Wednesday Color - Quiet, Fed Talk, Pound, Copper, Bond Optimism

Here's what's piquing my interest as traders react to the latest Fed talk.

All Quiet

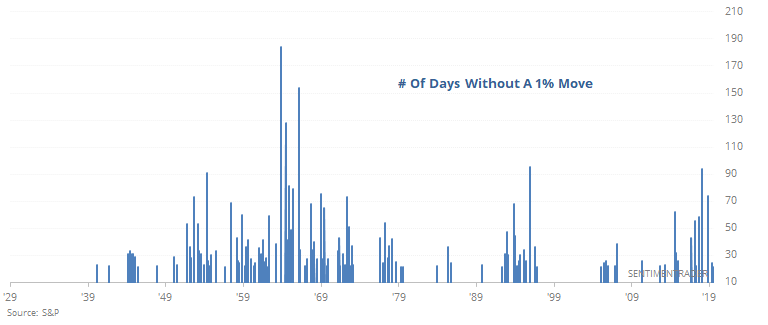

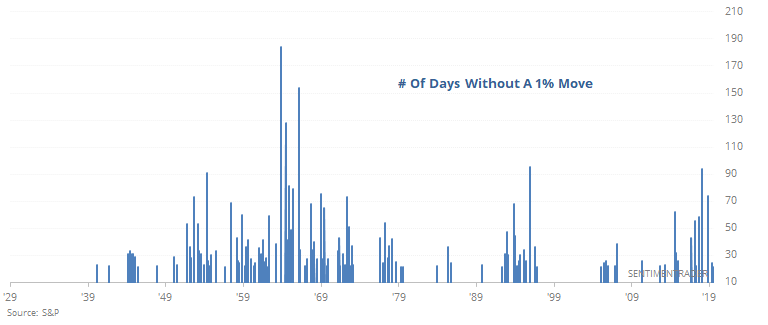

The WSJ notes that stocks haven't been moving much lately, with the S&P 500 notching its 21st day without a 1% or larger move. This is encroaching on some of the longer streaks in its history, especially when the index is flirting with multi-year highs. It has gone on much, much longer, but still this is a relatively long stretch.

In terms of predictive ability, there wasn't much. Returns over the next month were somewhat weak, with a poor average return and risk higher than reward. Other than that, about in line with random.

