Wednesday Midday Color - Technical Buy, Asia Flows, Economic Woes

Here's what's piquing my interest so far on this waiting-for-the-Fed day.

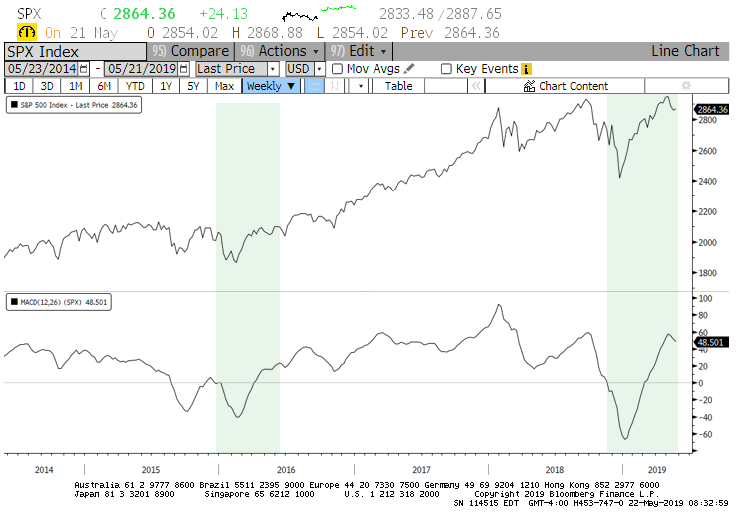

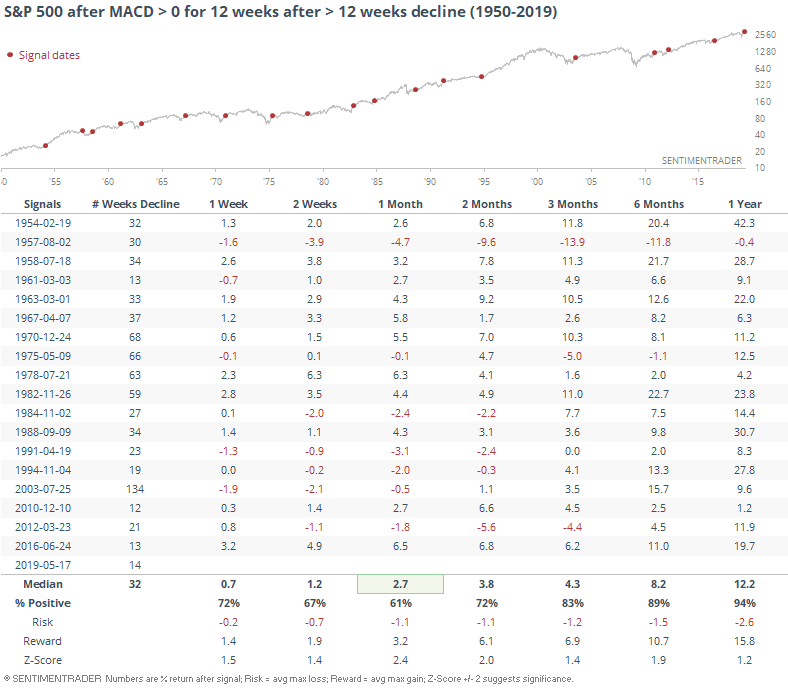

Momentum Shift

Marketwatch notes that there has been a long-term momentum shift in stocks that has had an unerring ability to lead to higher prices. This last happened in 2016, according to a popular technical indicator.

If we look for times when MACD had been negative for at least 12 weeks and then turned positive for 12 weeks, it has been a positive signal for forward returns across all time frames, with good consistency on longer-term ones. A year later, there was only a single loss, and it was minuscule.

If we focus on longer time frames, returns continued to be somewhere between good and excellent. Over the next 2 years, there was a 100% win rate and the risk/reward ratio was ridiculously skewed to the upside.

This is not an indicator we regularly follow, we could always find one indicator or another that gives whatever message we want to send, and it didn't work so well pre-1950, so won't be including it in the Active Studies. It's some confirmation that the previous momentum studies we've looked at, though, are still valid.

