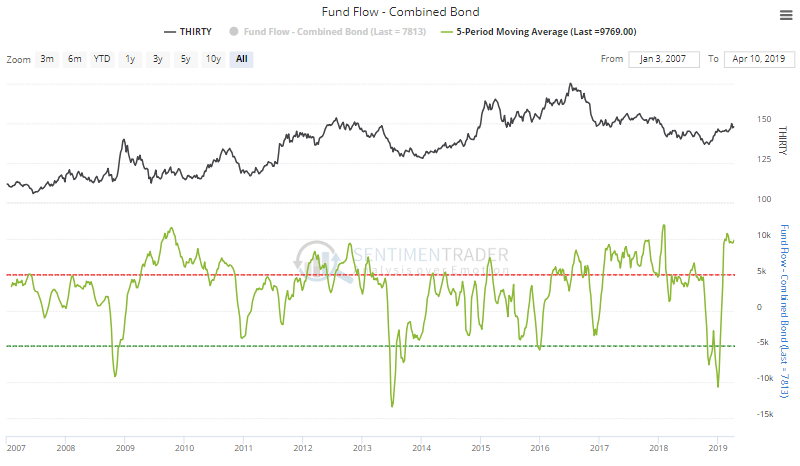

The rush into long-term Treasury ETFs has been really something. Four of the largest funds have increased their shares outstanding by more than 15% in just the past week. The last couple of times, that coincided with short-term exhaustion in funds like TLT.

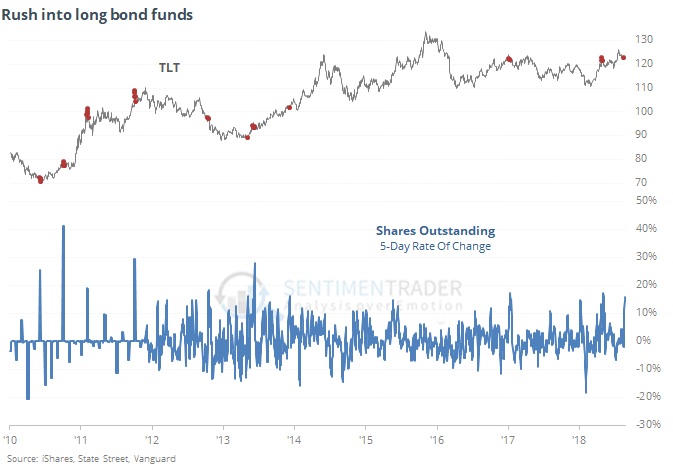

Over the past 100 days, the funds have added more than 55% to their assets. That ranks among the largest ever, but was not a sign of excess. Flows like this tend to be better at indicating fear conditions rather than greed. Buying when this rate of change was below -25% would have been an excellent signal for TLT.

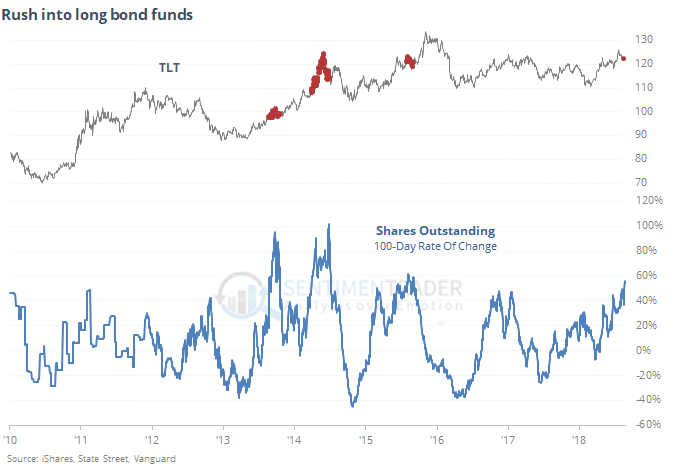

Over the past 5 weeks, there has been an average inflow of nearly $10 billion into bond funds. That's extreme, but again it's been an inconsistent indicator on the upside.