Round And Round

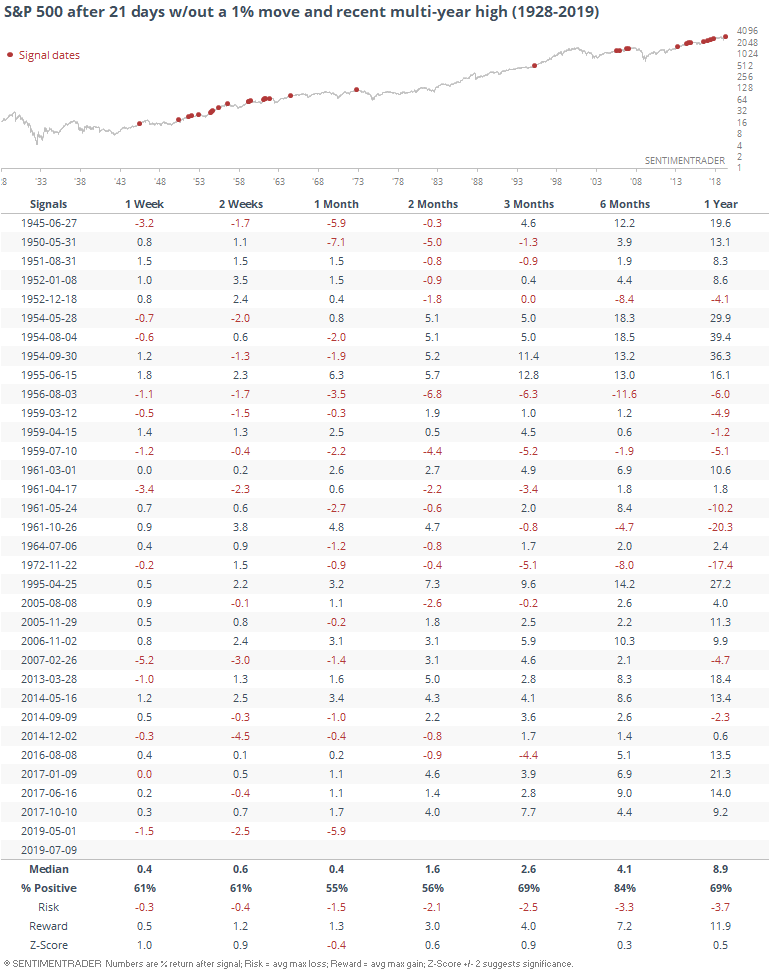

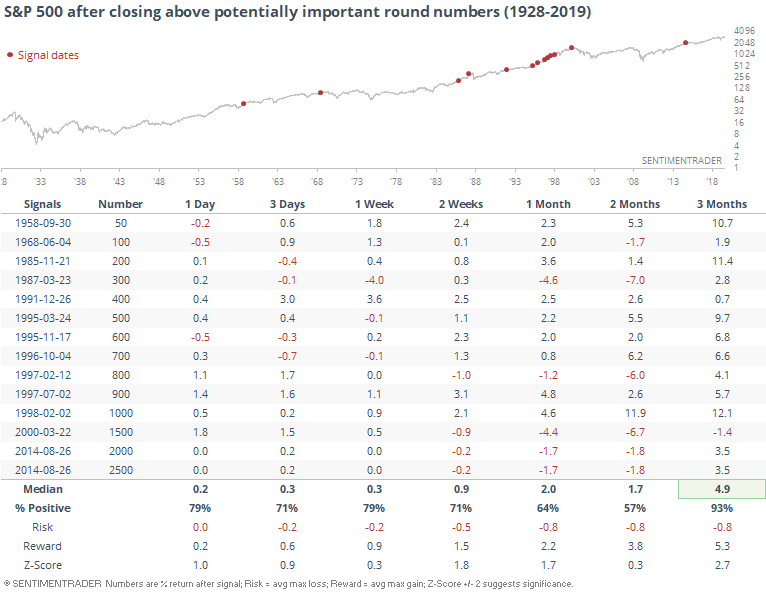

While today isn't yet on track to break the quiet streak, the S&P 500 might close above 3,000 for the first time. According to the media, this is a "psychologically important" number for investors. Why that might be so, I have no idea.

For what it's worth (which is nothing), here is how investors reacted after other times the S&P broached a "psychologically important" round number.

