Wednesday Midday Color - Big Outflows, More Hedging, Falling Momo

Here's what's piquing my interest so far today.

Flows

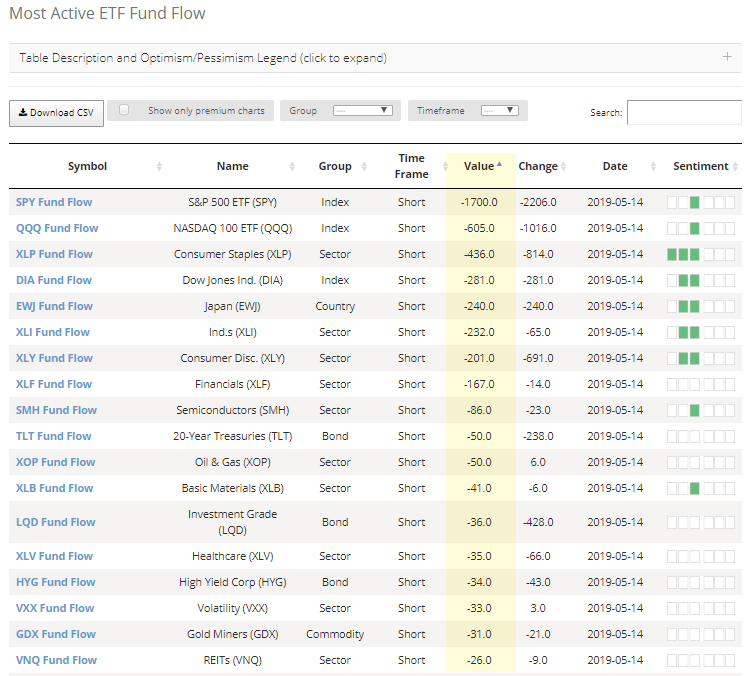

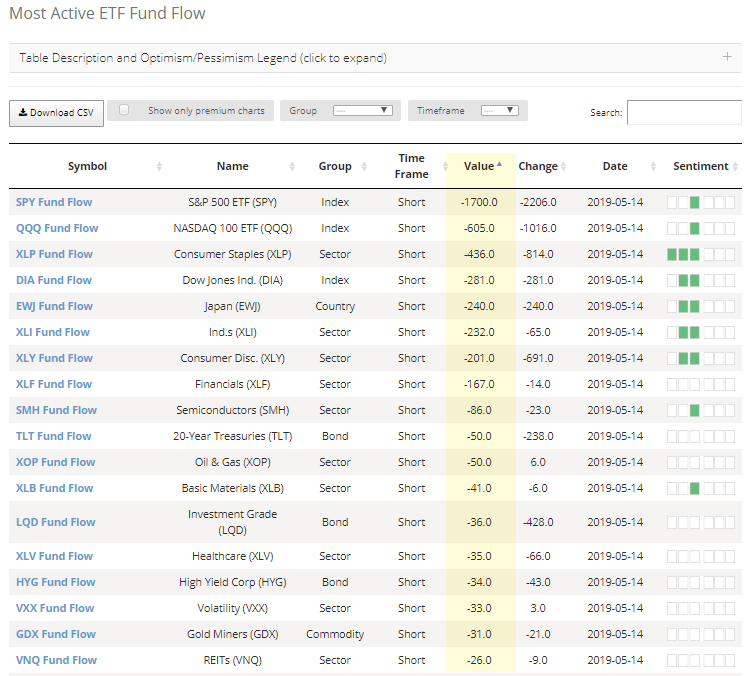

On Tuesday, there were outflows among a large number and variety of equity funds. A bunch of them lost more than $25 million in assets on the day, led by the two most popular.