Flow

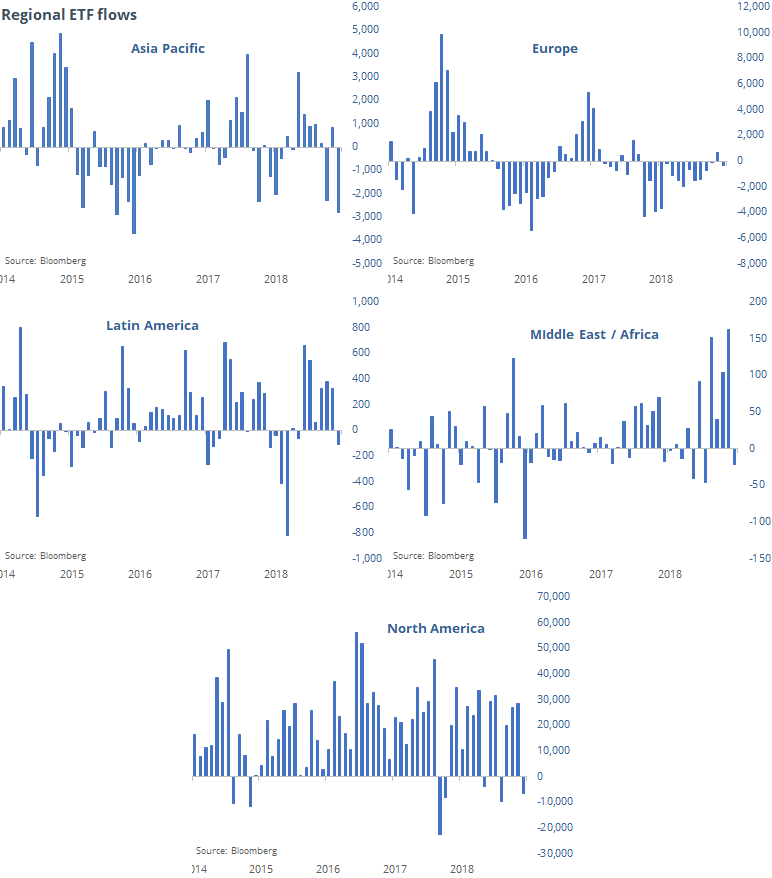

So far this month, investors have been busy pulling money from ETFs focused in Asia. Pretty much all other major regions as well, but not to nearly the same extent.

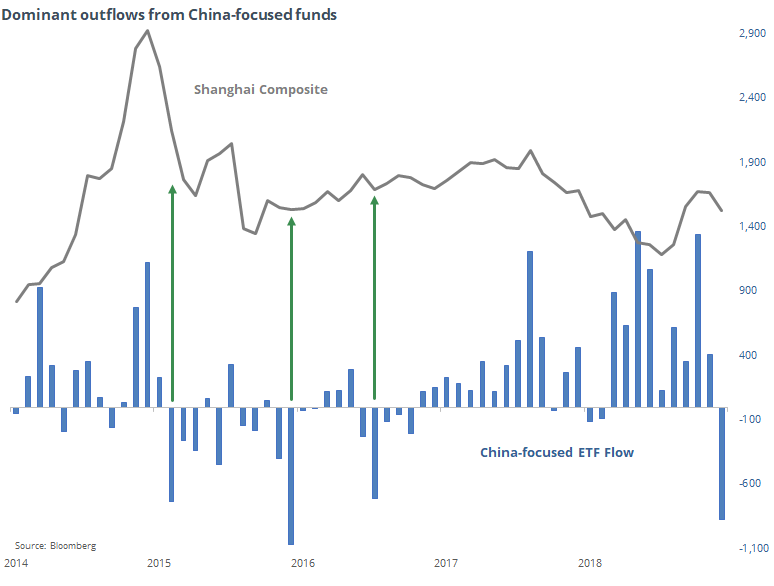

Much of that outflow in Asian funds is focused on China, with the consensus opinion being that investors are nervous about the trade war and other economic worries.

Fund flows are an iffy indicator sometimes, and that seems to be the case here. While a huge outflow seems like it should be a potential buy signal, it has been inconsistent the few times it has been seen before.