Fed Speak

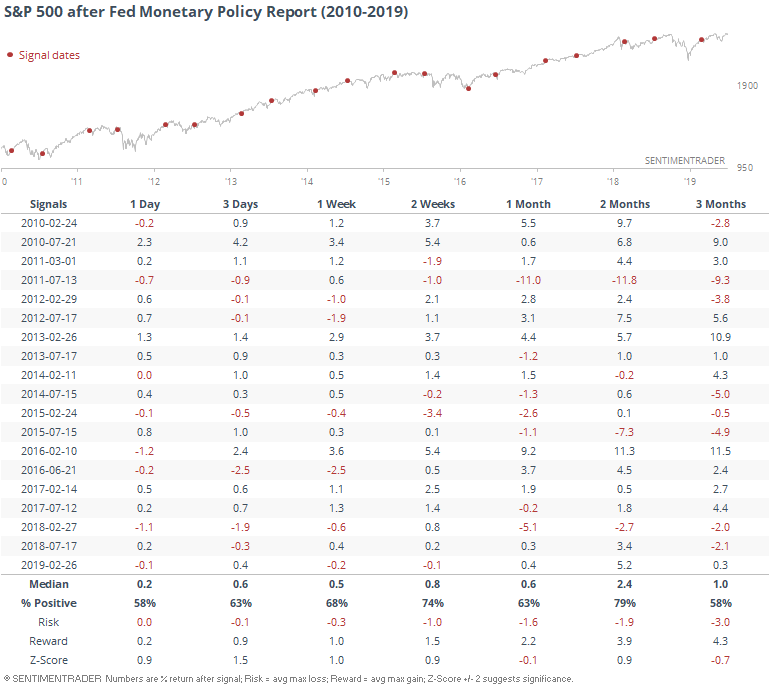

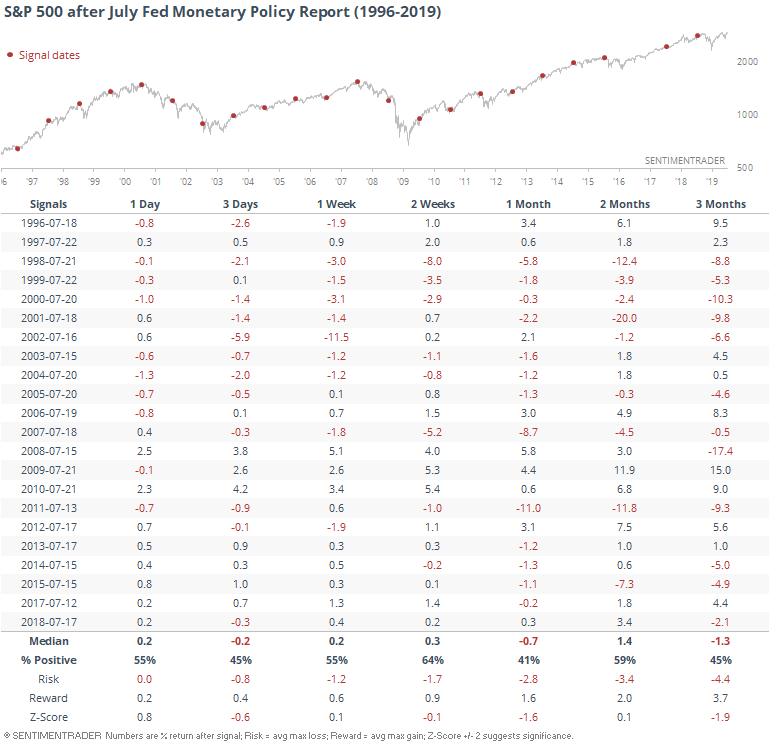

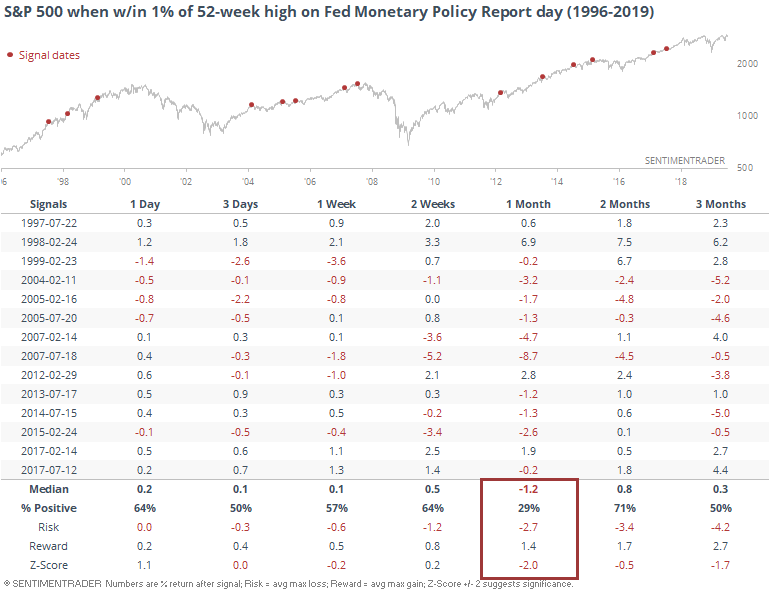

Part of the reason for the recent lack of movement could be investors waiting to hear the Fed Chairman's semi-annual testimony to Congress. We've looked at this a lot in the past, and it used to have a more consistent impact on markets. Not so much since the financial crisis, with mixed-to-positive returns for the S&P 500.

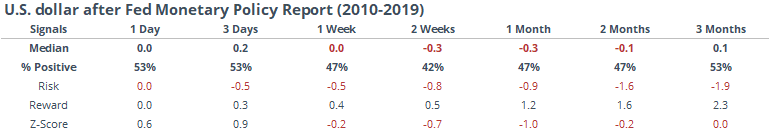

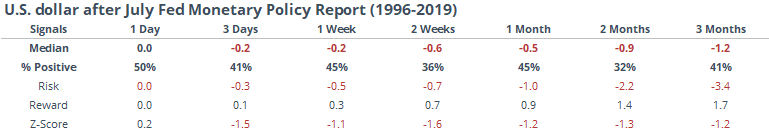

The dollar took the testimonies a little harder than stocks.

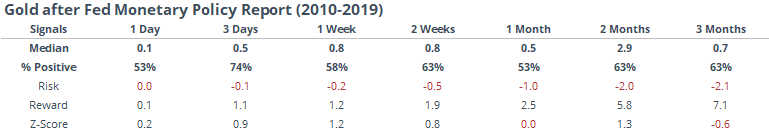

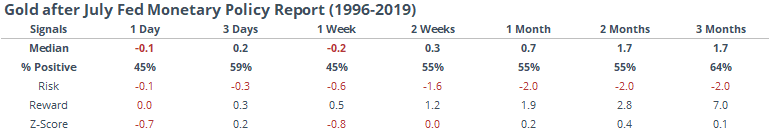

That helped gold a little.

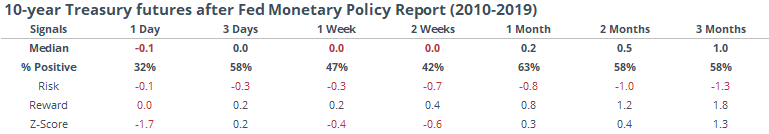

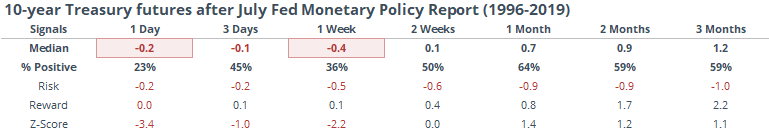

Bond prices tended to decline (yields rise).