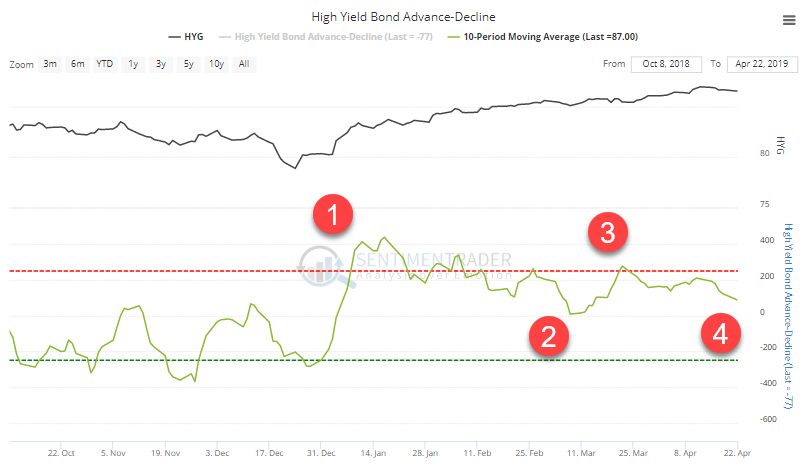

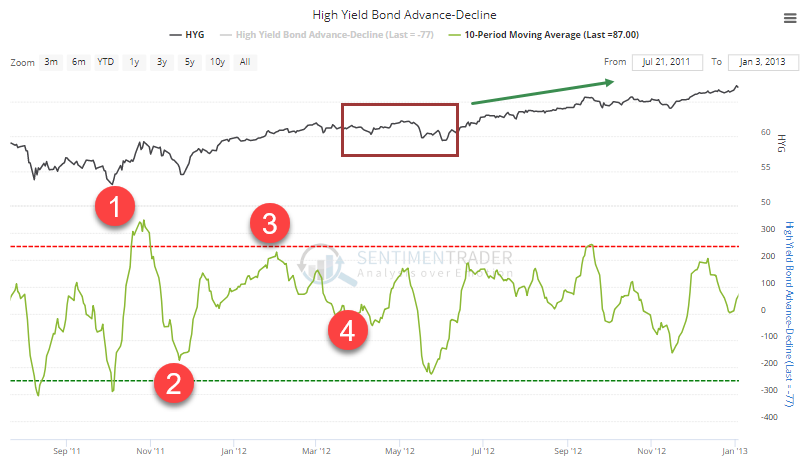

In high-yield bonds, we're seeing less and less enthusiasm as the uptrend has progressed. There was 1) an initial surge, then 2) the first pullback, then 3) a secondary push, then 4) grinding higher on less participation.

That happened after the rally in 2011.

And to a lesser extent in 2016.

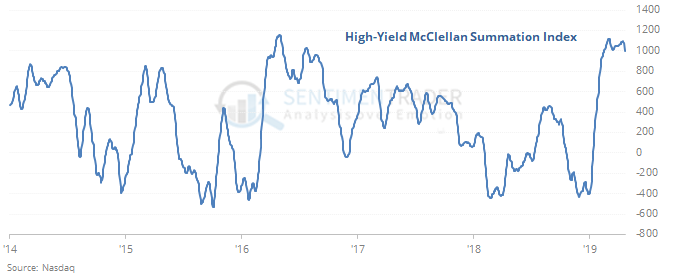

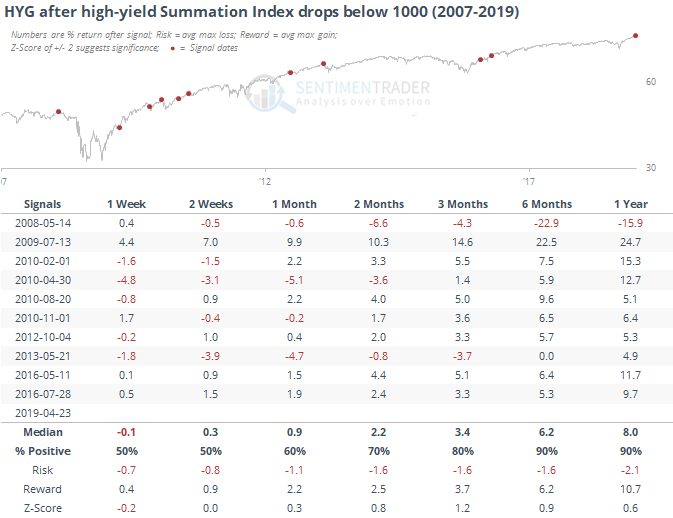

The ebbing momentum is causing the McClellan Summation Index for high-yield bonds to curl down and fall below 1000.