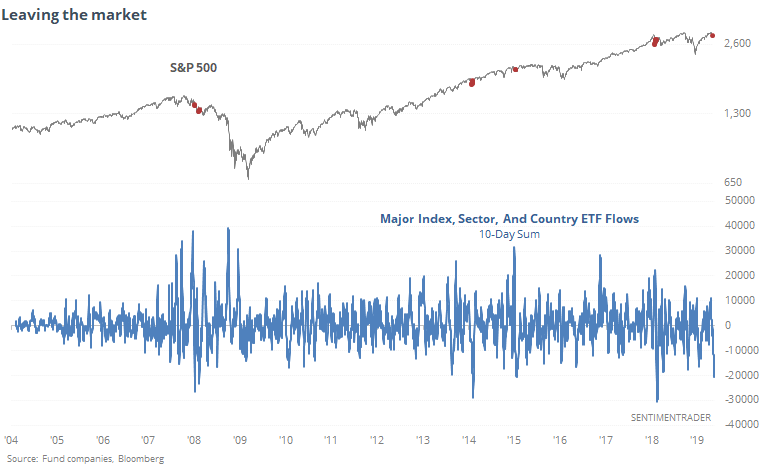

That continues a trend for both SPY and QQQ. Across all of the major index, sector, and country ETFs that we follow, they've lost more than $20 billion in assets over the past two weeks.

We can see from the chart above that when the flows get this heavily tilted to the downside, it's meant some relief for stocks, for a while at least.

Hedging

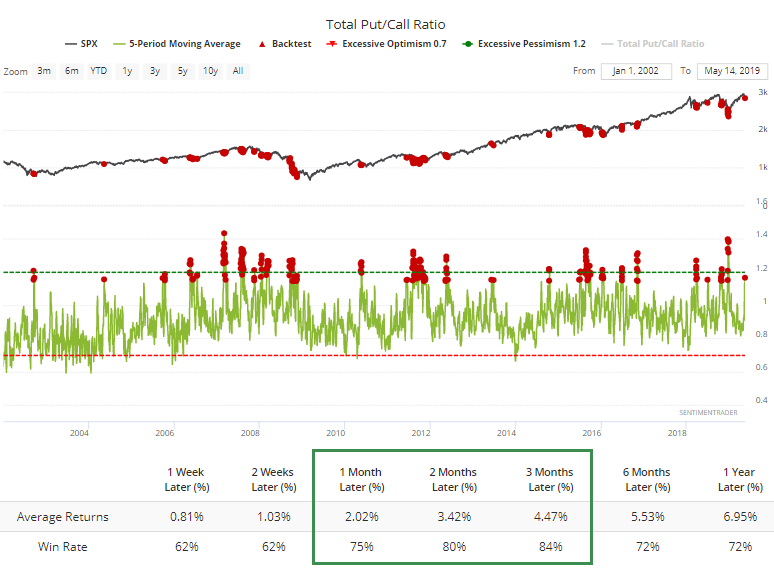

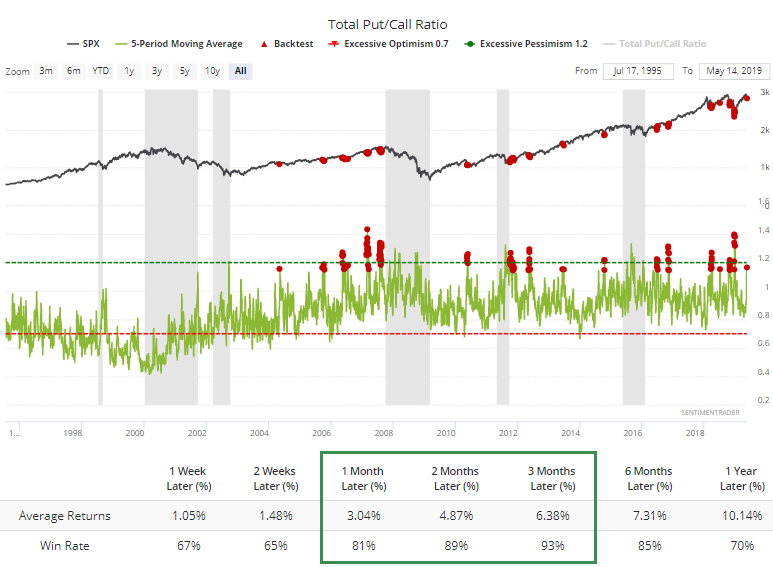

There has also been a pickup in assumed hedging activity, judging by the protracted rise in the Total Put/Call Ratio. It has been above 1.0 for the past 5 sessions, meaning more puts have been traded than calls every day for the past week. The average is now 1.15, which has been high enough to be contrarian on a medium-term time frame.