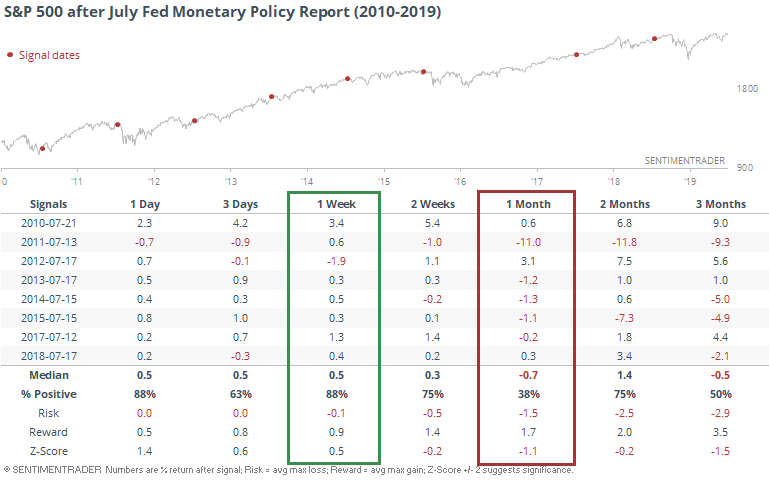

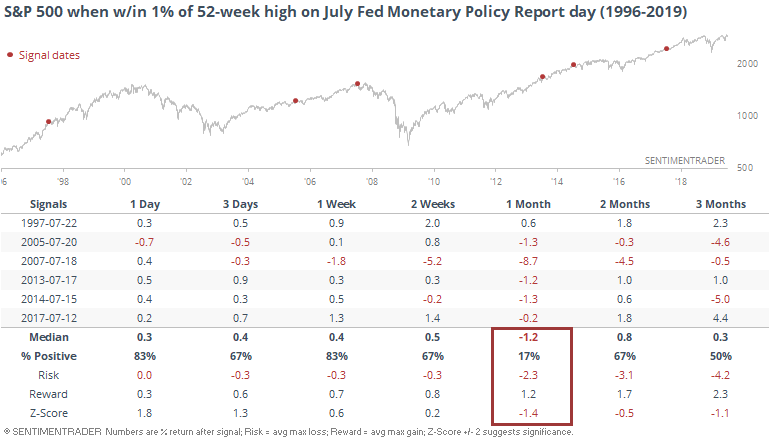

If we just focus on the July testimonies, then since the financial crisis, the S&P has rebounded over the next two weeks every time but once, though most of those rallies ended up failing and the S&P tended to be weaker over the next month.

This is probably a lot more due to seasonal summer weakness as opposed to anything the Fed chair says, but whatever the reason, the S&P rose over the next month only 41% of the time since 1996.

The dollar really struggled, managing only 7 gains out of 22 attempts during the next two months.

Gold was mixed.

Bond prices had a more consistent tendency to drop.

One other factor is that stocks have been reacting positively to the Fed and its recent stance. When the S&P was within 1% of a new high during one of these testimony sessions, it did not do well over the next month.

Especially in July.

Pounded

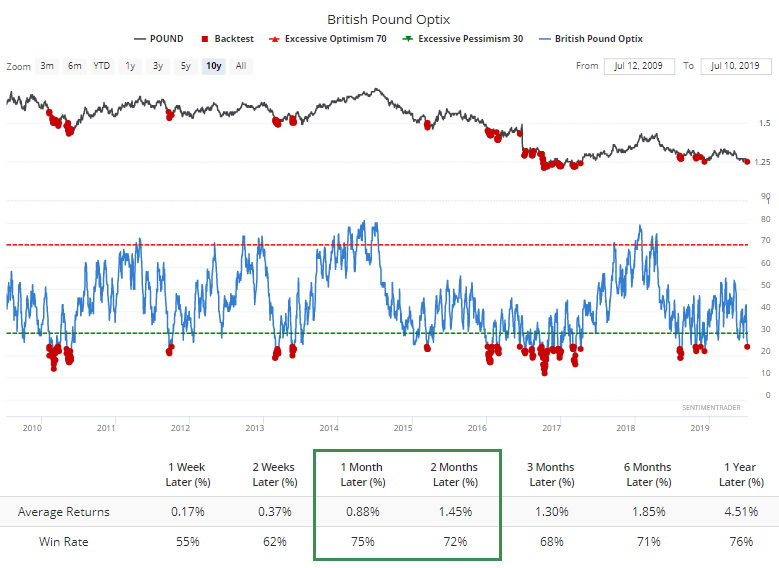

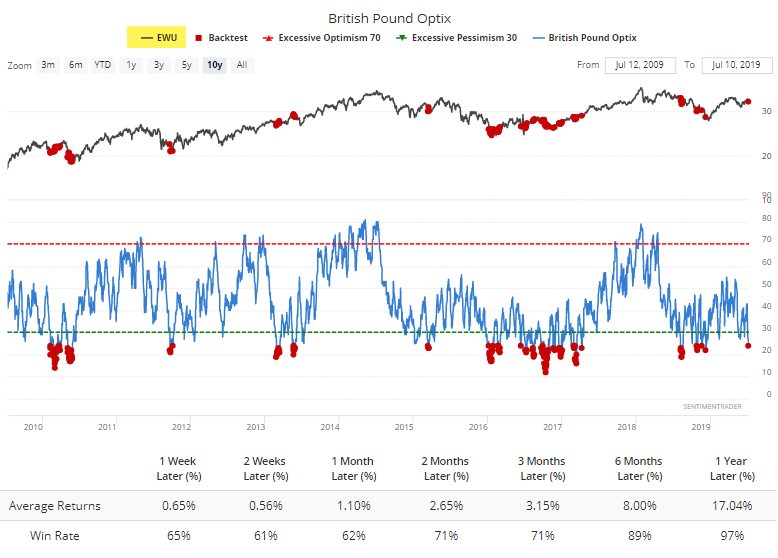

Political uncertainty has helped push sentiment toward the British pound to an extreme low. It's not *quite* to the depths its reached over the past decade or more, but it's low enough to be considered extreme. That didn't help the currency at all during 2008, but over the past decade, it has tended to snap back over the next 1-2 months when the Optimism Index dropped below 25%.