That has not been a particular worry.

Breadth Review

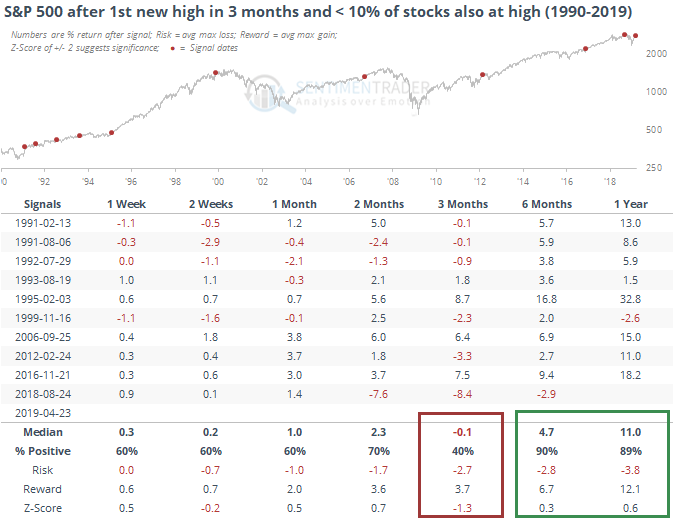

The S&P 500 hit a new record high but fewer than 10% of its components went along for the ride.

Not terrible returns, but there were several failures over the next three months.

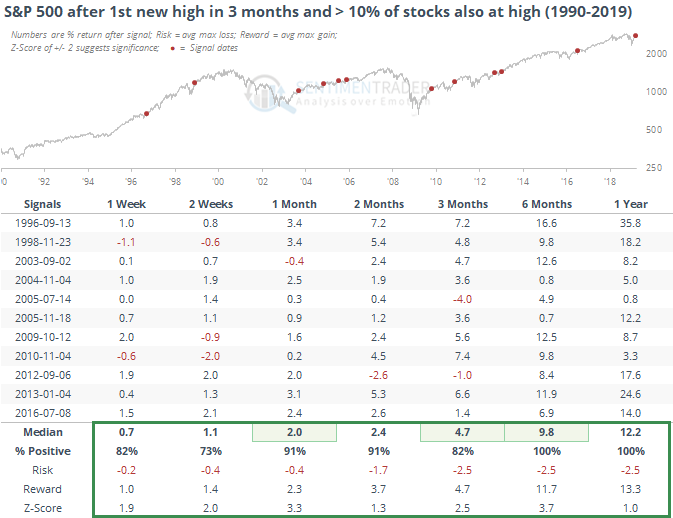

Contrast that with times when more than 10% of stocks also hit a new high along with the S&P.

Tech Valuation

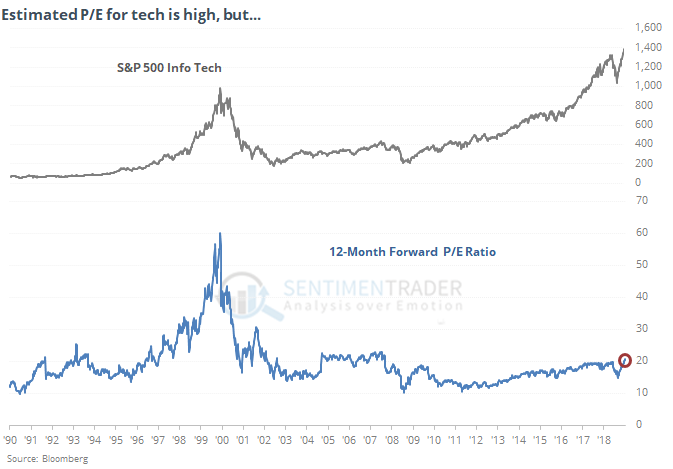

Bloomberg notes a semi-scary data point - tech valuation is the highest since 2007. Investors are pricing the S&P 500 Info Tech sector at nearly 20 times estimated earnings over the next year.

If we zoom out, though, the perspective changes quite a bit.

Doesn't seem quite so scary.