Especially during bull markets.

Breadth Review

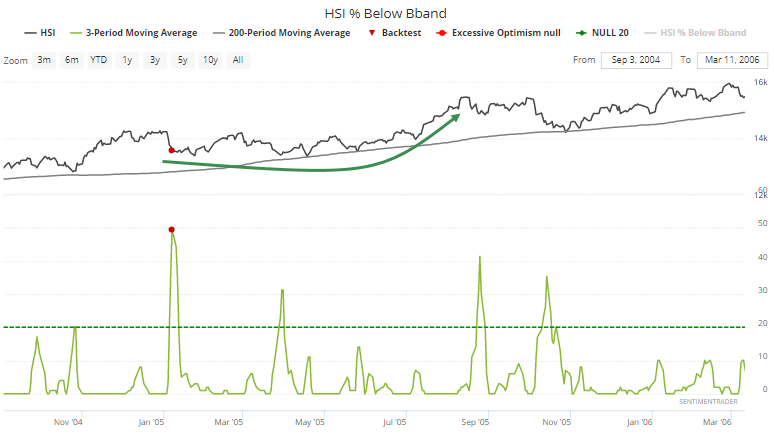

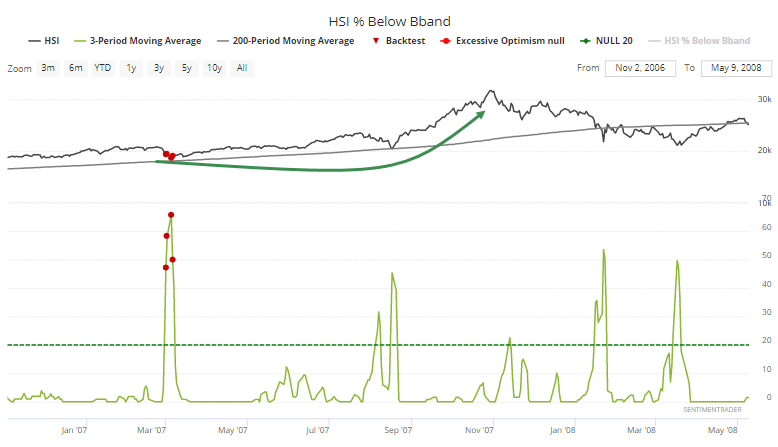

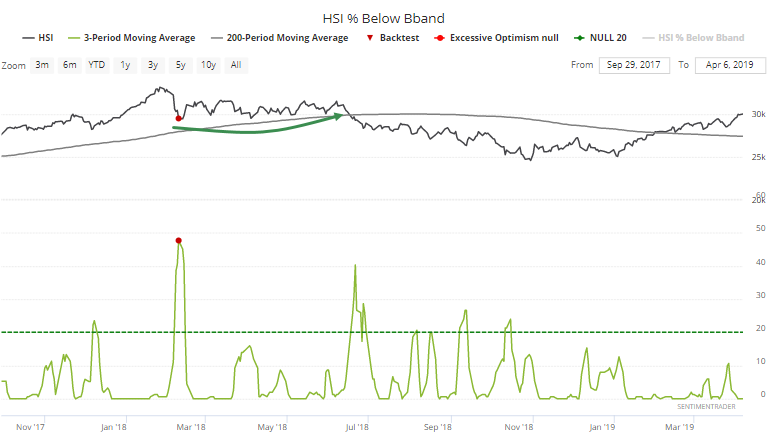

Within the Hang Seng, an average of more than 45% of stocks have traded below their lower volatility bands over the past 3 sessions. That's a very high figure for when the index itself is still trading above its 200-day average. It has triggered only a few other times, all leading to medium-term gains, but one had to be nimble in 2018.