The iShares United Kingdom ETF also tended to rise after these extremes in the pound.

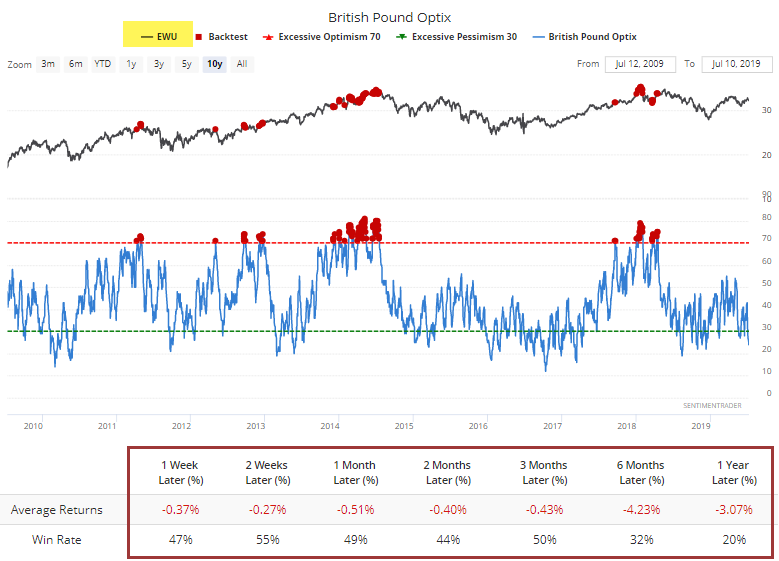

That's certainly a lot better performance than when sentiment on the pound was optimistic.

Gas Recovery

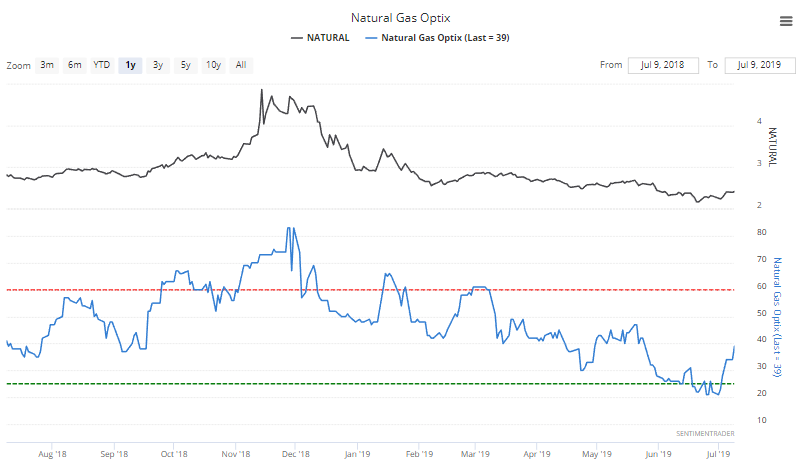

Near the end of June, we saw that optimism on natural gas was about wiped out, which has had a strong tendency to lead to rebounds over the next month or so.

Now that gas has perked up some, its Optimism Index is rising and is almost back to neutral.

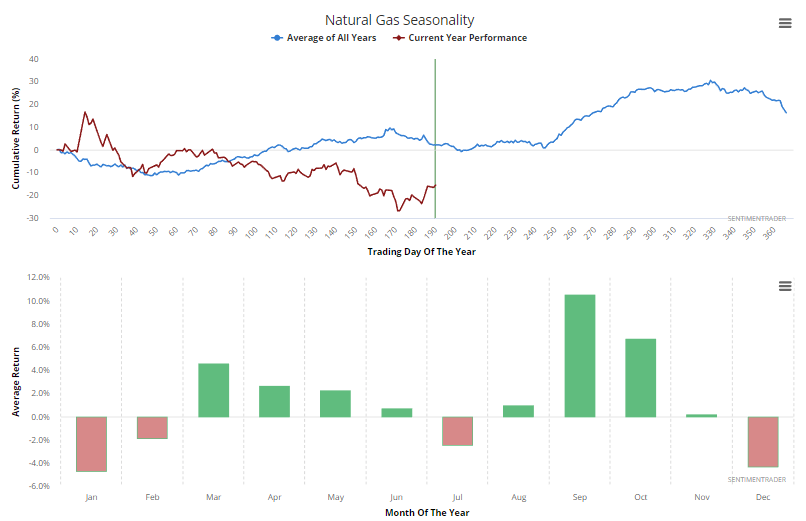

Gas is still in what has been a seasonal weak spot, but it's not very strong.