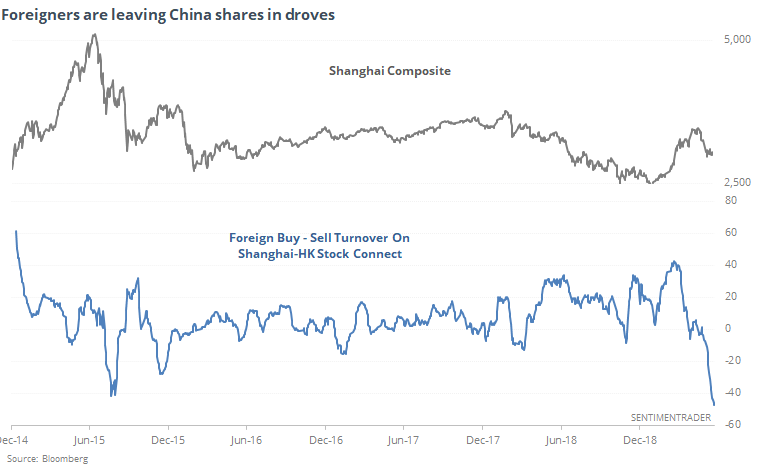

We can also see foreigners leaving Chinese shares via the Shanghai - Hong Kong Stock Connect program. Over the past 20 days, the outflow has hit a record low. It has a mixed record at being a contrary (or otherwise) indicator, however.

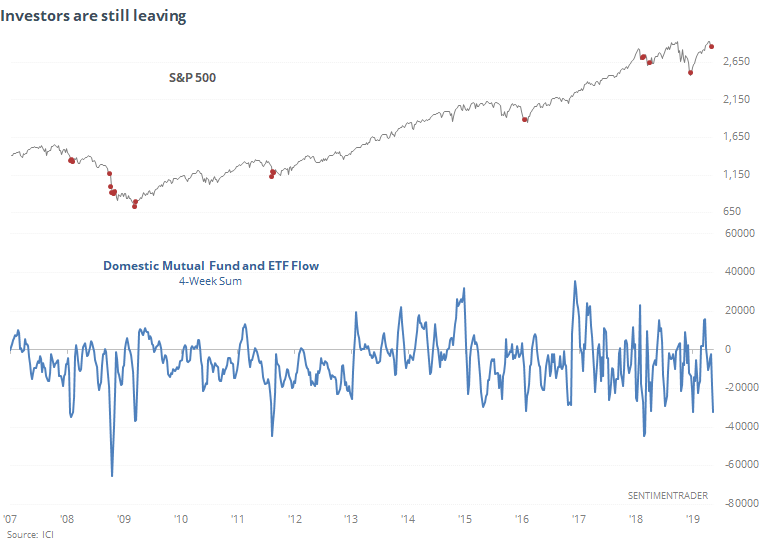

We've already touched on this before, but the latest aggregate fund flow data from the Investment Company Institute shows that investors in domestic (U.S.-focused) mutual funds and ETFs have pulled more than $34 billion in assets over the past four weeks. The little red dots on the chart show us that other times flows have been this negative, stocks did well (okay, the fall of 2008 not so much).

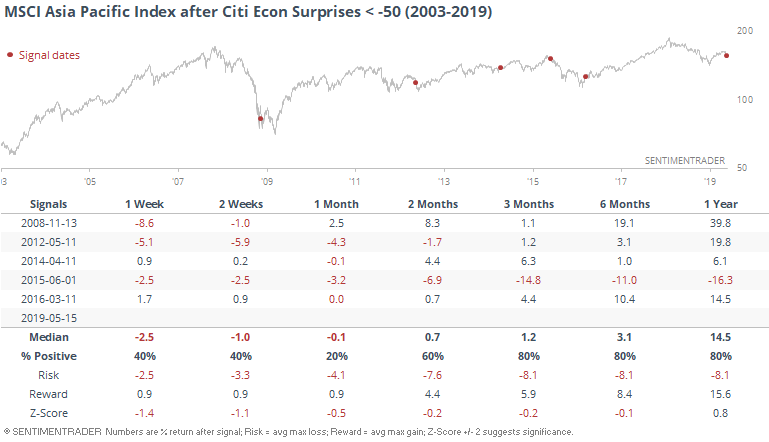

Economic Woes

The WSJ notes that part of the nervousness in Asian shares is due to poor economic results. The Citigroup Economic Surprise Index for Asian Pacific countries is down to -50, one of the worst readings in 16 years.

As we've seen with other economic surprise indexes, this is usually more of a contrary indicator for stocks than it is a harbinger of trouble ahead. By the time economic reports have been this bad, for this long, stocks have typically already born the brunt of the selling pressure from forward-looking investors.