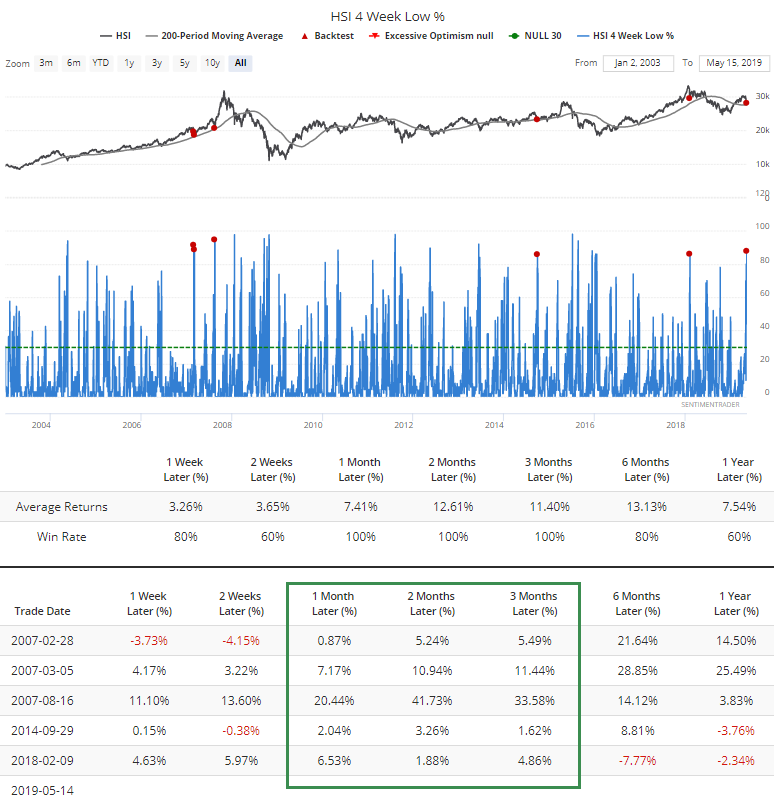

This is also one of the few times that more than 85% of stocks in the index collapsed to at least a one-month low while the index was still above its long-term average.

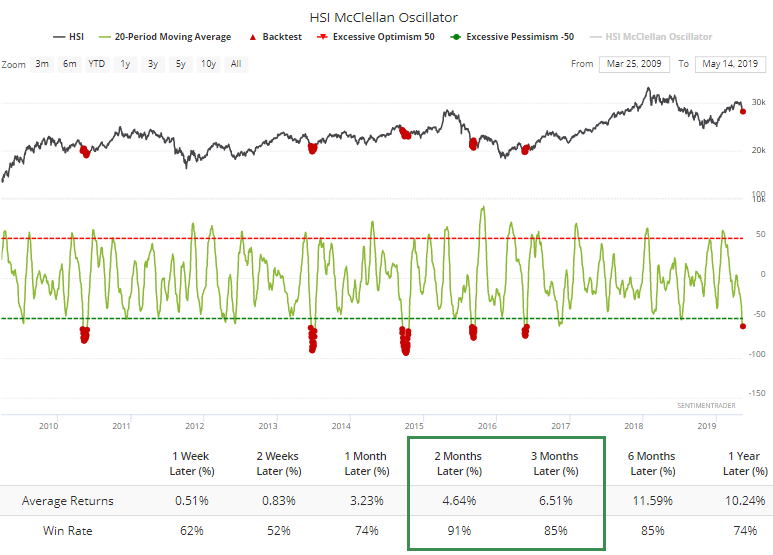

The selling has been intense, broad, and persistent enough to drag the 20-day average of the McClellan Oscillator for the Hang Seng below -60. Including all market environments, it has dropped this low five other times, all since 2010.