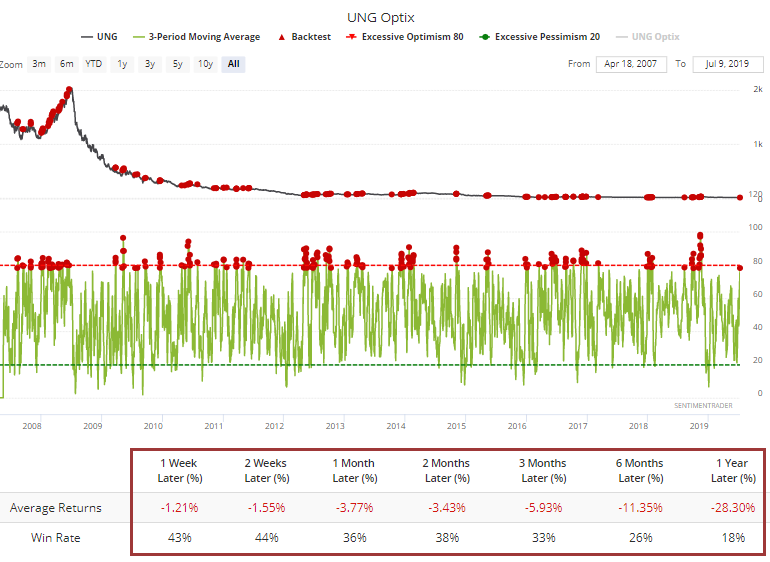

On a much shorter time frame, over the past 3 sessions, the Optimism Index for the UNG fund has averaged close to 80%, the highest since last November.

For a flawed product (for investors) that have to deal with the rolling over of futures contracts, high optimism in a commodity fund like UNG has been a very bad sign.

Contracts like natural gas are called widow-makers for a reason, since aggressive bets either way have triggered the liquidation of numerous funds and individual traders. They are prone to breathtaking rallies and declines, so there's always the chance that supply disruptions or weather predictions will overrule any other factor.

Copper Topped

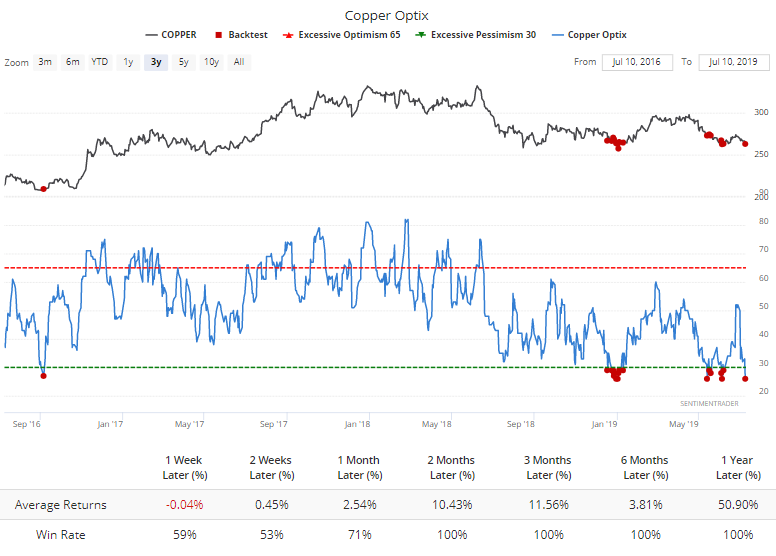

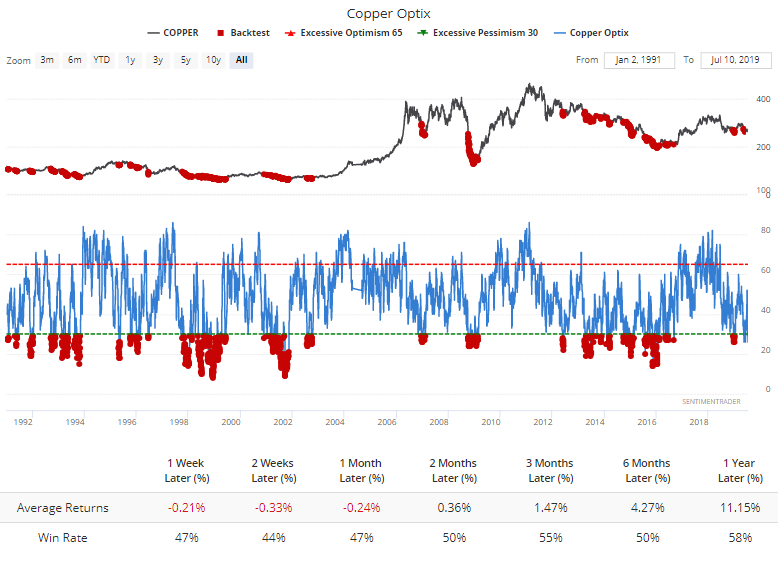

Another commodity that has suffered low optimism, and getting lower, is copper. Its use as a bellwether for stocks or other markets is highly questionable, with an unearned moniker of "Dr. Copper." Still, as a standalone contract, its Optimism Index has dropped below 30%, enough to be considered extreme over the past few years.

Long-term, this barely registers as extreme.

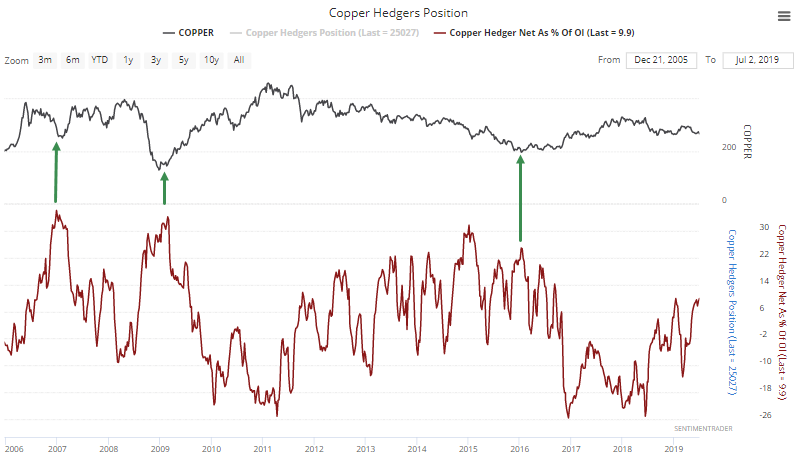

Smart-money hedgers have picked up their buying, now holding about 10% of the open interest in copper futures net long. But major lows over the past decade or so have come when hedgers held 20% or more of the contracts net long.

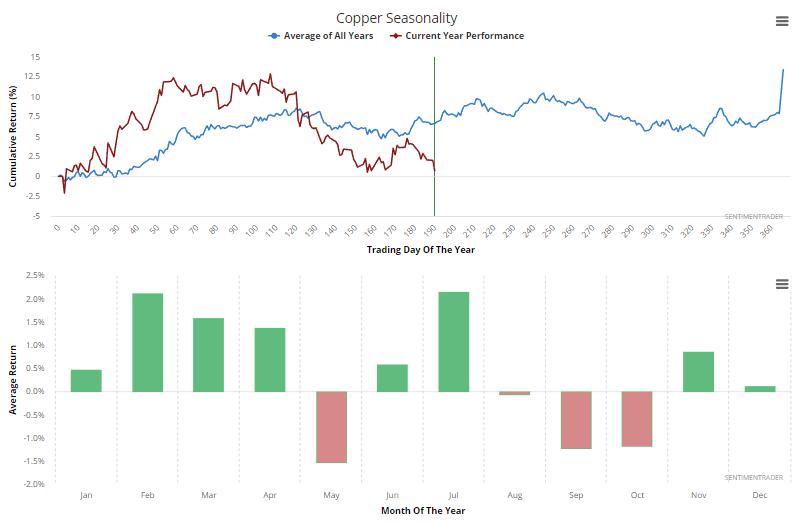

On the plus side, seasonality is good this time of year, with typically strong returns in July and into August. For what it's worth, copper has followed its very general seasonal path this year.

Overall, we're seeing pessimism during a seasonally strong time of year, with good support from the smart money. It's not a slam-dunk long setup by any means, but looks to be a modest positive.