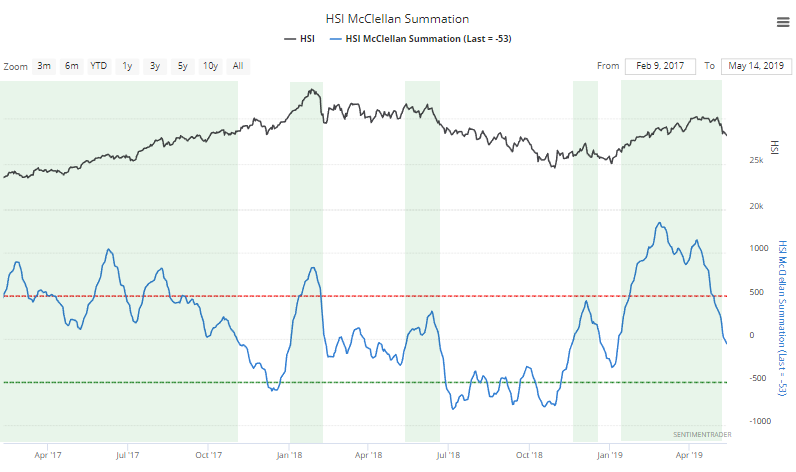

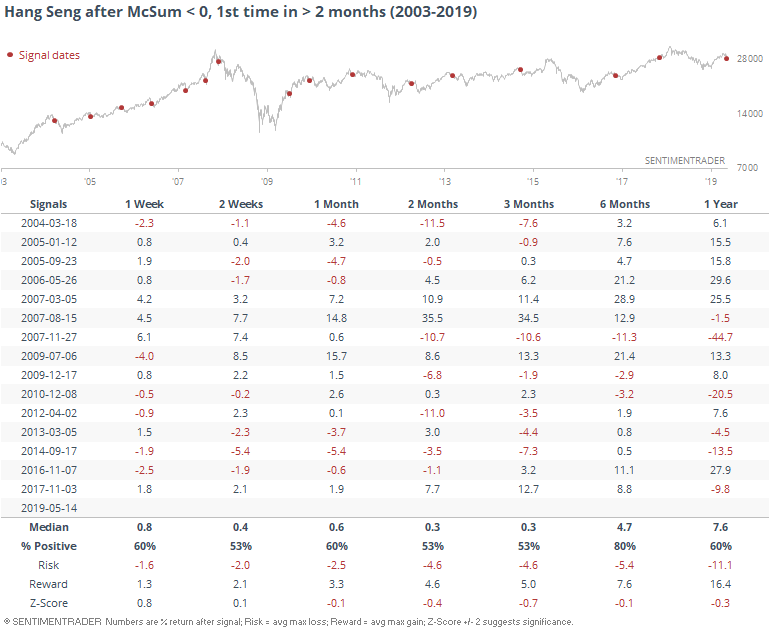

Momentum has ebbed enough that the McClellan Summation Index dropped below 0. Very generally, markets do better when the Summation is above zero than below.

A mitigating factor is that momentum had been strong enough that the Summation Index was above zero for months before falling below. After these kinds of scenarios, returns were better...but it's still best of the indicator goes back above the zero line.