Bond Optimism

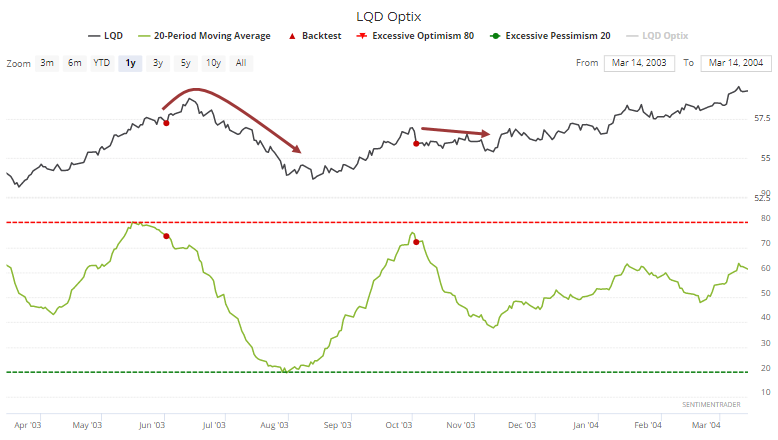

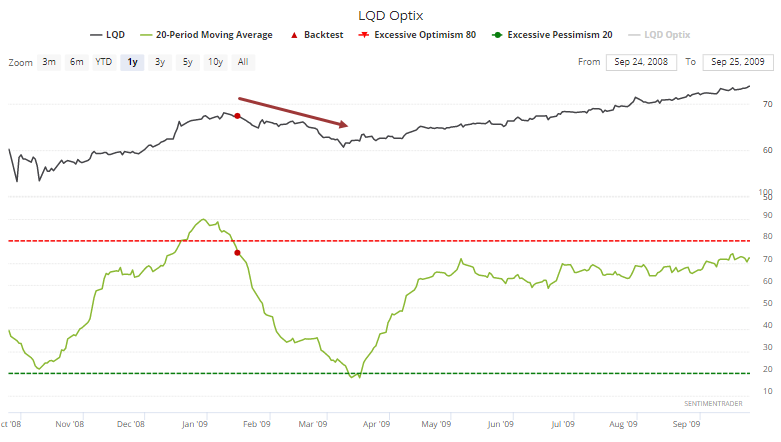

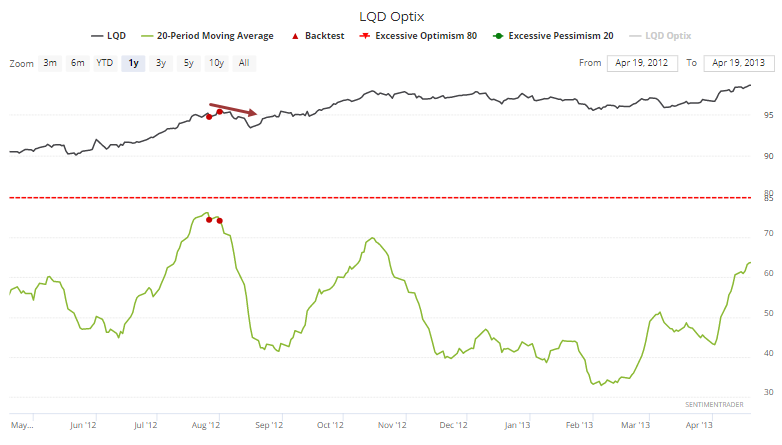

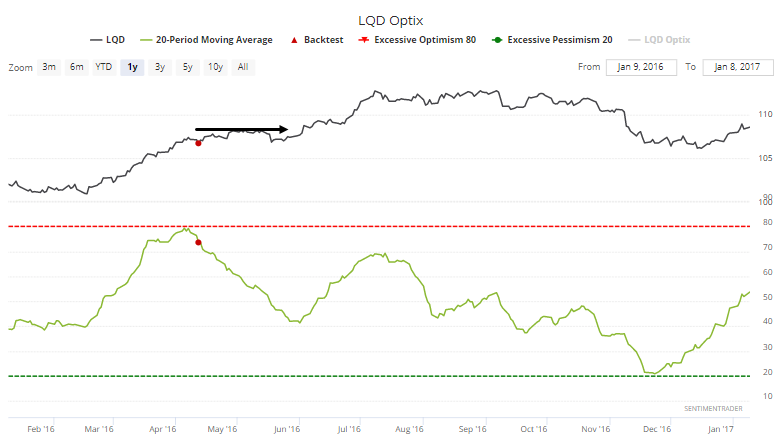

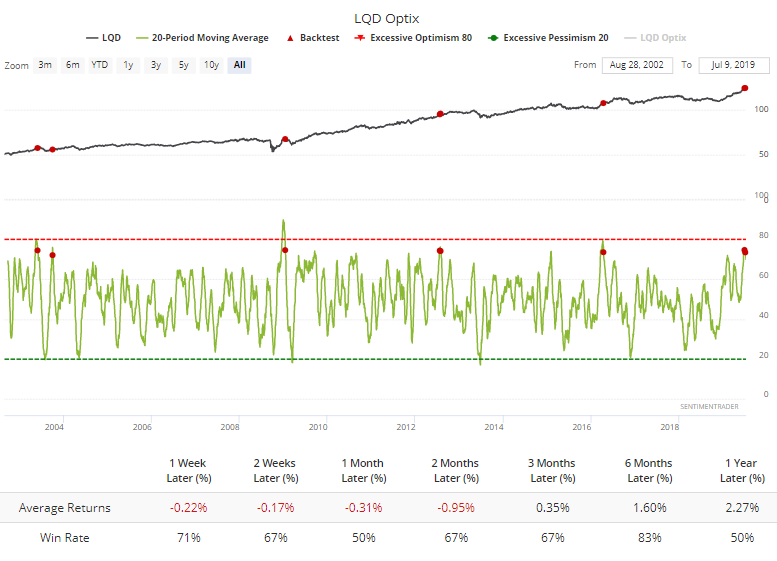

We spent quite a bit of time looking at the overly enthusiastic sentiment in bonds a couple of weeks ago, and that's starting to unwind. The 20-day average of the Optimism Index on LQD has crossed down below 75%, one of the few times in its history it managed to exceed that threshold.

Looking at each instance individually, there was a general tendency for these optimistic unwinds to last for a while, at least a month or so.