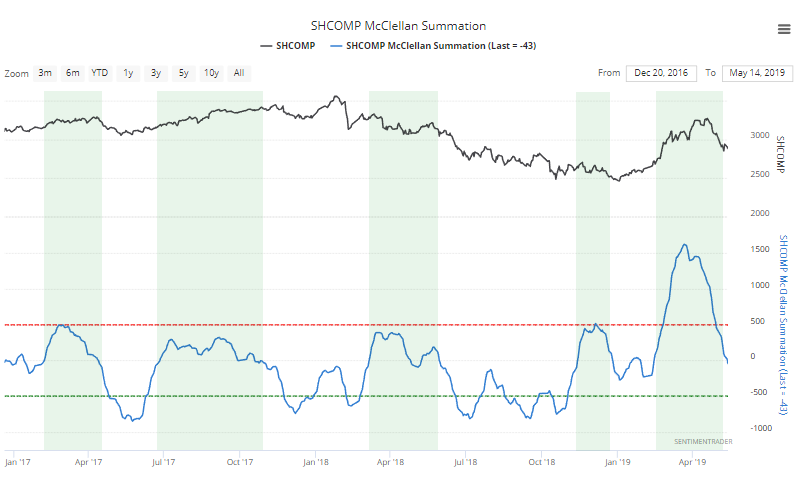

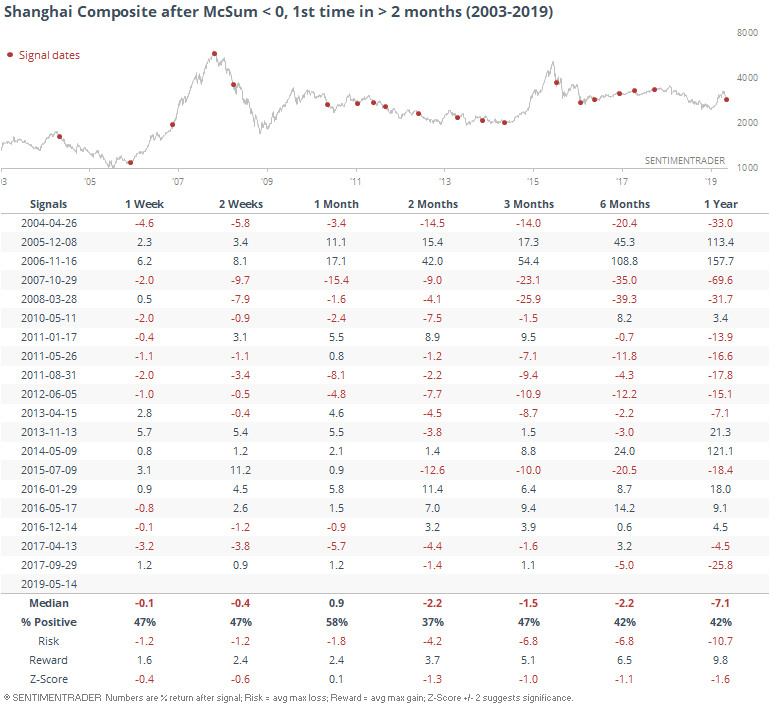

It's also happening in the Shanghai Composite.

Here, the loss of long-term underlying momentum has been much more of an issue.

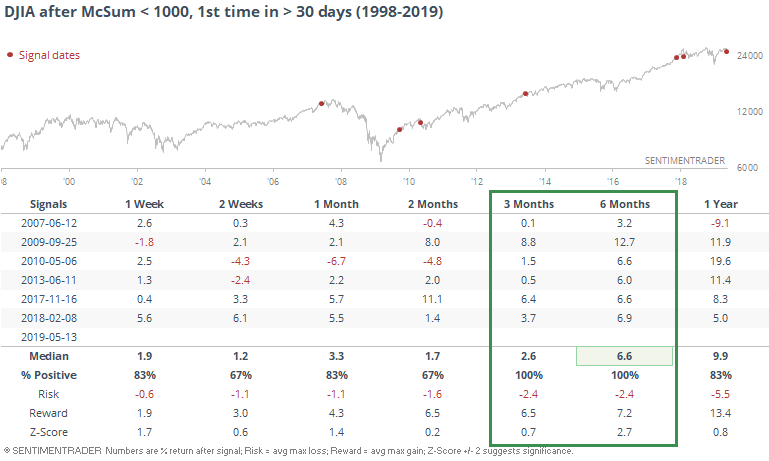

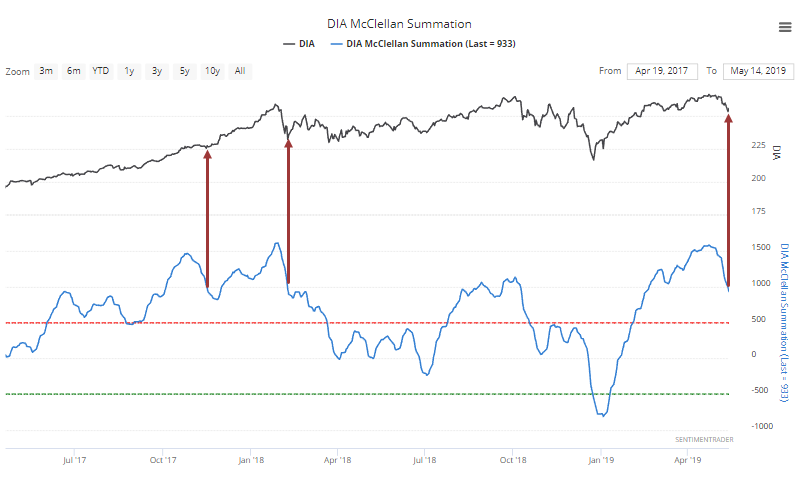

In the U.S. momentum has been much strong, and the Summation Indexes for the major indexes and sectors are all much higher than overseas markets. For the Dow Industrials, the Summation just fell below 1000 for the first time in more than 30 days.

Since 1998, there haven't been many times it went this long with this kind of persistent momentum. it was a good medium-term sign.